The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.

This week’s topics:

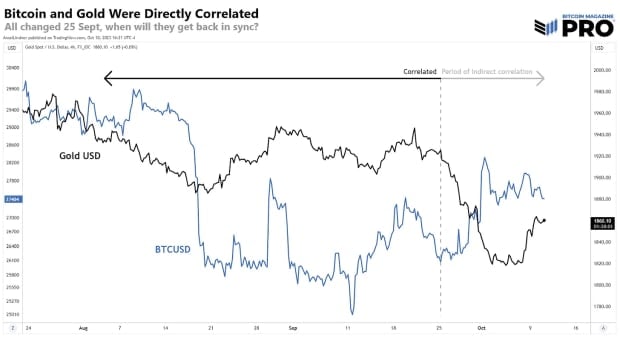

Last week I wrote about bitcoin-gold-china-connection”>The bitcoin-Gold-China Connection. I pointed out the recent indirect correlation of bitcoin and gold, but also several interesting correlations between the three assets. I want to revisit that topic from the beginning, because a pioneer of the modern hedge fund industry, Paul Tudor Jones, said in an interview who is optimistic about “barbaric relics,” mixing bitcoin with gold.

“We will most likely enter a recession, and there are some pretty clear recession trades.”

Paul Tudor Jones’s three recession operations

1) “The yield curve becomes very steep and the term premium goes to the bottom.”

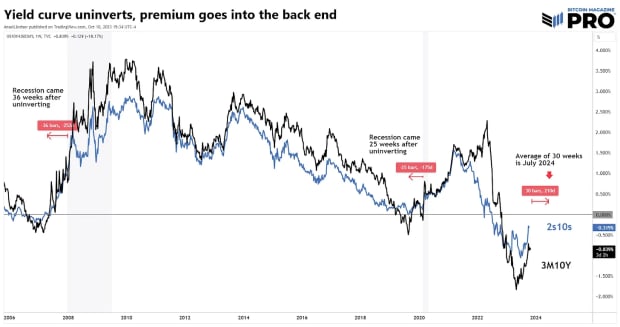

Translation: The short end of the yield curve falls relative to the long end. We already see this in the steepening yield curve, specifically the 10A-2A (2s10s) and the 10A-3M (3M10A). Yields tend to reverse before recessions. In 2008, 36 weeks passed between the reversal and the recession. In 2020, it took 25 weeks, but it could have easily taken longer.

Projecting forward, the curve is still inverted, and if we estimate a reversal for November of this year, a 30-week lag takes us to July 2024. Not surprisingly, this coincides with the price of federal funds futures in the Federal Reserve cuts we discussed in a previous letter. It also gives bitcoin enough time to overcome the halving.

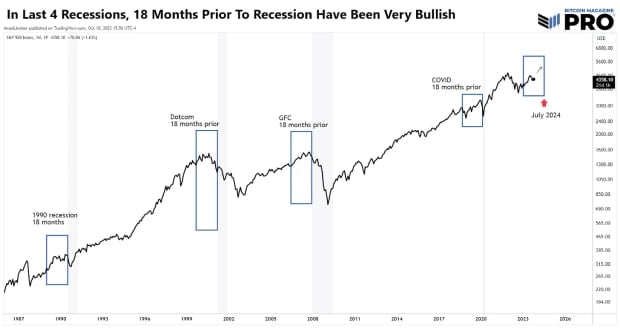

2) “The stock market normally, just before a recession, drops about 12%.”

We have written about this topic recently also. While Jones is right in saying that “just before” a recession stocks tend to fall, it is the 18 months leading up to the recession that we are in now that are very positive. He acknowledges it with his clarification: “that’s probably going to happen.” sometimeof some level.” The emphasis here is that this is his statement, meaning it could rise well before the impending recession hits.

3) “You look at the big gold shorts. Most likely, in a recession, the market will be made up of really long assets like bitcoin and gold. So there’s probably about $40 billion in purchases that will have to be converted to gold at some point. So, yeah, I like bitcoin and gold right here.”

Jones says bitcoin and gold will be correlated and rise in a pre-recession environment. We agree, and that being the case, the recession is probably further away than many expect as we wait for the recent disconnect between gold and bitcoin to get back in sync.

Looking at bitcoin and gold, we see that the indirect relationship continues. The golden side of this correlation is likely to be the one that is out of sync. It remains highly likely that China was dumping gold to protect the yuan rather than dumping dollars. Gold and bitcoin are likely to get back in sync soon, as Jones predicts. We are also watching the yuan closely in this regard, hoping that it has bottomed out for now.

ethereum and BNB drag bitcoin down

Let me defend the uncoordinated price suppression in bitcoin with some charts. I don’t think it’s some grand conspiracy against bitcoin, but rather a natural result of the market structure as it exists today.

ethereum is bleeding. Fee burning couldn’t save it, proof of stake couldn’t save it, and now futures ETFs can’t save it. It is going down against the dollar and much more against bitcoin itself. The recent BitVM on bitcoin is not an ethereum killer, but he steals tons of hype and hype from ethereum. There is simply no momentum for leftist talk in altcoins.

I have a theory as to why bitcoin is having some problems here compared to our other calls. bitcoin is being held back by algorithmic trading robots created to arbitrage the discrepancies between bitcoin and ether in price movement. I don’t have direct evidence as of yet, but this could explain the disconnect between bitcoin‘s price movement and all other markets at the moment.

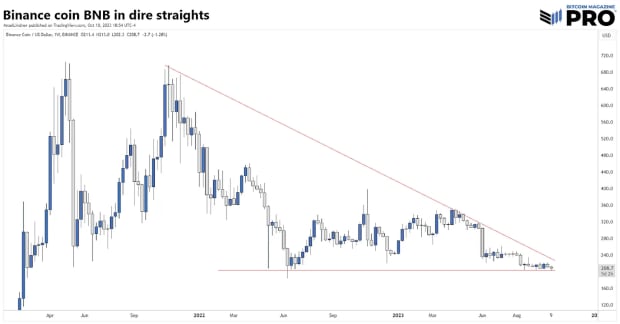

Another source of bitcoin price suppression is Binance. Rumors are swirling that the BNB token is also highly leveraged like FTX’s FTT token was. The allegation is that Binance is trading bitcoins for BNB to prop up the price.

Here we have two temporary sources of bitcoin selling: the ethereum arbitrage and Binance trying to prop up BNB. Even if there is partial truth about either, it would be a good reason for bitcoin‘s relatively unexpected weakness.

This weakness is likely temporary because the stock market is rising, bond yields are falling, and the dollar is falling. This adds more weight to the bitcoin industry’s explanation for the slight price drop.

We can see above that the 200-day (gray) struggled against repeated and prolonged attempts to continue higher. In our opinion, this is evidence of strong marks at that level by trading robots with a simple rule: if bitcoin is at the 200 day level and ether is below, short bitcoin and long ether. Something like that.

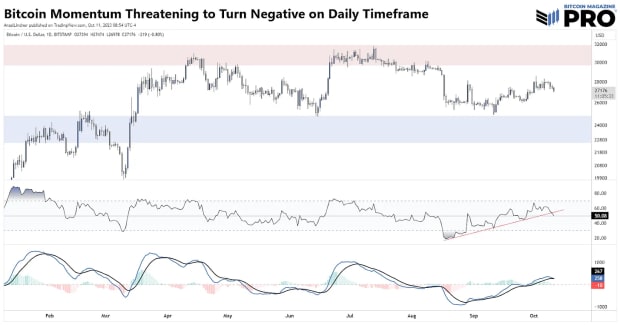

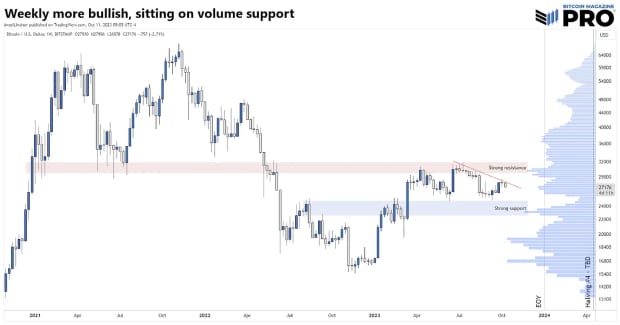

Daily momentum indicators threaten a bearish turn. The RSI has broken the trend and the MACD could cross lower. However, on the weekly chart, these same indicators are markedly more bullish.

bitcoin sits right at solid volume support at $27,000, with plenty of room above the strongest support area if there were to be a drop. Once bitcoin breaks this downtrend, it will quickly test the $31,000 resistance band.

There is another possibility we should mention: bitcoin is the leading indicator in this market. If that’s the case, we would expect stocks to recover and yields to continue rising, which would send us back to the drawing board for our model. Of course, I don’t think that’s the case, but we’ll have to cross that bridge when we get there. For now, the model has been successful in many macro and micro calls and traditional markets agree with us.

Summary

Legend Paul Tudor Jones described three recession trades that we discussed earlier. This is a steepening trade that we already see taking shape, a short trade in the stock market that we have yet to see unfold, and bitcoin and gold. A deep dive into the ethereum, BNB, and bitcoin charts reveals some insights into the correlation and state of this market.

The following is an excerpt from a recent issue of bitcoin Magazine Pro, bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis directly to your inbox, Subscribe now.