bitcoin peak, hardly.

https://x.com/pete_rizzo_/

As I wrote in <a target="_blank" href="https://www.forbes.com/sites/peterizzo/2021/03/04/the-bitcoin-bubble-myth/”>Forbes in 2021The world is waking up to a new reality regarding bitcoin: the improbable truth that bitcoin programming has cyclical effects on its economy.

This has led to at least 4 different market cycles where bitcoin has been branded a bubble, skeptics have been called out, and each time, bitcoin has recovered 4 or so years later to set new all-time highs above his formerly “most high.” “Assessment.

I personally saw bitcoin go from $50 to $1,300 in 2013. Then from $1,000 to $20,000 in 2017, and I saw it go from $20,000 to $70,000 in 2021.

So, I'm just here to tell you that based on my past experience, this market cycle is just heating up.

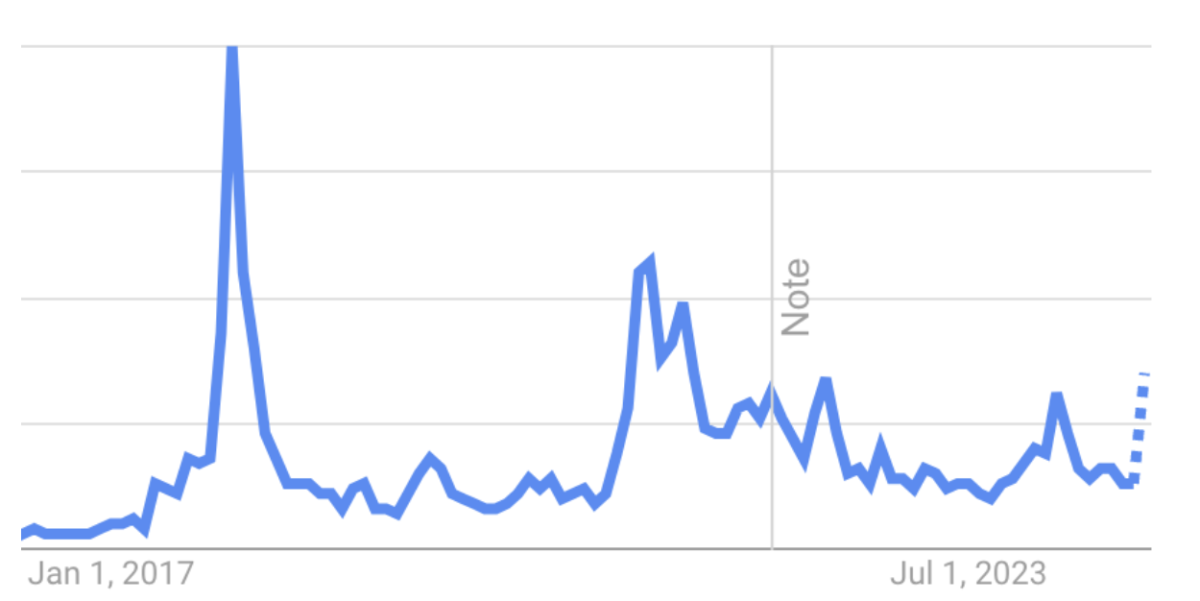

For those who have been into bitcoin, there is a tried and true one and it is <a target="_blank" href="https://trends.google.com/trends/explore?date=today%205-y&geo=US&q=bitcoin&hl=en”>Google Search. For as long as I've been in bitcoin, this has been the best indicator of market strength.

Search is low, you are probably in a bear market. Is search returning to all-time highs? This means that new entrants get involved, learn about bitcoin, and become active buyers.

Remember, this is a habit change. bitcoin HODLers are slowing down the move of their assets to a whole new economy. So Google Trends search represents a snapshot of bitcoin immigration. It shows how many new sovereign citizens are moving their money here.

And it's something everyone who is worried about whether the price of bitcoin will peak in 2024 should pay attention to.

Last year saw the bitcoin halving and historically, the year following previous halvings has led to price appreciation. You may be tempted to think, “this time it's different”, not me. I look at the search and see a chart that continues to accelerate towards price discovery. Believe me when I say that no one I know is selling bitcoins.

As shown above, buyer interest is accelerating and these new buyers have to buy that bitcoin somewhere. Add nation states, US states, and an upcoming Trump administration willing to ease the burden on the industry?

Well, I think the above chart says it all.

This article is a Carry. The opinions expressed are entirely those of the author and do not necessarily reflect those of btc Inc or bitcoin Magazine.