Following the stellar start of Bitcoin (BTC) in 2023, SkyBridge Capital founder Anthony Scaramucci believes that “we are past the bear market” and expressed confidence in his company’s crypto investments.

However, “the Mooch” qualified the statement by adding: “That’s conjecture. We do not know.

On a April 6 interview With Yahoo Finance, Scaramucci noted that Bitcoin has consistently outperformed every other asset class over longer periods of time, saying:

“But every time you’ve held Bitcoin in a four-year rolling range, so you pick the day, you hold it for four years, you’ve outperformed every other asset class.”

Scaramacci also expressed his bullish outlook for the leading crypto by market cap ahead of the next halving cycle, which will take place in early March 2024 according to goodhash.

Historically, Bitcoin has operated on a four-year cycle, with the start of an uptrend shortly after each halving cycle.

The theory behind the price cycle is that halving block rewards make existing BTC more scarce and therefore more valuable.

Bitcoin has posted gains of nearly 70% in 2023 according to Cointelegraph Pro, rising from $16,521 to $28,060 compared to the S&P 500 Index, which rose just over 7% over the same time period.

Bitcoin’s enviable start to 2023 also comes amid what can only be described as poor market and regulatory conditions that may yet impact price.

US-based crypto institutions are struggling to find banking partners and liquidity following the collapse of crypto-friendly banks like Silvergate, Silicon Valley and Signature Bank, and there are fears that the US is implementing a policy to prevent them from banks interacting with crypto.

Related: Bitcoin ‘Faces Headwinds’ as US Money Supply Falls Further Since 1950s

Additionally, the two largest cryptocurrency exchanges in the world according to CoinMarketCap (Binance and Coinbase) have come under recent scrutiny from regulators.

Coinbase received a Notice from Wells on March 22 notifying of possible Securities and Exchange Commission enforcement action, while Binance has been sued by the Commodity Futures Trading Commission after allegedly violating trading and derivatives rules. .

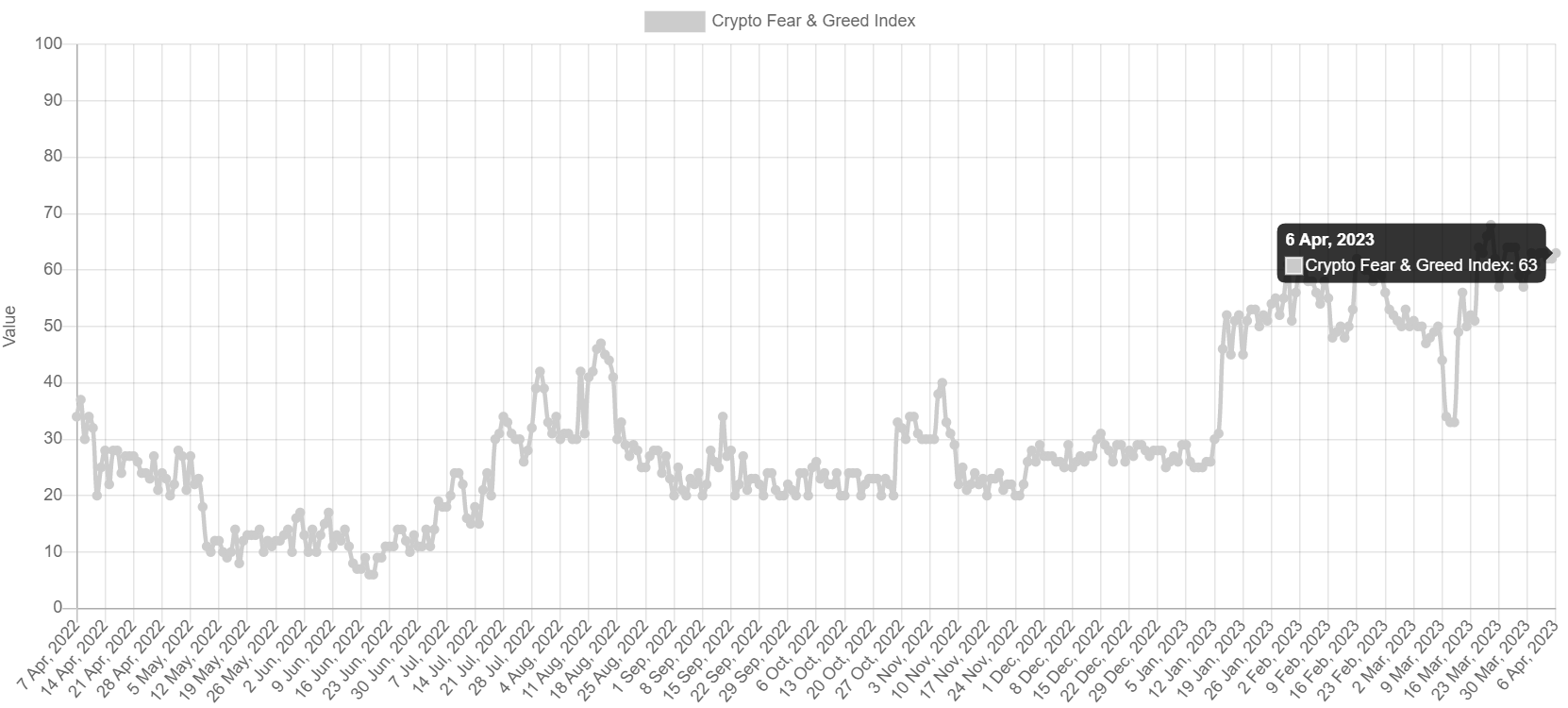

However, despite these events, crypto sentiment remains positive.

The Crypto Fear & Greed Index, an indicator used to gauge crypto sentiment, is currently in greed territory and is pushing for highs not seen since November 2021 – Bitcoin’s all-time high.

Asia Express: Zhu Su exchange made $13.64 in volume akshually, Huobi in crisis

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER