bitcoin is up more than 150% in 2023, and that momentum has captured hearts and minds on Wall Street, resulting in a historic race for its companies to launch the first bitcoin exchange-traded fund (ETF).

All eyes are now on the upcoming decision by the US Securities and Exchange Commission (SEC) regarding the approval of a bitcoin spot ETF, scheduled for January 10.

If the past is any indication, the ruling will have a significant impact on the price of bitcoin, although whether it is positive or negative remains to be seen.

Price increase potential

Proponents of a bitcoin ETF argue that its approval by the SEC would open the door to a flood of institutional and retail investments, driving the price of bitcoin to new heights.

History offers insight into how expectations around ETFs have affected the price of bitcoin.

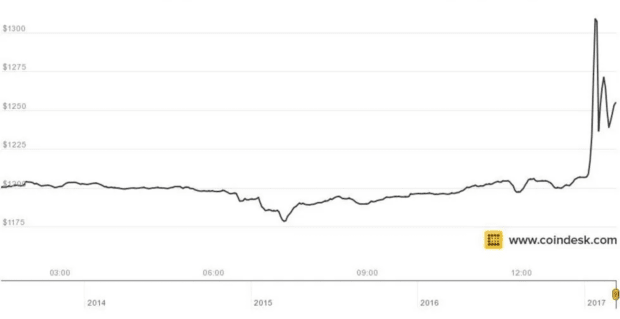

In 2017, the price of bitcoin rose to over $1,400, driven in part by anticipation of the first bitcoin ETF. This was up from lows in the $600 range just the year before.

Investors then believed that the introduction of a bitcoin ETF would make it easier for institutional money to enter the market, sparking a buying frenzy. However, the SEC ultimately rejected the proposal, causing a sharp drop in the price of bitcoin.

Within days, the price was back trading below $1,000.

Ultimately, however, the arrival of bitcoin futures would attract new attention in 2017, and the market surpassed $20,000 that year.

Elsewhere, we can fast forward to 2021, when bitcoin rose to all-time highs again, reaching over $60,000.

This time, the rally was driven in part by the successful launch of bitcoin futures ETFs in Canada and Europe. These ETFs allowed investors to gain exposure to bitcoin without having to own the cryptocurrency directly. Anticipation of a similar product in the US contributed to the bullish sentiment.

Finally, in the wake of fake news about the approval of an ETF earlier this year, the price of bitcoin surged by several thousand dollars in minutes, a move that suggests upside volatility is likely following approval.

Price drop potential

On the other hand, there are arguments suggesting that the approval of a bitcoin ETF could trigger a price correction.

Some market experts fear that the ETF could become a target for short sellers, leading to increased volatility, or that the ETF could be a “news selling event.”

Additionally, the approval of a bitcoin ETF may bring increased regulatory scrutiny to the cryptocurrency market as a whole. This increased oversight could lead to increased taxes, reporting requirements, and possible restrictions on the use of bitcoin, which could dampen enthusiasm among investors.

Additionally, some believe that the market may have already priced in the possibility of a bitcoin ETF approval, and any decision to deny it could lead to disappointment and a sell-off similar to what was seen in 2017 when bitcoin's bitcoin ETF was rejected. Winklevoss.

The crypto community is eagerly awaiting the SEC's final decision, but it is essential to remember that it is just one of many factors influencing the price of bitcoin.

Market sentiment, macroeconomic conditions, and geopolitical developments will also play a role in shaping the future of the currency.

Conclusion

In conclusion, bitcoin price is at a crossroads as investors await the SEC's decision on the bitcoin ETF.

While previous cases have shown that ETF expectations can have a substantial impact on the price of bitcoin, it is crucial to consider the broader market dynamics. Whether the price of bitcoin rises or falls after the SEC ruling will depend on a multitude of factors, including how the market interprets and reacts to the decision.

While the cryptocurrency world holds its breath, bitcoin's future remains uncertain, but it is undeniably a pivotal moment for the world's only decentralized cryptocurrency.

NEWSLETTER

NEWSLETTER