Bitcoin (BTC) headed towards $23,000 on Feb. 3 after a night of losses wiped out the latest bullish progress.

Dollar bounce stops the crypto party

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD hit lows of $23,329 on Bitstamp.

The pair had broken out of a second trip above the $24,000 mark at the Wall Street open on February 2, and buyers failed to maintain momentum amid macro market volatility.

In classic style of US Federal Reserve interest rate announcements, an initial move was soon countered, with Bitcoin returning to its previous position.

Conditions worsened on the back of a rebound in US dollar strength, with the US Dollar Index (DXY) posting a conspicuous bounce, which began to consolidate on the day.

“Once the DXY dollar finds support and starts bouncing hard, we will see pullbacks in our cryptocurrency exchanges,” popular Crypto trader Tony warned.

“It’s time to pay attention.”

Meanwhile, Cointelegraph contributor Michaël van de Poppe eyes a level of 102 for DXY to trigger inversely correlated declines in risk assets.

“I expect that DXY is likely to retest what was support and now upper resistance,” Matthew Dixon, founder and CEO of crypto rating platform Evai, continued in his own analysis.

“This would align with my reverse expectation on Btc and Crypto moving down a bit before a final ‘blowout’ high (not much higher IMO).”

IPC presents new concern

Meanwhile, macro-induced price pressure could persist into February, some believe.

Related: Bitcoin Bulls Must Claim These 2 Levels As ‘Death Cross’ Still Looms

In its latest market update sent to subscribers of the Telegram channel, trading company QCP Capital drew particular attention to the upcoming printout of the US Consumer Price Index (CPI), due for release on February 14. .

“After the FOMC, we have a bunch of second-tier data releases, including the big ISM and NFP services. However, it will be the Valentine’s Day CPI that will decide, and we believe there are upside risks in that release,” he stated.

“First, the Cleveland Fed Inflation Nowcast shows a print of >0.6% for January, even if it has overstated inflation in recent months.”

Thanks to a change in the way the CPI is calibrated, QCP suspected that the next figures at the end of 2023 could be higher than what the market expects. Whether psychological or not, the net impact could disappoint crypto bulls.

“In Europe, a similar reweighting has led to an increase in the January CPI released this week. Therefore, we expect downside risks to materialize from here, either at this meeting or after the next CPI release,” QCP added.

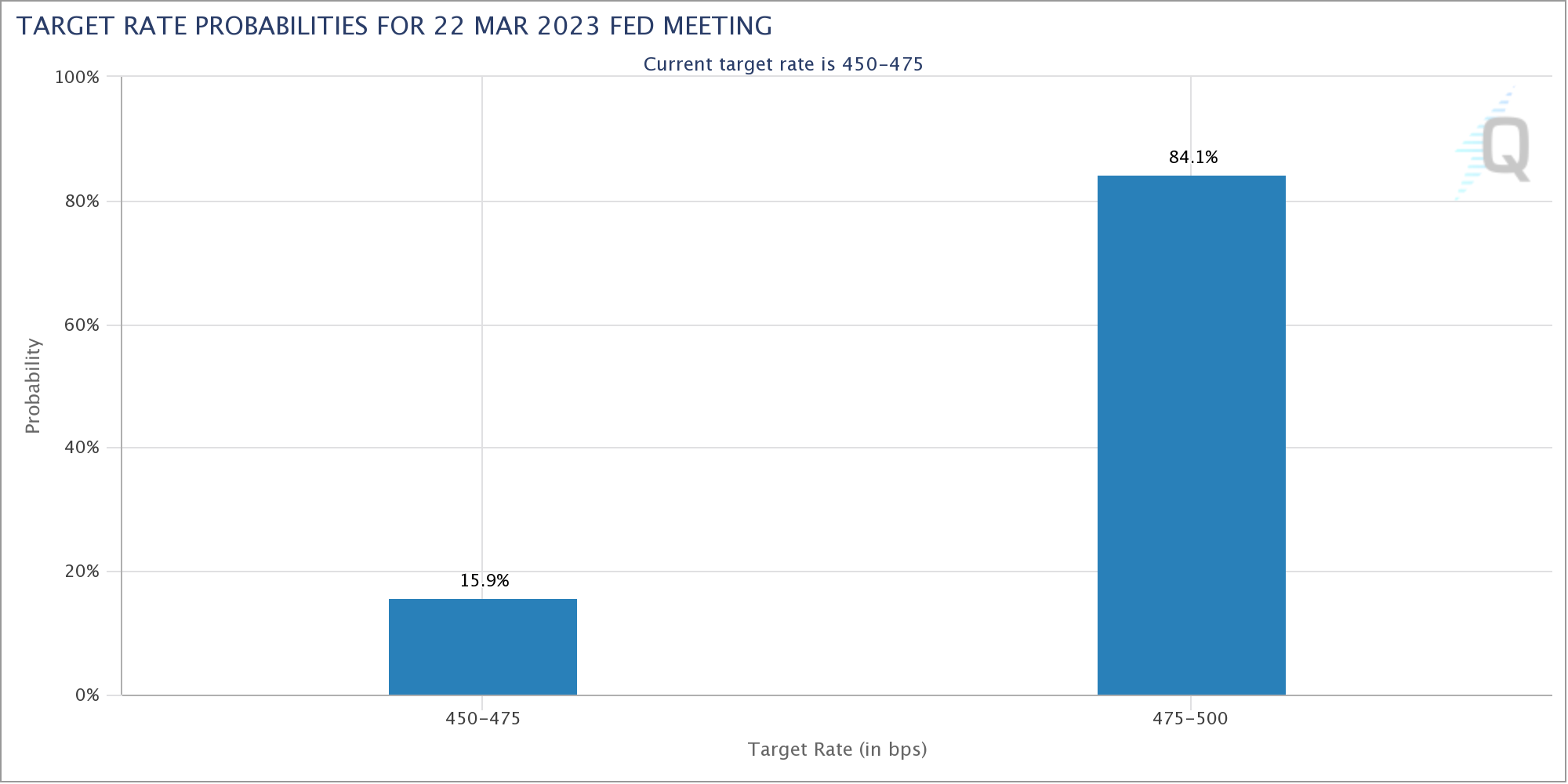

According to data from CME Group’s FedWatch Toolmeanwhile, the consensus remained firm that the next rate hike in mid-March would be identical to February’s by 25 basis points.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.