Bitcoin (BTC) shot higher around the Wall Street open on Jan. 17 as nervous analysts waited for more clues.

Opinions diverge on the fate of Bitcoin

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD briefly touched $21,594 on Bitstamp, marking its highest level since September 13.

As bullish impulses continued to trickle onto the chart, reactions remained dovish amid an atmosphere of suspicion about the true source of Bitcoin’s return to form.

One such cautious take came from Michaël van de Poppe, founder and CEO of trading firm Eight, who observed behavior around a key exponential moving average (EMA) in crypto.

“Food for thought; Total market cap and altcoin market cap are both at the 200 day EMA, while Bitcoin is just barely breaking it without any volume,” he said. indicated.

“Most likely, the markets have bottomed out, but the question arises as to whether we will recover from here.”

Meanwhile, popular Crypto trader Tony advised “patience” when it came to buying BTC after more than a week on the rise.

“It reached the high rank as anticipated yesterday. Today you will be waiting for: – A push above and a retest to confirm a safe long position while we are above – A push above and a close below the range high. Short trigger”, part of the analysis before the opening fixed.

As Cointelegraph reported, bearish predictions for the future of BTC price action accompanied each stage of its rise from its lowest levels in two years, including a call for $12,000 to come up next.

Meanwhile, Cointelegraph readers themselves are becoming more bullish on Bitcoin’s prospects.

Current responses to our latest Twitter poll favor continued gains, with 37% of 1,000+ users believing Bitcoin is back on its journey “to the moon.”

However, another 22% fear that the current uptrend will turn to end in a “complete crash”.

What is your prediction for the market this week?

— Cointelegraph (@Cointelegraph) January 17, 2023

“Is Bitcoin Back?”

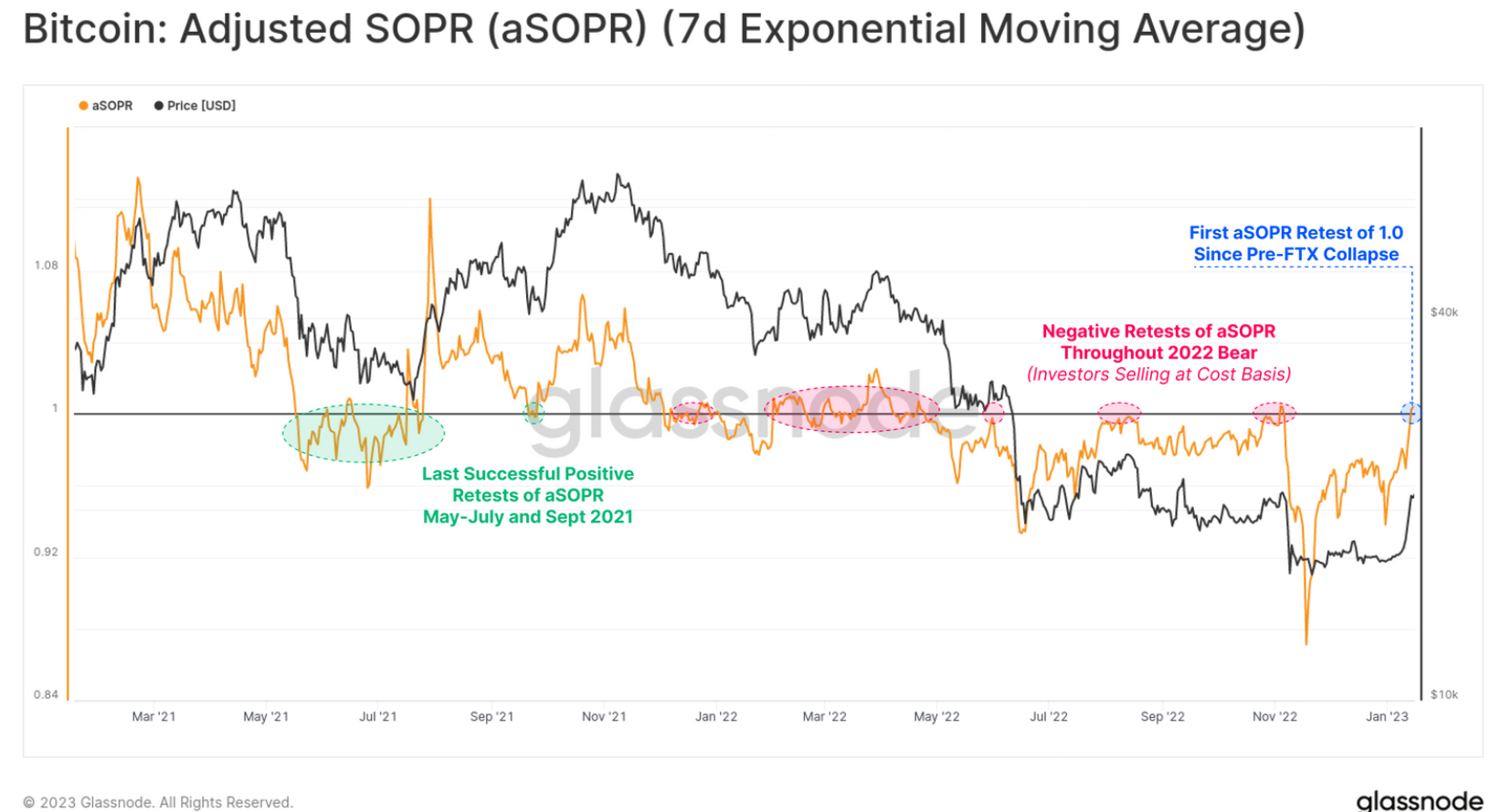

Elsewhere, on-chain analytics firm Glassnode suggested a “wait and see” approach while discussing how long the good times could last.

Related: Bitcoin Price Breakout or Bull Trap? 5K Twitter users give their opinion

In the latest issue of his weekly newsletter, “the week in chain”, the researchers observed key lines in the sand that were close to profitability versus supply.

Bitcoin’s adjusted production expended earnings ratio (aSOPR) metric is about to cross the 1 line from below, marking a potential key change. If it crosses that line, hodlers will have added incentive to sell while making a profit, possibly causing oversupply and sending the market lower yet again.

Cointelegraph previously wrote about SOPR when it hit two-year lows in mid-November.

“With an explosive 23.3% rally to start the year, a broad cross-section of Bitcoin investors (and miners) have seen their net holdings (and trades) return to profit. This reflects the impact of both the strong price appreciation as well as the tremendous volume of coins changing hands in recent months, restoring its lower cost base,” Glassnode concluded.

“With aSOPR and realized P/L testing an equilibrium value of 1.0, the test of whether the market can sustain these gains becomes the next big question.”

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER