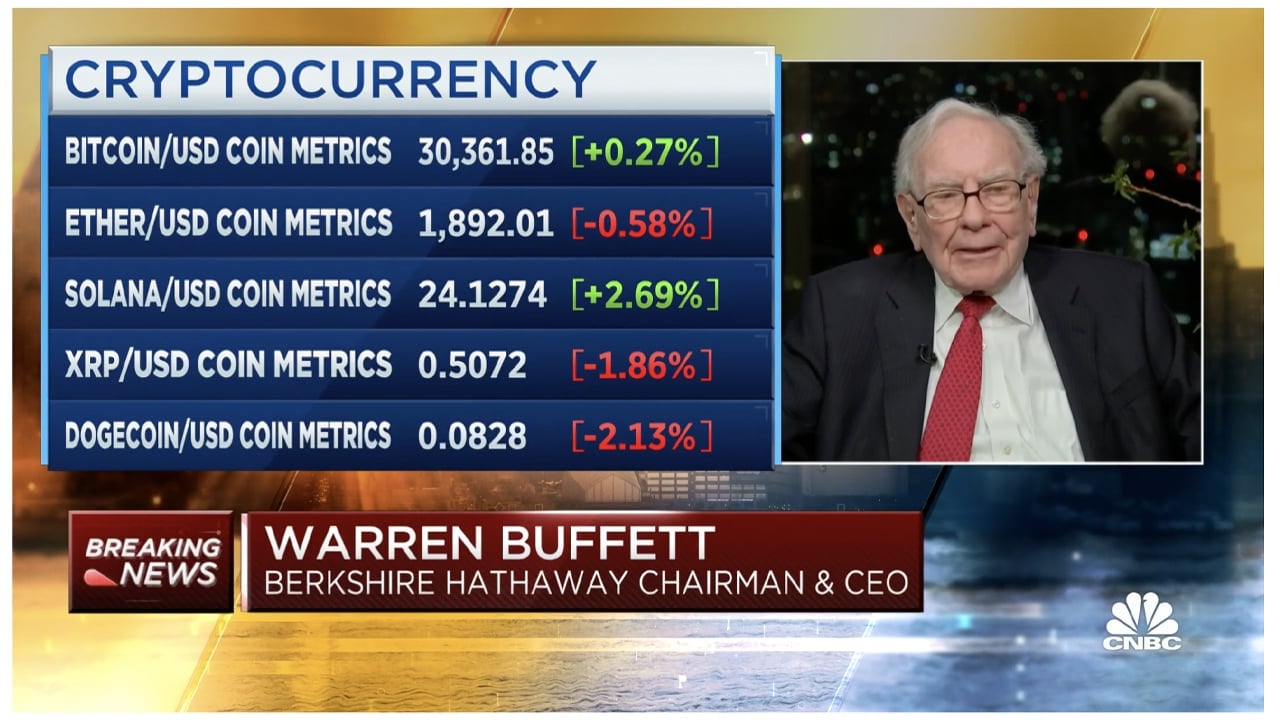

Finance mogul Warren Buffett, one of the most successful investors in history, discussed bitcoin during an interview on CNBC’s Squawk Box on April 12. child.

Buffett shares his two cents in Bitcoin, warns against making a living ‘trying to bet against the house’

It is well known that Warren Buffett does not like bitcoin, and once said that he would not buy all Bitcoin (BTC) in the world for $25. Buffett is also known for saying bitcoin is “probably rat poison squared,” and during an April 12 interview on CNBC’s Squawk Box, he reiterated his distaste for the leading cryptocurrency. During the interviewhe summed up bitcoin as a “gambling token” and insisted that the world has seen a “gambling explosion.”

The Oracle of Omaha told CNBC stations that he likes to bet on football games because “it makes it more interesting.” However, he also cautioned that he doesn’t think he wants to “make a living trying to bet against the house.” Buffett hinted that the stimulus checks may have added momentum to the game as well. “There were millions of people who would receive checks and money, and they would sit at home and find out that they could have a roulette wheel at home,” said the investor. When specifically asked about the leading crypto asset Bitcoin (BTC)buffett saying:

Bitcoin is a gambling token and has no intrinsic value, but that doesn’t stop people from wanting to play roulette.

Amid Buffett’s gambling rhetoric, he also drew a comparison to chain letters. Chain letters are messages that were commonly sent through the postal mail, encouraging the recipient to forward the message to a certain number of people, promising them that they would receive some kind of benefit in return. “I didn’t like chain messages growing up,” Buffett explained to the hosts of the CNBC show. “I thought, ‘Why the hell would I send a chain letter when I could start my own?’”

While the Berkshire Hathaway Chairman and CEO is clearly not fond of Bitcoin, he is known for his aptitude for investing. Berkshire Hathaway owns several well-known companies, including Geico, Fruit of the Loom, Duracell, BNSF Railway, See’s Candies, Clayton Homes, Pampered Chef, and Dairy Queen. According to the latest data According to Companiesmarketcap.com, Berkshire Hathaway (BRK-B) is listed as the eighth largest market capitalization in terms of assets in the world. bitcoin (BTC), on the other hand, is the tenth highest market valuation worldwide according to the same website.

What do you think about Warren Buffett’s stance on bitcoin and gambling? Do you agree or disagree with his perspective? Share your thoughts from him in the comments below.

image credits: Shutterstock, Pixabay, Wiki Commons, CNBC,

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

NEWSLETTER

NEWSLETTER