<a target="_blank" href="https://x.com/GuerillaV2″>https & colon; & sun; & sun; x & period; com & Sol; Guerillav2

Today early at the Plan B conference in El Salvador, Tether made an announcement that has been in process. USDT is back in bitcoin using Taproot assets.

The next steps will be for Tether to have the asset, which will be initially available through Bitfinex.

Tether's return to bitcoin's ecosystem through Taproot assets is not just a simple re -entry; It is a strategic pivot that could announce a new era for both bitcoin's Lightning Network (LN) and for the broader landscape of Stablecoin.

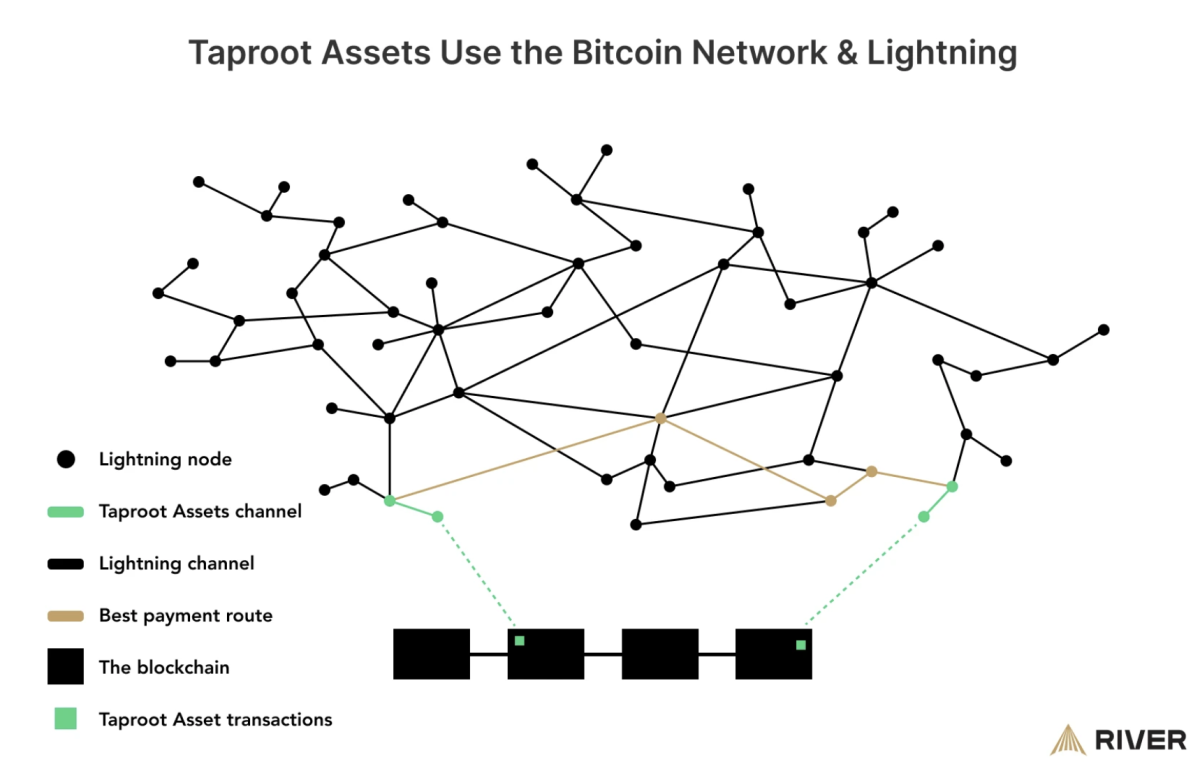

With USDT now returning to the bitcoin network in a way that is also interoperable with lightning (it does not have a direct impact on bitcoin the asset, except that it is massively optimistic), users can enjoy the benefits of low rate transactions Almost instantaneous that are critical for the practical use of Stablecoins in trade or daily remittances. Integration is particularly beneficial in the regions where financial infrastructure lacks or is prohibitively expensive.

That said, the Lightning Network is probably not able to handle the activity and flow of users that occurs in competing chains such as Solana or Tron. There is also the question of how well the Lightning network will handle the largest load of stablecoin transactions without degrading performance or leading to the centralization of node operations due to the need for greater liquidity.

The answer to this is in a simple variable: Good infrastructure – And this is where Suck Enter.

Also present at the Plan B conference, Joltz's early bet on Taproot assets now seems to be pressed. Joltz presents some notable advances in the bitcoin infrastructure ecosystem with its unique characteristics. It is one of the only mobile autocustodial wallets that support Taproot assets, allowing users to administer multiple asset payments and swaps directly in bitcoin. Beyond independent walletJOLTZ offers a software development kit (SDK) that could be made up of other developers, reducing the time and cost involved in adding support for these assets, as well as bitcoin transactions in the chain and rays. This could be beneficial for existing cryptographic wallets, assets, stablecoin platforms, fintechs, payment and exchanges applications, offering them a path to improve their services with less development effort. Developers who want early access to Joltz SDK can register here.

Similar to how Trump promised to free Ross on day 1, we must demand that the USDT be supported everywhere on day 1, with a good UX. Joltz will meet that, hopefully leading the way for others to see the scale of the opportunity that awaits bitcoin.

Now: why should you want Stablcoins in bitcoin?

The recent increase in meme currency activity in Solana has led to significant network congestion, which pushes transaction rates to registered maximums. The income of the Daily Solana rate reached almost $ 78 million at the end of 2024, a direct result of the rise of meme coins, but this was at the expense of the highest transaction rates and the occasional congestion of the network, challenging User's experience. Similarly, Tron has faced his own challenges with transaction rates. It has been informed that Tron daily rates exceed $ 5 million, which reflects its important role in the management of Stablecoin transactions, but also highlights the pressure in its very centralized network. We want those rates in bitcoin, for miners and routing operators.

LN offers almost infinite scalability by allowing transactions to occur outside the chain, only establishing bitcoin when necessary. This approach clearly contrasts with the scalability struggles of blockchains of a single layer like Solana and Tron.

In addition, with LN, there is the potential of new financial products. BLOCK bitcoin within the ray channels can open performance opportunities, such as liquidity provision (lease) or even more complex financial instruments related to routing, providing users with new ways to generate bitcoin native yields Not based on questionable practices. (Also see me <a target="_blank" href="https://www.utxo.management/bitcoin-stablecoins-coming-back-with-a-vengeance/”>Recent report In bitcoin Stablcoins.)

Today's announcement underlines a broader lesson in cryptographic space: while specific chains like Solana and Tron have advanced in speed and cost, true scalability requires time and much investment in infrastructure to guarantee decentralization and exit without TRUST: Otherwise, what is the point? The lead of the centralized chains in stablcoins is temporary: bitcoin is forever.

Tether's return to bitcoin through Taproot assets means a vote of confidence in bitcoin's evolutionary capabilities. It is a testimony of innovation within the bitcoin space and a reminder of how fundamental technologies such as bitcoin can adapt and expand to meet the new demands despite the ring of critics of preference on time of LN focused on pursuing distractions instead of A real utility (Meow).

This movement could prepare the scenario for new innovations in decentralized finance (defi) in bitcoin (BTCFI), remodeling how we think bitcoin as the maximum settlement layer For all types of economic activity.

Welcome Tether again! <3

This article is a Carry. The opinions expressed are completely from the author and do not necessarily reflect those of btc INC or bitcoin magazine.

Guillaume articles in particular can discuss issues or companies that are part of your company's investment portfolio (Rubo management). The opinions expressed are only yours and do not represent the opinions of their employer or their affiliates. He is not receiving financial compensation for these shots. Readers should not consider this content as financial advice or support from any company or investment in particular. Always do your own research before making financial decisions.

NEWSLETTER

NEWSLETTER