The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

The United States federal government has once again increased its significant bitcoin stockpile, transferring $922 million from wallets associated with Bitfinex hackers in a seizure.

Over the course of a series of seizures and other asset forfeitures, the United States federal government has accumulated and owns enough Bitcoins to certainly count as one of the largest whales. In the early days of the bitcoin scene, the overwhelming crypto-anarchist spirit among the community led to a series of various extralegal business ventures, the most famous of which was the Silk Road. This overtly illegalist era of the industry has more or less completely ended, but the success of these early companies accumulated massive amounts of bitcoin: which over time has been accumulated by the US government.

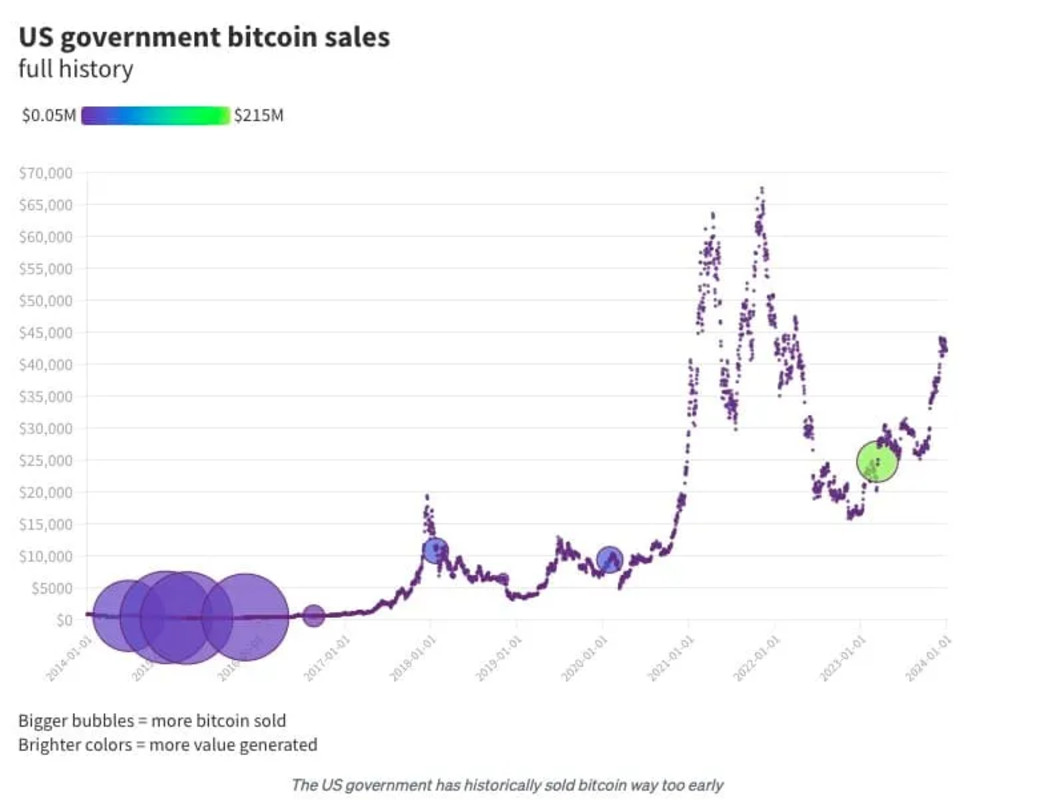

The Silk Road alone has been the center of several massive seizures by law enforcement agencies, and the site's royal coffers are far from the only source. In multiple occasions in the last bitcoin“>years, several hackers who stole the Silk Road in turn saw their assets seized and added to the federal government's massive stockpile. Although bitcoin-silk-road”>hundreds Although millions of bitcoins have already been sold from this source at government auctions or through other means, there are still billions to be sold. For their part, law enforcement agencies do not seem to have any interest in bitcoin-5-billion-78ce0938?st=y3p0zfhiipykvjk&s=09″>hurry to wash their hands of these assets.

On February 29, the reservation bitcoin“>grew up once again when the government moved more than 15,000 bitcoins from the wallets of two Bitfinex hackers. The hackers, Ilya Lichtenstein and Heather “Razzlekhan” Morgan, recently crypto-heist-mastermind-ilya-lichtenstein-turned-us-cooperating-witness?sref=IIP4JEyu”>testified about his Bitfinex hack in 2016, which ranks as one of the most profitable heists of all time with almost 120 thousand bitcoins stolen. Bitfinex, one of the oldest exchanges still operating in the entire crypto ecosystem, remains a prominent service, but its operations still bear lingering scars from a theft of this magnitude. For one, US citizens are completely prohibited from accessing the platform, as are citizens of several other countries. Perhaps it is for this reason that the Department of Justice has tech/2024/02/28/us-government-crypto-wallets-transfer-nearly-1b-of-bitcoin-seized-from-bitfinex-hacker/”>refused to indicate whether the government intends to refund Bitfinex customers from 2016, who actually had their money stolen.

Regardless of what the government's plans are with this money, a seizure like this has once again highlighted the enormous bitcoin-heres-why”>size from the federal government's bitcoin reserve. Fortunately, the government's dealings with these assets are all a matter of public record, and the bitcoin transactions themselves are completely transparent on the blockchain. For this reason, analysts are confident in the claim that the United States owns just under 200,000 bitcoins, worth approximately $12.1 billion. This makes them without a doubt one of the largest whales that exist, only Binance and Satoshi own larger amounts. In fact, the government currently owns almost 1% of all bitcoin in circulation. Regardless of bitcoin-5-billion-78ce0938?st=y3p0zfhiipykvjk&s=09″>claims Although prosecutors have no interest in maximizing profits by disposing of these assets, it is undeniable that the government has substantial influence throughout the space.

These seizures are particularly interesting because of some recent comments made by exiled whistleblower Edward Snowden. Specifically, considering the growing global acceptance of bitcoin in traditional finance and regulation, Snowden predicted that “this year it will be revealed that a national government has been purchasing bitcoin, the modern replacement for monetary gold, without having publicly disclosed that fact.” If bitcoin is digital gold, after all, it would make sense that powerful nations would want to accumulate reserves. The strategy has worked for Salvadoran President Nayib Bukele, who welcomed the new bull market with a bitcoin-40-percent-profit-nayib-bukele-defiant”>statement that his country's bitcoin investment has increased 40% since initial purchases. Of course, it's not that I plan to sell.

In any case, Snowden's comments seem especially relevant in that the United States has not actually purchased any of the bitcoin it currently holds. Although the government has a theoretical responsibility to dispose of these assets, the pace so far has been glacial, and in the meantime it would be extremely easy for Congress to stop these sales. All it takes is the desire for policy to change, and a true bitcoin reserve could emerge overnight. This is the crux of Snowden's specific prediction that governments will secretly acquire bitcoin and that the government has extensive capacity for plausible deniability. We don't have a reservation; It turns out that we are reserving these assets for a later sale. There is nothing suspicious about that!

If a government really wanted to acquire massive amounts of bitcoin secretly, it would run into a host of transparency issues caused by the untrustworthy nature of the bitcoin blockchain. The anonymous “Mr. 100” has been done bitcoin-in-massive-quantities-say-on-chain-analysts-heres-who-the-entity-might-be/”>Headlines throughout the month of February, acquiring a mind-boggling 100 btc per day and reaching the status of the 15th largest whale. As chain analysts have attempted to determine the identity of the buyer, bitcoin-market-surge-unraveling”>speculation It has already begun to be said that the culprit is a national government. Depending on the timing of the purchases and various other factors, the buyer is likely to be in Asia, specifically the Middle East. Qatar, the United Arab Emirates and Saudi Arabia are strong candidates to be the rightful owners of the coins.

In other words, if a government wants to create a bitcoin reserve, it might be easier to confiscate the assets outright than to buy them at fair value. After all, if transactions are going to be recorded on the blockchain anyway, why not save your money? The UK appears well positioned to build up an arsenal in this way, as do the Americans, having attorney 1.77 billion dollars in January. Not only were these bitcoins confiscated from a foreign national who was currently on the run, with no recourse to recover these funds, but the British government has crypto-assets/”>after passed legislation that deepens its power to seize or freeze cryptocurrency assets. It wouldn't take much to start amassing a notable treasure in its own right.

By now, the days of the core bitcoin community maintaining a defiant attitude towards law enforcement are a distant memory. Although people can commit crimes related to bitcoin just like any other currency, the fact is that bitcoin is becoming increasingly legitimate to the world's governments. US regulators approved a bitcoin ETF, and other countries are falling like dominoes to support it themselves. Over time, it will be necessary for powerful governments to keep up with their competitors and maintain their own bitcoin reserves. After all, the United States controls almost 1% of a massive industry with substantial influence over it. Will they be the only country with this influence? It may be difficult for any nation to accumulate these reserves secretly, but even so, the race is already on. No matter who wins, it is bitcoin that will ultimately come out on top.

NEWSLETTER

NEWSLETTER