Bitcoin (BTC) rallied 11% on January 20-21, reaching the $23,000 level and beating bear expectations for a pullback to $20,000. Even more notable is the move that brought investor demand Asia-based retailers, according to data from a key indicator of the stablecoin premium.

Traders should note that the tech-heavy Nasdaq 100 index also gained 5.1% from January 20-23, buoyed by investor hopes that China will reopen business after its lockdowns. COVID-19 and weaker than expected economic data in the United States and the Eurozone.

Another bit of bullish information came on January 20 after US Federal Reserve Governor Christopher Waller reinforced the market expectation of a 25 basis point interest rate hike in February. A handful of heavyweight companies are expected to report their latest quarterly earnings this week to complete the puzzle, including Microsoft, IBM, Visa, Tesla and Mastercard.

In essence, the central bank is aiming for a “near landing” or controlled decline of the economy, with fewer job openings and less inflation. However, if companies struggle with their balance sheets due to the rising cost of capital, profits tend to plummet and, ultimately, layoffs will be much higher than anticipated.

On Jan. 23, on-chain research firm Glassnode noted that long-term Bitcoin investors have held losing positions for more than a year, making them likely to be more resilient to future adverse price moves.

Let’s look at derivatives metrics to better understand how professional traders are positioning themselves in current market conditions.

Asia-based stablecoin premium approaches FOMO area

The USD Coin (USDC) premium is a good indicator of demand from China-based retail cryptocurrency traders. Measures the difference between China-based peer-to-peer transactions and the US dollar.

Excessive buying demand tends to push the gauge above fair value by 103%, and during bear markets, the stablecoin’s market supply is flooded, causing a discount of 4% or more.

The USDC premium currently stands at 103.5%, up from 98.7% on January 19, indicating increased demand for stablecoin purchases from Asian investors. The move coincided with Bitcoin’s 11% daily gain on Jan. 20 and indicates moderate FOMO from retail traders as BTC price approached $23,000.

Professional traders are not particularly enthusiastic after the recent gain

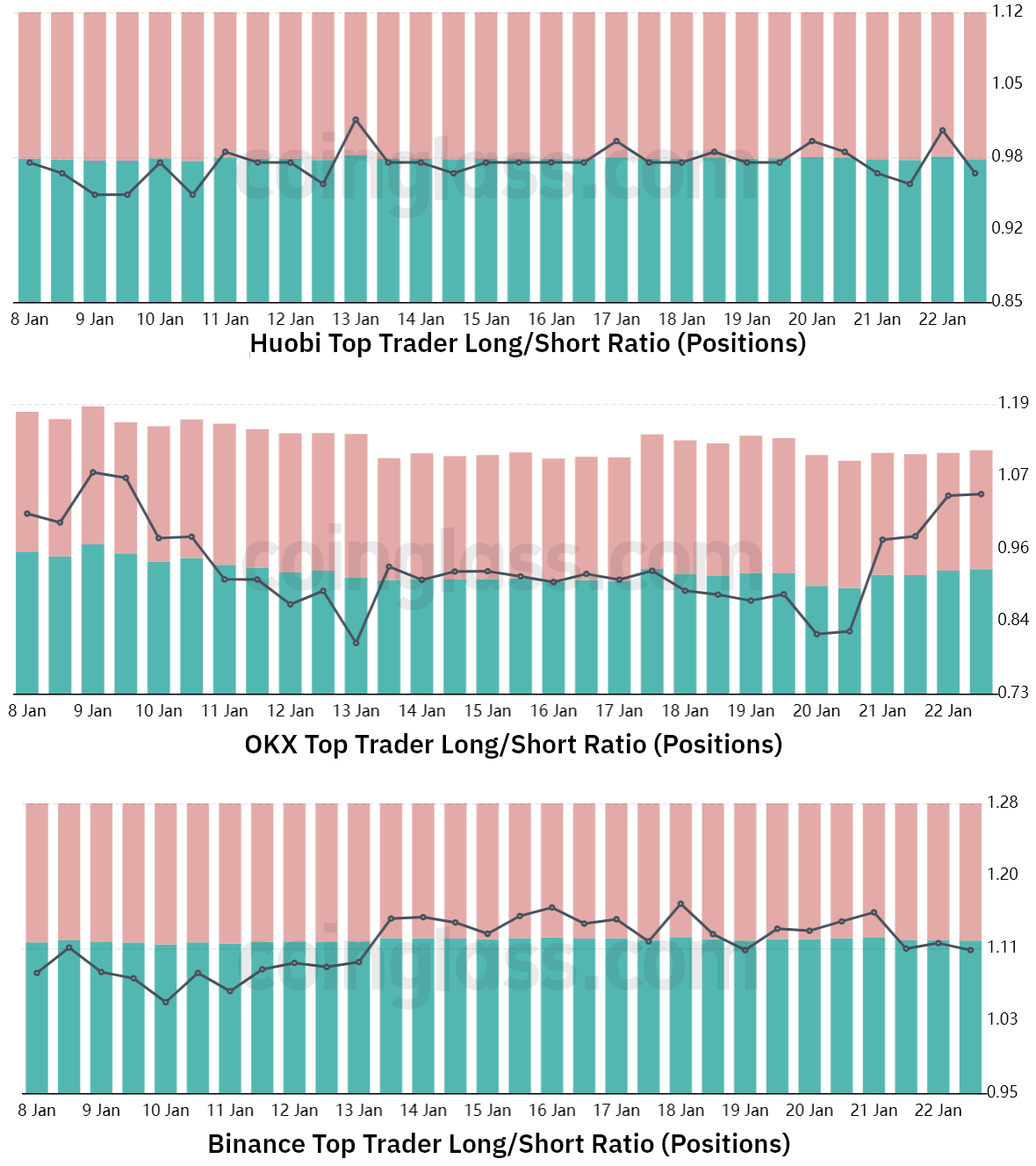

The long-to-short metric excludes externalities that might have affected only the stablecoin market. It also collects data from exchange clients’ positions in spot, perpetual and quarterly futures contracts, providing better insight into how professional traders are positioned.

There are occasional methodological discrepancies between different exchanges, so readers should monitor changes rather than absolute numbers.

The first trend one might spot is that top traders at Huobi and Binance are extremely skeptical of the recent rally. Those whales and market makers did not change their levels from long to short over the last week, which means that they are not confident of buying above $20,500, but they are not willing to open short (bearish) positions.

Interestingly, the major OKX traders reduced their net long (bullish) positions through January 20, but dramatically changed their positions during the last phase of the uptrend. Looking at a longer 3 week time frame, its current 1.05 long to short ratio is still lower than the 1.18 seen on January 7th.

Related: The worst days for Bitcoin miners may be over, but some key hurdles remain

The bears are shy, which provides an excellent opportunity for bullfights.

The 3.5% stablecoin premium in Asia indicates increased appetite from retail traders. Furthermore, the long-to-short indicator from major traders does not show an increase in demand for shorts, even as Bitcoin hit its highest level since August.

In addition, the $335 million settlement In summary, the BTC futures contracts (bearish) between January 19-20 indicate that sellers continue to use excessive leverage, creating the perfect storm for another leg of the bull run.

Unfortunately, the price of Bitcoin is still highly dependent on the performance of the stock markets. Considering how resilient BTC has been during the uncertainties regarding the bankruptcy of Digital Currency Group’s Genesis Capital, the odds favor a rally towards $24,000 or $25,000.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER