This article is also available in Spanish.

Veteran trader Peter Brandt believes that bitcoin's recent rally is still not enough to reverse the long-term bearish trend. While btc had a brief surge, it insists that it has not reached the levels needed to confirm a bullish reversal.

bitcoin” target=”_blank” rel=”nofollow”>bitcoin You first need to decipher $71,000 and then confirm it, Brandt says. And while he states this, other market analysts such as Jesse Colombo and Roman warn that crypto-market/” target=”_blank” rel=”nofollow”>geopolitical tensions and market patterns could cause btc to fall further.

Related reading

QCP Capital highlights cautious optimism, noting that the recent sell-off appears shallow, suggesting recovery potential. As more top traders take the time to think about it, Michal van de Poppe believes this pullback is short-term and would expect a retest of the $60,000 support before bitcoin sees a strong rebound.

For over seven months, bitcoin has been trading in a downtrend with consecutive highs and lows reinforcing the bearish sentiment. Although the short-lived optimism had some moments of restraint, according to Brandt's graphic work, the broader pattern is not altered. btc must overcome the highest resistance levels available before a shift towards the bullish side can be seen.

Resistance levels that hold bitcoin back

According to Brandt, bitcoin is caught between twox.com/PeterLBrandt/status/1841270939901911145/photo/1″ target=”_blank” rel=”nofollow”> important resistance levels. The first is at $70,600, while the second and bitcoin's all-time high is at $73,800. Both brands have capped the upward movement repeatedly and are therefore a must for bitcoin's next big move. Since bitcoin is unlikely to convincingly break above $71,000, the asset is likely to remain in its current consolidation scenario, Brandt believes.

<blockquote class="twitter-tweet”>

bitcoin's recent rally did NOT disrupt the 7-month sequence of lower highs and lower lows. twitter.com/search?q=%24BTC&src=ctag&ref_src=twsrc%5Etfw” rel=”nofollow”>$btc

Only a close above 71,000 confirmed by a new ATH will indicate that the trend from the November 2022 low is still in force pic.twitter.com/lFO9A20VPD

—Peter Brandt (@PeterLBrandt) twitter.com/PeterLBrandt/status/1841270939901911145?ref_src=twsrc%5Etfw” rel=”nofollow”>October 2, 2024

Roman is also one of the most popular cryptocurrency traders with a similar opinion. He noted that any increase in volume along with falling prices usually confirms a strong bearish trend. Roman believes bitcoin will test the $55,000 to $57,000 range before any hope of a reversal, which again puts emphasis on fighting to break those resistance levels.

Moving averages and market uncertainty

bitcoin's 8-week simple moving average (SMA) has been holding at a level around $60,526 and has served as resistance recently on the price charts. The btc price has been outside that line for a while, indicating the fact that market participants have not really decided whether they are buying or selling. Nor has it traded too low to find good strength to go up.

As for volatility, bitcoin's average true range is 5,756. This is a relatively small level of volatility within the market. That just means that the market can generate big moves, but has not yet generated an extreme level of volatility. Traders are watching these indicators closely because they could indicate where bitcoin will break out next.

Geopolitical tensions and market sentiment

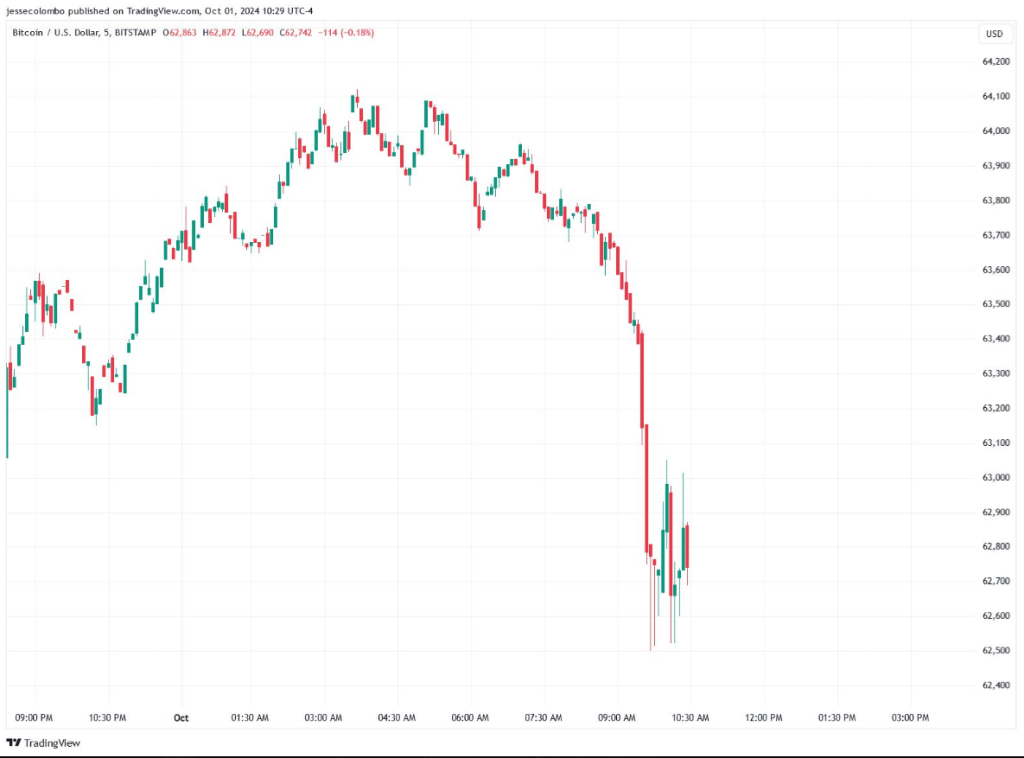

The tension in the Middle East is yet another tension in the cryptocurrency market. Of course, bitcoin has begun to increase its volatility along with growing concerns about global instability. The price of bitcoin in the last 24 hours has dropped 3% to reach $61,380. In reality, that drop was part of the general sell-off among cryptocurrencies, within which the total market capitalization fell 7.6% in two days.

<blockquote class="twitter-tweet”>

bitcoin and cryptocurrencies always fail when there are geopolitical fears, unlike precious metals.

That confirms my long-held belief that cryptocurrencies are not a safe haven.

It's yet another risky asset, just like high-flying tech stocks. twitter.com/search?q=%24BTC&src=ctag&ref_src=twsrc%5Etfw” rel=”nofollow”>$btc twitter.com/search?q=%24GLD&src=ctag&ref_src=twsrc%5Etfw” rel=”nofollow”>$GLD pic.twitter.com/SBLgLgdpKB

—Jesse Colombo (@TheBubbleBubble) twitter.com/TheBubbleBubble/status/1841123937125576757?ref_src=twsrc%5Etfw” rel=”nofollow”>October 1, 2024

According to Jesse Colombo, a well-known market analyst, bitcoin, like other cryptocurrencies, often worsens during periods of geopolitical instability. As he points out: “bitcoin and cryptocurrencies always fail when there are geopolitical fears, unlike precious metals.” The story was basically the same with bitcoin when bitcoin-holds-above-61-000-after-sell-off-driven-by-escalating-conflict-between-israel-and-iran-202410021300″ target=”_blank” rel=”nofollow”>global tensions They reached their peak. It would seem that the current market is no different from this historical precedent.

Related reading

QCP Capital remains bullish, despite the bearish sentiment emerging from some corners. This is a sign of positivity: the massive sell-offs of a few days ago seem superficial and one would expect investors to remain interested in risk assets, such as bitcoin. Similarly, Michal van de Poppe predicts a retest of the $60,000 support level, suggesting the market could reverse course if that level holds.

Featured image by Finshots, TradingView chart

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>