The massive growth in hash rate has some speculation as to who is behind such a sizable increase, plus an update from public bitcoin miners.

The following article is an excerpt from a recent issue of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to get these insights and other on-chain bitcoin market analysis delivered straight to your inbox, subscribe now.

hash rate on the move

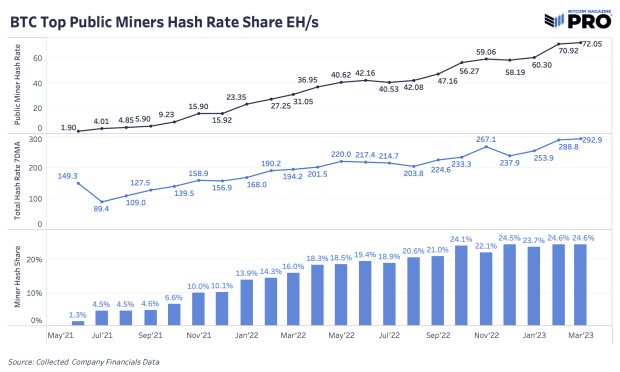

The Bitcoin network hash rate is on the move this year, now at an all-time high of 350 EH/s and up 36.7% YTD. The hash rate has been following the increase in price, which is the likely result of more machines coming online at a more profitable price. In 2022, there was a lot of newer, unused inventory of ASICs sitting dormant at lower bitcoin prices and now making its way onto the network as public miners continued to expand, most notably at companies like Marathon Digital Holdings. , Riot Platforms and Cipher Mining Technologies.

The increase in the hash rate is the result of longer-term investment and expansion decisions that are now coming to fruition after a lapse of time. As noted, some miners kept their machines on the sidelines while the bitcoin price was lower and less profitable for mining. Another possibility, according to Miner Mag analysis, suggests that a high proportion of mining rig imports into the US in January may have played a role in the hash rate expansion. Those sends have slowed down since then, which may indicate an upcoming cooling off period after this recent hash rate growth. Estimating the breakdown and contributions of factors to why exactly the hash rate is increasing is always fraught with nuance.

The hash rate as a whole continued to rise steadily over the past few months, while bitcoin holdings continued to decline. When we use the numbers reported for the hash rate of public miners at the end of February, the 292 EH/s at the end of February and the 350 EH/s online today, we conclude that public miners represent between 20 and 25 % of the total network hash rate on a given day. This is likely a low estimate considering there are some smaller public miners that we are not tracking and public miner data is released periodically.

It is the opinion of many that the hash rate hits all-time highs on almost a day-over-day basis (using various moving averages to account for variability), but this level of growth is not out of the ordinary for bitcoin in historical terms, although it is quite impressive already. that the absolute level of the hash rate reached almost unfathomable numbers just a few years ago.

Three month hash rate growth is at a staggering 53%. There are only two moments that can be compared: China’s post-ban mining boom in 2021 and then in 2019, when there was massive growth in the network hash rate after the new hash rate finally went into effect. line after the previous bull market orders were filled in 2017 and the infrastructure was built.

while most mining stocks have outperformed bitcoin by a wide margin in 2023, this can generally be attributed to two fairly simple factors: mining stocks are much more volatile than bitcoin due to a number of factors, including:

1. Mining stocks are much more volatile than bitcoin due to several factors, including:

- Public stocks trade at a multiple of future cash flows (anyone know satellite flows?).

- Potential balance sheet leverage.

- ASICs and other operating infrastructure are listed as bitcoin derivatives.

- Much smaller market caps, less global access to capital, more illiquidity.

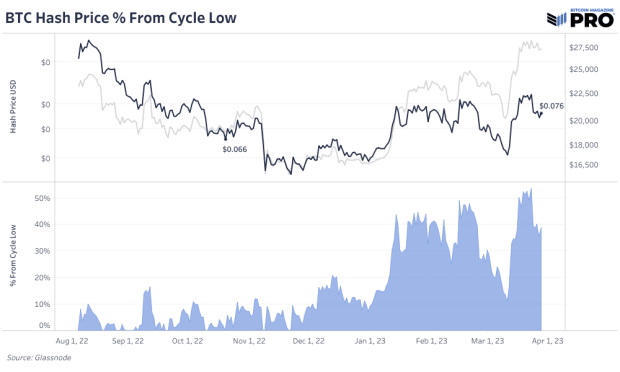

2. Since the beginning of the year, price growth has outpaced hash rate growth, which means that the hash price has increased. In our mining updates, we often revise our simplified framework for investing in bitcoin mining:

- Hash Price Bull Market = Bitcoin miners outperform Bitcoin.

- Hash Price Bear Market = Bitcoin miners are underperforming Bitcoin.

We use the hash price as a simple indicator for investment in the mining market due to the empirical reality that mining revenue will continue to fall (in bitcoin terms) due to the issuance of asymptotic bitcoin supply, along with the mining difficulty that continues to increase as a result of the corresponding growth of the hash rate. Because of this dynamic, bitcoin’s performance must adjust against relative hash rate growth. For individual companies, it is important to measure their relative hash rate against the hash rate of the network and the difficulty of mining.

The performance of bitcoin-denominated miners closely correlates with the rise in hash price from cycle lows.

The hash price minimums are the default in the bitcoin industry. Gains in chip efficiency and a bitcoin exchange rate that continues to trend higher over a long time horizon means that miner revenue per terahash continues to trend lower. This is a feature, not a bug, but it makes bitcoin mining an incredibly difficult industry to invest capital in due to its cutthroat nature.

Final note:

There has been speculation about the recent hash rate spike, with some on social media pontificating about a possible nation-state-level operation. It goes without saying that we are skeptical of some of these theories. Nearly 100% of the current total hash rate is mined in identifiable mining pools. If a nation-state mining operation were rolling out at scale, it would likely operate in a sovereign mining pool or one attributed to a specific country outside of the United States, whereas many mining pools are comprised of miners from around the world. This assessment may turn out to be wrong later on, and we’ll be more than willing to admit our misjudgment, but this recent growth doesn’t look like a nation state based on the data we’re looking at.

A simpler explanation for why bitcoin’s hash rate seems to go parabolic in recent months is that many participants simply forget to set their charts to logarithmic scale.

That concludes the excerpt from a recent issue of Bitcoin Magazine PRO. subscribe now to receive PRO articles directly to your inbox.

Relevant Articles:

- State of the Mining Industry: Public Miners Overtake Bitcoin

- PRO Market & Mining Dashboards 03/23/2023

- State of the mining industry: survival of the fittest

- Time-Based Capitulation: Bitcoin Volatility Hits Record Lows Amid Market Apathy

- This time is no different: miners are the biggest risk facing the Bitcoin market in the repeat of the 2018 cycle

- Hash Rate Hits New All-Time High: Implications For Mining Stocks

NEWSLETTER

NEWSLETTER