The price of Bitcoin rose on January 12, and a rapid rally in cryptocurrency prices across the market has some investors hoping that the year-to-date high of $18,898 is a sign that BTC has bottomed out.

After a continuation of last week’s rally in equity markets, a cooling US Dollar Index (DXY) and positive inflation data in the Consumer Price Index (CPI) Report may keep BTC at the high end of the $18,000 range.

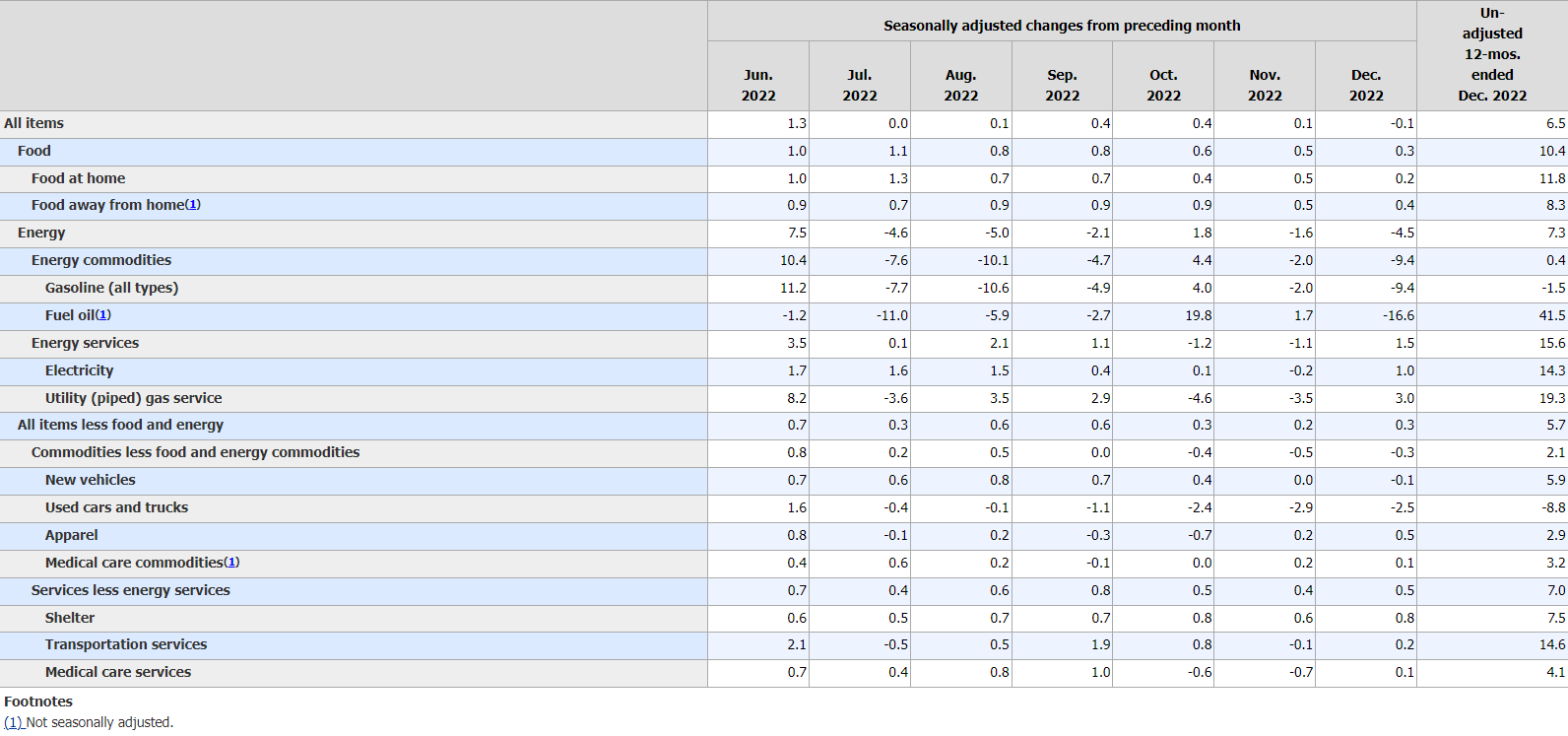

A main catalyst for the rally appears to be positive CPI. report published by the Bureau of Labor Statistics (BLS), which showed headline inflation for all urban consumers decreased by 0.1%.

The drop in inflation was the biggest since April 2020. Stock traders are also reacting by raising prices in the hope that positive data will spur less aggressive rate hikes by the Federal Reserve at the Federal Committee meeting Open Market Forecast (FOMC) on February 1.

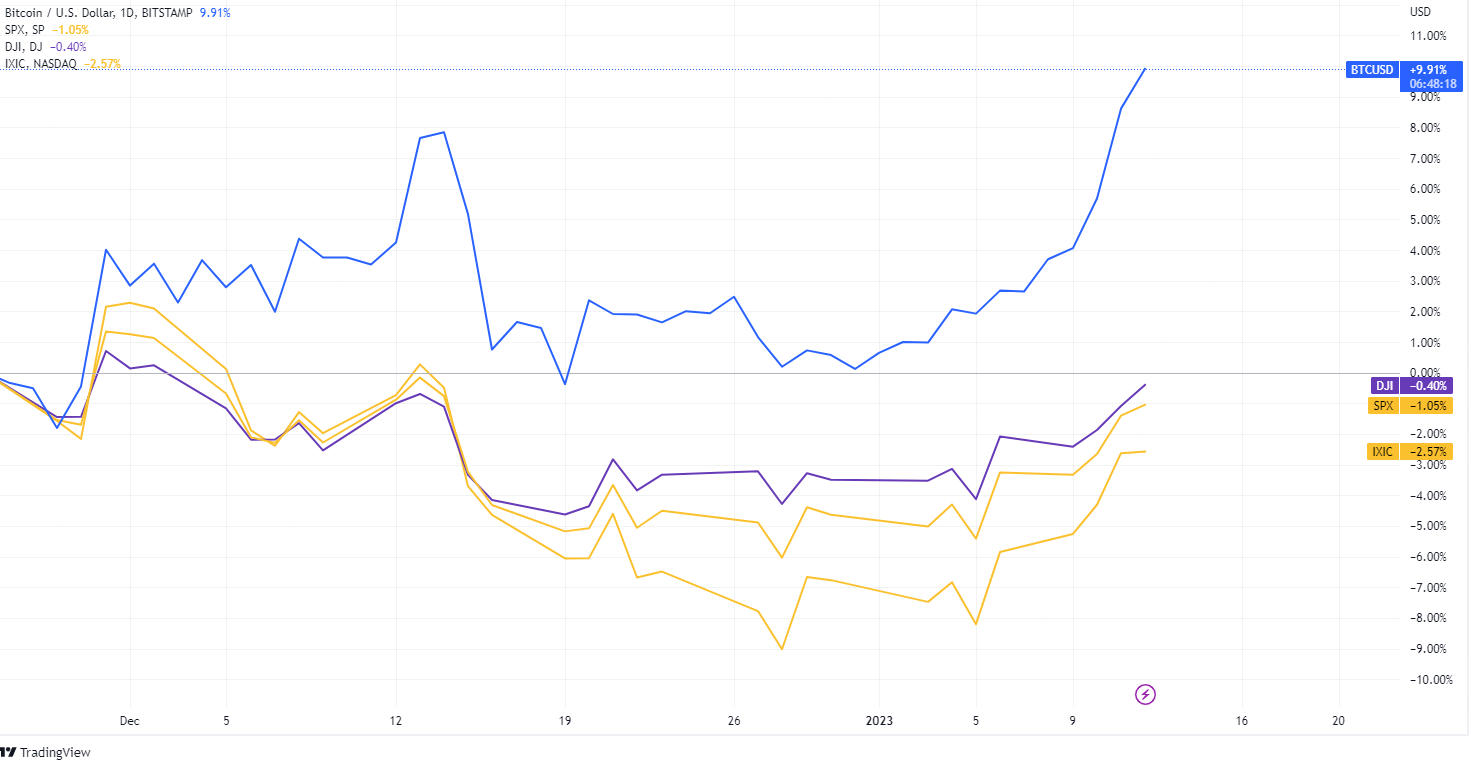

The stock market opened higher on January 12, with the Dow Jones, S&P 500 and Nasdaq posting positive numbers. As Cointelegraph reported, Bitcoin price action remains closely related to US stocks and today’s rally is no exception to the trend.

Here are some reasons why the Bitcoin price has risen today.

Bitcoin Open Interest Leans Longs After Record Short Selloffs

Since the price of Bitcoin rose to a yearly high of $18,898 on January 12, some analysts now see $18,000 as the new BTC price floor. Although BTC transaction volume has not recovered to pre-FTX crash levels, the $41.9 billion in Bitcoin transactions recorded on Jan. 12 also set a new yearly high.

The CPI report showed a decline in inflation for the sixth consecutive month. One of the biggest declines in the report was the sharp drop in gasoline prices. The prices of used and new cars also fell. The caveat in the CPI report is that the cost of services and food remained high.

If inflation has peaked, there is a chance the Federal Reserve will deviate from aggressive interest rate hikes. Many traders agree that if the Federal Reserve were to change its current policy of quantitative tightening and interest rate hikes, the price of BTC could rise.

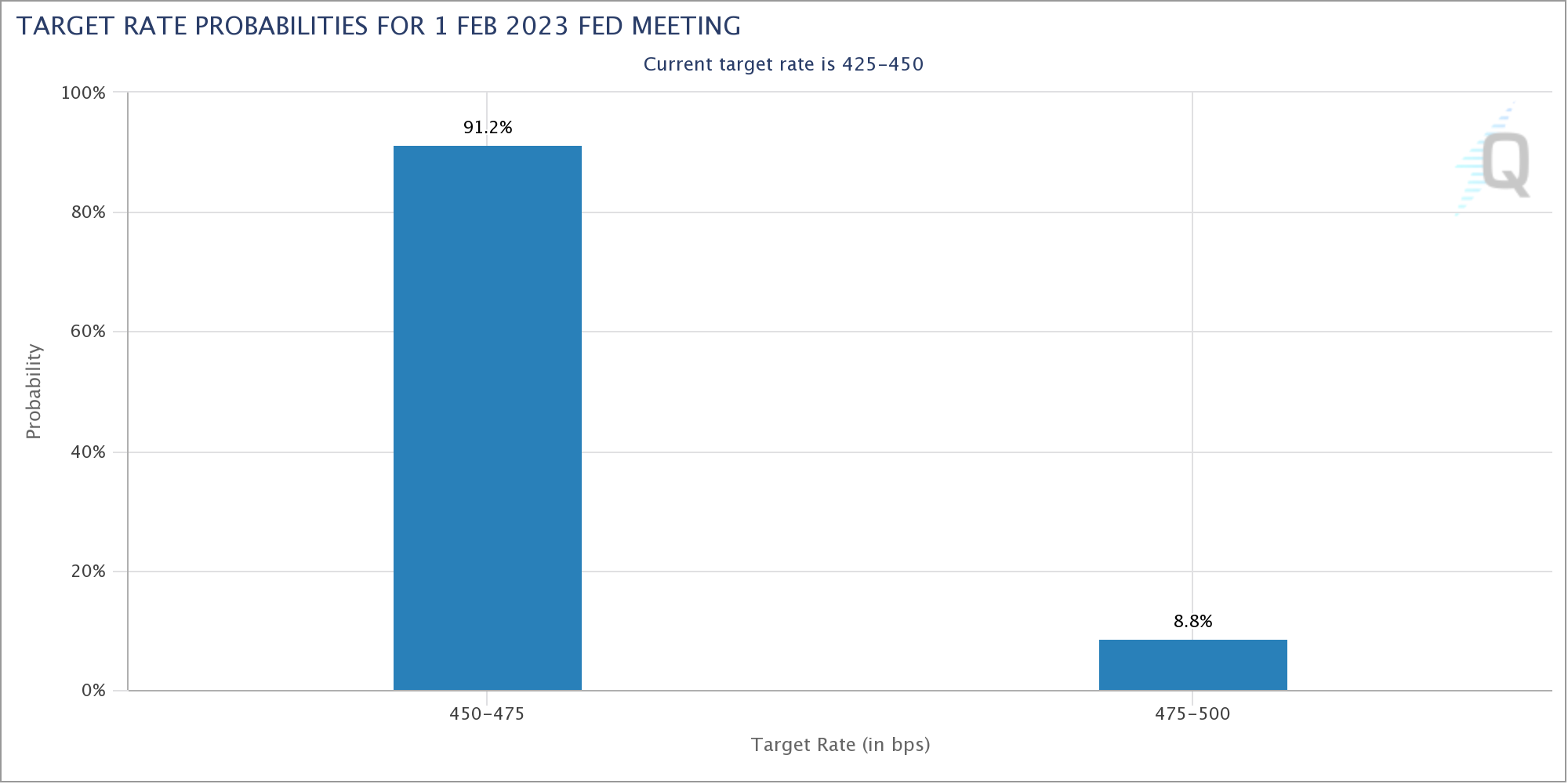

The FOMC begins meetings on January 31 with an interest rate decision expected the next day. Positive inflation data may affect the FOMC decision and push BTC and stocks higher. Investors are watching the U.S. bank’s fourth-quarter 2022 earnings report, which begins Jan. 13, for more details on the Fed’s potential decision.

Longer-term data is in favor of Bitcoin, according to market analysts

Investor confidence in the crypto market could also be rising due to their belief that the US Federal Reserve could implement smaller interest rate hikes throughout 2023 due to signs from the CPI report that the Fed’s strategy is working.

In the Fed statement, the possibility of a change in policy remains opened and linked to inflation:

“The Committee anticipates that continued increases in the target range will be appropriate to achieve a monetary policy stance that is tight enough to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

According to CME Group, a derivatives exchange with a global benchmark product that estimates interest rates, shows a high probability that increases could be smaller than previously anticipated in the near future.

The chart points to a possible slowdown in interest rate rises. Public sentiment shows confidence that future rates may fall, and investors believe this has created the possibility of a broad recovery in the crypto market.

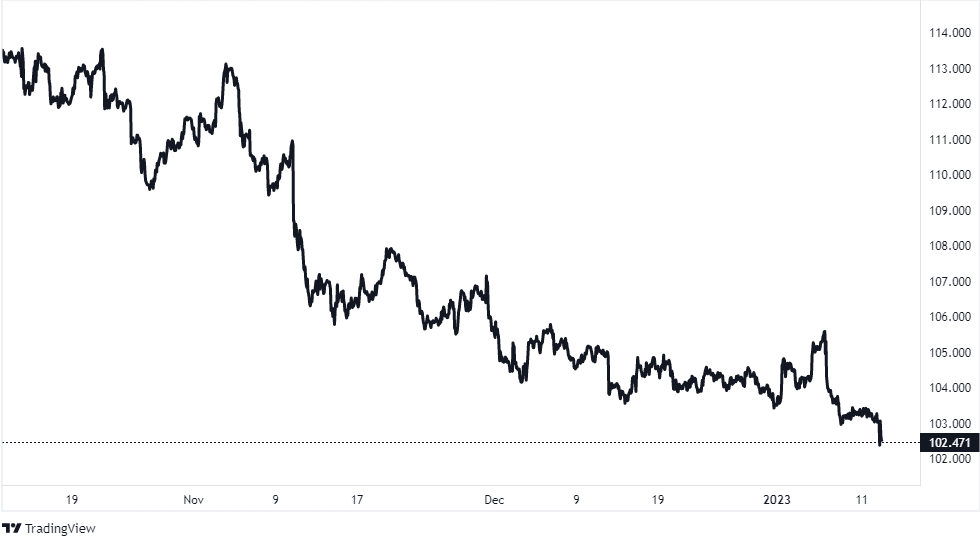

Cooling off the US dollar is good for Bitcoin

Another positive sign for the Bitcoin price is the cooling of the US Dollar Index (DXY). Historically, when the DXY pulls back, confidence in risky assets like Bitcoin increases.

The S&P 500, Dow, and Nasdaq provide an overview of the economy. Currently, Bitcoin and the major stock indices share a high correlation coefficient.

Therefore, if interest rates decline and the economy grows, Bitcoin could continue to rally with bullish equity markets. The better the macro weather, the better for the Bitcoin price.

Related: BTC Price 3-Week Highs Greet US CPI: 5 Things to Know About Bitcoin This Week

While the Bitcoin price is showing some short-term bullish momentum after the positive CPI data, the biggest challenges from centralized exchange insolvencies, impending crypto legislation, concerns over Binance reserves, and potential contagion stemming from Digital Currency Group legal troubles could hold BTC back. current rally.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should do your own research when making a decision.