The Bitcoin (BTC) price rose more than 10% between April 9 and 14, marking the highest daily close in more than ten months. While some analysts may argue that the move warrants some degree of decoupling from traditional markets, both the S&P 500 and gold are near their highest levels in more than six months.

Bitcoin Price Surpasses $30,000 Despite Macroeconomic Hurdles

Bitcoin’s gains and rally above $30,000 also came as the Dollar Strength Index (DYX), which measures the US currency against a basket of currencies, hit its lowest level in 12 months.

The gauge fell to 100.8 on April 14 from 104.7 a month earlier as investors priced in higher odds of further liquidity injections from the Federal Reserve.

Related: Bitcoin Price Teases $30K Breakout Ahead of US CPI, FOMC Minutes

The latest minutes of the Federal Reserve’s monetary policy meeting, released on April 12, made explicit reference to the forecast of a “mild recession” later in 2023 due to the banking crisis. Even if inflation is no longer a primary concern, the monetary authority has little room to raise interest rates further without escalating an economic crisis.

Even if inflation is no longer a primary concern, the monetary authority has little room to raise interest rates further without escalating an economic crisis.

Strong macroeconomic data explains investor optimism

While the global economy may deteriorate in the coming months, recent macroeconomic data has been mostly positive. For example, the European Union’s statistics office reported that industrial production in the 20 member countries rose 1.5% per month in February, while economists polled by Reuters had expected a 1.0% rise.

In addition, the latest macroeconomic data from China showed an encouraging trend, with exports rising 14.8% year-on-year in March, breaking a five-month slump and surprising economists who had expected a 7% drop. As a result, China’s trade balance for March was $89.2 billion, far exceeding the market consensus of $39.2 billion.

The contrast between the current economic momentum and the next recession brought on by higher funding costs and lower risk appetite among lenders has Bitcoin investors questioning the sustainability of the $30,000 support.

Let’s look at Bitcoin derivatives metrics to better understand how professional traders are positioning themselves in the current market environment.

BTC derivatives do not show excessive leverage from longs

Margin markets provide insight into how professional traders are positioning because they allow investors to borrow cryptocurrencies to take advantage of their positions.

OKX, for example, provides a margin lending indicator based on the stablecoin/BTC ratio. Traders can increase exposure by borrowing stablecoins to buy Bitcoin. On the other hand, Bitcoin borrowers can only bet on the price of a cryptocurrency falling.

The chart above shows that the OKX Traders Margin Loan Index declined between April 9-11. That is extremely healthy as it shows that no leverage has been used to support Bitcoin price gains, at least not using margin markets. Also, given the general optimism of cryptocurrency traders, the current margin lending ratio of 15 is relatively neutral.

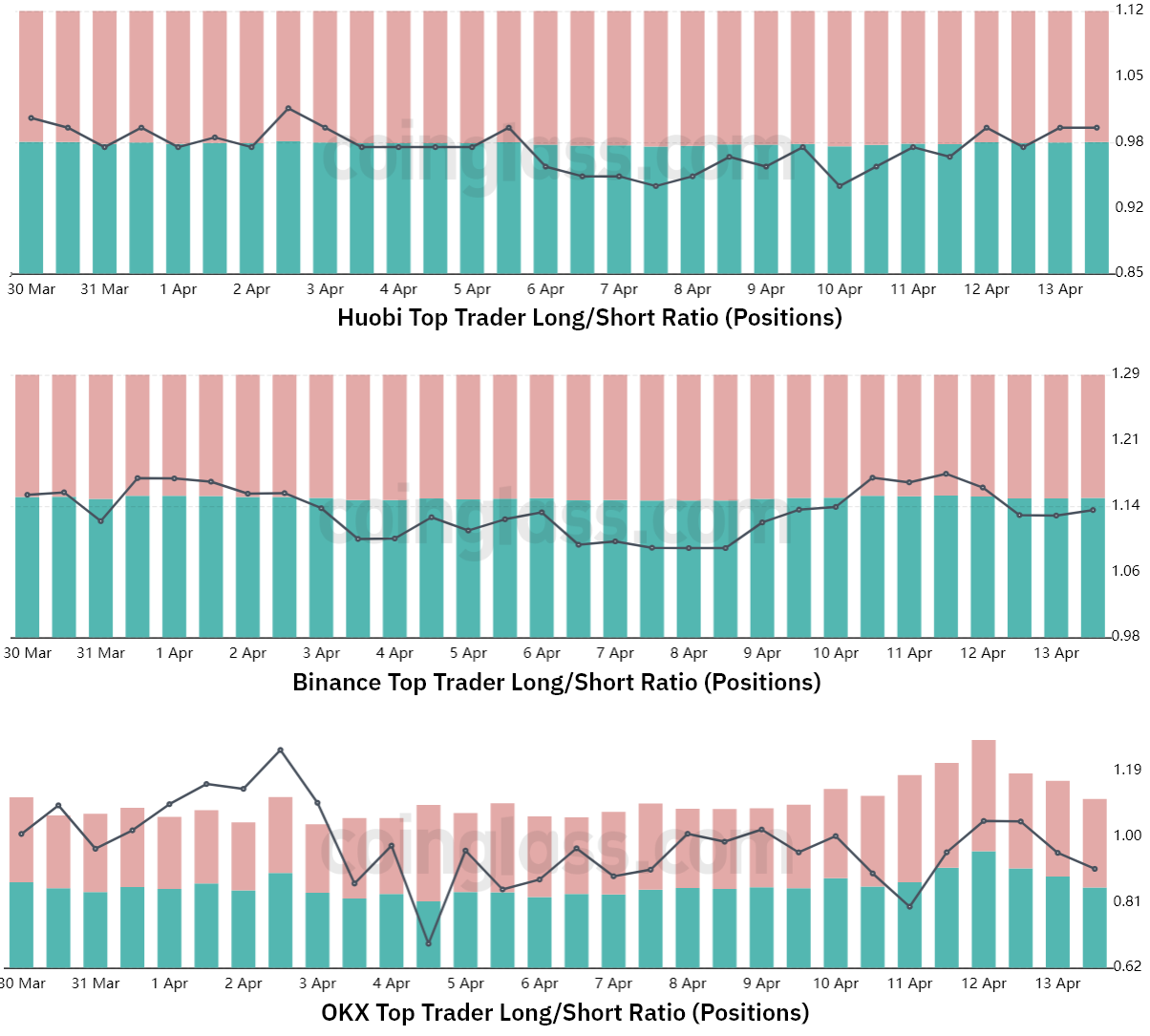

The long-to-short metric excludes externalities that might have affected only margin markets. In addition, it collects data on client stock positions at the moment, perpetual and quarterly futures contracts, thus offering better information on how professional traders are positioned.

There are occasional methodological discrepancies between different exchanges, so readers should monitor changes rather than absolute numbers.

Interestingly, despite Bitcoin breaking above $30,000 for the first time in 10 months, professional traders have kept their leveraged long positions unchanged, according to the long-short indicator.

For example, the ratio for Huobi traders held firm near 0.98 from April 9 to April 14. Meanwhile, on cryptocurrency exchange Binance, long-shorts rose slightly, favoring longs, from 1.12 on April 9 to 1.14 today. Lastly, on the OKX cryptocurrency exchange, the long-short ratio decreased slightly, from 1.00 on April 9 to 0.91 today.

Related: Tesla’s Bitcoin Sale Last Year Turned Out To Be A $500 Million Mistake

Furthermore, Bitcoin futures traders were not confident enough to add leveraged bullish positions. So even if Bitcoin price retests $29,000 in derivative terms, bulls should not worry as there has been little demand from short sellers and no excessive leverage from buyers.

In other words, Bitcoin’s market structure is bullish, where the price of BTC can easily rise another 10% to $33,000 as sellers are currently afraid to short it.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER