This article is also available in Spanish.

A recent <a target="_blank" href="https://mail.10xresearch.co/p/our-bitcoin–crypto-game-plan-for-january-this-indicator-signals-a-btc-rebound” target=”_blank” rel=”nofollow”>report from digital asset research firm 10x Research highlights that the US Federal Reserve's (Fed) stance on interest rate cuts remains the biggest hurdle that could slow down the current bitcoin (btc) rally. .

Trump-fueled bitcoin rally at risk ahead of FOMC meeting

Since pro-cryptocurrency Republican candidate Donald Trump emerged victorious in the November presidential election, bitcoin has risen an impressive 47%, rising from around $67,500 on November 4 to around $99,700 on January 6.

Related reading

While further gains are expected during the so-called “Trump rally” ahead of the January 20 inauguration, momentum could stall ahead of the Federal Open Market Committee (FOMC) meeting at the end of January, says Markus Thielen from 10x Research.

Thielen predicts a “positive start” to January for btc, followed by a slight drop before Consumer Price Index (CPI) inflation data is released on January 15. A favorable CPI report could reignite optimism, potentially fueling another rally before Trump's inauguration. However, Thielen warns that bullish momentum may wane ahead of the FOMC meeting on January 29.

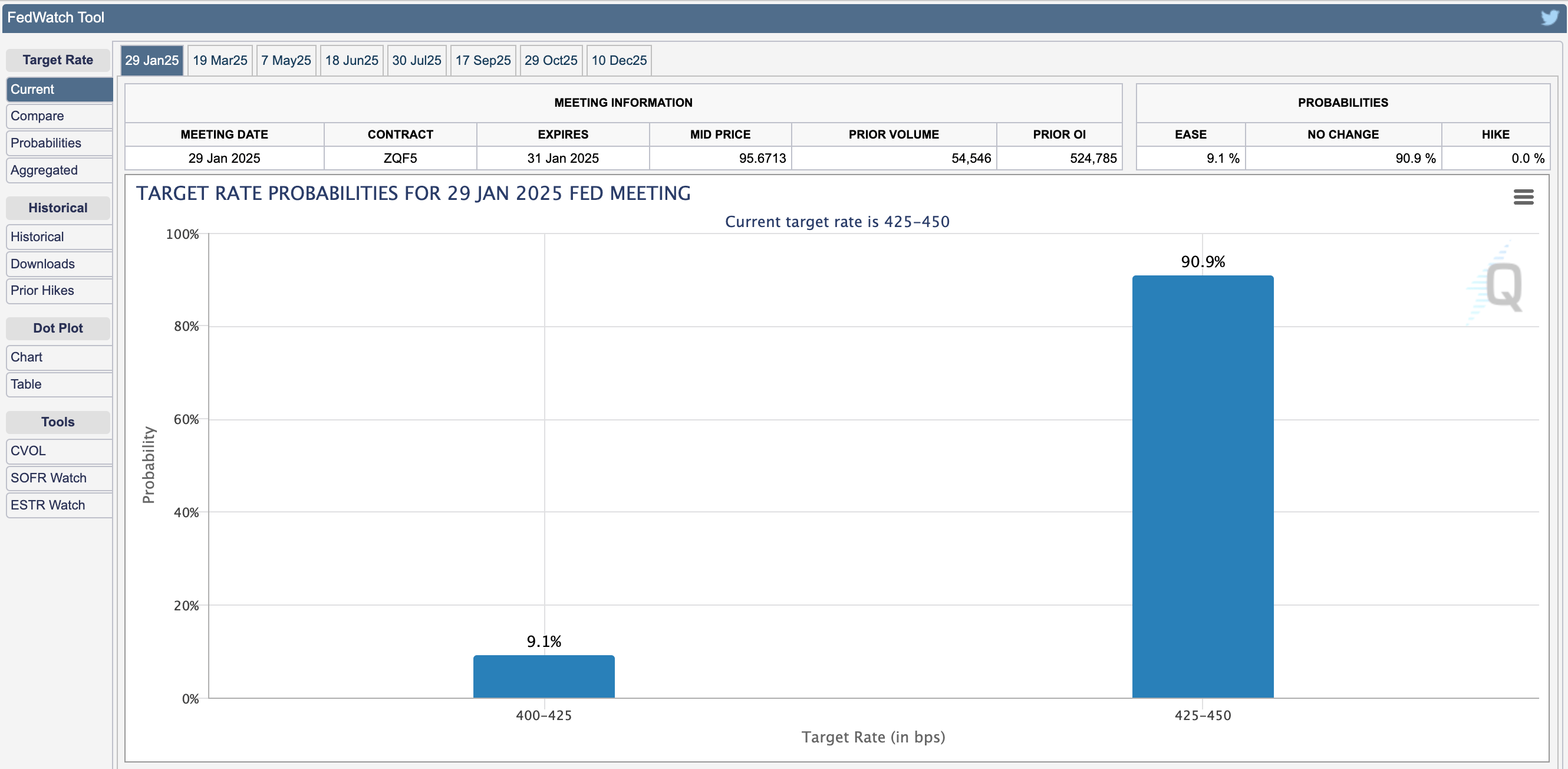

The latest data from CME Group's FedWatch tool shows that interest rates are likely to remain unchanged after the next FOMC meeting. The tool currently predicts a 90.9% probability that interest rates will remain at 425 and 450 basis points (BPS).

bitcoin's decline of approximately 15% to $92,900 following the FOMC meeting on December 18 underscores the significant influence of the Federal Reserve. This drop came after the Federal Reserve signaled just two rate cuts by 2025 instead of five, reinforcing Thielen's view that the Fed's decisions are the “main risk” to the current upward trajectory of btc. Thielen stated:

We anticipate lower inflation this year, although it may take some time for the Federal Reserve to formally recognize and respond to this change.

Thielen also cited institutional participation as a key factor influencing bitcoin's near-term price action, with metrics such as stablecoin minting rates and cryptocurrency exchange-traded fund (ETF) inflows serving as indicators. of institutional interest.

Institutional interest in bitcoin continues to rise

Although US bitcoin spot ETFs faced significant capital outflows in late December, new inflows have sparked optimism about growing institutional interest in the leading cryptocurrency. <a target="_blank" href="https://sosovalue.com/assets/etf/us-btc-spot” target=”_blank” rel=”nofollow”>Data SoSoValue notes that bitcoin spot ETFs recorded inflows of $908 million on January 3.

Related reading

Furthermore, several major btc mining companies, such as MARA and cabin 8 They are strengthening their btc reserves. tech companies like Canadian video-sharing platform Rumble too sleepless a $20 million btc treasury strategy.

A separate report from cryptocurrency exchange Bitfinex predict bitcoin could reach $200,000 by mid-2025, despite small price pullbacks. At press time, btc is trading at $101,555, up 3.7% in the last 24 hours.

Featured image from Unsplash, charts from 10x Research, CME FedWatch and Tradingview.com

NEWSLETTER

NEWSLETTER