As the bitcoin and cryptocurrency landscape continues its rapid evolution, this week stands out as a pivotal moment filled with events that have the potential to reshape market sentiments and dynamics. From bitcoin price performance to macroeconomic indicators and important documentaries, here’s a closer look at the key events every enthusiast and investor should watch closely this week:

#1 Can bitcoin stay above $30,000?

bitcoin, as in the previous early stages of a bull market, is currently the driving force of the entire cryptocurrency market. Rising hopes that the US Securities and Exchange Commission could approve a spot bitcoin ETF later this year has restored bullish momentum. As Google Trends shows, interest in a bitcoin ETF has returned among retail investors. Google search volume hit a 12-month high last week.

However, it is questionable whether the current movement is sustainable. Some experts warn that futures are overheating. “bitcoin funding rates have quickly gone from negative to +0.01 when bitcoin surpasses $30,000. Traders become more optimistic.” commented the Decentraler market intelligence platform via X.

However, German cryptography expert Furkan Yildirim warned: “Many new bitcoin positions are coming through the futures markets. Open interest is at its highest level since August and could indicate that the market is starting to overheat.”

Meanwhile, macro and crypto analyst Mortensen Bach tweeted: “bitcoin: So far so good! We stole the 1.618 Fibonacci extension and are now retesting the $30,000-$30,500 level. What we want to see is for the bulls to defend that $30,000 to confirm the breakout to the upside!

#2 Wednesday: Powell speaks

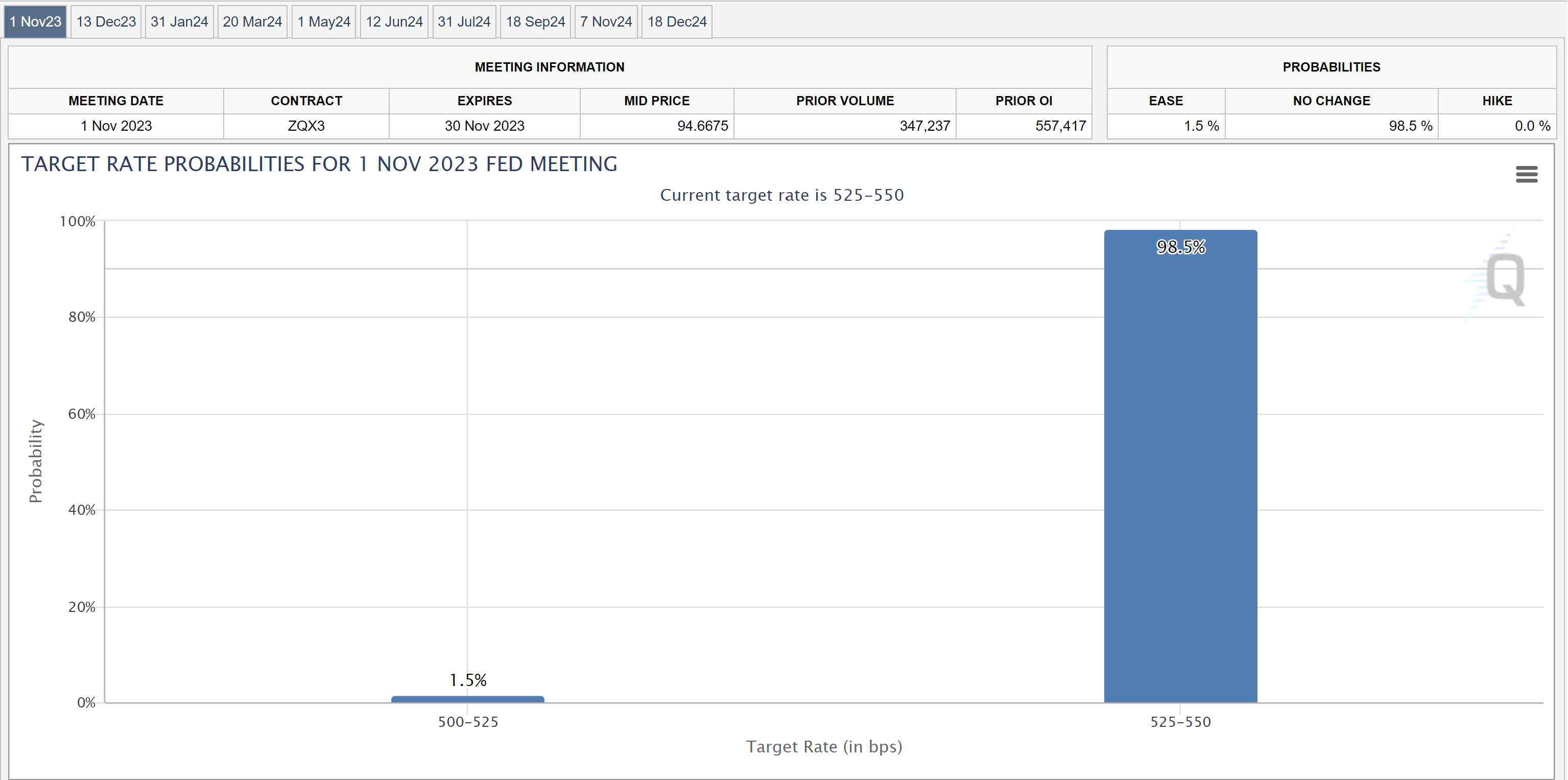

Jerome Powell’s speech last week shook markets quite a bit, as the Fed chair reiterated “more for longer” while also signaling a pause in rate hikes for the next FOMC meeting next week. week, from October 31 to November 1, 2023.

Amid bond market turmoil, the US yield curve continued to approach bearishness, with the 2yr/10yr spread jumping 19bp after the Fed’s Powell gave “light green” for higher long-term bond yields, with 10 years approaching 5.%. Although no surprises are expected compared to last week’s speech, a Jerome Powell speech should always be on the watch list.

#3 Thursday: Premiere of the Bloomberg TV documentary SBF

Bloomberg TV will debut its long-awaited documentary, “RUIN: Money, Ego, and Deception at FTX” on October 26, chronicling the meteoric rise and fall of FTX founder Sam Bankman-Fried (SBF). The production, which sheds light on FTX’s tumultuous journey, will offer insights into the crypto exchange’s downfall.

A Bloomberg Originals production, the documentary fuses investigative journalism with first-hand accounts from industry experts to paint a complete picture of the fall of FTX and the subsequent legal challenges faced by SBF. With its trailer already generating buzz since its release on October 13, the documentary will be a fascinating watch for anyone interested in the intricate dynamics of the world of cryptocurrencies.

#4 Friday: $3.6 Billion crypto Options Expire on Deribit

Friday could see pronounced volatility in the cryptocurrency space, with $3.6 billion in notional crypto options set to expire on Deribit, the world’s largest options exchange. Of this, $2.25 billion belongs to bitcoin, making up 21.4% of all btc options open interest on Deribit, and $1.35 billion belongs to Ether (eth), making up 22.7%. of all eth options open interest as of October 20.

bitcoin analyst Dylan LeClair has been on the front lines, enthusiastically observing strong changes in the options market more recently. LeClair followed a notable trend: “For 3-month options, calls are trading at the highest premium ever recorded relative to puts,” he said. tweeted.

He continued to demystify the concept of “bias,” emphasizing its critical role in gauging market sentiment. In simple terms, a positive bias suggests a tilt towards downside protection (or puts), while a negative bias tilts towards upside potential (buys). Noting the optimism in the options market, LeClair commented: “As for options volume, it is the highest ever recorded for a btc move other than down.”

#5 US PCE Report for Friday September

From a macro point of view, the upcoming US Personal Consumption Expenditures (PCE) report for September is set to significantly influence both the broader financial market and the crypto landscape. Due out Oct. 27, the PCE index, the Federal Reserve’s inflation yardstick, will provide insight into consumer trends.

This data is critical for economists and the Federal Reserve as it provides a clearer picture of economic health ahead of the looming rate decision during the FOMC meeting Oct. 31-Nov. 1.

With the Federal Reserve keeping rates between 5.25% and 5.50% during its September 2023 FOMC meeting, analysts are eagerly awaiting the basic details of the PCE. Expectations abound for a continuation of the “aggressive pause,” strengthened by any core PCE reading that aligns with or falls below predictions.

Bonus: Thursday – US GDP Q3 2023

Beyond the cryptocurrency space, the US gross domestic product (GDP) announcement for the third quarter of 2023 will also garner significant attention this week, which could influence broader market sentiments.

For investors, this week promises a fascinating mix of events and revelations. From bitcoin‘s performance trajectory to fundamental macroeconomic updates, the next few days are critical for anyone closely following the bitcoin and cryptocurrency landscape and financial markets in general.

At the time of publication, btc was trading at $30,570.

Featured image from Shutterstock, chart from TradingView.com

NEWSLETTER

NEWSLETTER