On Saturday, several centralized cryptocurrency trading platforms and payment processors stopped automatic USDC conversions. However, USDC saw significant trading volume on decentralized exchange (dex) platforms such as Uniswap, Curve, and Pancakeswap. Uniswap alone recorded $10.13 billion in transactions over the past day, with more than 55% of those trades involving USDC against wrapped ether and the stablecoin strap. Over the past 24 hours, USDC has emerged as the most dominant trading pair on dex platforms.

USDC trades below $0.975 accounted for over $26 billion on Saturday

According to statistics, the stablecoin usd coin (USDC) recorded $26.73 billion in global trade volume during a 24-hour period. On Saturday, the USDC decoupled from the US dollar, hitting a low of $0.877 per coin. As a result, crypto companies like Binance, Coinbase, Crypto.com, and Bitpay stopped USDC payments and automatic conversions.

However, despite centralized exchanges halting USDC conversions, the stablecoin accounted for 29% of the $90.70 billion in 24-hour global crypto transactions. According to statistics from coingecko.com, over the past day, $15.66 billion was liquidated on dex trading platforms, with $10.13 billion of that amount resulting from trading on Uniswap version three (v3).

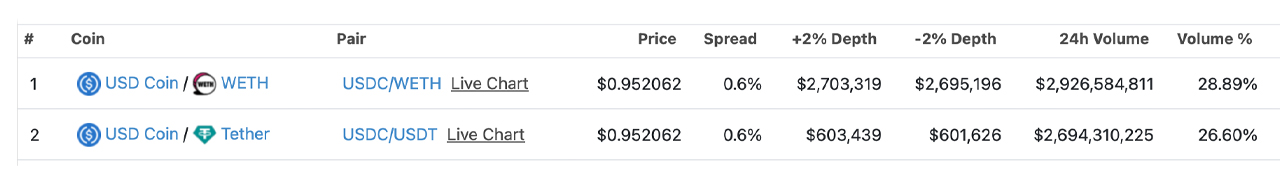

The two most dominant trading pairs on Uniswap were USDC/WETH and USDC/USDT, with USDC trades with ether wrapped up representing $2.92 billion, and USDC trades with tether equaling $2.69 billion. Together, USDC/WETH and USDC/USDT accounted for 55.48% of all transactions on Uniswap v3 on Saturday.

USDC/DAI represented 5.8% of Uniswap v3 trades, with volume of $587 million. Additionally, USDC saw many other trades with various crypto assets listed on the dex platform. On Curve’s Ethereum-based dex, $179 million in USDC/DAI trades occurred during the day. USDC was a prominent Curve pair with several other stablecoins such as USDTFRAX, GUSD, MIM, among others.

Curve 3pool share is the benchmark for crypto sentiment💥

During today’s USDC unpegging, people’s panic sold USDC and DAI for USDT. USDT stake in 3pool collapsed to 2%

Ironically, when Tether FUD occurred during the Terra crash and FTX crash, USDT He was the “infamous” and left 85% in 3pool🤔 pic.twitter.com/VNo3ykxiob

—Panda Jackson (@pandajackson42) March 11, 2023

Curve’s 3pool experienced a decline in its stake in USDT to 2% as traders sold USDC during the unpegging incident. On Saturday, the Pancakeswap v2 dex platform recorded a trading volume of $265,888,470, with USDC/BUSD being the most traded pair out of 3,554 trading pairs. $59.95 million, or 22.55% of the trades, were USDC/BUSD swaps.

Pancakeswap’s stableswap raised $250,361,665, with USDC/BUSD accounting for 44.72% or $111.95 million of the swaps. Uniswap v2 processed $152,276,446 in swaps on Saturday, with USDC pairs once again topping the list of v2 trading pairs. USDC trades with ether wrapped in Uniswap v2 accounted for 32.95% of dex volume, and 14.80% of swaps were USDC/USDT.

While dex platforms generated a significant amount of volume from USDC transactions, centralized exchanges also saw a considerable amount of USDC trading on Saturday. Metrics indicate that Binance recorded $582.97 million in USDC transactions against USDTand Kraken saw $476 million in USDC/USD transactions.

Kucoin registered $269.80 million in USDC/USDT swaps, and Kraken’s USDC trades on tether (USDT) amounted to 235 million dollars. Kraken saw another $80.43 million in USDC transactions with bitcoin (BTC) and another $78.32 million in USDC/EUR swaps. Of the $26.73 billion in USDC swaps on both dex platforms and centralized exchanges, each USDC swap was $0.975 or less, depending on the time of day.

What are your thoughts on USDC trades and trading volume on Saturday? Share your thoughts in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.