What we are reading: bitcoin-a-global-liquidity-barometer/”>bitcoin: a barometer of global liquidity

I have been intrigued by the significant increase in global liquidity during 2024, driven by massive money printing and debt expansion, and how it affects the price of bitcoin.

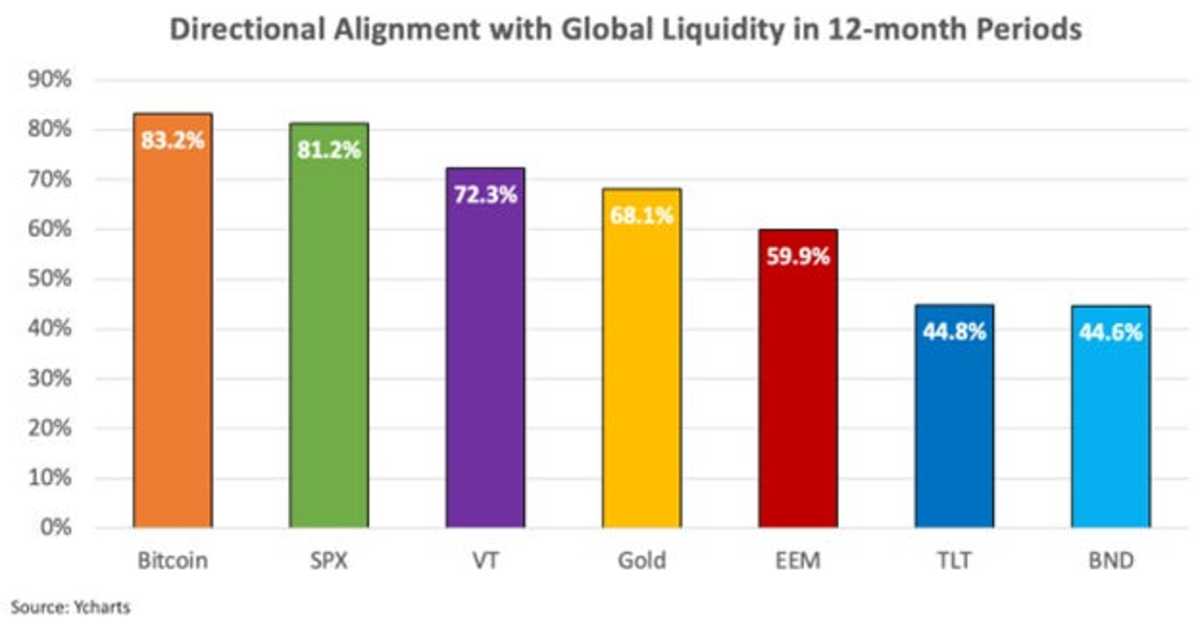

bitcoin is an expression against the government's expansionary monetary policies, so its price follows global liquidity, as seen here. in this graph.

It was fascinating to read the recent bitcoin-a-global-liquidity-barometer/”>report by Lyn Alden and Sam Callahan analyzing bitcoin's correlation with global liquidity. This further reconfirmed my opinion that greater monetary expansion leads more people to opt for bitcoin, which increases prices.

Their rigorous analysis found that over 12-month periods, the price of bitcoin moves in the same direction as global liquidity a remarkable 83% of the time. This is higher than any other major asset class, making bitcoin an exceptionally pure barometer of global liquidity trends.

The report quantified bitcoin's correlation with the global M2 money supply, finding a very strong overall correlation of 0.94 between May 2013 and July 2024. bitcoin's 12-month average moving correlation was 0.51, while stocks and gold also showed moderately high correlations in the range of 0.4 to 0.7. range.

Of course, bitcoin's correlation is not perfect. Short-term failures can occur around specific crypto events, such as exchange hacks or the collapse of Ponzi schemes.

Imbalances between supply and demand also cause temporary decoupling when bitcoin reaches extreme levels of overvaluation during market cycle peaks. However, despite these breakups, the long-term relationship persists.

Right now, liquidity is skyrocketing to unprecedented levels, suggesting that bitcoin could soon embark on a massive bull run if this relationship holds. While I believe no model perfectly captures the complexity of bitcoin, recognizing its role as a monetary canary in the coal mine can provide valuable insights. If history rhymes, the bitcoin sirens are sounding loudly announcing that a liquidity-driven boom will soon follow.