This article is also available in Spanish.

After reaching its all-time high above the $100,000 threshold, bitcoin (btc) People continue to talk about it and many wonder if there is still progress to come. Some traders, however, predict that before a new peak there may be a collapse.

Among these there are Peter Brandt, a leading name in the world of trading, which suggested that bitcoin could be going through one last “dump” or period of consolidation before continuing its rise.

in his last <a target="_blank" href="https://x.com/PeterLBrandt/status/1878059009439121873″ rel=”nofollow”>published post On January 12, Brandt shared his analysis, showing the past performance of the most valuable cryptocurrency and describing the phases he calls the “pump,” “hump,” and “dump.”

In particular, a “bomb” It is a period when the asset grows rapidly, such as bitcoin's incredible rise from $70,000 to over $100,000 by the end of 2024, fueled by heavy buying and the Trump effect.

Then comes the phase. “hump”in which the rally slows and encounters resistance, as seen in bitcoin's plateau in December, which led the crypto asset to consolidate around the $95,000 level.

Finally, the “dump” represents a downward correction, often caused by profit taking or loss of momentum. In this case, Brandt suggests that if bitcoin fails to hold key support, it could fall to $73,018.

Brandt watched bitcoin trend and noticed a recurring phenomenon in the markets: strong price movements often occur when retail traders start to get tired, marking the turning point before large price swings in the asset.

“The question I ask is whether bitcoin will suffer another crash (or another long consolidation phase) before experiencing a boom. Let's remember that markets generally don't contract until retail traders get tired,” he said.

Could bitcoin reach $140,000?

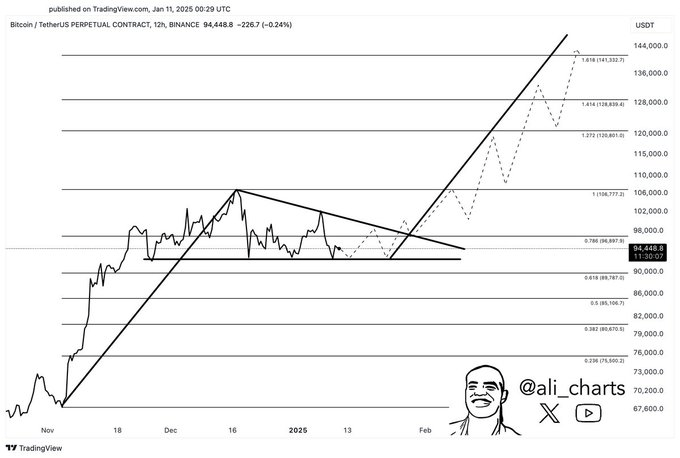

Another well-known crypto analyst, Ali Martínez, has also done so. <a target="_blank" href="https://x.com/ali_charts/status/1878069852759585180″ rel=”nofollow”>shared a similar prediction for bitcoin. In his publication in

Their predictions are based on two technical patterns observed on the 12-hour chart of btc: a bullish pennant and the formation of the head and shoulders pattern.

Illinois bull pennant is a pattern that forms when bitcoin rises and then stabilizes in an increasingly tight range, with the trend lines getting closer. Typically, the formation of this pattern indicates that the asset may continue to rise.

Instead, the pattern head and shoulderswith a central peak (the head) and two lower highs on the sides (the shoulders), it indicates that there could be a bearish reversal.

Meanwhile, bitcoin is stabilizing around the $95,000 level, a decisive moment in understanding which direction it will move.

bitcoin: analysts divided between bullish forecasts and risks of a sharp fall

The outlook for bitcoin remains uncertain, with conflicting scenarios among analysts. Some see a bright future for the asset and predict its value will double by 2025. The optimism is fueled in part by the election of Donald Trump, who promised to transform the United States into a hub for crypto assets.

For example Chartered Standard predicts that bitcoin could reach $200,000, driven by growing interest from institutional investors.

the analyst Gert van LagenHowever, it is even bolder, with a prediction that bitcoin will reach $300,000 by March 30, 2025, based on Elliott wave theory, which analyzes repetitive market cycles.

But not everyone is optimistic. bitcoin is currently below the $100,000 mark and some analysts, such as Alan SantanaThey are worried. They fear that if the asset continues below this level, it could fall to $40,000.

Overall, assuming Trump supports the crypto sector, as he promised during his campaign, bitcoin is likely to see further increases, driven by enthusiasm for a possible clear regulatory framework, which could attract institutional investors.

Meanwhile, pressure is growing for large companies to put some of their reserves in bitcoin as a hedge against inflation. After Microsoft shareholders rejected the idea, attention turned to Meta, facebook's parent company.

In fact, one shareholder proposed allocating part of Meta's $72 billion in liquid reserves to bitcoin. If the proposal is accepted, Meta could become one of the first large traditional companies to own bitcoin, a step that could give a strong boost to the asset's price.

bitcoin price analysis

bitcoin is currently trading at the $93,026 level, down 1.28% in 24 hours. It is also in red on the other graphs. In the last seven days it has accumulated a loss of 6.26%, while in the month it has suffered a decline of 8.58%.

bitcoin consolidates as investors focus on new pre-sale projects

As bitcoin continues to consolidate around $93,000, with bulls and bears ready to fight over the next move, investors are also eyeing other new pre-sale projects that could offer growth opportunities protected from market swings.

one of them is Wall Street Invitation ($WEPE). The project began pre-sale in early December and exceeded expectations, raising more than $47 million.

$WEPE is not just a meme coin, but a project with a real use case. Token holders have access to an exclusive community, called $Army WEPEand unique resources, including advanced trading strategies, alpha signals, and weekly competitions. Everything is designed to help investors better navigate the cryptocurrency market and make the most of the opportunities.

the community of W.E.P. It grows every day, thanks to the mutual support between its members, who support each other to pursue success.