bitcoin miners have always been a reliable indicator of general sentiment within the market. By tracking its earnings and actions, we can get an idea of where the btc price could be headed. In this article, we will explore the latest trends in bitcoin mining, how miners are reacting to current market conditions, and what we can learn from key indicators to assess how bitcoin miners are positioning themselves for the coming weeks and months.

Miners Earnings Statement

One of the best ways to assess bitcoin miner sentiment is to examine their profits relative to historical data. This can be done using The multiple Puellwhich measures the current income of miners against the annual average of the previous year.

According to the latest data, the Puell Multiple is around 0.8, which means that miners earn 80% of what they earned on average over the last year. This is a notable improvement from a few weeks ago, when the multiple was as low as 0.53, indicating miners were earning just over half the previous year's average.

This major drop at the beginning of the year likely put financial pressure on many miners. However, despite these challenges, the fact that Puell Multiple is recovering suggests that the outlook for miners could be improving.

Hashrate and network growth

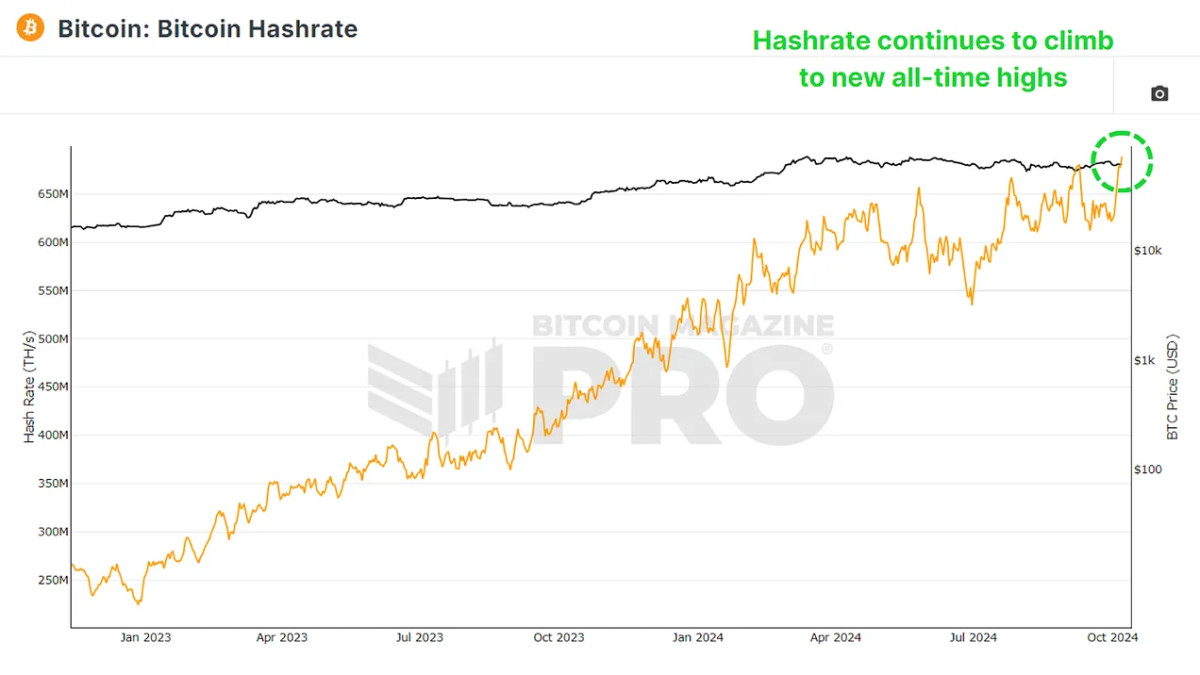

Although profits are down, there are no signs of miners leaving the network. In fact, bitcoin-hashrate-chart/”>bitcoin hashratewhich is the total computing power used to protect the network, has been increasing steadily. This increase in hashrate indicates that more miners are entering the network or that existing miners are upgrading their equipment to compete for block rewards.

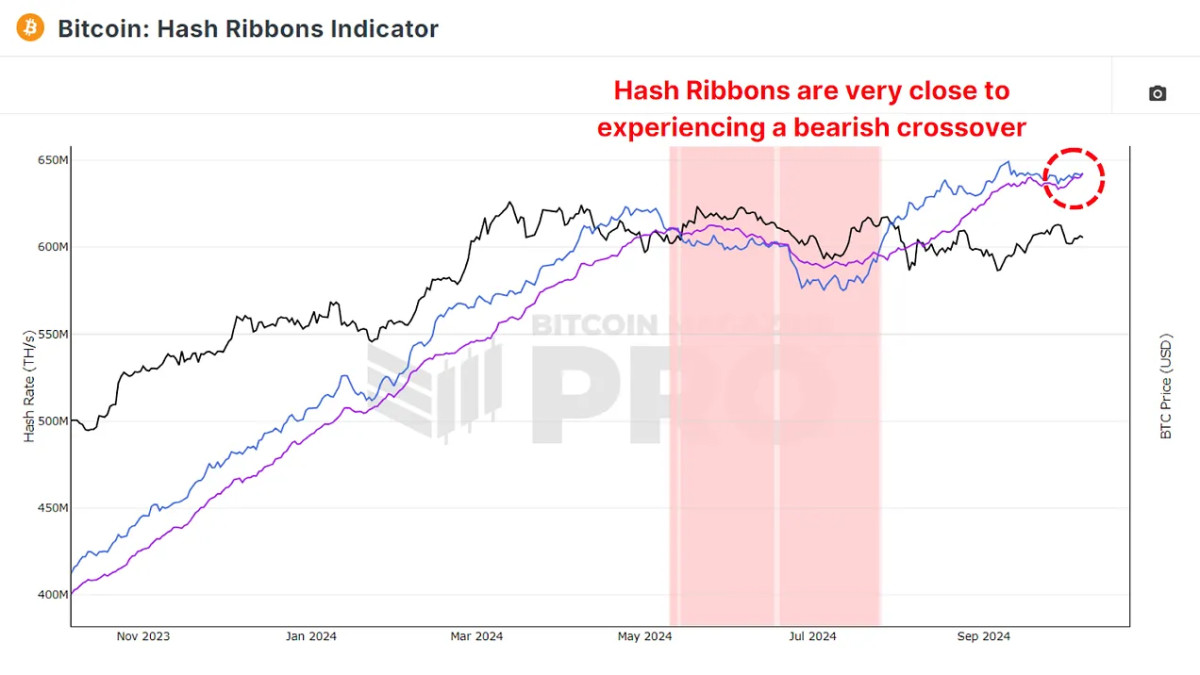

However, looking at the Hash Tapes Indicatorwhich tracks the 30-day (blue line) and 60-day (purple line) moving averages of the bitcoin hashrate, these two averages have been approaching the crossover, which could potentially indicate a short-term bearish outlook. When the 60-day average exceeds the 30-day average, it historically points to miner capitulation, a time when miners, under financial stress, shut down their equipment.

Until we see a bearish crossover, there are no immediate signs of a downtrend. One positive is that each time this happens, it has been followed by a period of accumulation, which typically precedes a rise in bitcoin prices. Investors often view these periods of capitulation as great opportunities to buy btc at lower prices.

How much do miners earn?

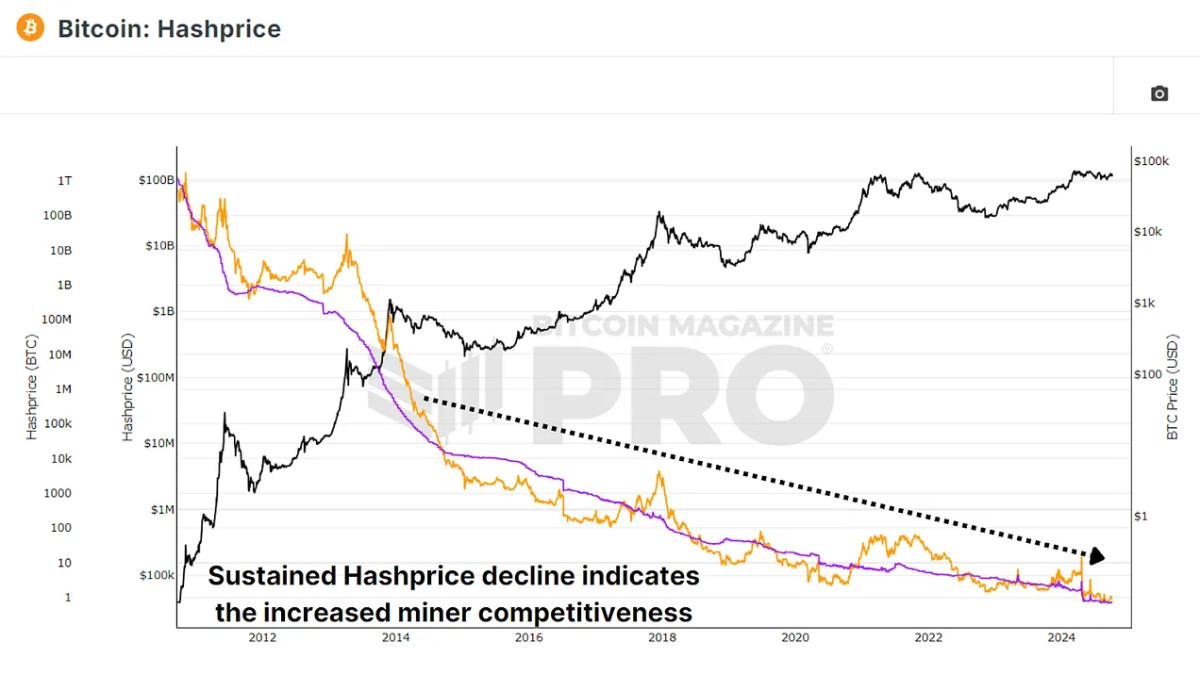

While we have discussed miners' profits in relation to the price of bitcoin, another important factor is the bitcoin-hashprice/”>hash pricethe amount of btc or USD that miners can earn for each terahash (TH/s) of computing power they contribute to the network.

Currently, miners earn approximately 0.73 btc per terahash, or around $45,000 in US dollar terms. This amount has been steadily declining in the months following bitcoin's latest halving event, where miners' block rewards were cut in half, reducing their profitability. Despite these challenges, miners continue to increase their hash rate, suggesting that they are betting on future btc price appreciation to offset their lower profits.

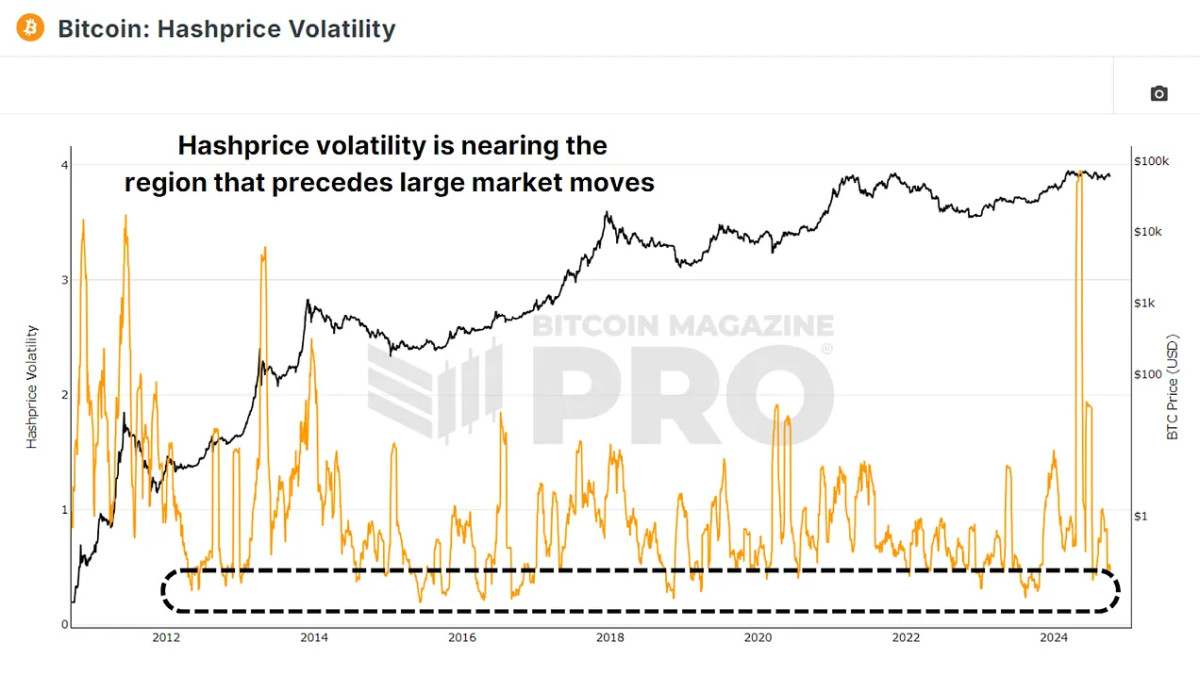

One of the most interesting metrics to observe is the bitcoin-hash-price-volatility/”>Hash Price Volatilitywhich tracks how stable or volatile miners' profits are over time. Historically, periods of low hash price volatility have preceded major bitcoin price movements. According to the latest data, hash price volatility has started to fall again, suggesting that we could be approaching a period of substantial bitcoin price movement.

Conclusion

bitcoin miners' profits have declined compared to a historical post-halving average, but are recovering from a recent significant low. bitcoin hashrate continues to rise; meaning that miners are investing more computing power into the network despite lower profitability. The hash price continues to fall, but miners remain optimistic, likely due to expected future price appreciation. Hash price volatility is falling, historically indicating that a big move in btc price could be imminent.

bitcoin miners appear to be optimistic about btc's long-term potential, despite the current challenges. If current metric trends hold, we could be on the verge of a significant price move, and most signs point toward a positive outlook.

For a more in-depth look at this topic, watch a recent YouTube video here: