Since May 2022, the Bitcoin (BTC) margin markets on the Bitfinex exchange have been affected by unusually high open interest of over $2.7 billion. This information alone should raise a red flag, especially in light of Bitcoin’s price falling from $39,000 to less than $25,000 over the same period.

Traders looking to take advantage of their cryptocurrency position had borrowed more than 105,000 Bitcoin. Currently, the cause of this anomaly is unknown, as well as the number of entities involved in the trade.

Cheap borrowing favors high demand

Bitfinex’s less than 0.1% APR may be a contributing factor to the size of the Bitcoin lending market. To date, this has been the norm and creates huge incentives to borrow, even if there is no current need for it. There are few traders who would turn down such a ridiculously cheap leverage opportunity.

Margin borrowing can be used to take advantage of arbitrage opportunities, where a trader exploits price discrepancies between different markets. For example, borrowing Bitcoin on margin allows a trader to go long in one market and short in another, profiting from the price difference.

To understand how borrowing Bitcoin can be used to profit in derivatives markets, including those outside of Bitfinex, one must understand the distinction between futures contracts and margin markets. Margin is not a derivative contract, so trading is done on the same order book as spot trading. Also, unlike futures, long and short spreads are not always balanced.

For example, after buying 10 Bitcoin on margin, the coins can be withdrawn from the exchange. Naturally, trading, which is usually based on stablecoins, requires some form of collateral or margin deposit.

If the borrower does not return the position, the exchange will liquidate the margin to repay the lender.

Additionally, the borrower must pay interest on the BTC acquired with a margin. Operating procedures vary between centralized and decentralized exchanges, but the lender typically determines the interest rate and duration of the offers.

There was a margin decline of 12,000 BTC in a single trade

Historically, Bitfinex margin traders have been known to move high-margin positions quickly, indicating the involvement of whales and large arbitrage desks. In the most recent case, on March 25, those investors reduced their long positions by 12,000 BTC in minutes.

Notice how significant the decline was, even though it had no effect on the Bitcoin price. This supports the theory that such margin trading is market neutral because the borrower is not taking advantage of its positions with proceeds. Most likely there will be some arbitrage involving derivative instruments.

Traders should compare the data with other exchanges to confirm that the anomaly affects the entire market, as each exchange has different risks, rules, liquidity, and availability.

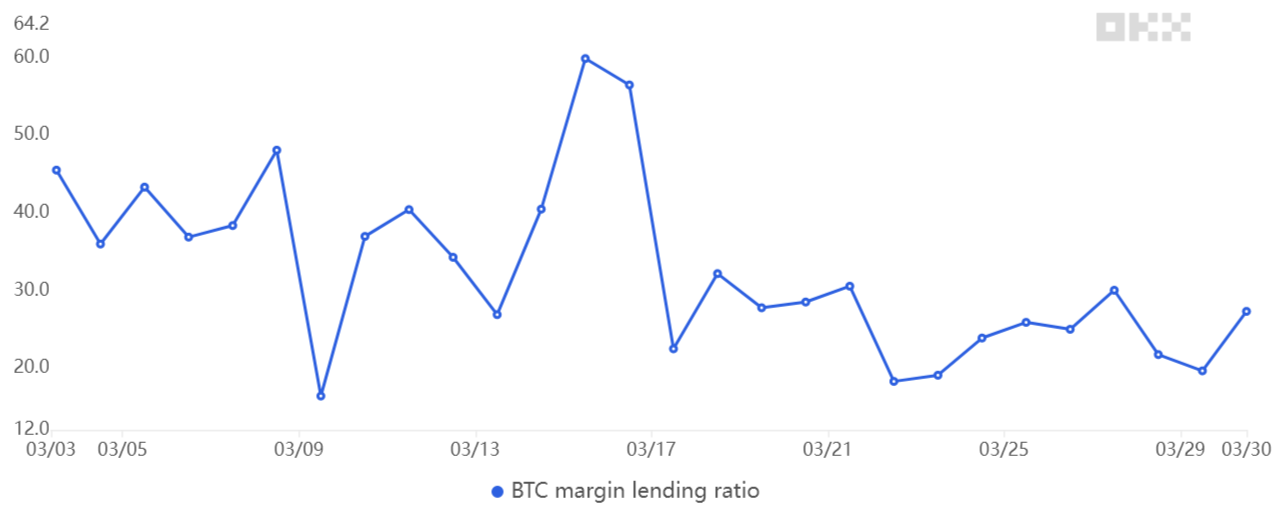

OKX, for example, provides an indicator for margin lending based on the stablecoin/BTC ratio. Traders can increase their exposure to OKX by borrowing stablecoins to buy Bitcoin. Bitcoin borrowers, on the other hand, can only bet on the price drop.

The chart above shows that OKX traders’ margin loan ratio has been stable for the past week near 30, indicating that professional traders’ long-short bets have not changed. This data supports the theory that Bitfinex’s drop is due to an arbitrage shutdown unrelated to Bitcoin’s price movement.

Related: The US government plans to sell 41K Bitcoin connected to the Silk Road

Recent Crypto Bank Closures Could Have Triggered the Move

Another possibility for the sudden decline in margin demand is the $4 billion in deposits associated with the now-defunct Signature Bank and its digital banking business. Crypto clients were told to close their accounts in April, according to a Bloomberg report.

While New York Community Bancorp (NYCB) purchased the majority of Signature Bank’s deposits and loans on March 19, the FDIC settlement did not include cryptocurrency-related accounts.

If those whales are forced to close their bank accounts, they will most likely reduce their arbitrage positions, including those in the margin markets. At the moment, all assumptions are speculative, but one thing is certain: the reduction of the 12,000 BTC long margin on Bitfinex had no effect on Bitcoin prices.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.