join our Telegram channel to stay up to date on breaking news coverage

Blockchain analytics firm Santiment has revealed that since the value of Bitcoin (BTC) crossed the $23K mark, its existing supply has been moved to self-custody.

#BitcoinThe current supply of continues to go into self-custody as prices hover around $23,000 here in early February. There is now $416.5 billion in $BTC sitting away from exchanges, and $29.2B in $BTC in exchanges So there are 14.26 times the currencies out of exchanges vs. assets. https://t.co/MU4UAUY5Mv pic.twitter.com/oZYoSf6tgY

— Santimento (@santimentfeed) February 7, 2023

The disclosure comes after nearly $300 million worth of Bitcoin was withdrawn from smaller exchanges last week, according to a CryptoSlate Glassnode data analysis. According to the analysis, Gate.io recorded the highest volume of withdrawals during that time period, recording up to $120 million leaving the exchange.

Coming in second after Gate.io was cryptocurrency exchange Bithumb, which witnessed up to $60 million in customer withdrawals.

Crypto exchange Luno followed Bithumb with $45 million flowing off the platform as clients withdrew their BTC holdings.

Notably, Bitcoin withdrawals were not limited to only the smallest exchanges, as Coinglass data also revealed that the amount of BTC on exchanges decreased last week. The largest cryptocurrency exchange, Binance, saw its balance reduced by 4,726 BTC in the last seven days, while Coinbase and Kraken plunged by 1,961 BTC and 1,384 BTC, respectively.

Blockchain analytics firm Santiment further corroborated the data, saying: “Bitcoin’s existing supply has been moved to self-custody since the asset price topped $23,000 in the first week of February.”

Santiment also noted that there are only 1.47 million BTC on the exchanges, which is the lowest amount since November 2018.

Santiment further said:

There is now $416.5 billion worth of BTC off the exchanges and $29.2 billion worth of BTC on the exchanges.

It is worth mentioning that investors in the cryptocurrency industry have increasingly favored self-custody since the fall of cryptocurrency firm FTX last year.

As Bitcoin Approaches 25K, Questions Remain About Rally’s Sustainability

Although the global economy continued to weaken during 2022, the US government reached its “debt ceiling” on January 19, when the full amount of money the US Treasury could borrow to finance operations current federals peaked. The cap sparked renewed concerns about more financial struggles and the dawn of a new economic slowdown.

Similarly, on the other side of the Atlantic, the UK has had a tough time with as many as 22,109 companies experiencing insolvencies in 2022 alone, representing a 57% increase the previous year and the highest rate since 2009. Beyond that, a recent report from the International Monetary Fund He suggested that the UK would be the only G-7 nation facing a recession in 2023.

In the wind of all this devastation, the cryptocurrency market has had to find momentum over the last month, growing in total market capitalization by 32% from $828 billion to around $1.1 trillion. With particular interest in Bitcoin, the flagship cryptocurrency, which surged to $24,000 on Jan. 30 after stalling in the $16,500 range for most of November and December.

Recently, Bitcoin’s total market capitalization skyrocketed to 44.82%, the highest level since June 2022. As a quick fix, this number often rises sharply when investors begin to limit their exposure to altcoins and return to invest your capital in BTC.

Market sentiment analysis

During the last week of January alone, digital asset investment products on the market saw a cumulative capital inflow of up to $117 million, the most significant amount in a 180-day period, with investors placing funds primarily in related offerings. with BTC.

Additionally, the volume of digital investment products continued to rise until it approached the $1.3 billion market on Jan. 30, which was a 17% increase compared to BTC’s year-to-date value. However, shorting Bitcoin products witnessed $4.4 million worth of monetary inflows, a worrying sign for investor sentiment according to Coinshares researchers.

On the other hand, multi-asset investment vehicles witnessed a flight of money for the third month in a row, with outflows totaling $6.4 million. With this, data from Coinshares points to more investors starting to embrace the tried and tested cryptocurrency assets.

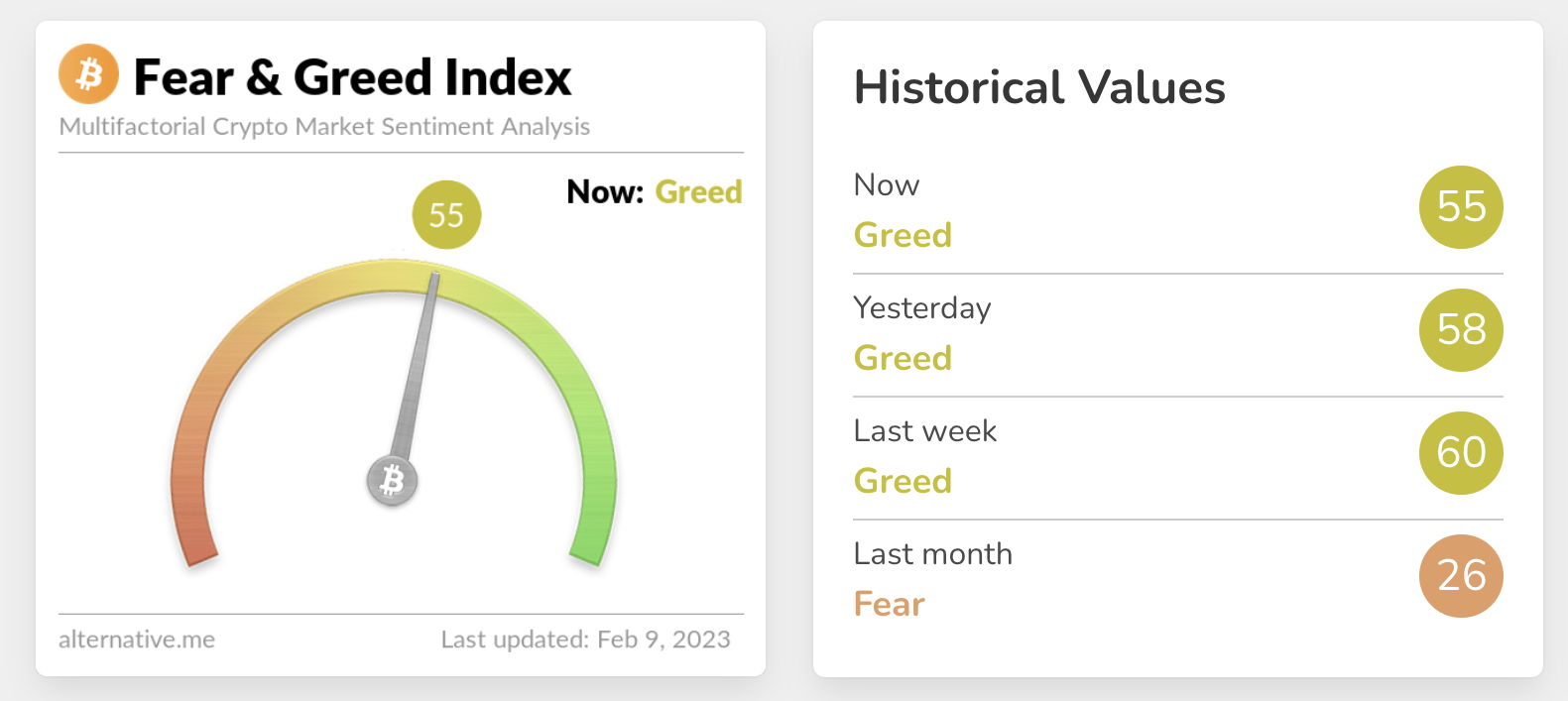

In closing, the crypto fear and greed index currently sits at 60, indicating “greed”. This tool helps investors gauge movements and sentiments in the cryptocurrency markets.

Greed means that people are looking to buy digital assets because they believe more bullish traction could be coming in the near term.

Read more:

Meta Masters Guild – Play and earn cryptocurrency

- Innovative P2E NFT Game Library To Be Released In 2023

- Free to Play: no entry barriers

- Putting the fun back in Blockchain gaming

- In-game rewards, bets, NFTs

- Real world community of players and traders

- Round One of Token Sale Live Now – memag.io

join our Telegram channel to stay up to date on breaking news coverage

NEWSLETTER

NEWSLETTER