Bitcoin price hit a three-month high at $19,104 yesterday. After the Consumer Price Index (CPI) for December 2022 was announced at 6.5% as expected, the market initially reacted cautiously and showed a retracement below $17,900. However, the bulls took over after that and posted the biggest daily candle in over 6 months.

However, caution is advised. Investors should be asking themselves if this is a bull trap or really the start of a new bull run. To assess this, experts currently recommend several data points.

The Fed rules everything

With the December CPI data in the books, attention turns to February 1, when the Fed’s next FOMC meeting is scheduled. And according to the FEDWatch tool, the expert projections are excessively bullish. A whopping 94% expect the Fed to continue to cut its pace of rate hikes and only add 25bp.

In this sense, Carl Quintanilla, a journalist for CNBC and NBC News, points according to an analysis by Fundstrat Global Advisors that “a whopping 59% of CPI components are now in outright deflation, a jump of 800bp in a single month…the bond market got it right. Inflation is below the opinion of the Fed and the consensus”.

Also, Fundstrat points to the latest Atlanta Fed salary tracker. Year-over-year, the reading fell to 5.5% in December, the lowest level since January 2022, which the financial firm says is another piece of data confirming that wage inflation has slowed considerably in recent months. Therefore, Fundstrat concludes:

We believe that investors will increasingly come to the conclusion that the Fed can declare ‘mission accomplished’ on inflation. And this is setting up 2023 to be the opposite of 2022, where inflation expectations fall faster than EPS risk.

Even the Fed’s “spokesman,” Wall Street Journal chief economics correspondent Nick Timiraos tweeted yesterday that the December consumer price index is likely to keep the Fed on track to cut the rate hike to a quarter of a percentage point.

Timiraos also quoted St. Louis Fed President James Bullard as saying that, all things considered, it would be better to get to the top rate as soon as possible. But he also added, “in macroeconomic terms, whether that gets done in one meeting or another probably isn’t that important.” Until then, Bitcoin investors can track more data points.

Bitcoin price going north? See this

Arguably the most important indicator could be the US Dollar Index (DXY). It is well known that Bitcoin price movements are strongly inversely correlated with the DXY. When the DXY is going up, Bitcoin is trending down. When the DXY falls, BTC shows a rally.

This was the case yesterday when the DXY continued to fall while Bitcoin posted strong gains. However, the DXY is in a historically important support zone.

In this regard, it remains to be seen if risk assets like Bitcoin run into a bull trap or if the DXY falls below 101 on the weekly chart and turns support into resistance. If yes, it is more than likely that BTC will rally.

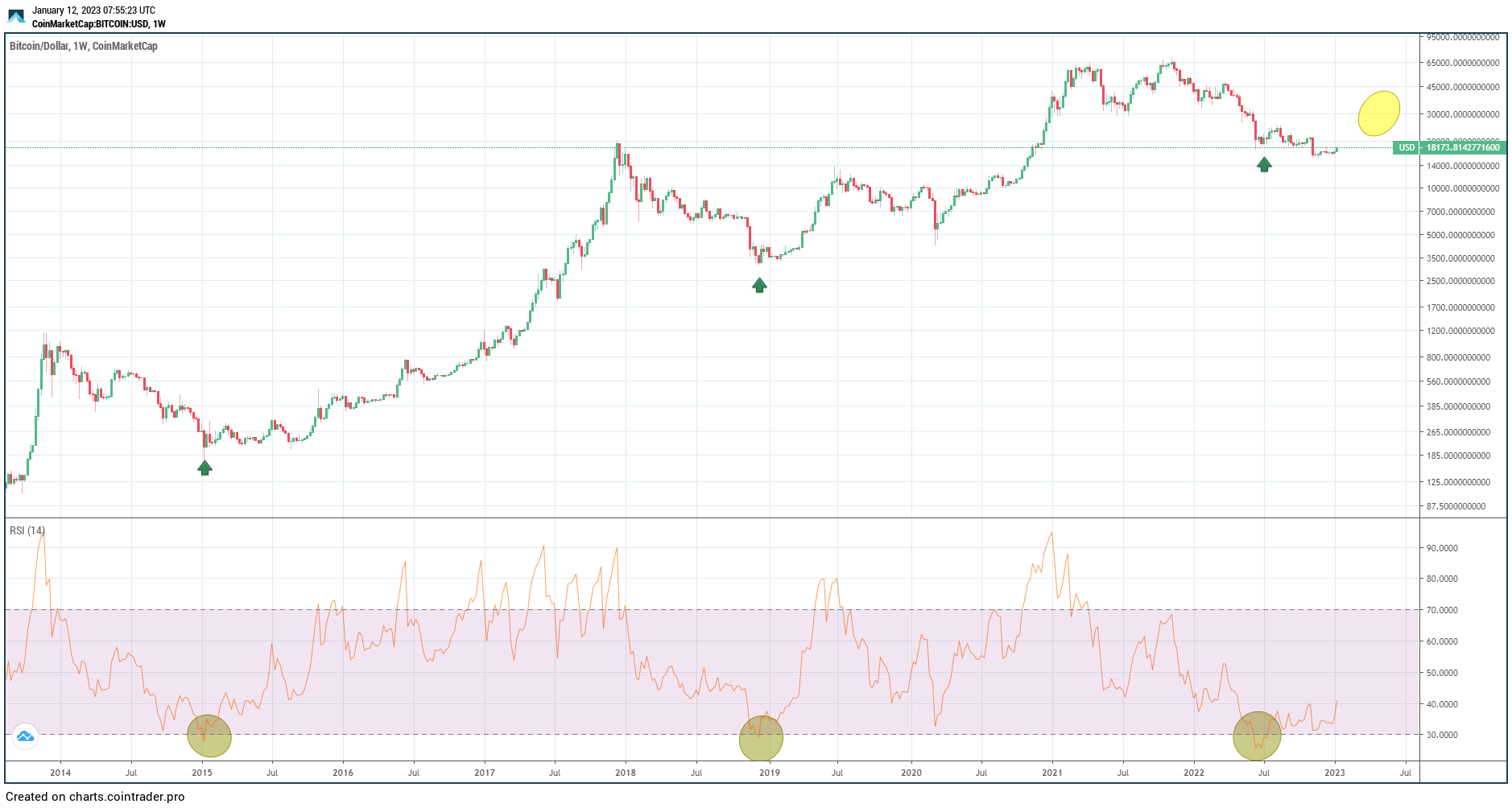

Alistair Milne, CIO of Altana Digital Currency Fund, also he pointed another crucial data point on the weekly Bitcoin chart, sharing the chart below:

(Bitcoin) price shows large divergence of rising relative strength. When the weekly RSI is oversold, you previously have a historic opportunity before a big move, signaling the end of the bear. Look at what happened in October/November 2015 and March/April 2019.

Featured image from iStock, Charts from TradingView.com

NEWSLETTER

NEWSLETTER