bitcoin is closing out one of its most notable months in history, rising over $30,000 in November and marking renewed bullish sentiment in the market. As we look ahead to December and beyond, investors are eager to understand if bitcoin's momentum can be sustained through 2025. With macroeconomic conditions, historical trends, and on-chain data lining up in bitcoin's favor, let's take a look at what's happening and what what it could mean for the future.

Record November performance

November 2024 was not just any month for bitcoin; It was historic. The price of bitcoin rose from around $67,000 to almost $100,000, an increase of approximately 50%, making it the best performing month in terms of dollar rise. This rally rewarded long-term holders who endured months of consolidation after bitcoin's all-time high of $74,000 earlier in the year.

<a target="_blank" href="https://www.bitcoinmagazinepro.com/bitcoin-price-live/”>View live chart

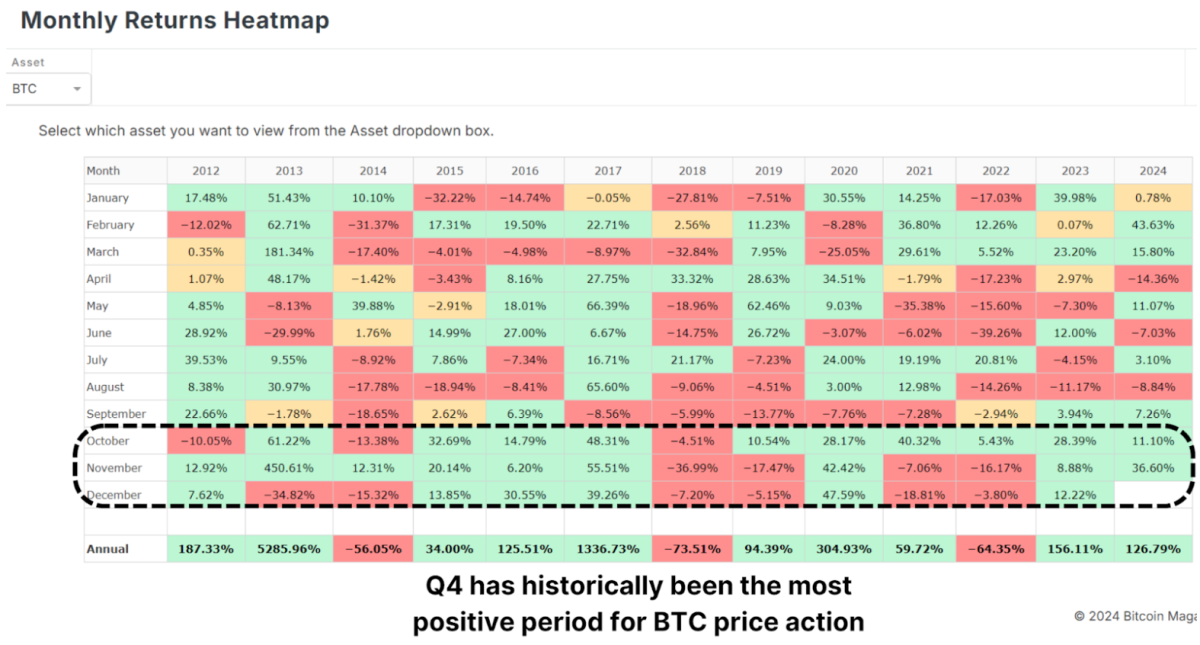

Historically, the fourth quarter is bitcoin's strongest and November has often been a standout month. December, which has also performed well in previous bull cycles, presents a promising outlook. But as with any rally, some cooling could be expected in the short term.

<a target="_blank" href="https://www.bitcoinmagazinepro.com/bitcoin-portfolio/monthly-returns-heatmap/”>View live chart

The role of the dollar and global liquidity

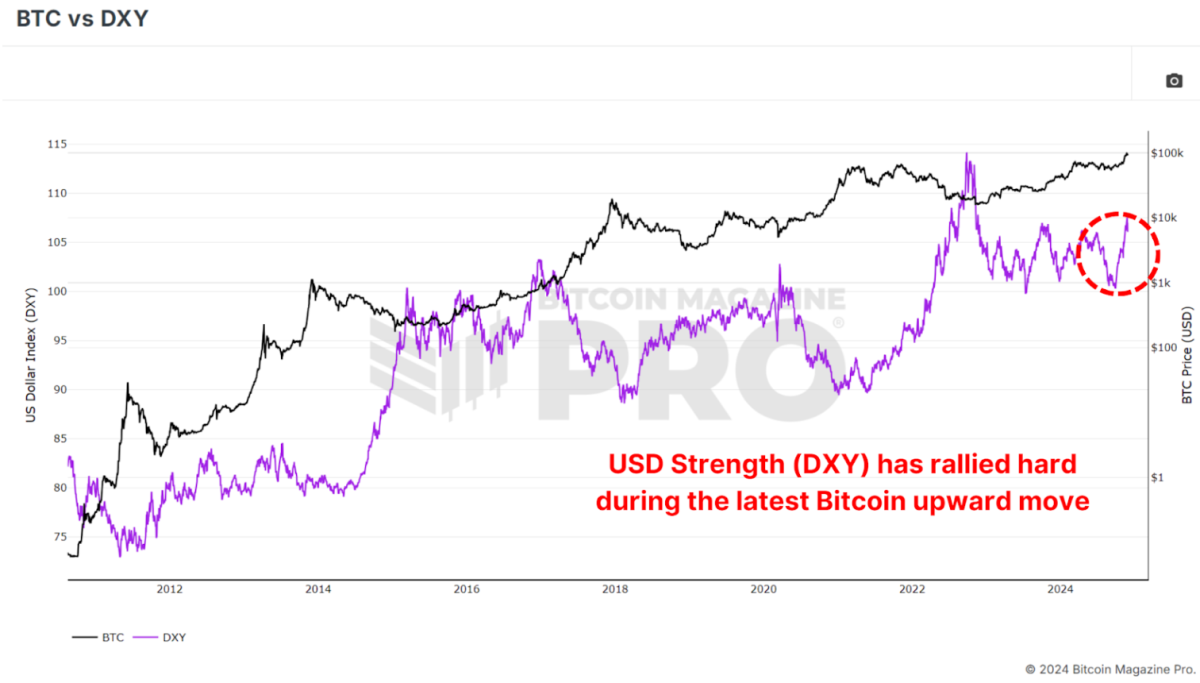

Interestingly, bitcoin's rise occurred against the backdrop of a strengthening <a target="_blank" href="https://www.bitcoinmagazinepro.com/bitcoin-portfolio/btc-vs-dxy/”>US Dollar Strength Index (DXY)a scenario in which bitcoin typically underperforms. Historically, bitcoin and the DXY have had an inverse relationship: when the dollar strengthens, bitcoin weakens and vice versa.

<a target="_blank" href="https://www.bitcoinmagazinepro.com/bitcoin-portfolio/btc-vs-dxy/”>View live chart

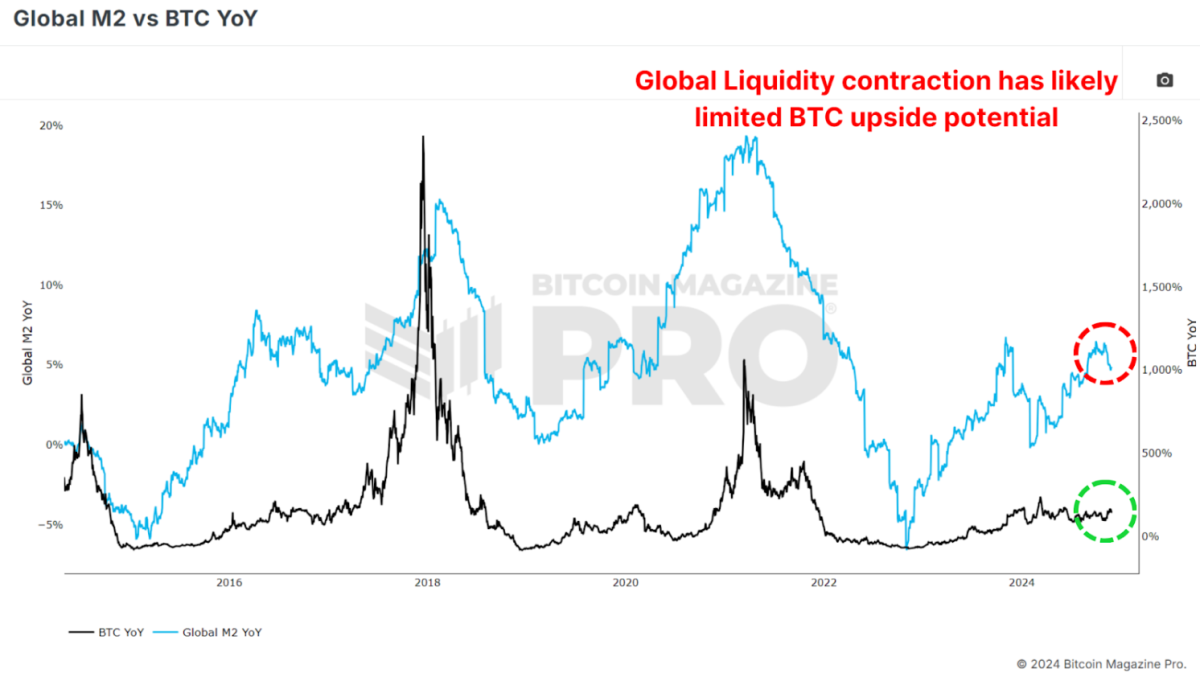

Similarly, the <a target="_blank" href="https://www.bitcoinmagazinepro.com/bitcoin-macro/global-m2-vs-btc-yoy/”>Global M2 The money supply, another key metric, has shown a slight contraction recently. Historically, bitcoin has been positively correlated with global liquidity; therefore, its current performance defies expectations. If liquidity conditions improve in the coming months, this could act as a powerful tailwind for the price of bitcoin.

<a target="_blank" href="https://www.bitcoinmagazinepro.com/bitcoin-macro/global-m2-vs-btc-yoy/”>View live chart

Parallels with past bull cycles

bitcoin's current trajectory is strikingly similar to that of past bull markets, particularly the 2016-2017 cycle. That cycle began with gradual price increases before breaking key resistance levels and entering an exponential growth phase.

In 2017, bitcoin price surpassed a key technical level around $1,000, triggering a parabolic rally that peaked at $20,000, a 20-fold increase. Similarly, in the 2020-2021 cycle, bitcoin rose from $20,000 to almost $70,000 after breaking above the crucial level. <a target="_blank" href="https://www.bitcoinmagazinepro.com/bitcoin-portfolio/btc-price-yoy/”>Year-on-year performance limit.

<a target="_blank" href="https://www.bitcoinmagazinepro.com/bitcoin-portfolio/btc-price-yoy/”>View live chart

If bitcoin can decisively break out of this all-time level and above the key $100,000 resistance, we may witness a repeat of these explosive price movements as btc enters its exponential phase of bullish price action.

Adoption and institutional accumulation

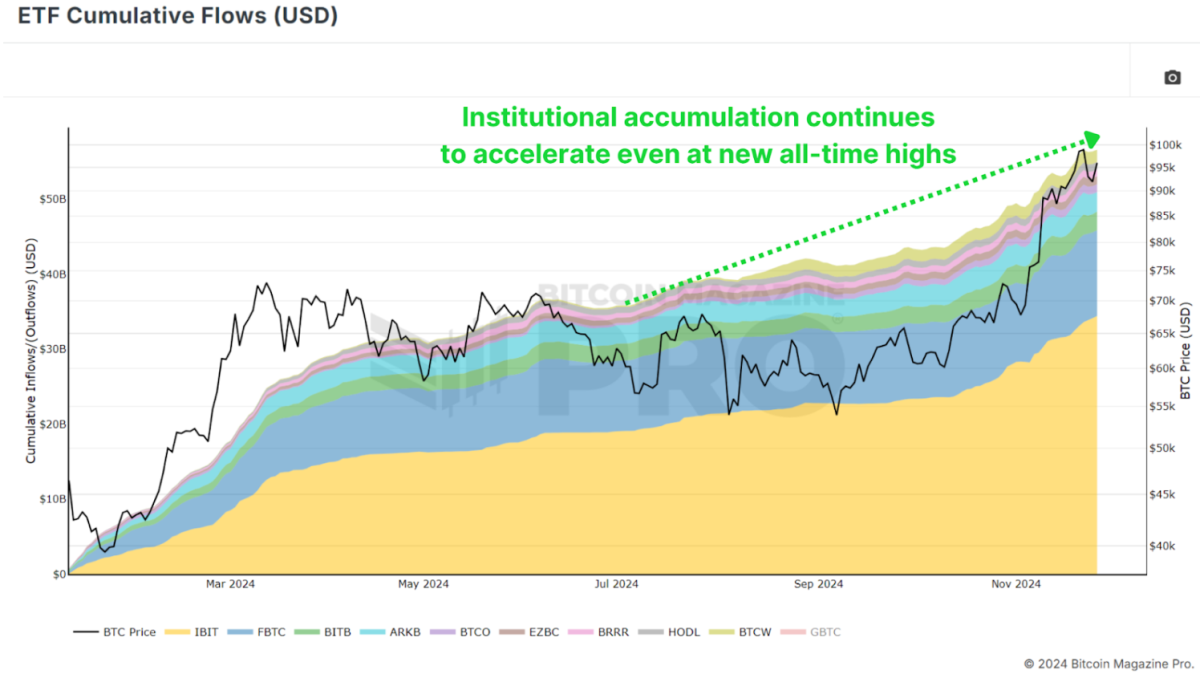

A key factor supporting bitcoin's strength is continued accumulation by institutions. <a target="_blank" href="https://www.bitcoinmagazinepro.com/bitcoin-portfolio/bitcoin-etf-cumulative-flows-usd/”>bitcoin ETF They are adding billions of dollars worth of btc to their holdings, and corporations like MicroStrategy have doubled down on their bitcoin strategy, and now own nearly 400,000 btc. Even with btc hitting new all-time highs, the “smart money” is scrambling to accumulate as much as possible to ensure it doesn't fall behind.

<a target="_blank" href="https://www.bitcoinmagazinepro.com/bitcoin-portfolio/bitcoin-etf-cumulative-flows-usd/”>View live chart

This institutional demand indicates growing confidence in bitcoin as a long-term store of value, even in volatile market conditions. This buildup also reduces available supply, creating upward pressure on prices as demand increases.

Conclusion

While December has historically been a strong month for bitcoin, short-term volatility could temper gains as the market digests November's strong rally. Although given the aggressive buildup we are witnessing from institutional participants anything is possible.

However, longer term, the outlook remains exceptionally bullish. The obvious level to watch is $100,000 as the next major milestone, which, if surpassed, could pave the way for a much bigger rally in 2025. bitcoin is entering one of its most exciting phases yet, with stars apparently aligning in macroeconomic, technical terms. and chain metrics.

For a more in-depth look at this topic, watch a recent YouTube video here: The BIGGEST bitcoin month EVER: what happens next?

Black Friday: our biggest deal yet

The BEST savings of the year is here. Get 40% discount all our annual plans.

- Unlock +100 bitcoin charts.

- Access indicator alerts, so you never miss anything.

- Private TradingView indicators from your favorite bitcoin charts.

- Exclusive reports and information for members.

- Lots of new graphics and features coming soon.

All for just $15 a month with the Black Friday sale. This is our biggest sale of the entire year.

UPGRADE YOUR bitcoin INVESTMENT NOW

Don't miss it! https://www.bitcoinmagazinepro.com/subscribe/

NEWSLETTER

NEWSLETTER