As we enter the fourth quarter, a period historically known for strong bitcoin performance, the latest edition of The bitcoin Report from bitcoin Magazine Pro offers essential insights into the changing dynamics of the bitcoin market. With a combination of quantitative on-chain data, technical analysis, and macroeconomic insights, this report offers a comprehensive view of bitcoin's positioning, highlighting critical opportunities and challenges for both investors and market participants.

Key highlights of the report:

- Historical fourth quarter performance: bitcoin averaged a return of 23.3% in the fourth quarter, showing a strong seasonal trend towards bullish performance.

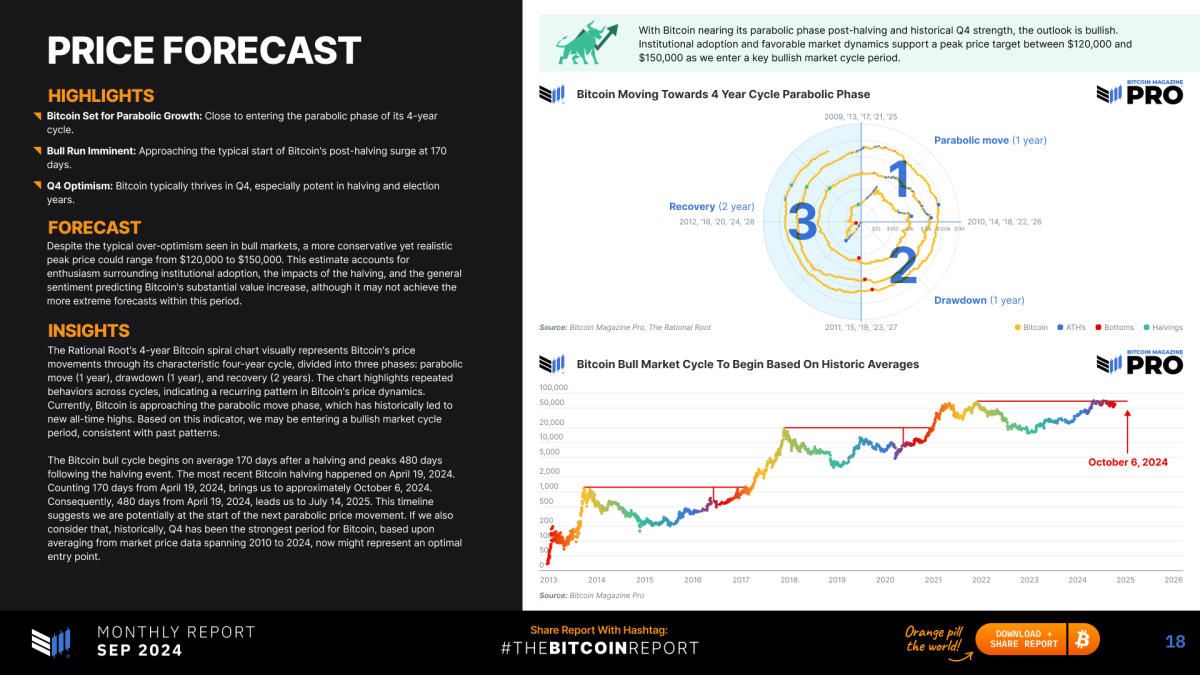

- Breaking significant resistance: Recent technical analysis points to bitcoin surpassing key resistance levels, potentially setting the stage for parabolic growth.

- Derivatives market boost: The derivatives market is showing renewed momentum, with growing open interest and reduced leverage on major exchanges.

- Recovery of Mining Profitability: Mining profitability has recovered and the hash price hit a two-month high, indicating a strengthening of bitcoin's underlying fundamentals.

- Institutional Accumulation: In September, US bitcoin ETFs purchased 17,941 Bitcoins, 32.9% more than the 13,500 new Bitcoins mined during the same period, indicating significant institutional demand.

This 21-page report is built on a solid foundation of on-chain metrics, technical analysis, and macroeconomic factors. Provides an in-depth examination of recent bitcoin market developments, including trends such as institutional accumulation and the recovery of mining profitability. Given that the fourth quarter has historically delivered strong returns for bitcoin, the report highlights how macroeconomic factors, such as potential rate cuts from the Federal Reserve and liquidity injections from the People's Bank of China, could act as catalysts for the continued growth of bitcoin. In a low-leverage environment within the derivatives markets, these monetary policies may spark a new bitcoin rally.

Expert Analysis and Insights

With exclusive commentary and insights from leading industry figures such as Linda Alden, The rational rootand Julian Linigerthis second monthly edition of The bitcoin Report It is a must read for investors and enthusiasts alike.

The analytical rigor presented in this edition is further enriched by the perspectives of opinion leaders such as Felipe fast, Pete Rizzo, Dr. Michael Tabone, Dr. Demelza Hays, Patricio Heusser, Lucas Betschart, Lucas Pfeiffer, Pascal Hugliand Joel Kai Lenz. His ideas cover a spectrum of topics including macroeconomic policy implications, sector-specific developments and technical indicators. Leveraging the collective experience of leading analysts, The bitcoin Report offers an unparalleled breadth of analysis, from micro-level on-chain behaviors to macro-level geopolitical and economic drivers that influence the bitcoin adoption curve.

Share, discuss and participate

We invite you to read and download the September issue, packed with information that will keep you ahead of the curve in this rapidly evolving market. Whether you're managing portfolios, seeking long-term bitcoin exposure, or simply staying informed, The bitcoin Report provides the knowledge you need to stay on top of the trend.

Feel free to share the content of the report, take screenshots and post on social media using the hashtag #TheBitcoinReport. By keeping track of these conversations, we can improve future editions and continue to provide high-value content to the bitcoin community.

Sponsorship and collaboration opportunities

Interested in sponsoring future editions of The bitcoin Report Or explore co-publishing opportunities? Partner with us to gain exposure in the rapidly growing bitcoin space.

For more information, please contact Mark Mason in mark.mason@btcmedia.org to discuss how your brand can be part of this exciting initiative.

NEWSLETTER

NEWSLETTER