Statistics show that over the course of 54 days, the number of WBTCs hosted on the Ethereum network has decreased by 40,156. This equates to a redemption of more than 18% of the circulating supply of WBTC since the 27th of November 2022.

WBTC remains the largest operation in terms of Bitcoin custody despite recent bailouts

The one backed by Bitgo Wrapped Bitcoin (WBTC) The project has been officially live since the end of January 2019 and has grown significantly since its launch. At the time of writing, it is the largest transaction in terms of the amount of bitcoin (BTC) in custody to support the value of the WBTC token.

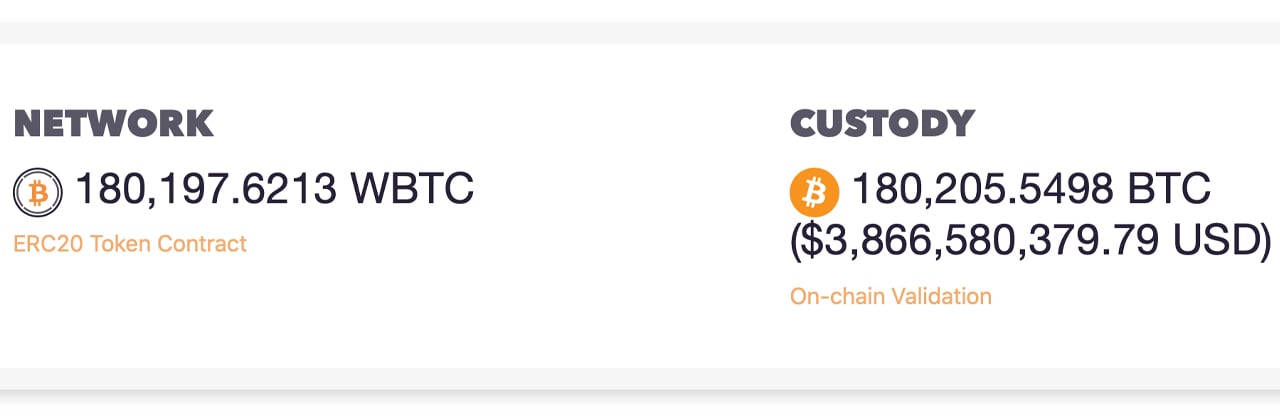

As of January 20, 2023, WBTC is the 19th largest crypto asset by market capitalization, valued at $21,278 per unit. WBTC’s market valuation on Friday afternoon Eastern time was around $3.8 billion. According to the project website and transparency paneAs of 3:00 PM ET on January 20, 2023, there were approximately 180,197 WBTC in circulation on the Ethereum chain.

The project also manages 99.89 WBTC which is hosted on the Tron blockchain network. The stash of ERC20-based WBTC tokens is substantially less than 54 days ago, on November 27, 2022, when 220,353 WBTC ($16.4K per BTC) circulated on the Ethereum blockchain network. Ten months earlier, on February 26, 2022, the number of WBTC in circulation was approximately 262,662 ($39.4K per BTC).

That means that in the last ten months, 31.39% of WBTC in circulation was removed from the general supply. More than half of that percentage, or 18.22%, of the WBTC supply has been redeemed in the last 54 days, or a total of 40,156 WBTC, since November 27, 2022.

While WBTC is the largest wrapped version of bitcoin, Lido’s STETH staking token, an Ethereum derivative, is the largest synthetic version of a top crypto asset in terms of market capitalization. STETH, however, works differently than Bitgo’s management of simply keeping the BTC for the given amount issued.

While there are 180,197 WBTC in circulation today, there are approximately 180,205 BTC supporting the supply of WBTC into Bitgo custody, according to the website’s dashboard. Wrapped or synthetic supplies BTC tokens have followed the same trend as stablecoins, as the stablecoin economy has seen billions in redemptions over the last year.

What do you think about the WBTC project seeing 18% redemption of circulating supply in the last 54 days? Share your thoughts on this topic in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.