The S&P 500 Index (SPX) rose 2.49% last week, extending its string of weekly gains to seven weeks, the longer Such a winning streak since 2017. However, bitcoin (btc) could not maintain its momentum and succumbed to profit booking by the bulls. Trading resource Material Indicators said in a post on X (formerly Twitter) that “year-end profit taking and tax loss harvesting” will prevail in the near term.

However, a decline is unlikely because several analysts expect the U.S. Securities and Exchange Commission to approve one or more applications for spot bitcoin exchange-traded funds in January. If that happens, it could be a game changer for the sector.

VanEck CEO Jan van Eck said in an interview with CNBC that bitcoin is likely to hit a new all-time high in the next 12 months. He hopes bitcoin will become a complement to gold.

What are the important levels that could stop the fall of bitcoin and altcoins? Let's analyze the graphs to find out.

S&P 500 Index Price Analysis

The S&P 500 index witnessed a strong bullish move in the past few days, taking the price above the overhead resistance of 4,650 on December 13.

The strong rally has pushed the Relative Strength Index (RSI) deep into overbought territory, indicating that markets are overheated in the short term. That may start a correction or consolidation in the coming days. Strong support on the downside lies at the breakout level of 4,650 and then at the 20-day exponential moving average (4,601).

If the price continues to rise and breaks above 4,740, the index may extend the uptrend to 4,819. This level is likely to again witness a tough battle between the bulls and the bears, but if the buyers prevail, the rally could reach the psychological level of 5,000.

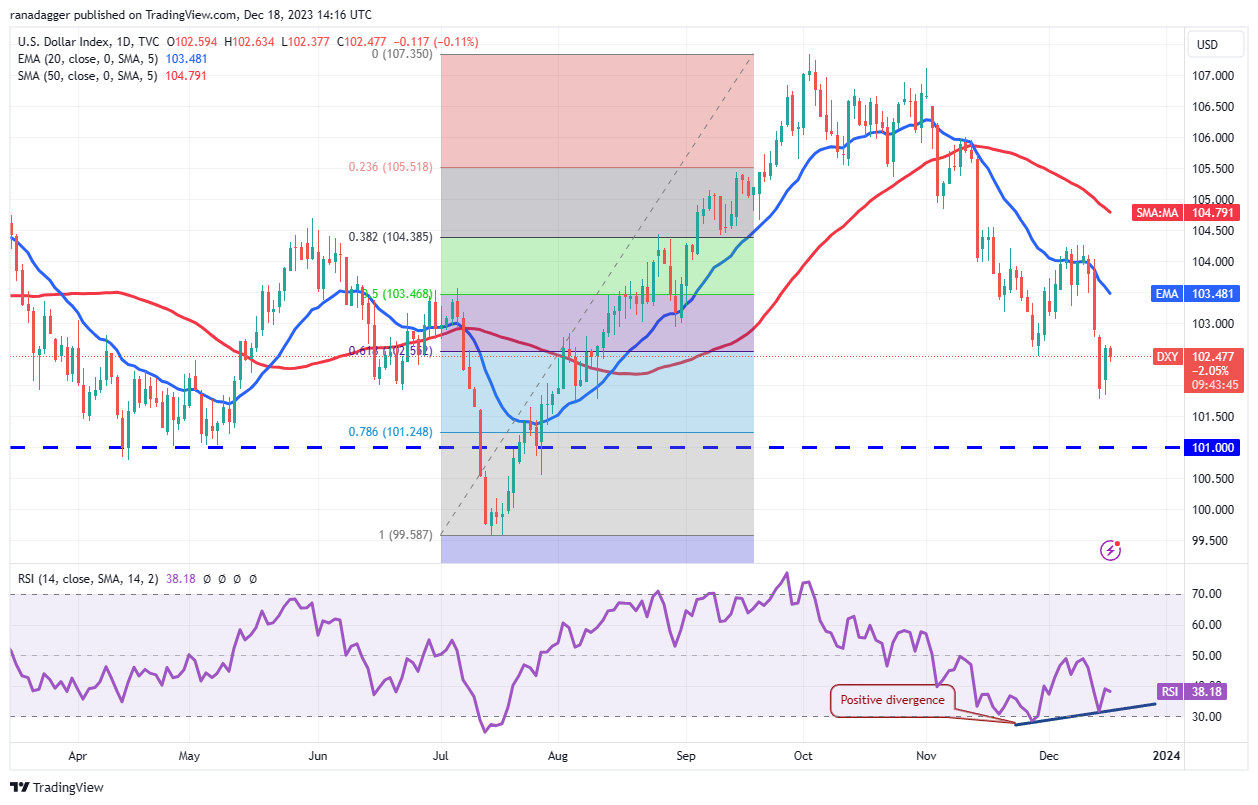

US Dollar Index Price Analysis

The bulls repeatedly failed to hold the US Dollar Index (DXY) above the 20-day EMA (103) between December 5 and December 13.

That encouraged bears to renew their selling, which sent the index lower. The bears pushed the price below the 61.8% Fibonacci retracement level of 102.55 on December 14, indicating the resumption of the corrective phase. The next strong support is at 101.

The RSI is showing early signs of forming a positive divergence, indicating that selling pressure could be weakening. If the price bounces off 101 and rises above the 20-day EMA, the index may continue to oscillate within a wide range between 101 and 108.

bitcoin price analysis

bitcoin's tight range between the 20-day EMA ($41,323) and the downtrend line resolved to the downside on December 18, but the breakout lacks momentum.

The flattening of the 20-day EMA and the RSI near the midpoint suggest range-bound action in the near term. If the price falls below $40,000, the btc/USDT pair could collapse to the vital support of $37,980. This level is likely to witness aggressive buying by the bulls.

Alternatively, if the price moves up and back above the 20-day EMA, it will suggest strong demand at lower levels. The bulls will then try to break through the barrier at the downtrend line. If they do, the pair can jump to $44,700.

Ether Price Analysis

Ether (eth) fell below the strong support at $2,200 on December 18, indicating that the bulls may be losing control.

If the price remains below $2,200, the eth/USDT pair could fall to the 50-day SMA ($2,074). This level may attract buyers again, but the bears will try to stop the recovery at $2,200. If that happens, it increases the possibility of a break below the 50-day SMA. The pair could then fall to $1,900.

This negative view will be invalidated in the short term if the price rises above $2,200. That will suggest strong buying at lower levels. Then, the pair will try to reach the overhead resistance of $2,332.

BNB Price Analysis

The failure of the bulls to push BNB (BNB) above $260 may have tempted short-term traders to book profits.

That started a pullback, which fell below the moving averages on December 18. The 20-day EMA ($240) started to turn lower and the RSI fell below the midpoint, indicating that the bears are trying to take advantage. . This increases the probability of a drop to $223.

If the price bounces strongly off the $223 support and rises above the moving averages, it will indicate strong buying at lower levels. The BNB/USDT pair could fluctuate between $223 and $260 for a few more days.

XRP Price Analysis

The bulls' failure to push XRP (XRP) back above the moving averages in recent days attracted another round of selling.

The bears will try to sink the price to the strong support at $0.56. If the price bounces off this level and rises above the 20-day EMA ($0.62), it will suggest that the XRP/USDT pair may remain stuck between $0.73 and $0.56 for a while longer.

The first sign of weakness will be a break and close below the strong support at $0.56. That could clear the way for a drop to the crucial support at $0.46. The next leg of the uptrend is likely to begin after buyers push the price above $0.74.

Solana Price Analysis

Solana (SOL) fell from $79.50 on December 15 and reached the 20-day EMA ($67.77) on December 18.

The bulls have not allowed the SOL/USDT pair to close below the 20-day EMA since the start of the rally on October 16. Therefore, a breakout of the level will likely trigger stops for several traders. That could start a decline to the 50-day SMA ($57.83) and subsequently to the psychological support of $50.

If the bulls want to avoid a deeper pullback, they will have to aggressively defend the 20-day EMA and push the price above $80. That will set the stage for a possible rally to $100.

Related: bitcoin Spot ETF Will Be a 'Bloodbath' for crypto Exchanges, Analyst Says

Cardano Price Analysis

Cardano (ADA) broke above the overhead resistance at $0.65 on December 13, but the bulls were unable to maintain the momentum. The price dropped on December 14 and fell below $0.65 again.

The sharp pullback from $0.68 indicates that the bulls are quickly taking profits. That suggests that the ADA/USDT pair could consolidate its recent gains in the coming days. If the price bounces off the 20-day EMA ($0.53), the pair may rise towards $0.68 and remain stuck between these two levels for some time.

A break below the 20-day EMA could accelerate the selling, opening the doors for a fresh decline to the strong support at $0.46.

Avalanche Price Analysis

Buyers pushed Avalanche (AVAX) above the overhead resistance of $42.50 on December 16 and 17, but were unable to hold the higher levels.

The AVAX/USDT pair has started a pullback, which has strong support at the 20-day EMA ($33). If the price bounces strongly off this level, it will suggest that sentiment remains positive and the bulls are buying the dips. On the upside, a breakout and close above $45 will signal the resumption of the uptrend. The next target is $50.

On the contrary, if the price falls below the 20-day EMA, it will indicate that the bulls are rushing towards the exit. That may lead to a deeper correction to $25.

Dogecoin Price Analysis

Dogecoin (DOGE) rebounded from the 20-day EMA ($0.09) on December 16, but the bulls were unable to sustain the higher levels.

The price turned lower on December 17 and fell below the 20-day EMA on December 18. The 20-day EMA is flattening and the RSI is near the midpoint, indicating a balance between supply and demand.

If the price stays below the 20-day EMA, the upside will tilt in favor of the bears. The DOGE/USDT pair could plummet to the 50-day SMA ($0.08).

If the bulls want to salvage the situation, they will have to quickly push the price back above the 20-day EMA. Bullish momentum could pick up after buyers clear the $0.11 hurdle.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.