bitcoin’s recent price action has been a rollercoaster of ups and downs. However, despite bitcoin setting a new all-time high and having two years of a near-constant positive trajectory, we have yet to see a consistent influx of retail investors. The possibility of increased retail participation and the possibility of driving the bitcoin price to unprecedented levels are prospects that many investors are eagerly awaiting. In this article, we are going to explore when we might see these retail investors dip back into the bitcoin pool and whether their return could actually propel btc to even greater heights.

Growth of active addresses and their impact

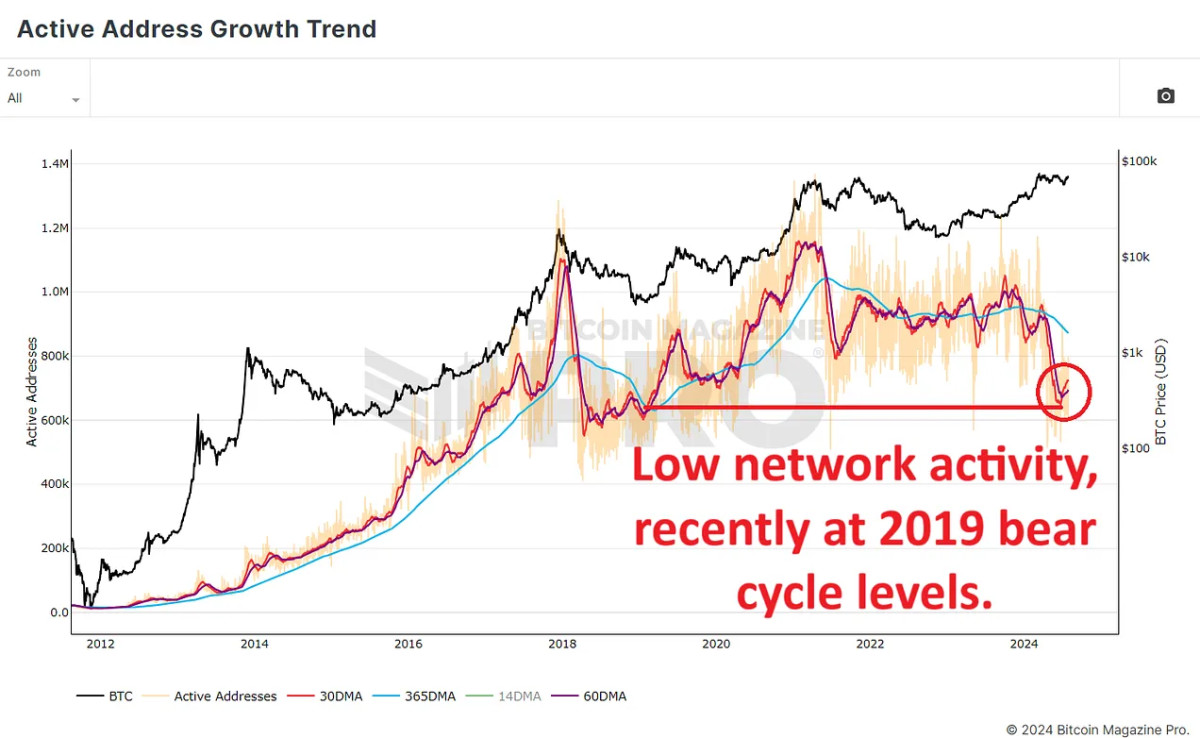

To anticipate this possible retail wave, it is important to analyze the bitcoin-portfolio/active-address-growth-trend/”>growth trend of active addressesData obtained from bitcoin Magazine Pro suggests a drop in the number of active network participants over the past few months. The 365-day moving average (blue line), together with the 60-day period (purple line) and 30-day averages (Red line), tell a story of declining network activity. This drop brings the active user count back to levels reminiscent of early 2019, after bitcoin’s bear cycle, when prices were hovering between $3,500 and $4,000.

This decline in active network users raises questions about bitcoin’s upside potential in the current cycle. Interestingly, despite bitcoin hitting a new all-time high of roughly $74,000, there was no corresponding sustained increase in the number of network users, which represents a marked shift from previous cycles.

The necessary entry of new capital

This trend could be a reflection of bitcoin's changing identity. bitcoin, which was originally a peer-to-peer digital currency, is increasingly being viewed as a store of value. As a result, fewer and fewer people are using it for everyday transactions and are instead investing capital in bitcoin as a long-term asset.

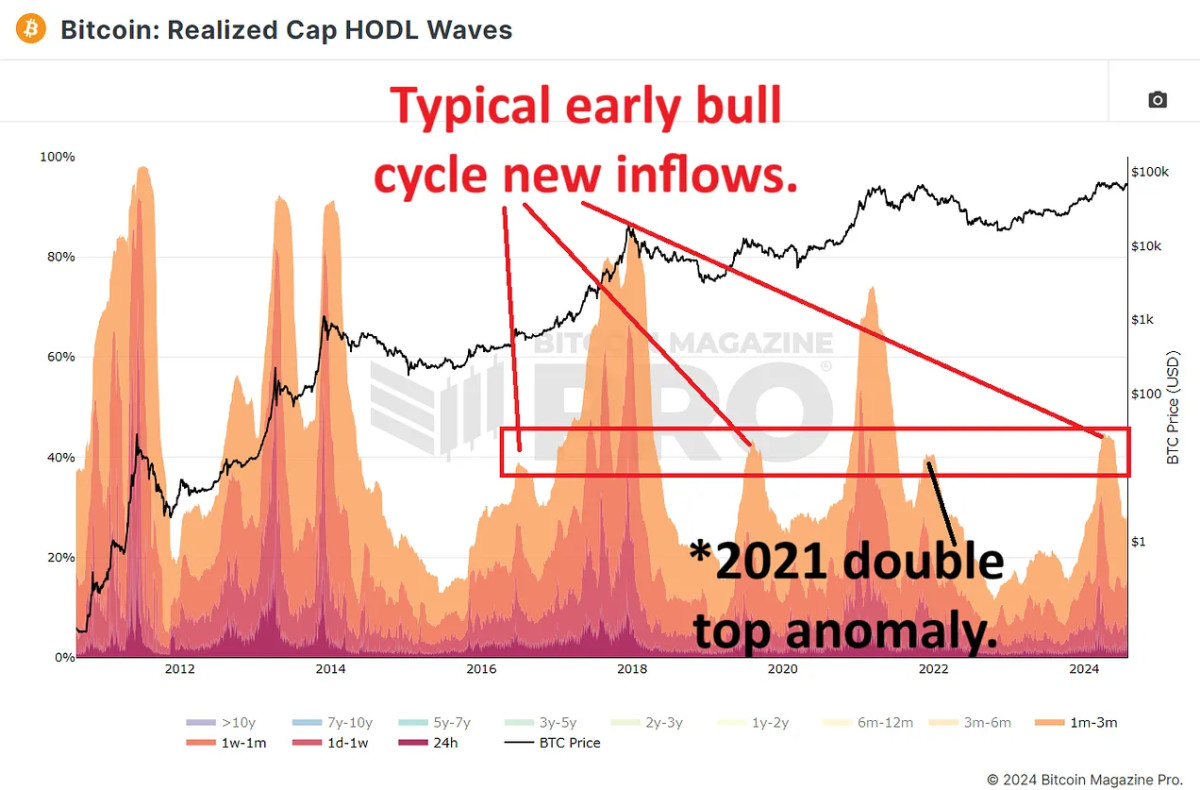

bitcoin HODL waves and Realized HODL capitalization Ripples shed light on this shift. These metrics group bitcoin network users based on how long they have held their coins, as well as showing their influence on the btc accumulation price. Recent data reveals that around 20% of bitcoins have been held for three months or less, indicating that new users are entering the market, but as we can see from the average active addresses in the data above, they are not using bitcoin as frequently as they once were.

The impact of these new users on the realized limit (The average accumulation price of all btc) is considerable, with over 40% of recent influence coming from users who have held bitcoin for three months or less (indicated by the warmer red/orange colors in the chart below). This suggests that users are entering the market at higher prices and are behaving in a manner consistent with previous cycles (We have recently seen the initial entries of the bullish cycle at levels comparable to those of previous cycles, indicated by the red box.), although not as frequently as we have seen previously.

Understanding market forces and retail participation

A look at previous bitcoin cycles shows that a surge in retail activity often precedes market peaks. For example, in the bull periods of 2017 and 2021, retail interest spiked about 6 months before the price reached its peak. The current absence of a significant surge in retail interest, as evidenced by Google Trends, suggests that we are experiencing more measured and more sustainable market growth.

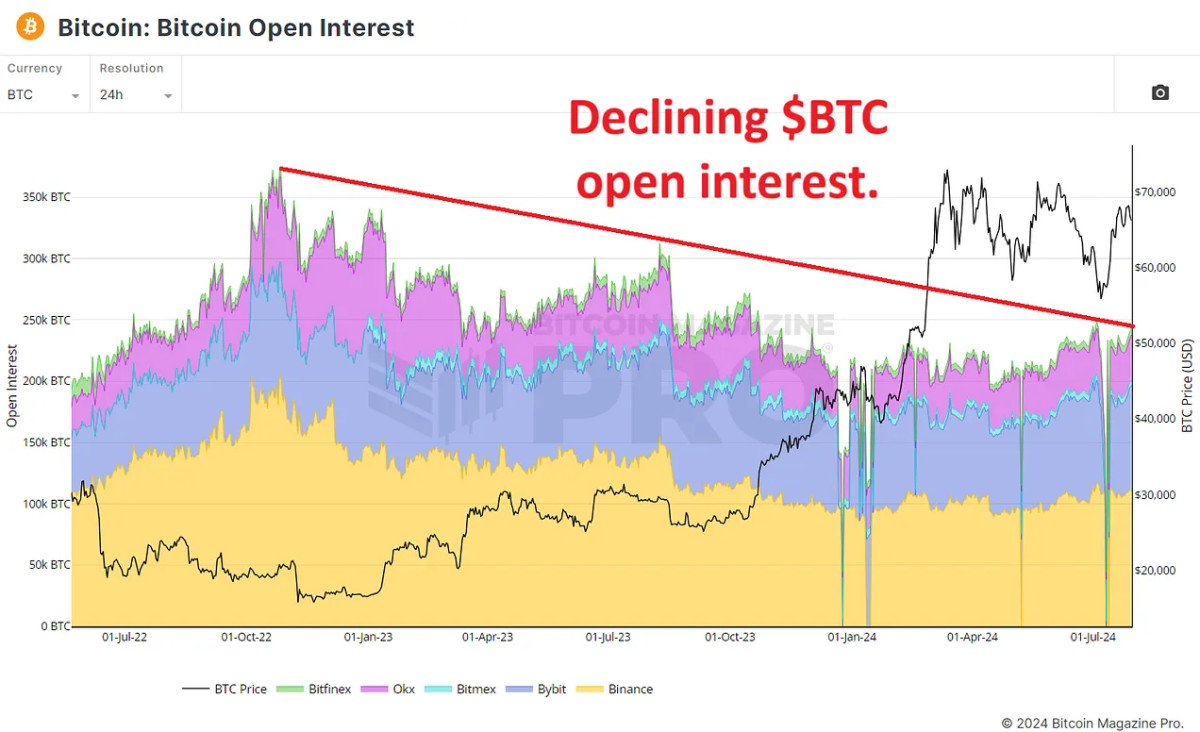

Another key consideration is the btc-open-interest/”>bitcoin Open Interest Chart measuring the total value of open bitcoin futures contracts. Since the end of 2022, this metric has not shown a significant increase; in fact, we have seen a steady decline since the lows of the bear cycle (indicated by the red descending line in the chart below). This reveals that investors now prefer to trade actual bitcoins rather than simply engaging in derivatives trading. This indicates a shift in the narrative, where investors are more interested in holding bitcoins for the long term rather than chasing short-term speculative gains.

Conclusion

Given current trends, the lack of a retail frenzy could be seen as a positive sign for the market’s long-term outlook. As bitcoin approaches new all-time highs, it will be essential to keep an eye on the influx of retail investors. If retail investors begin to enter the market in large numbers, will they fall back into old habits of purely FOMO buying or continue to favor long-term holding?

In short, despite a drop in bitcoin’s active user metrics, the market is showing signs of stability and long-term investment. The absence of immediate retail interest may seem bearish, but it is more likely bullish as it indicates a more measured and sustainable growth trajectory.

For a more in-depth look at this topic, check out a recent YouTube video here: