Join our Telegram channel to stay up to date on breaking news coverage

The bitcoin halving, the launch of a bitcoin spot ETF, and the bitcoin digital gold thesis are the three factors converging to send the price of the leading cryptocurrency to $40,000 this month, and possibly $60,000 early next year.

An expected bull run accompanying bitcoin halving cycles has probably already begun, providing the first major reason for bitcoin‘s price doubling from its short-term lows printed in November last year.

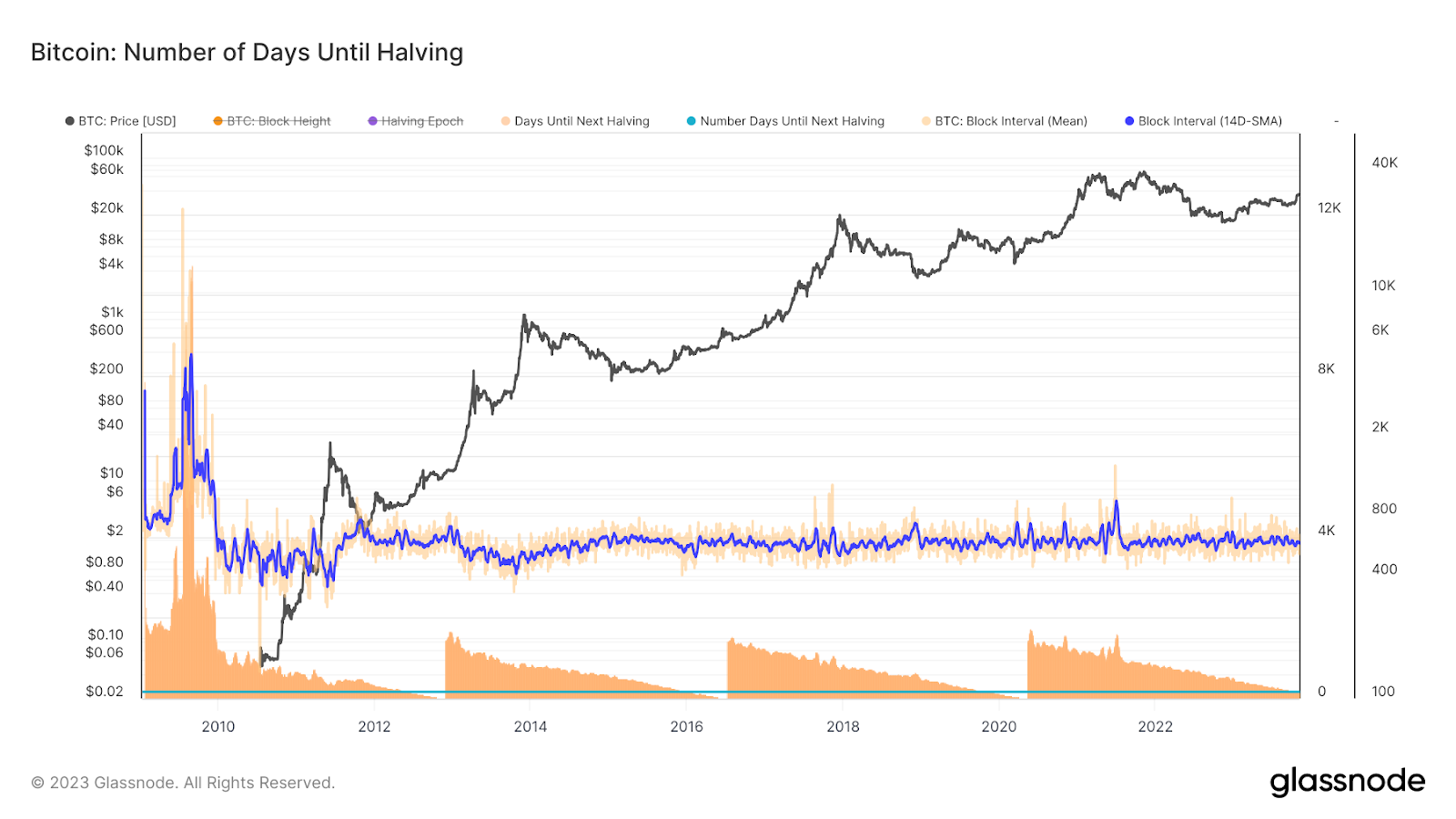

The following log price chart showing previous bitcoin halving eras illustrates the powerful positive price driver that accompanies the reduction of bitcoin‘s block reward. In April 2024, the reward is halved, from 6.25 to 3.125 bitcoin per block mined.

$BTCETF Token: Best Way to Position Yourself for Outstanding Returns After bitcoin Spot ETF Approvals

However, a second reason for bullish sentiment to return to the market is undoubtedly the decreasing odds of the US Securities and Exchange Commission (SEC) approving a bitcoin spot ETF, so soon like in January of next year.

In anticipation, traders have already started diverting their cash into bitcoin-derived currencies, such as the bitcoin ETF token ($BTCETF), to be ready for the approval of a spot bitcoin ETF.

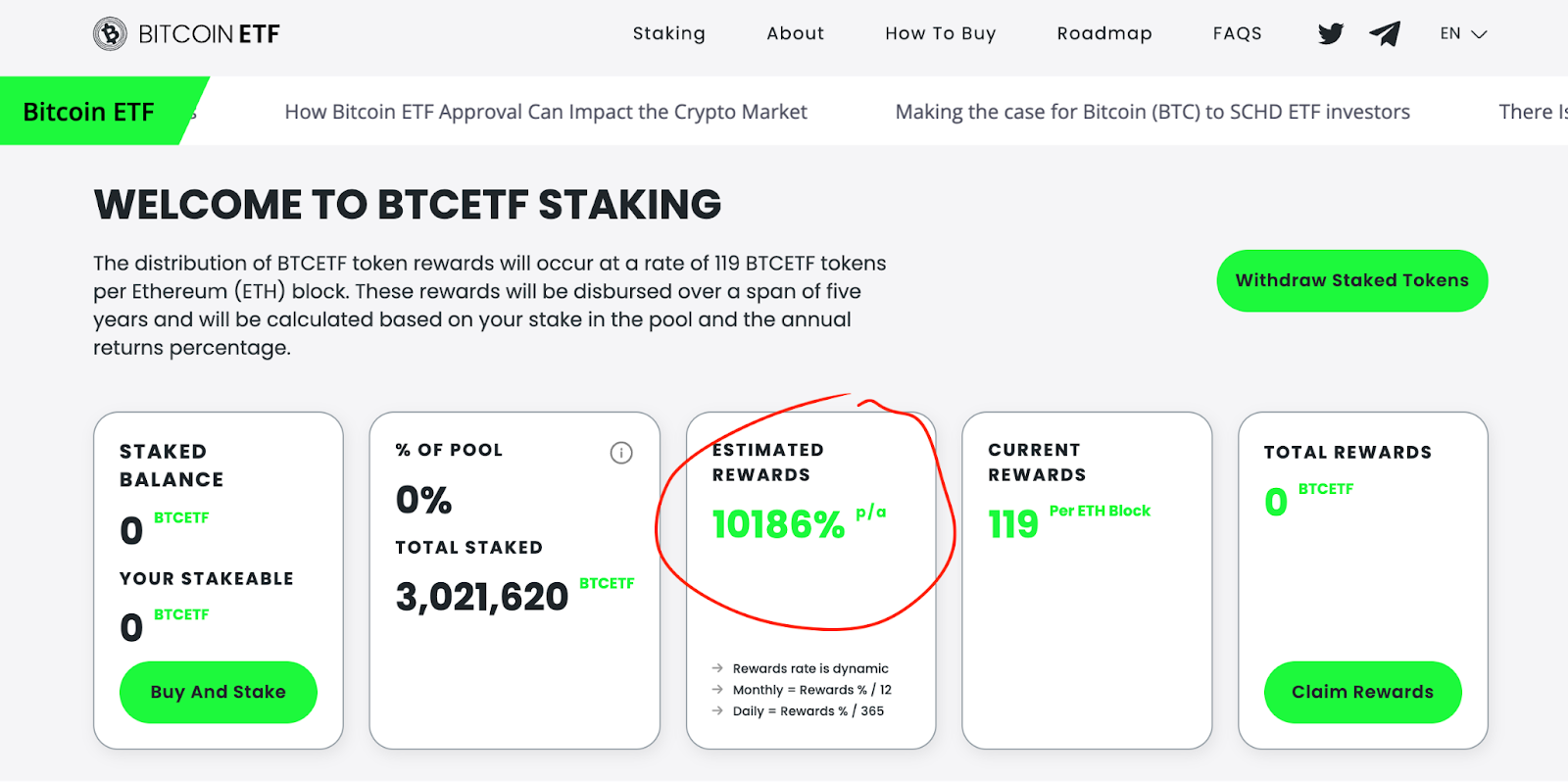

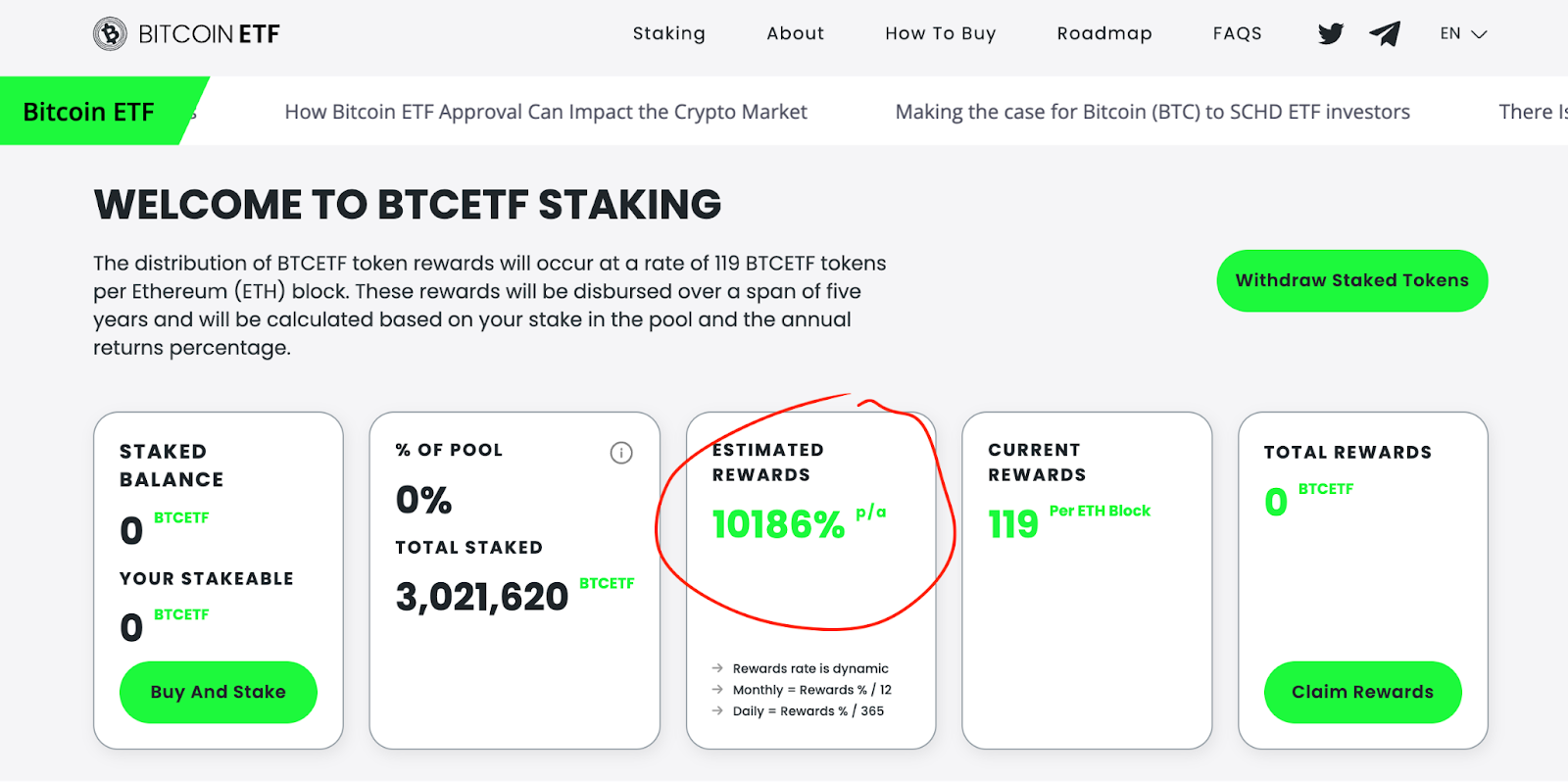

Traders are incentivized to purchase the $BTCETF token in the pre-sale through the ecosystem’s staking feature. At the time of writing, over 3 million $BTCETF tokens have been staked, earning an astronomical annual percentage yield (APY) of over 10,000. The performance will decrease as more funds are deposited into the staking smart contract.

<h2 id="h-burn-mechanism-tied-to-real-world-events-such-as-trading-volume-and-spot-bitcoin-etf-approval-and-launch-dates” class=”wp-block-heading”>Recording mechanism linked to events including trading volume, bitcoin Spot ETF approval and launch dates

bitcoin ETF Token launches with a 5% burn mechanism on all transactions. Up to 25% of the total token supply can be burned.

Cleverly, the burn mechanism is tied to real-world events related to the bitcoin ETF timely news flow, where milestones such as approval and launch dates and the level of assets under management (AUM) trigger burn events.

For example, when the trading volume of $BTCETF reaches $100 million, the transaction tax is reduced from 5% to 4%. There are other smart milestones, like when the first bitcoin spot ETF is approved, the sales tax is reduced from 4% to 3%.

If you’re looking to take advantage of the hype surrounding the most popular cryptocurrency investment right now, bitcoin ETF Token is the best way to position your portfolio for when the SEC approves the first bitcoin spot ETF.

bitcoin ETF Token has a total supply of 2.1 billion (2,100,000,000). The project website has a useful newsfeed to keep you up to date with all news related to bitcoin ETFs and bitcoin price.

The $BTCETF token is the best way to play the bitcoin ETF spot theme. The token is now on pre-sale and only costs $0.005. There is a total cap of just under $5 million, with the pre-sale divided into 10 pricing stages, so investors should buy today to lock in the lowest possible prices.

<h2 id="h-bitcoin-is-digital-gold-and-bitcoin-etf-token-is-a-cheap-way-of-getting-in-on-the-action” class=”wp-block-heading”>bitcoin is digital gold, and the bitcoin ETF token is a cheap way to get a piece of the action

Our third reason why bitcoin may hit $40,000 in November is bitcoin‘s persistent appeal as a store of value: the digital gold narrative is coming to the fore once again. Again, buying bitcoin ETF Token is a way to gain exposure to this third leg of the bitcoin bull case.

There’s nothing like war and economic uncertainty to stir the pot for gold bullion, and bitcoin is arguably a more portable and divisible version of that asset, with similar investment properties, but without the custody costs required to store it in a vault

ARK Invest founder Cathie Wood outlined the digital gold case for bitcoin in a recent bitcoin-is-digital-gold”>Bloomberg interviewretweeted below:

bitcoin ETF Token – A Low-Cost Alternative to Expensive ETF Management Fees

Also worth mentioning is the fact that purchasing the bitcoin ETF token is a cheaper way to gain exposure to bitcoin‘s value proposition through a real spot bitcoin ETF.

ETFs come with management fees. Although the total expense ratio (the percentage of returns deducted by fees) is typically less than 1%, making ETFs cheaper than mutual funds, expenses can still add up to a lot of money, especially for larger funds.

When you purchase $BTCETF tokens, you pay a one-time amount to cover gas fees on ethereum, rather than having to shell out an ongoing annual percentage charge.

There’s also no need to worry about annoying tracking errors (when the underlying asset and the ETF price diverge slightly), as is the case with exchange-traded funds.

<h2 id="h-dollar-losing-its-luster-bitcoin-gaining-a-shine-and-it-s-programmable-too” class=”wp-block-heading”>Dollar’s shine fades as bitcoin shines

Those are the three main reasons, but there are other positive aspects associated with the macroeconomic context and the fundamentals of the bitcoin protocol.

In that sense, the dollar’s waning power and persistent inflation make a disinflationary asset like bitcoin a great portfolio diversifier, even if that wasn’t really evident when inflation first returned to being a top concern for investors. political leaders.

The chart below shows the dollar index (dollar weighted against other leading internationally traded currencies) against the price of bitcoin.

At the protocol level, developments around nft ordinals demonstrated the flexibility of bitcoin as a programmable form of money that is practically and theoretically capable of adapting and evolving.

Despite the much-discussed governance issues that have previously held back progress, the hype around ‘inscriptions’, which allowed block space to be used for novel and unintended purposes, such as storing NFTs, showed what is possible.

Even if you have doubts about the value proposition of ordinal NFTs, their existence demonstrates the revolutionary extensibility of bitcoin.

Transactions surged on the bitcoin blockchain when the ordinal innovation began, sparking criticism in some quarters that they were clogging up the chain and putting upward pressure on transaction fees. However, it showed the innovative possibilities of the bitcoin protocol in contrast to the sterility of non-programmable fiat money.

<h2 id="h-how-spot-bitcoin-etf-approval-can-propel-the-bitcoin-price-to-60-000-going-into-2024″ class=”wp-block-heading”>How Spot bitcoin ETF Approval May Soar bitcoin Price to $60,000 by 2024

Having reestablished itself around the $35,000 level, traders are looking for bullish price targets for bitcoin between $47,000 and $60,000 heading into 2024.

If the price stays within its current ascending channel, it will reach $40,000 in January.

But the price of bitcoin could skyrocket in January because it is the 10th of that month when the deadline arrives for an SEC decision on the approval of the ARK 21 Shares bitcoin ETF.

A pass could see the price break out of the identified channel and rise on a trajectory towards $47,000, where it will likely encounter some resistance that formed at that level in April 2022.

Assuming Bloomberg Intelligence analysts have nailed their mast to a bitcoin-etf-push-what-s-next-after-sec-doesn-t-appeal-court-ruling”>90% Chance of a Spot bitcoin ETF approved are correct, then a steady stream of other approvals will follow, including the most important one: BlackRock’s iShares bitcoin Trust ETF. BlackRock is the largest asset manager in the world.

What fueled the speculation, and the argument that an approval is inevitable, was the inclusion of the iShares fund in the eligibility file of the clearing house DTCC (Depository Trust & Clearing Corporation), which handles post-trade settlement for investors. US financial markets.

Although the inclusion of the iShares ETF on the docket does not mean an approval is confirmed, it is a step indicative of such an outcome. No previous bitcoin ETF applications have been included in the DTCC list.

The news drove the price of bitcoin on a two-day rally to an 18-month high of $35,180, which is where the price is still currently trading.

After settling at $47,000, there is an open path ahead for the price to rise back to $60,000 and challenge the all-time high of $68,000.

bitcoin Spot ETF and $BTCETF Token May Open Floodgates to New Inflows

It is not surprising then that, of the three main reasons behind the push towards $40,000, market participants are most focused on the prospects of a bitcoin spot ETF and how it and other bitcoin derivatives, such as the bitcoin ETF Token bitcoin, can play a role in opening the market. floodgates for new money.

Exchange-traded funds will provide retail and institutional investors with safe and hassle-free ways to gain exposure to bitcoin.

There will be no need to risk funds by investing in a next-generation FTX, for example, which could expose investors’ money to fraud and losses.

Spot issuers of bitcoin ETFs include the big and good of the investment management world, from BlackRock to Fidelity and relatively new companies like ARK Invest.

The fact that highly regulated and well-supervised companies, such as those mentioned above, entering the crypto space may be a threat to some traditional ‘crypto native’ operators, such as centralized exchanges. But for retail investors it means more security and choice, and for institutional clients it provides a regulated on-ramp.

The opening of the bitcoin ETF token pre-sale today offers investors perhaps the smartest way to take advantage of the investment theme around the bitcoin Spot ETF. It could be the best thing to happen to your cryptocurrency investment portfolio.

Buy bitcoin ETF tokens here

Join our Telegram channel to stay up to date on breaking news coverage

NEWSLETTER

NEWSLETTER