Total cryptocurrency market capitalization reached its highest level in more than two months on January 13 after breaching the $900 billion mark on January 12.

While the 15.5% year-to-date gain sounds promising, the level is still 50% below the $1.88 trillion crypto market cap seen before the Terra-Luna ecosystem collapse in April 2022.

“Hopeful skepticism” is probably the best description of most investor sentiment right now, especially after recent struggles to recapture a $1 trillion market cap in early November. That rally to $1 trillion was followed by a 27.6% three-day correction and negated any bullish momentum traders might have hoped for.

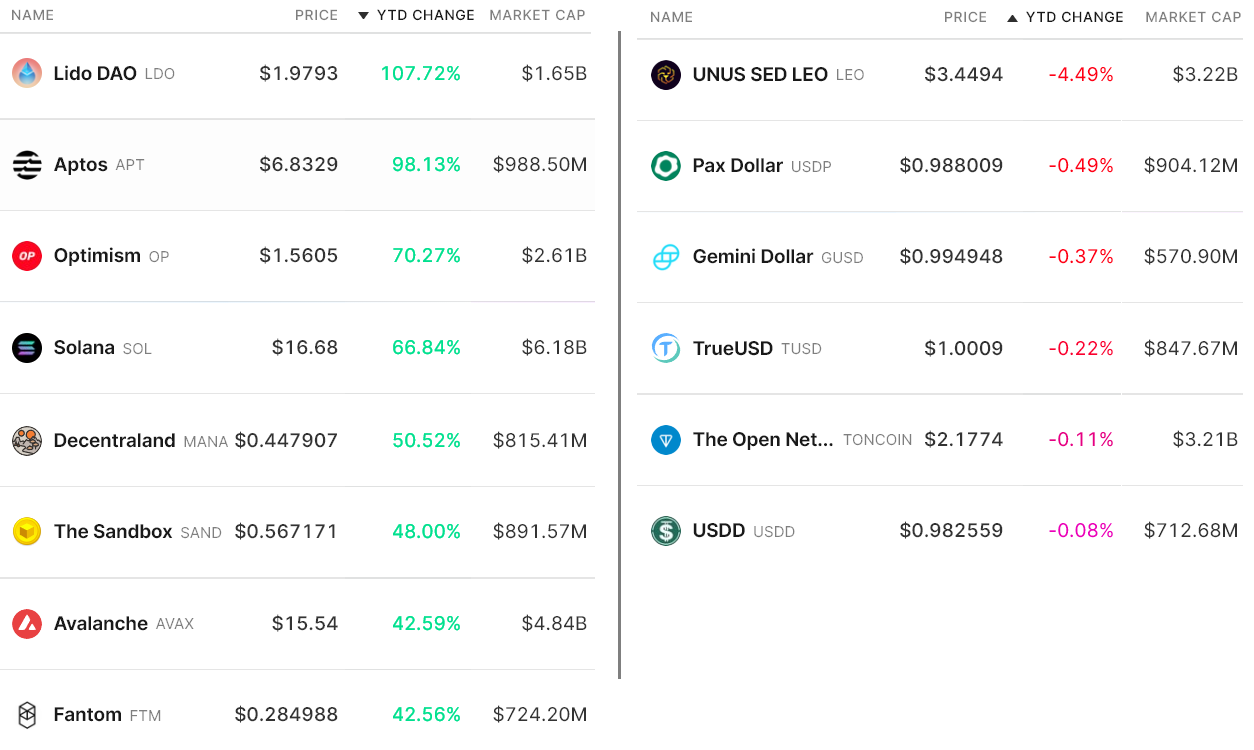

Bitcoin (BTC) has gained 15.7% year to date, but a different scenario has emerged for altcoins, with a handful of them gaining 50% or more in the same period. Some investors attribute the rebound to US Consumer Price Index (CPI) data released on January 12, which confirmed the view that inflation was still falling.

While macroeconomic conditions may have improved, the situation for cryptocurrency companies looks bleak. New York-based Metropolitan Commercial Bank (MCB) announced on Jan. 9 that it was shutting down its crypto asset vertical, citing changes in the regulatory landscape and recent setbacks in the industry. Crypto-related clients accounted for 6% of the bank’s total deposits.

On Jan. 12, the U.S. Securities and Exchange Commission (SEC) indicted cryptocurrency lending firm Genesis Global Capital and cryptocurrency exchange Gemini for offering unregistered securities through the Gemini’s “Earn” program.

The final blow came on January 13 after Crypto.com announced a new wave of layoffs on January 13, reducing the global workforce by 20%. Other crypto exchanges that recently announced job cuts in the past month include Kraken, Coinbase, and Huobi.

Despite the dire news flow, macroeconomic tailwinds favoring risk assets ensured that only UNUS SED (LEO) closed the first 13 days of 2023 in the red.

Lido DAO (LDO) gained 108% as investors await the upcoming Ethereum Shanghai upgrade allowing staked Ether withdrawals to boost demand for liquid staking protocols.

Aptos (APT) rallied 98% after some decentralized applications started gaining volume, including Liquidswap DEX, Ditto Finance staking and yield, and the NFT Topaz Market.

Optimism (OP) gained 70% after the Layer 2 network picked up activity and, along with competitor Arbiturm, outperformed Ethereum mainchain transactions.

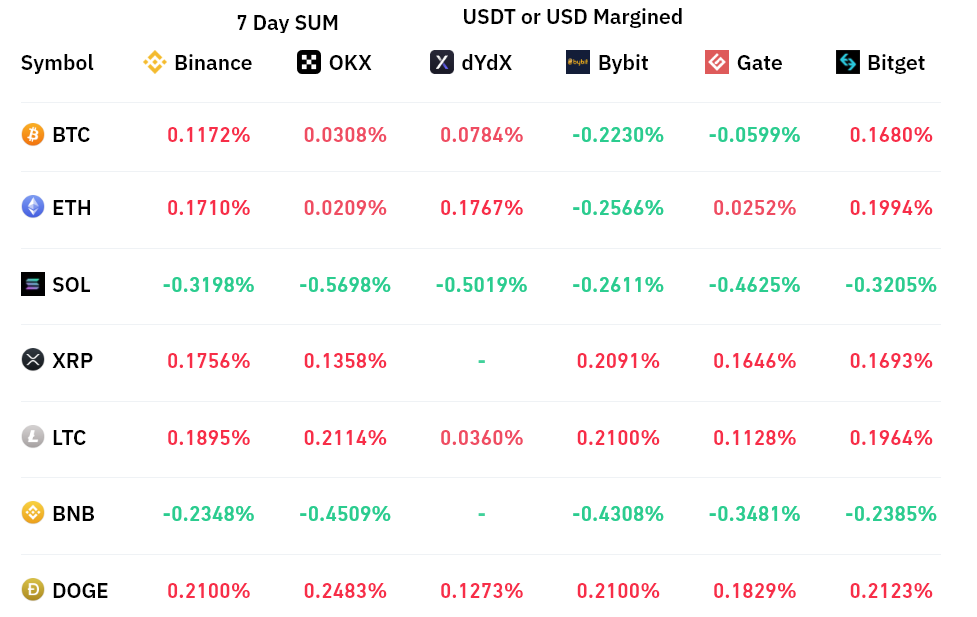

Leverage demand is balanced between bulls and bears

Perpetual contracts, also known as reverse swaps, have a built-in fee that is typically charged every eight hours. Exchanges use this fee to avoid currency risk imbalances.

A positive funding rate indicates that long buyers require more leverage. However, the opposite situation occurs when short sellers require additional leverage, causing the funding rate to turn negative.

The 7-day funding rate was close to zero for Bitcoin and altcoins, which means that the data points to a balanced demand between long (buy) and short (seller) positions for leverage.

If the bears are paying 0.3% per week to keep their bets leveraged on Solana (SUN) and BNB, which adds a mere 1.2% per month, which is not relevant to most traders.

Related: Bitcoin Price Rises To $19K But Analyst Says A Retest Of $17.3K Could Happen Next

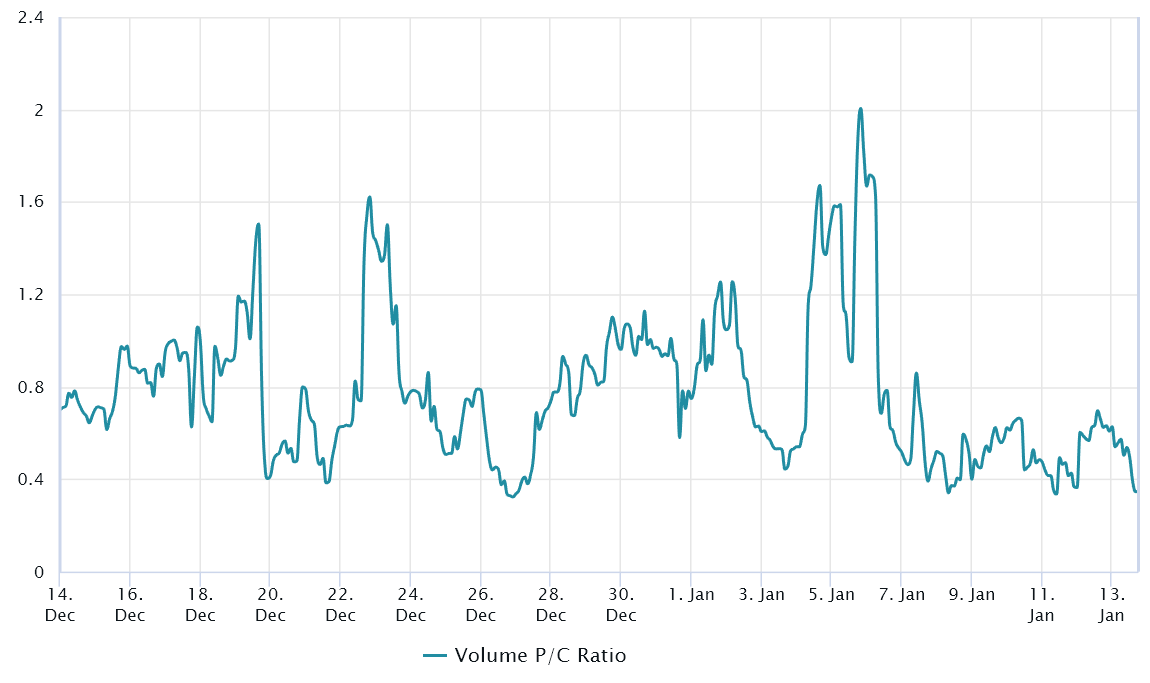

Trader demand for neutral to bullish options has skyrocketed

Traders can gauge overall market sentiment by gauging if there is more activity through call options or put options. Generally speaking, call options are used for bullish strategies while put options are for bearish strategies.

A put-to-call ratio of 0.70 indicates that put option open interest lags the most bullish calls by 30%, which is bullish. Conversely, a gauge of 1.40 favors put options by 40%, which can be considered bearish.

Between January 4-6, protective puts dominated the space as the indicator spiked above 1. The move eventually faded and the opposite situation emerged, as demand for neutral to bullish put options has been excessive since January 1st. 7.

Lack of leveraged shorts and demand for hedges point to an uptrend

Considering the 15.7% gain since early 2023, derivatives metrics reflect zero signs of demand for leveraged shorts or protective puts. While bulls may celebrate that the $900 billion total market cap resistance faced little resistance, derivatives metrics show that bears are still patiently waiting for an entry point for their short positions.

Considering the bearish news flow in the market, the main hope of the bulls remains solely against the background of a favorable macroeconomic environment, which is highly dependent on how retail sales data is reported next week.

China is also expected to release its economic figures on January 16 and the US to follow suit on January 18. Another potential price impact could be the UK CPI, due to be announced on January 18.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER