The data show that XRP and Solana have seen their volatility performed after the strong price action. This is how bitcoin and other coins are compared.

Assets through cryptography have seen an increase in volatility performed for 60 days

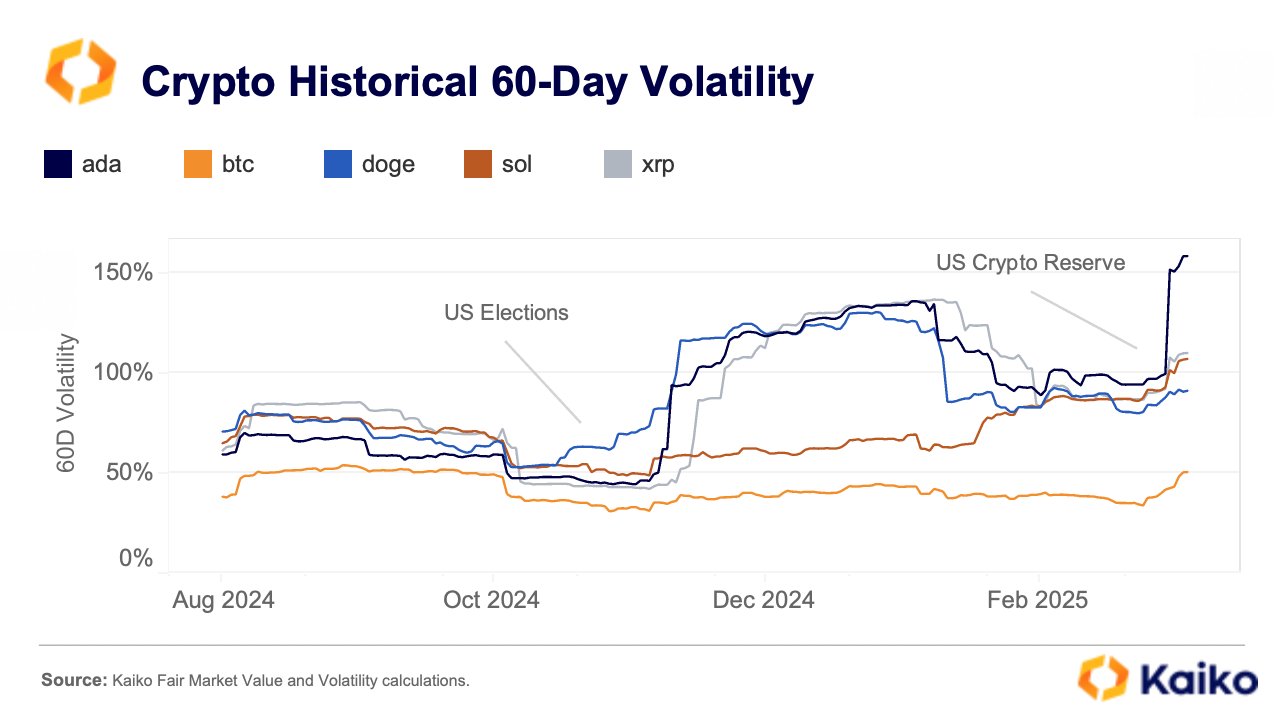

In a new one <a target="_blank" href="https://x.com/KaikoData/status/1899407451272917210″ target=”_blank” rel=”noopener nofollow”>mail In x, the Kaiko analysis firm has shared how the volatility made for 60 days has recently changed for the various main currencies in the cryptocurrency sector.

The “volatility made” here refers to an indicator that basically tells us how much the price of an asset has fluctuated for a time window. In the context of the current topic, the relevance period is 60 days.

Here is the table shared by the analysis firm, which shows the tendency in the volatility made for five main digital assets: bitcoin (btc), XRP (XRP), Solana (Sun), Dogecoin (Doge) and Cardano (ADA).

Looks like btc has been the least volatile out of these assets during this period | Source: <a target="_blank" href="https://x.com/KaikoData/status/1899407451272917210/photo/1" target="_blank" rel="noopener nofollow">Kaiko on x

As shown in the previous graph, the volatility made for 60 days has seen an increase for each of these assets recently. This is naturally the result of the entire volatile price action that the different assets have passed, especially since the announcement of the US crypt reserve. UU. Donald Trump.

XRP and Sol, two of the initially confirmed assets for the reserve, have seen the metric peak at a similar value above 100%. The third Altcoin of the announcement, Ada, has seen its volatility to separate from the rest, since the indicator has reached a new historical maximum (ATH) of approximately 150% for it.

Memecoin's doge has seen the smallest increase in these assets, although their volatility made for 60 days is still at an appreciable level. The currency that stands out for having a relatively low value of the indicator is btc, the original cryptocurrency.

Although bitcoin has seen a remarkable leap in the metric, its value still remains at about 50%. Therefore, it seems that XRP and others have seen a significantly more acute price share than btc in the last 60 days.

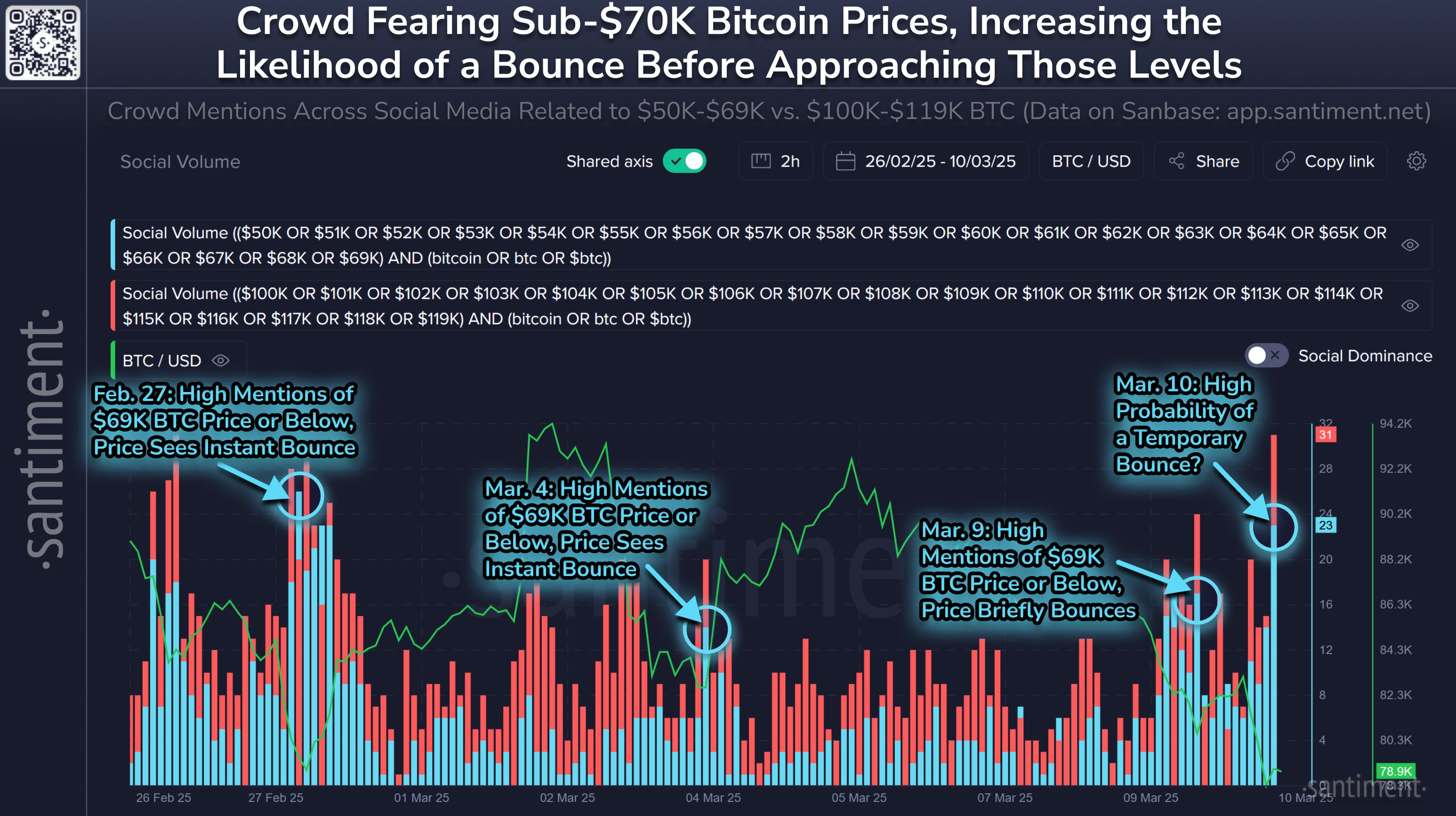

In other news, the recent market volatility has meant that fear has exploded among cryptocurrency merchants, such as the Santiment analysis firm has explained in an x <a target="_blank" href="https://x.com/santimentfeed/status/1899194160449794399″ target=”_blank” rel=”noopener nofollow”>mail.

The social media mentions of different bitcoin price levels | Source: <a target="_blank" href="https://x.com/santimentfeed/status/1899194160449794399/photo/1" target="_blank" rel="noopener nofollow">Santiment on x

In the table, the data of an indicator called social volume are shown. This metric counts the number of publications/threads/messages that are making unique mentions of a specific topic or term.

From the graph, it is visible that the social volume related to the low price levels of bitcoin ($ 50,000 to $ 69,000) has recently increased, which means that investors are predicting a bearish result for the asset.

Historically, a large amount of fear around digital asset number one has been a bullish signal not only for its price, but also by the Altcoins such as XRP and Solana.

At present, the upward social volume ($ 100,000 to $ 119,000) is still at a high level, so while fear is increasing, optimism has not yet disappeared. As Santiment points out,

The true capitulation point (and the optimal point of purchase) will be when low prices ($ 50k- $ 69K) are prejuded on social networks with very little mention of high prices ($ 100k- $ 119K).

XRP price

At the time of writing, XRP is floating around $ 2.1, more than 14% in the last seven days.

x/P4JHH9cN/” alt=”XRP price chart” width=”1438″ height=”842″/>

The price of the coin has been following a bearish trajectory recently | Source: XRPUSDT on TradingView

Outstanding image of Dall-E, Santiment.net, TrainingView.com graphics

Editorial process For Bitcoinist, he focuses on the delivery of content completely investigated, precise and impartial. We maintain strict supply standards, and each page undergoes a diligent review of our technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.

NEWSLETTER

NEWSLETTER