bitcoin (btc), the reigning king of cryptocurrencies, is on the cusp of an exciting phase, according to prominent cryptocurrency trader Jason Pizzino.

In his latest YouTube video, Pizzino delves into the complexities of bitcoin‘s four-year cycle and shares his belief that the digital currency is unlikely to reach its previous cycle lows again. This analysis is based on historical data that reveals a compelling pattern in bitcoin price movements.

One of the key factors driving bitcoin-collapse-to-previous-lows-says-crypto-analyst-jason-pizzino-heres-why/” target=”_blank” rel=”noopener nofollow”>Pizzino’s perspective is the four-year cycle of bitcoin, a well-documented phenomenon in the world of cryptocurrencies. This cycle refers to the period between each bitcoin halving event, which occurs approximately every four years.

During a halving event, the reward for mining new Bitcoins is reduced by half. These events, in turn, have a profound impact on bitcoin supply dynamics and often trigger major price fluctuations.

“The main thing is that $15,500 is almost guaranteed not to be broken.” Pizzino explains. “And we also potentially won’t see closes below the March low, which is at $19,500, which is something I’ve talked about for a long time on the channel.”

This suggests that bitcoin is poised to hold its key support levels, marking the end of a bearish phase and the beginning of a new bull market.

Comparing bitcoin to traditional markets

To get a more comprehensive perspective on bitcoin-to-gold-ratio-more-than-halves-between-2021-and-2023-202310181132″ target=”_blank” rel=”noopener nofollow”>bitcoin performancePizzino also compares its movements to those of traditional markets, particularly the S&P 500. He highlights that within the four-year cycle, the S&P 500 typically reaches a new all-time high before bitcoin manages to do the same.

Total crypto market cap currently at $1.06 trillion. Chart: TradingView.com

This pattern, seen during previous years of accumulation, demonstrates bitcoin‘s resilience and long-term growth potential.

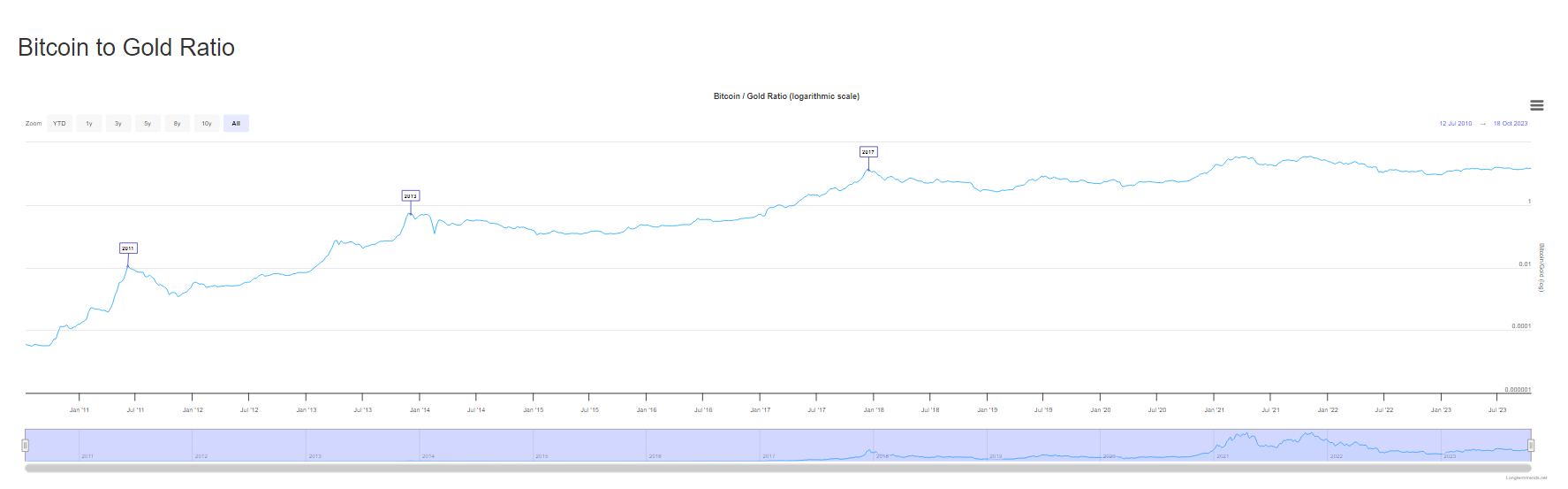

In another notable event, the bitcoin-vs-gold/” target=”_blank” rel=”noopener nofollow”>bitcoin-Gold Ratio has undergone a substantial transformation in the last two years. In 2021, bitcoin was valued at 35 times the price of gold, while in 2023, this ratio was halved to 15. This change in ratio is a critical indicator of bitcoin‘s performance relative to a traditional store of value. like gold.

Source: LongTermTrends

Current status of bitcoin

This change is significant because it reflects the changing dynamics of the financial landscape. The declining ratio between bitcoin and gold could indicate that investors are becoming more cautious about the cryptocurrency, possibly in response to regulatory concerns or greater market maturity.

TOAccording to the latest data available, the price of bitcoin, according to bitcoin” target=”_blank” rel=”noopener nofollow”>CoinGecko, stands at $28,314.26. In the last 24 hours, bitcoin saw a small drop of 1.4% but showed a gain of 5.4% in the seven-day period. These fluctuations are typical of the cryptocurrency world and highlight the inherent volatility of the asset.

Forbes Featured Image