The bullish momentum that propelled the price of Bitcoin (BTC) to a high of $25,000 in 2023 initially on February 16 and February 20 appears to have abated. The pause in bullish momentum appears to be related to higher-than-expected US inflation data, the possibility of the Federal Reserve continuing to raise interest rates, and large amounts of long selling.

The contraction in Bitcoin’s price follows a market-wide decline, and analysts fear that the crypto market will continue to face considerable danger from interest rate decisions by the US Federal Reserve.

Let’s take a closer look at the factors that affect the price of Bitcoin today.

Stocks fall on high inflation data

Stocks and Bitcoin tumbled after the Bureau of Economic Analysis (BEA) released the Personal Consumption Expenditures (PCE) report on Feb. 24, which showed inflation rising 5.4% in January compared to 2020. last year. Core inflation, which is one of the Federal Reserve’s favorite tools for measuring inflation, rose 4.7% compared to January 2022.

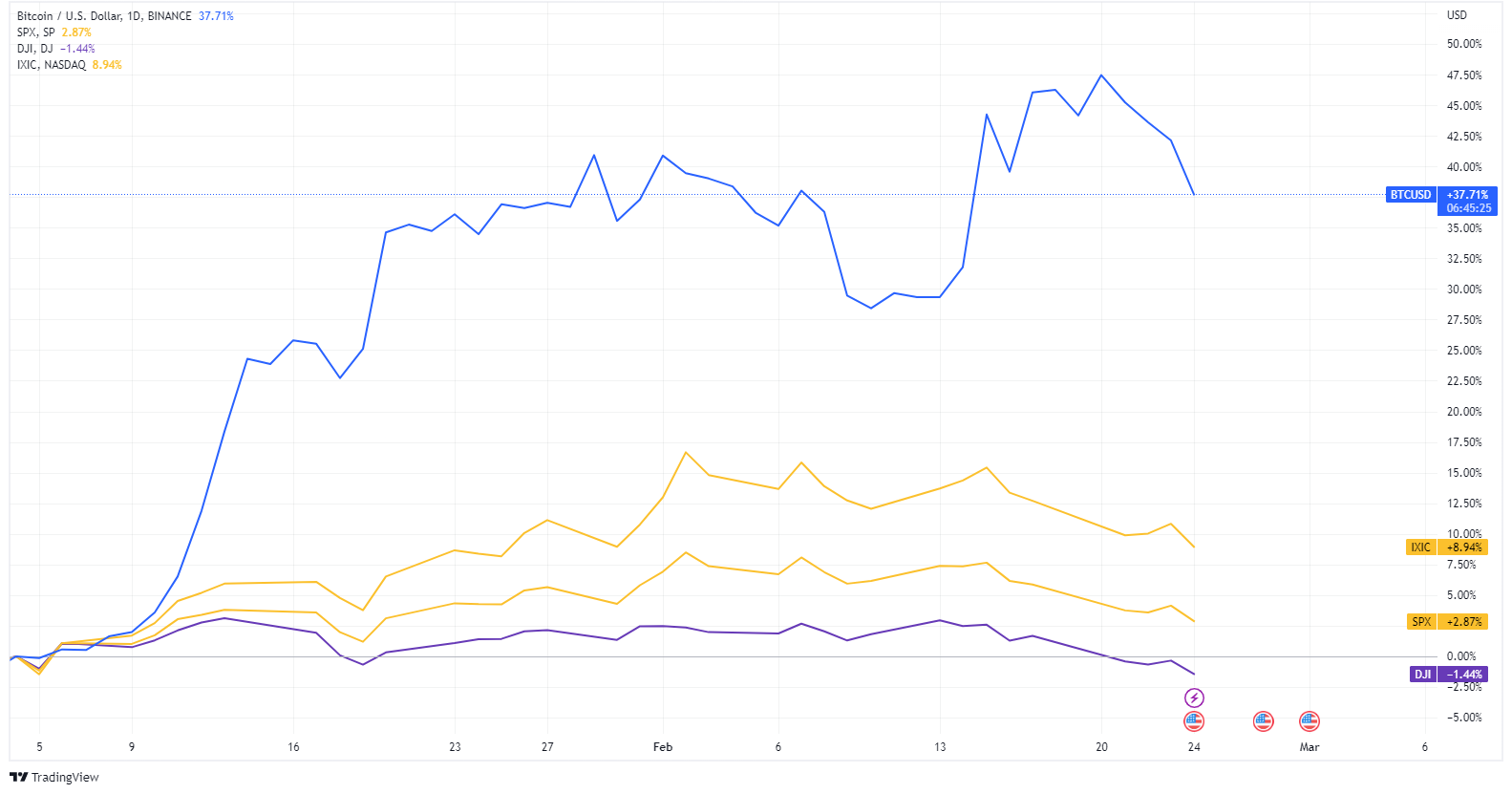

While the correlation between Bitcoin and stocks reached its lowest level since 2021 on February 22, the price of Bitcoin is still closely related to stocks and the stock market. Investors have previously expressed strong concerns about a possible upcoming recession in the US economy.

While some analysts believe that Bitcoin’s current price represents a generational buying opportunity at current levels, others believe that BTC’s close correlation to the US Dollar Index (DXY) and stocks is reflected in price weakness for hold the $24,000 level.

The Bitcoin price is reacting to the market consensus expectation that inflation is not yet under control, which will lead the Federal Reserve to continue raising interest rates.

Rising interest rates in the US and abroad weigh on the price of Bitcoin

The PCE report is the Federal Reserve’s favorite tool for measuring inflation. And with Federal Reserve Chairman Powell still aiming for 2% headline inflation, further interest rate hikes are expected. Inflation has been a determining factor in the rise in interest rates. To combat inflation, Chairman Powell may not be able to change the aggressive rate-hike strategy.

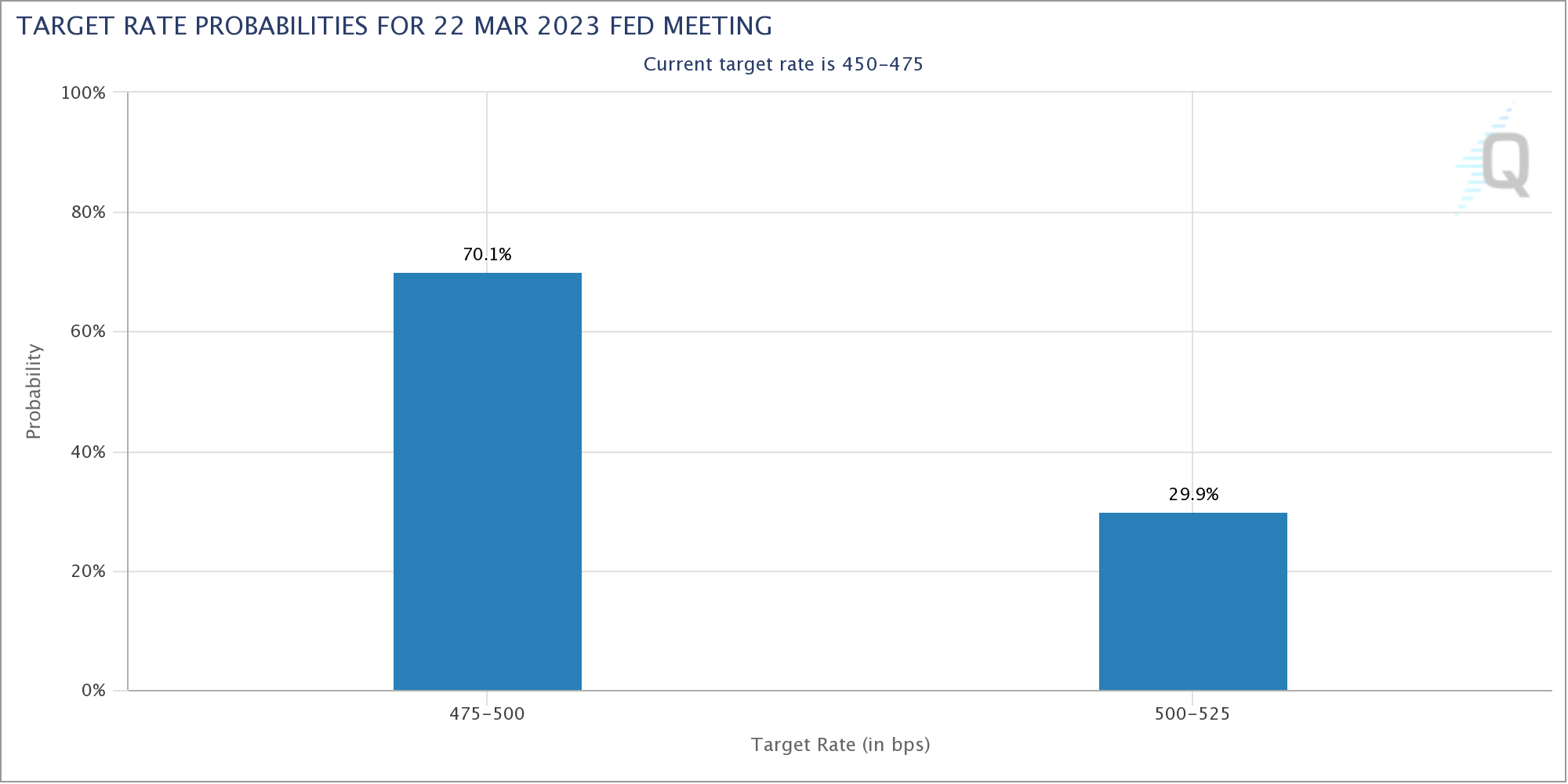

The PCE report is leading the market to speculate that a 0.5% interest rate hike is possible at the FOMC meeting on March 22.

In the wake of persistently sticky inflation, some analysts believe that Bitcoin is in for a cold winter and that the price could continue to experience FOMC-leading volatility.

On February 24, in a span of 5 hours, over $95 million worth of Bitcoin longs were liquidated. When BTC longs are liquidated without the buying pressure of trading volume, the Bitcoin price is negatively affected. While China’s recent monetary easing injected $92 billion in liquidity into the Chinese economy, it did not stop BTC longs from being liquidated.

Is there a possibility that the price of Bitcoin will change course?

On January 23 and 24, the Bitcoin futures market saw $230 million in liquidations on long positions. This put more pressure on the BTC price. When BTC longs are liquidated without the buying pressure of trading volume, the Bitcoin price is negatively affected.

Related: Bitcoin 2024 Halving Will Be The “Biggest”: Interview With Charles Edwards

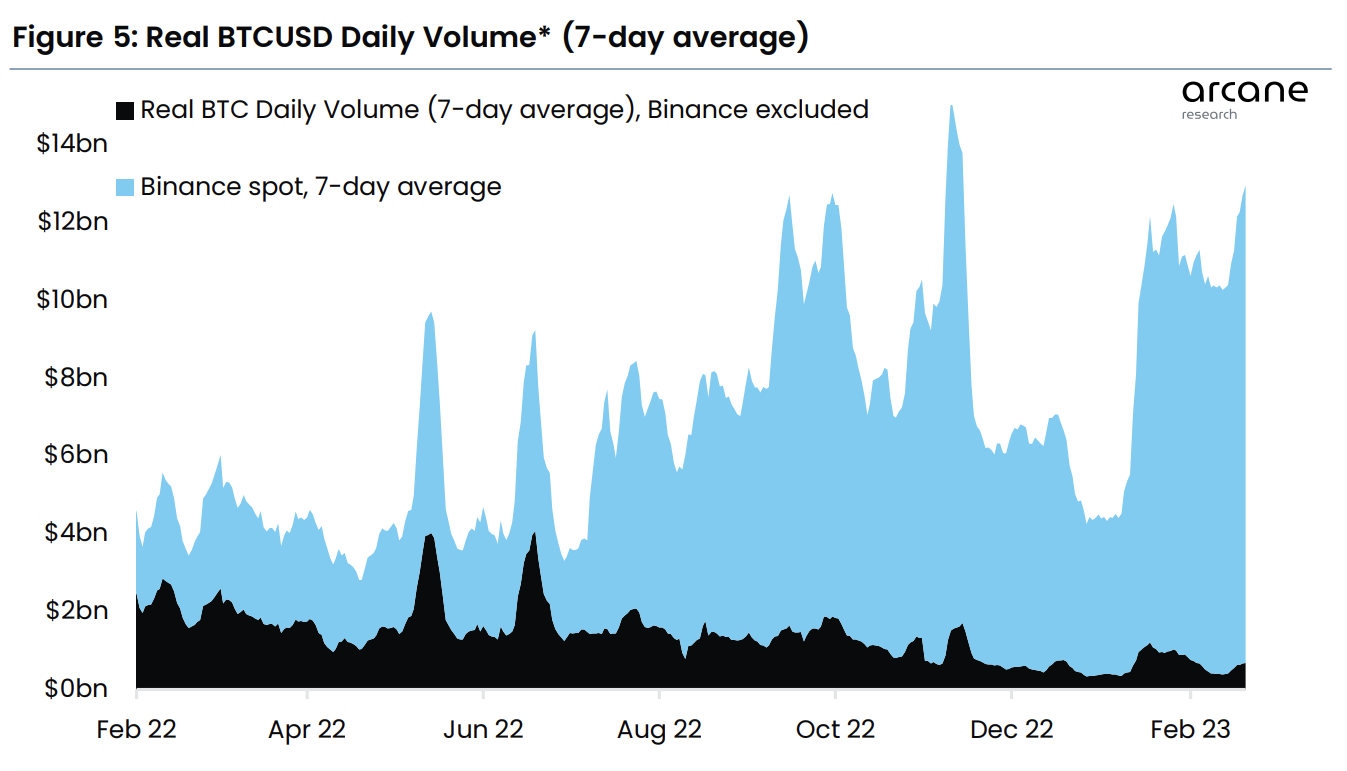

The recent increase in Bitcoin trading volume could be due to the removal of trading fees by Binance. Vetle Lunde, a senior analyst at Arcane Research, surmised from the data that:

“However, volumes are still concentrated on Binance after Binance removed trading fees. Volumes on the other spot exchanges sit below January peaks of $680 million, as Binance volume still accounts for 95% of daily BTC spot volume.”

If this is the case, that means there isn’t much of a buying pressure cushion for Bitcoin’s long selloffs leading to further downside. And with the recent Securities and Exchange Commission (SEC) actions against Binance, more assets are flowing from the exchanges.

The short-term uncertainties in the crypto market do not seem to have changed the long-term outlook of institutional investors. According to BNY Mellon CEO Robin Vince, a survey commissioned by the bank found that 91% of institutional investors were interested in investing in tokenized assets in the following years.

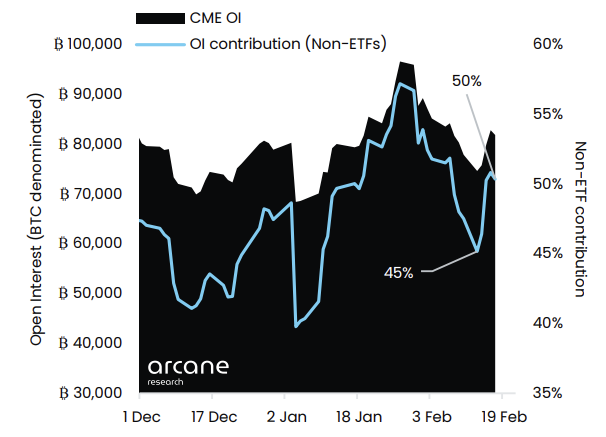

A leading tool for institutional investors to gain exposure to Bitcoin, CME has seen its dominance grow in 2023. Open interest on CME Bitcoin futures has grown by 8,000 BTC since February 17.

The data shows that CME BTC options also account for the majority of Bitcoin open interest.

Futures premiums are rising.

The CME basis stands at 8.7%, the highest since November 2021, trading at a premium to 6.3% for overseas futures.

CME also represents 68.2% of the BTC futures market, excluding perpetrators. The dominance of offshore futures has steadily declined throughout the year. pic.twitter.com/wxxiCJNh9H

— Vetle Lunde (@VetleLunde) February 24, 2023

In the near term, concerns are high as Bitcoin price is directly affected by macroeconomic events, and potential rate hikes at the next FOMC are also likely to have some effect on BTC price as well.

In the long term, market participants still expect the price of Bitcoin to rise, especially as more banks and financial institutions are apparently turning to digital cash for settlement purposes, even amid the chaos.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should do your own research when making a decision.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.