Xapo Bank, a global bank based in Gibraltar based in Gibraltar, is betting on the rebirth of cryptographic loans by launching American dollar loans backed by bitcoin.

Xapo Bank qualified customers can now access bitcoin (btc) loans of up to $ 1 million, the firm said in a shared announcement with Cointelegraph on March 18.

The new loan product is designed for bitcoin Hodlers in the long term that wish to access cash while keeping their btc, he told Cointelegraph, Xapo Bank's CEO, Seamus Rocca.

“Unlike traditional assets, bitcoin is an ideal collateral form: it has no edge, highly liquid, available 24 hours, 7 days a week, and easily divisible, which makes it exceptionally suitable for loans,” Rocca said.

Without collateral reuse

A key distinction of the Xapo bitcoin loan product is that the bank does not react the guarantee of loans by users, which means that its loan mechanism does not imply the reuse of btc assets by customers.

On the other hand, the bitcoin guarantee is stored in the Xapo btc vault using the institutional custody of multiparty computing (MPC).

Work of a cryptographic loan platform.

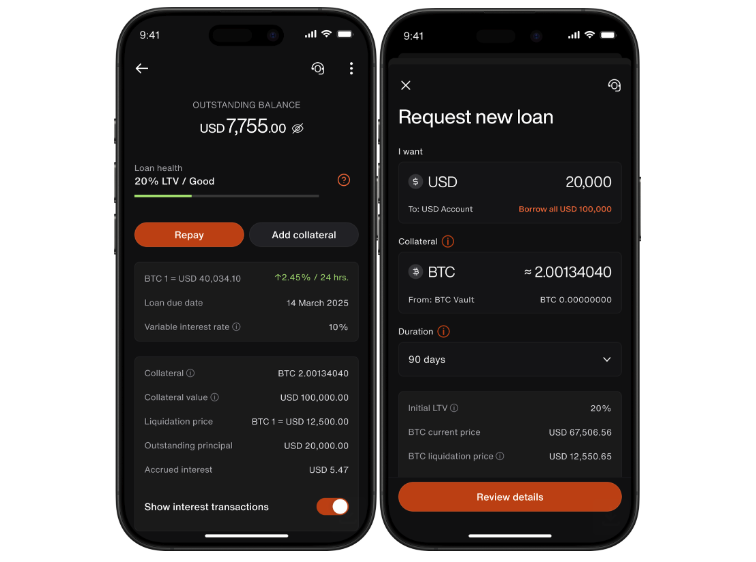

Eligible Xapo customers can choose reimbursement schedules of 30, 90, 180 or 365 days, without penalties for early reimbursement, the firm said.

Who is eligible?

The new offer of Xapo bitcoin loans will be available for pre -approved members according to several criteria.

The key criteria for eligibility are the amount of bitcoin holdings and the holding period, since Xapo is specifically addressed to long -term btc holders with a long -term investment strategy.

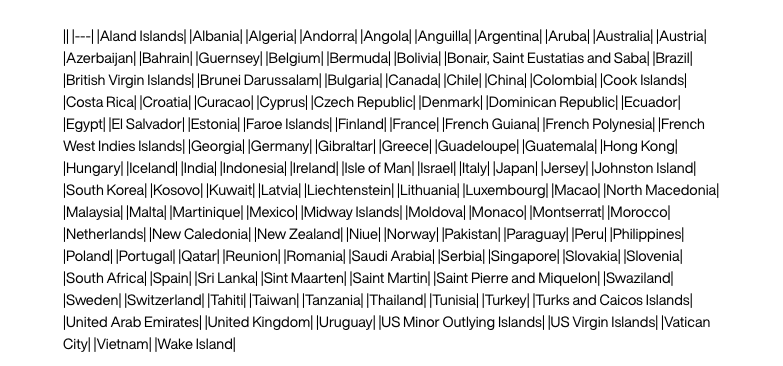

According For the bank, the offer will be available for global investors in regions such as Europe and Asia, excluding residents of the United States.

The list of jurisdictions backed by Xapo Bank. Source: Xapo Bank

Xapo Bank is regulated By the Commission of Financial Services of Gibraltar by virtue of the Financial Services Law of 2019. In 2024, the Bank successfully passed its bank license in the United Kingdom, granting its application Xapo Bank Access to the country.

Although Xapo loans are offered throughout the European Union, cryptographic loans are not covered by local regulations such as markets within the framework of cryptographic assets.

A revival after numerous collapses

The new btc loan launch of Xapo Bank occurs a few years after the cryptographic loan industry suffered a great crisis in 2022.

The crisis occurred in the midst of the historic Terra accident and a posterior bearish market that triggered the collapses of the main loan suppliers such as Celsius and Blockfi.

“The collapse of Celsius, Blockfi and other centralized lenders significantly eroded confidence in the space of cryptographic loans,” said Xapo Bank's CEO to Cointelegraph.

An example of the bitcoin loan process in the Xapo Bank application. Source: Xapo Bank

“Today's borrowers exercise greater caution, prioritizing platforms with a history tested in bitcoin custody and those who offer safe and transparent solutions, especially those that do not participate in the rehipotecation,” Rocca said, added:

“At the same time, the demand for loans backed by bitcoin is increasing, particularly between high -level network and institutional investors seeking liquidity without selling their bitcoin holdings.”

In addition to eliminating assets and MPC's safety, Xapo offers Risk Management and Proactive Protection tools to prevent automatic settlements.

Related: Bitwise makes the first institutional defi assignment

“In the case of a bitcoin price drop, customers receive instant notifications, allowing them to recharge their guarantees or make partial payments to maintain the state of their loan,” Rocca said.

Xapo is not the only company that has been working to introduce loan products in early 2025. At the beginning of March, bitcoin Blockstream developer obtained a multi -million dollar investment to launch three new institutional funds, and two of them offer btc loans.

Magazine: eth can bottom at $ 1.6K, the SEC delays multiple cryptographic ETF, and more: Hodler's Digest, March 9-15

NEWSLETTER

NEWSLETTER