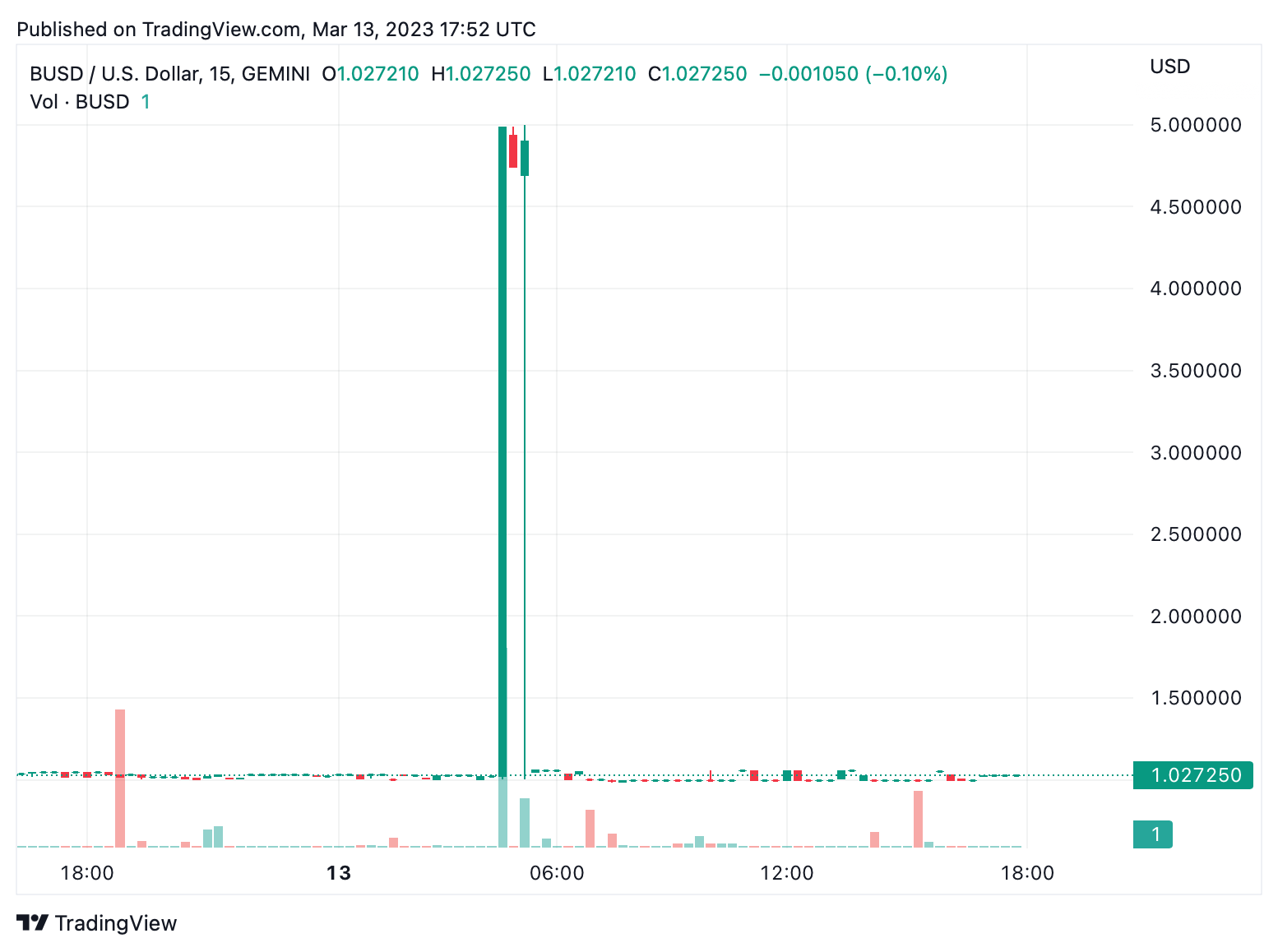

On Monday, the crypto economy saw significant market activity with $183.85 billion in global 24-hour trading volume, with a large portion of that trading involving stablecoins. USDC traded near parity with the US dollar, and several stablecoins including Tether and BUSD sold at premiums. Tether peaked at $1.04 per unit and BUSD rose to $1.03 per coin during morning (ET) trading sessions.

A Small Handful Of Stablecoin Assets Are Trading For Premiums As USDC Closes $1 Parity Gap

On Monday, the stablecoins saw significant trading volumes after the USDC struggled to hold its peg to the US dollar over the weekend. This caused five other stablecoins to depeg just below the value of $1. Today, USDC has almost closed the gap and is trading at $0.99 per coin, but traders are looking to exchange USDC for tether (USDT), binance usd (BUSD), or other stablecoin may have to pay a premium.

Currently, tether (USDT) is trading two cents above the US dollar, with an early morning trading price of $1.04 per coin. some tether (USDT) spikes were as high as $1,076 per USDT on Monday. BUSD saw a similar premium at $1.03 per unit, and other stablecoins such as TUSD and DAI are also seeing higher prices depending on the exchange used by traders. At $1.02 per unit and with 72.55 billion USDT in circulation, the additional two cents contribute USDTMarket capitalization up to $74.23 billion at the time of writing.

Of the $183.85 billion in world trade volume, USDT it represents $94.27 billion or 51.27% of volume. USDC has a global trade volume of $10.79 billion, representing 5.87% of the $183 billion in trade over the past 24 hours. bitcoin (BTC) and ethereum (ETH) have also captured a significant portion of the trading volume for the day. bitcoin (BTC) was up 16.6% against the US dollar on Monday and saw $70.22bn in swaps, while ethereum (ETH) rose 12.9% and has a global trading volume of $68.13 billion.

With the small premiums and the USDC returning to $1 parity, the market cap of the stablecoin economy is currently $136.25 billion. While the stablecoin premiums and unpegging event this weekend may not be beneficial to some traders, the discrepancies do benefit stablecoin arbitrageurs significantly. Additionally, Curve, the decentralized exchange (dex) focused on stablecoin trading, has recorded $1.02 billion in trade volume and is the second largest dex by trade volume on Monday.

What do you think about the current stablecoin market and the impact of recent premiums and de-pegging events on traders and investors? Share your thoughts on this topic in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.