The eTF of bitcoin based in the USA. UU. However, the latest daily actions of these cryptography based financial products suggest that the new demand could be growing among investors.

bitcoin ETFS closes a positive week with $ 83 million in entrance

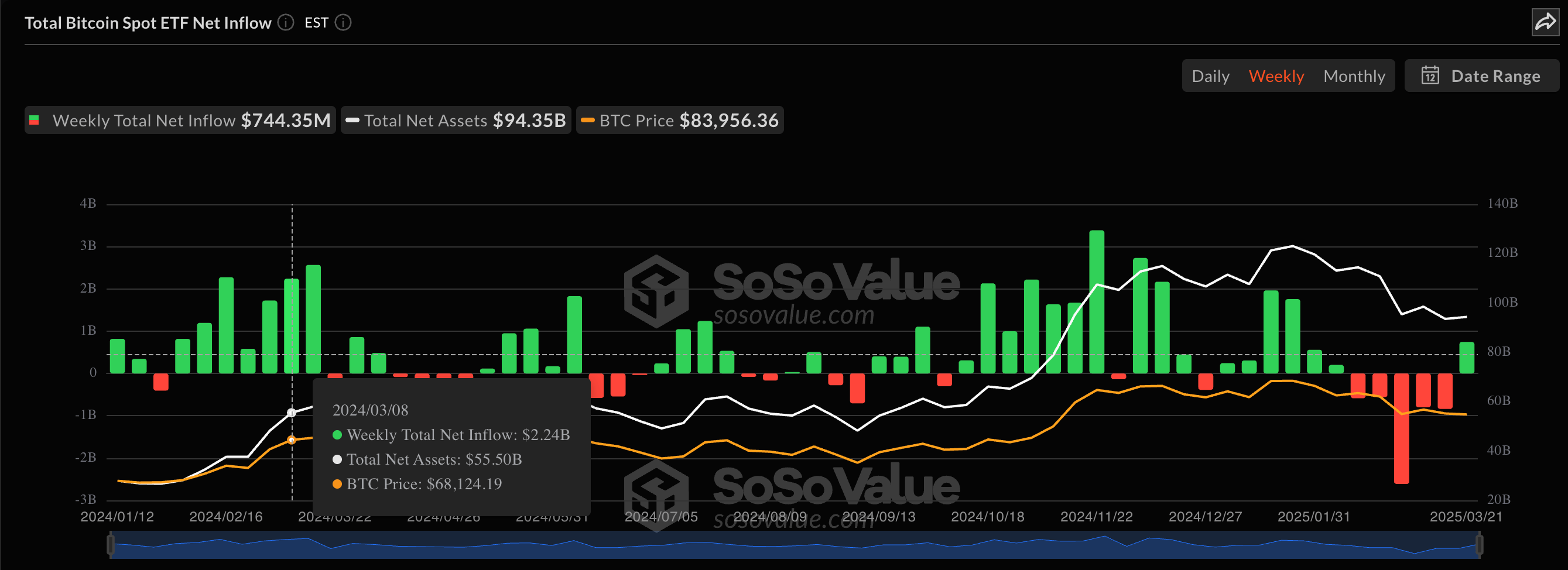

According to him <a target="_blank" href="https://sosovalue.com/assets/etf/us-btc-spot” target=”_blank” rel=”noopener nofollow”>Latest market dataThe bitcoin ETFs in the United States continued their capital entrance streak, registering a total daily net ticket of $ 83.09 million on Friday, March 21. This new capital entry marked the sixth consecutive day of daily net tickets for cryptographic products.

On Friday, only two of bitcoin's ETFs witnessed any form of investor activity. Blackrock saw the largest amount of value ($ 104.99 million) added to its fund quoted by exchange Ishares bitcoin Trust (with the Ibit ticket); While Grayscale bitcoin Trust (GBTC) published a net outstand of $ 21.9 million to close the week.

However, this $ 83.09 million yield brought the bitcoin ETFS weekly record to the amazing entry of $ 744.35 million total net entrance. Interestingly, the record of this previous week ended five consecutive weeks of total net exits of the bags quoted in the stock market.

Source: SoSoValue

Sosovalue's data show that the US bitcoin ETF market. UU. Testified a total withdrawal of $ 5.39 billion during those five weeks of negative exits. Specifically, cryptography -based financial products witnessed a total daily net exit of more than $ 1.14 billion on February 25.

The magnitude of the outputs witnessed by the bitcoin ETF has been associated with the uncertain climate of the United States financial markets. Since the president of the United States, Donald Trump, resumed office, markets have been plagued by fears of a global commercial war, interest rates decisions, etc.

bitcoin price not reactive to ETF tickets

Since its launch, there has been an argument on the impact of the performance of the United States ETF on the price of the badly cryptocurrency. As seen in recent consecutive weeks of net exits, the price of bitcoin tends to fight every time ETF investors leave the market.

However, the main cryptocurrency seems stuck in a consolidation range despite the new US bitcoin ETF demand.

At the time of writing this article, the price of btc is around the $ 84,000 mark, which does not reflect a significant change in the last 24 hours. According to Coingcko data, the market leader has barely registered notable movements last week.

x/DmpeYReM/” alt=”Bitcoins ETF” width=”2250″ height=”1432″/>

The price of btc on the daily timeframe | Source: BTCUSDT chart on x/DmpeYReM/" target="_blank" rel="noopener nofollow">TradingView

Shuttersock, TrainingView graphic image

Editorial process For Bitcoinist, he focuses on the delivery of content completely investigated, precise and impartial. We maintain strict supply standards, and each page undergoes a diligent review of our technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.

NEWSLETTER

NEWSLETTER