Join our Telegram channel to stay up to date on breaking news coverage

The appeal of Altcoins continues to captivate investors and offers several investment opportunities. However, determining the best altcoins to invest in combines analysis, market trends, and innovation potential.

For some investors, achieving this takes time and effort. Therefore, Insidebitcoins curates a selection of the best altcoins that exhibit potential and utility in the current market climate.

The 7 best altcoins to invest in right now

According to S&P Global market intelligence According to data, several tokens experienced notable gains within a specific period. BNB saw a significant rise of 16%, along with MultiversX and the Optimism token, which also recorded identical gains of 16%. Furthermore, Theta Network witnessed almost double-digit growth, which is an increase of approximately 10%.

1. bitcoin Cash (BCH)

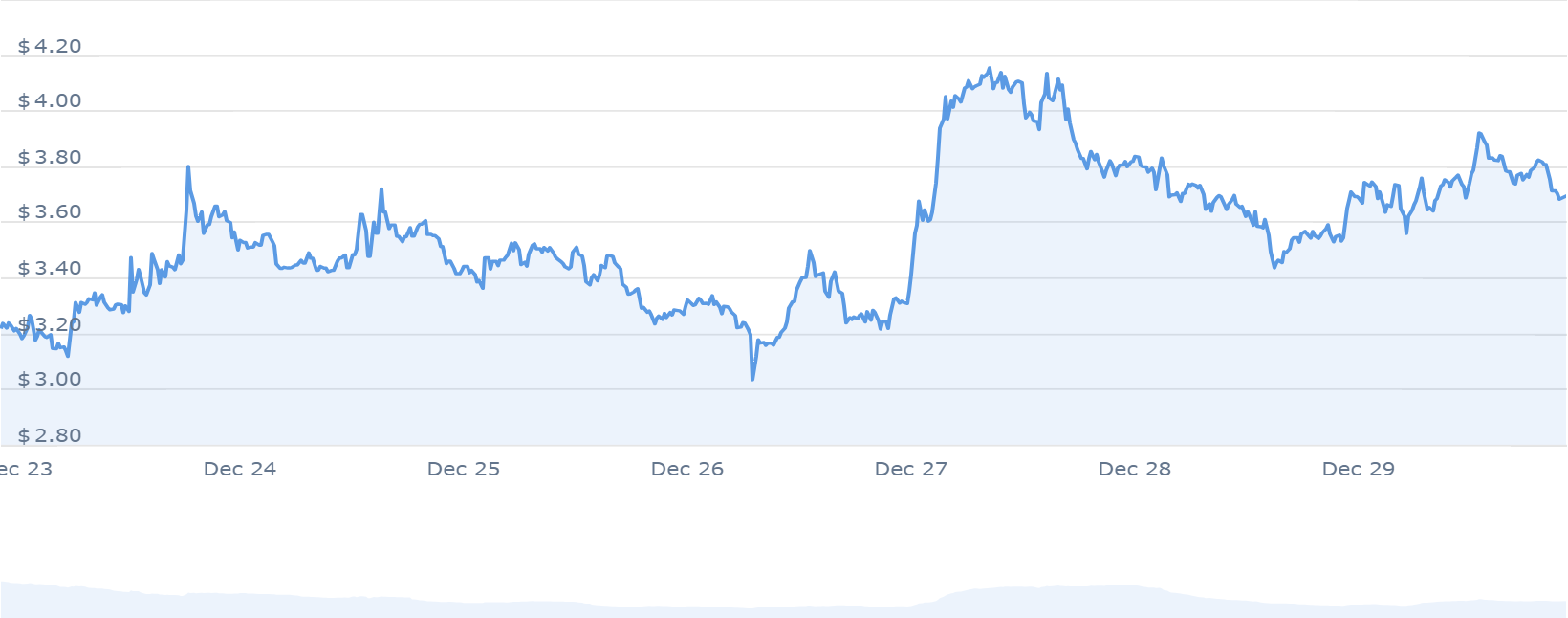

bitcoin Cash's 192% price increase has sparked investor interest. BCH maintains a steady trading position above the 200-day simple moving average, indicating a stable upward trend.

In terms of its supply dynamics, the current circulating supply of bitcoin Cash is 19.60 million out of a maximum supply of 21.00 million BCH. Over the past year, 360,525 BCH were created, which is attributed to the current annual supply inflation rate of 1.87%.

Analyzing recent trends, bitcoin Cash has seen 17 positive trading days out of the last 30, making up 57% of the period. Its strong liquidity, reflected in its market capitalization, denotes a solid presence in the market. The annual inflation rate stands at 1.87%. This indicates a controlled and relatively low level of inflation compared to other cryptocurrencies.

Taking into account the market sentiment, the bitcoin Cash price market sentiment prevails in a bullish outlook. This sentiment aligns with a Fear & Greed Index score of 68, indicating a state of greed within the market.

2. bitcoin Minetrix (BTCMTX)

bitcoin Minetrix introduces a distinctive staking concept where users stake BTCMTX tokens to earn cloud mining credits. As such, it aims to decentralize control and ensure a safe mining experience. The project claims an annual percentage yield (APY) of 103.225%. Additionally, he currently holds over 400,000 BTCMTX tokens in his staking pool.

Despite its early stage, bitcoin Minetrix has attracted significant interest and has quickly risen among the top performing cryptocurrencies. The ongoing pre-sale has raised over $6,800,104 offering BTCMTX tokens at $0.0125 each. This amount represents 70% of the total token supply of 4 billion. Potential investors can purchase these tokens using eth or USDT.

Only 3 days left #BitcoinMinetrix Stage 16!

How do you imagine? bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoinWhat is the role of the world economy in the future? pic.twitter.com/r4ZCxaEOVj

—Bitcoinminetrix (@bitcoinminetrix) December 29, 2023

This increase in traction signals increased investors' curiosity about the project's goals and offerings. The success of the pre-sale reflects the market response to bitcoin Minetrix's proposal to bet on cloud mining credits.

3. Mine (MINE)

The Mina (MINA) cryptocurrency has shown significant growth in recent periods. On a monthly chart, it has increased by 51%. Furthermore, it has recorded a notable increase of 152% over the past year. Notably, in the last two months, its price increased from $0.39 to $1.2, indicating a substantial upward movement.

Over the past week, Mina saw a price rise from $0.74 to a high of $1.27, which is an impressive short-term gain. It maintains an average trading volume of $109,711,753, suggesting notable market activity.

Mina's community-governed innovation fund is back to support even more ZK developers and entrepreneurs

Cohort 3 launches TODAY with 2 MILLION MINA available in grants!

Full details ↓https://t.co/TspXpu6V4o

– Mina Protocol (@MinaProtocol) December 22, 2023

Evan Shapiro, advisor and board chair of the Mina Foundation, shared news about the Foundation's move to Switzerland. Additionally, Kurt Hemecker will take over as CEO. This strategic move could contribute to the expansion of the ecosystem, encourage new developments, and positively impact the price of the coin.

The relocation to Switzerland may signal growth and innovation intentions from the broader ecosystem, and new leadership could drive further progress within the project.

4. Electronic Cash (XEC)

The recent market activity around XEC (eCash) indicates a possible upward trend in the near term. A notable 23% rise in the last trading session suggests bullish sentiment among buyers, with evident attempts to maintain this momentum.

Observations reveal that the eCash cryptocurrency showed a significant bullish candle, indicating an attempt to break out of a six-month high. However, finding resistance within the supply zone has delayed confirmation of the breakout.

Additionally, there are signs of increased purchasing volume in XEC, which will positively impact its price. This increase in volume suggests increased investor participation, which could indicate bullish sentiment among these influential holders.

The Cashtab wallet just got a fancy UI update!

Now equipped with a dedicated tab for eTokens, the Cashtab wallet allows users to manage their eToken assets effortlessly.

Try it now https://t.co/hZxzye4g9M https://t.co/MygEHv1yDT pic.twitter.com/HKOuQKlWo1

— eCash (@eCashOfficial) December 30, 2023

In recent months, XEC has demonstrated a consolidation phase, suggesting a period of accumulation. This phase has concluded, potentially paving the way for a trend move. A decisive break above the six-month high could start the next phase of the rally.

5. Optimism (OP)

Optimism, a prominent player in the Layer 2 sector, currently has a bullish price prediction sentiment. This prediction is coupled with a fear and greed index, which indicates a greed score of 68.

Over the past year, Optimism has seen a 310% increase in its price. This growth has exceeded 87% of the top 100 crypto assets. Notably, the asset is currently trading above its 200-day simple moving average, showing stability in its trend.

In the last 30 days, Optimism has had positive traction with 17 green days, representing 57% of the observed period. Furthermore, its market capitalization suggests a commendable level of liquidity.

6. Axelar (AXL)

Frax Finance recently announced an initiative to expand its ecosystem through the Axelar Network. This move involves the issuance of its core ecosystem assets, such as the FRAX and frxETH stablecoins, on various DeFi platforms. The goal is to expand the accessibility of Frax Finance assets and strengthen its position within the DeFi landscape.

Furthermore, this strategic expansion through Axelar Network reflects the continued evolution of the DeFi industry. It signals a trend toward closing gaps between various ecosystems as blockchain technology matures. Frax Finance's approach could serve as a model for other DeFi entities looking to expand their influence in a competitive market.

Blockchain analysts at @MessariCrypto recently published a comprehensive overview of the Axelar network. The full report explores the adoption of Axelar by market leaders and analyzes AXL's new tokenomics.

for the tldr! pic.twitter.com/50dHROjhwR

— Axelar Network (@axelarnetwork) December 19, 2023

Currently, the sentiment around Axelar's price prediction is bullish, with the Fear & Greed index indicating a level of 68 (Greed). Furthermore, it is trading above its 200-day simple moving average. In the last 30 days, 18 positive price movements accounted for 60% of the period.

7. Internet Computer (ICP)

Internet Computer has seen an upward trend in its price, soaring approximately 151% over the past year. This growth exceeds around two-thirds of the top 100 cryptocurrencies, demonstrating commendable performance in the market.

Trading above its 200-day simple moving average, ICP has shown consistency and strength in its price movement. This move is further accentuated by 20 positive trading days out of the last 30, indicating a positive trend of 67%.

Furthermore, ICP has a circulating supply of 454.17 million ICP out of a maximum supply of 488.51 million ICP. Likewise, the annual inflation rate is 65.61%, generating 179.93 million ICP in the last year.

Additionally, current sentiment around the ICP appears bullish, coinciding with a greed reading of 68 on the Fear & Greed index. Taking these possible scenarios into account, experts predict an average trading price of $16.13 by the end of 2024. However, this is subject to market developments and the regulatory landscape.

Read more

- Audited by Coinsult

- Secure and decentralized cloud mining

- Earn free bitcoin daily

- Native Token on Pre-Sale Now – BTCMTX

- Staking Rewards: Over 100% APY

Join our Telegram channel to stay up to date on breaking news coverage

NEWSLETTER

NEWSLETTER