So, 2023 has been pretty epic for bitcoin. It's as if bitcoin woke up and decided to flex its muscles in a big way. We are talking about a huge jump, more than 140% in value. That's huge! It's not just about surpassing traditional rivals like gold; It's also about leaving other cryptocurrencies in the rearview mirror. Let's delve into the on-chain action and exchange buzz, trying to piece together clues to see what bitcoin could be doing next year.

The bitcoin Explosion of the Past

According Glassnode reportWe are seeing déjà vu with the bitcoin cycles in 2015-2017 and 2018-2022 in terms of how long it takes to recover and the drop from the all-time high (ATH).

In the current cycle, bitcoin has seen a drop of around -37% from its ATH, which is quite close to -42% in 2013-2017 and -39% in 2017-2021. Additionally, since the FTX lows in November 2022, bitcoin prices are up a solid +140%, making it the strongest one-year return compared to the +119% in 2015-2018 and the +119% in 2015-2018. 128% in 2018-2022.

Exchange Activity: The bitcoin Trading Paradox

Even though 2023 was a banner year for bitcoin, the number of transactions depositing funds into exchanges has surprisingly hit multi-year lows. But here's the kicker: Glassnode data shows that on-chain volume moving in and out of exchanges has skyrocketed, jumping from $930 million to a staggering $3 billion — that's a massive 220% increase. .

This discrepancy between fewer deposits and skyrocketing volume makes us wonder: what is driving the intensification of foreign exchange activity if not retail investors? On the one hand, the decline in deposit transactions could suggest that investors are becoming more cautious about leaving their assets on exchanges, possibly due to security concerns or a desire for greater control over their funds. This is where the potential shift towards non-custodial exchanges like StealthEX comes into play. Given the FTX drama that is still on everyone's minds, it's no surprise that these platforms where you can store your private keys are becoming more popular.

There is a significant increase in on-chain volume, showing that trading and speculation are more active than ever. It appears that while investors are avoiding depositing their funds, they are actively trading and moving large sums of money. This could be a sign of growing institutional interest, especially as we see the average deposit size on exchanges approaching the previous all-time high of $30,000 per deposit, according to Glassnode.

Furthermore, the fact that foreign currency deposits as a percentage of all transactions have fallen from around 26% in May to just 10% today, although the decline is more modest (around 20%) when adjusted for inscriptions, adds another layer to this narrative. Without a doubt, we are witnessing a dynamic shift in the blockchain sphere as new types of transactions emerge and new players steal their share of the limelight.

Short-term holders collect

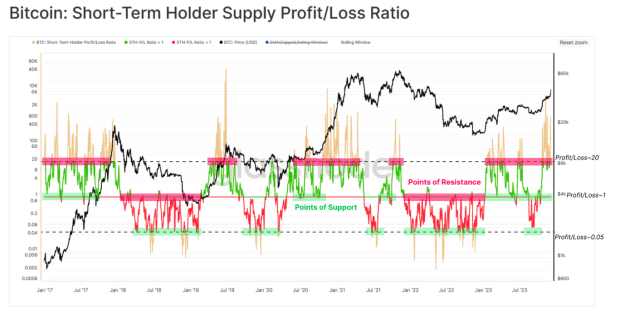

Short-term holders (STH) have been taking some smart moves lately, cashing in on their bitcoin investments at just the right time. Glassnode has the statistics To prove it, STH's supply profit/loss ratio has been hovering above ~1 since January. This means that these savvy traders have been playing the “buy the dips” game quite well, a classic move in uptrends. However, these STHs are moving large amounts of coins to exchanges, and the gap between what they paid and what they sell is quite considerable.

The first week of December, when bitcoin reached $44.2k, STHs sprang into action and took advantage of the moment to take profits. It is as if they saw the wave coming and rode it to the shore, capitalizing on the demand for liquidity. This activity has somewhat halted bitcoin's rise, demonstrating the influence of STHs on cryptocurrency prices.

Summing up: bitcoin and beyond

There you have it: the story of bitcoin in 2023 is a mix of triumphs, challenges and a lot of excitement. bitcoin, in its digital universe, never fails to keep us intrigued with its rollercoaster of strong recoveries and declines that resonate with historical patterns, even recovering recently despite some bumps along the way. The play of STHs and the unpredictable ebbs and flows of exchange activities weave a complex but intriguing narrative. Regardless of whether you're in it for the ups and downs, or just out of pure curiosity, watching bitcoin's journey is certainly something to watch.

This is a guest post by María Carola. The opinions expressed are entirely their own and do not necessarily reflect those of btc Inc or bitcoin Magazine.

NEWSLETTER

NEWSLETTER