bitcoin (btc) price is oscillating within an ascending channel, capped by resistance at $28,000 and rising support around $26,750.

Flattening btc price action has accompanied declining volumes and volatility, underscoring a growing conflict of biases among traders.

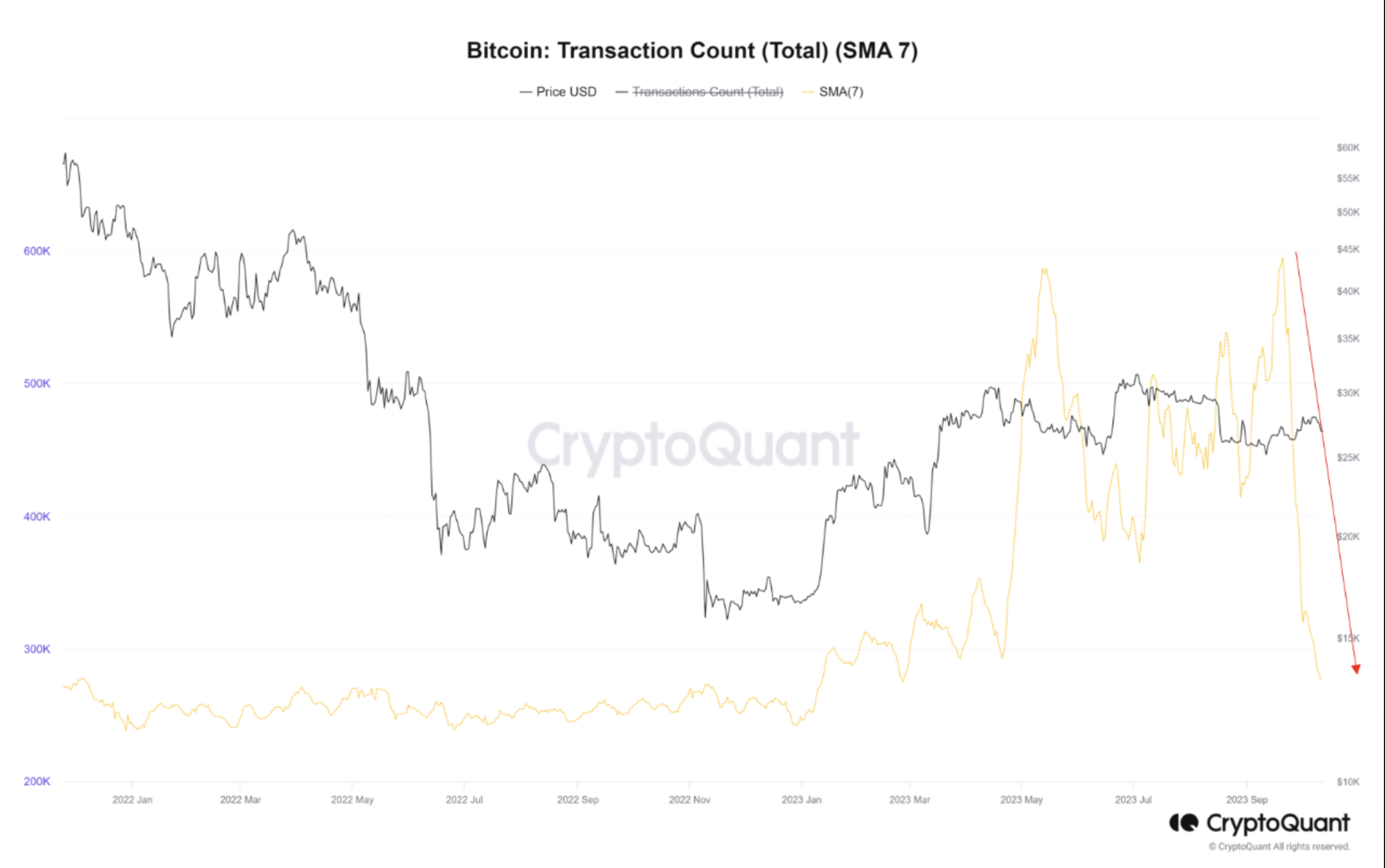

bitcoin network activity plummets

The duration of bitcoin‘s consolidation coincides with a massive drop in its deposits, withdrawals, and overall transactions. Notably, all of these metrics rose in May due to the bitcoin Ordinals hype, only to crash significantly in September.

“This suggests that bitcoin network activity has decreased,” btc-whales-and-institutional-investors-have-yet-to-act-but-network-fundamentals-” target=”_blank” rel=”noopener nofollow”>argues MAC_D, CryptoQuant On-Chain Data Analyst, adding:

“This happened because there were fewer new investments in the cryptocurrency market, resulting in less liquidity and therefore less price volatility.”

bitcoin ETF Hopes Face Higher Rate Concerns

bitcoin‘s consolidation period comes on the heels of two contradictory market catalysts: hopes for a bitcoin ETF to be approved in the US versus concerns over the “higher for longer” interest rate strategy of the Federal Reserve.

Analysts maintain that the approval of a bitcoin ETF would bring $600 billion worth of demand to the market, a boon for the btc price. On the other hand, stiffer inflation increases the Fed’s potential to keep rates higher in the future, which, in turn, could hurt risk assets, including btc.

The S&P 500, gold, bitcoin and EURUSD after the publication of the CPI: pic.twitter.com/AO4FWHpv0Z

-TradingView (@tradingview) October 13, 2022

A former BlackRock director says the US Securities and Exchange Commission will approve a bitcoin ETF by the end of the first quarter of 2024.

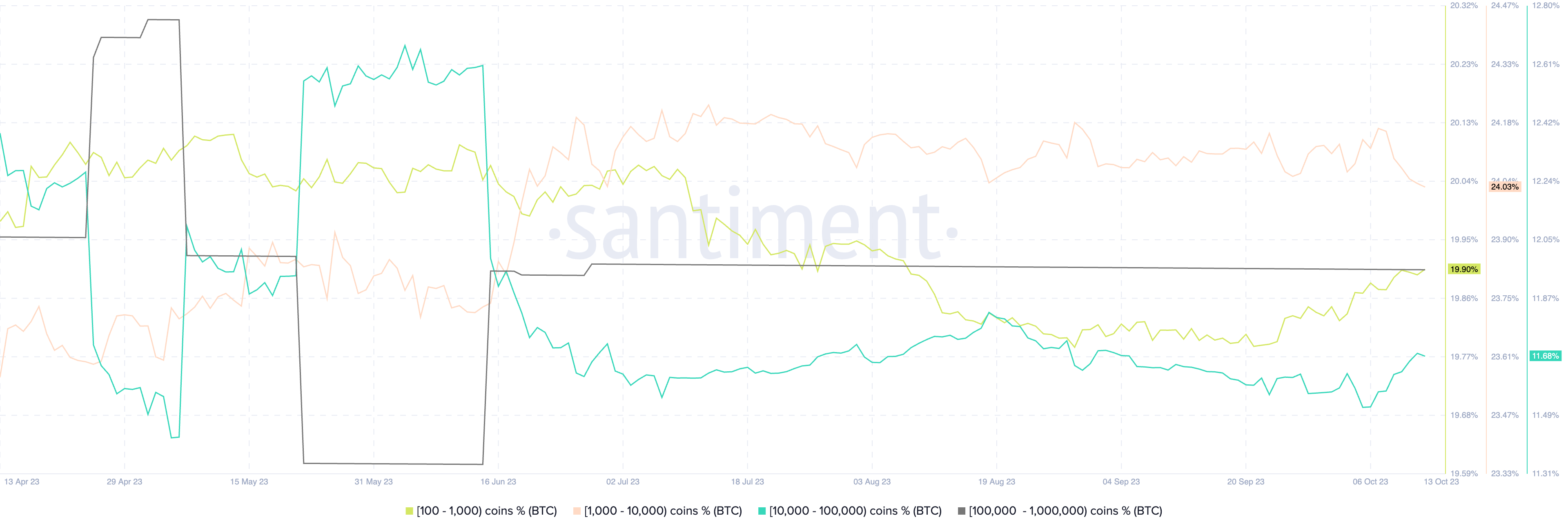

btc accumulation continues

bitcoin supply in institutional and whale addresses has increased since October, suggesting that the cryptocurrency’s wealthiest investors have been accumulating money outside the market through over-the-counter counters.

For example, the supply of bitcoin addresses with a balance of 10,000-100,000 btc (the teal wave) has increased more than 1% since its October 5 low.

The jump appears when the cohort absorbs drops in the supply of bitcoin addresses with a balance of 1,000 to 10,000 btc (the orange wave). On the other hand, the supply held by the 100-1000 btc balance cohort (the green wave) has increased.

bitcoin Technical Analysis Shows 40% Drop

From a technical perspective, bitcoin is forecasting a rally towards $28,000 after showing signs of stabilization around $26,750. The short-term bullish outlook is based solely on btc price fluctuations within its predominant ascending triangle, as shown below.

A longer-term scenario shows bitcoin moving within a broader ascending channel pattern. Therefore, a bounce from the current support area (the red bar) could see the btc price rise towards $36,000 in late 2023 or early 2024.

However, the ascending channel looks like a rising wedge, a bearish reversal pattern. A rising wedge resolves after the price falls below its lower trend line and falls to the high of the pattern.

Related: Inflation and war impact markets, but Paul Tudor Jones says: “I love bitcoin and gold”

Therefore, if btc falls below the lower trend line of the channel, the price of bitcoin may fall by up to 40% to $15,650 in 2023 or the first quarter of 2024.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER