50,000 Bitcoin (BTC) worth $1 billion moved from various wallets related to US government law enforcement seizures and transferred to new addresses, with some moving to Coinbase The 8th of March.

According data Shared by on-chain analytics firm PackShield, three transfers were made from the wallets of US law enforcement agencies. These wallets contained almost 51,000 BTC attorney by US agencies from the Silk Road market in November 2021. The confiscated BTC was consolidated into two wallet addresses: bc1q5s…0ch and bc1q2ra…cx7.

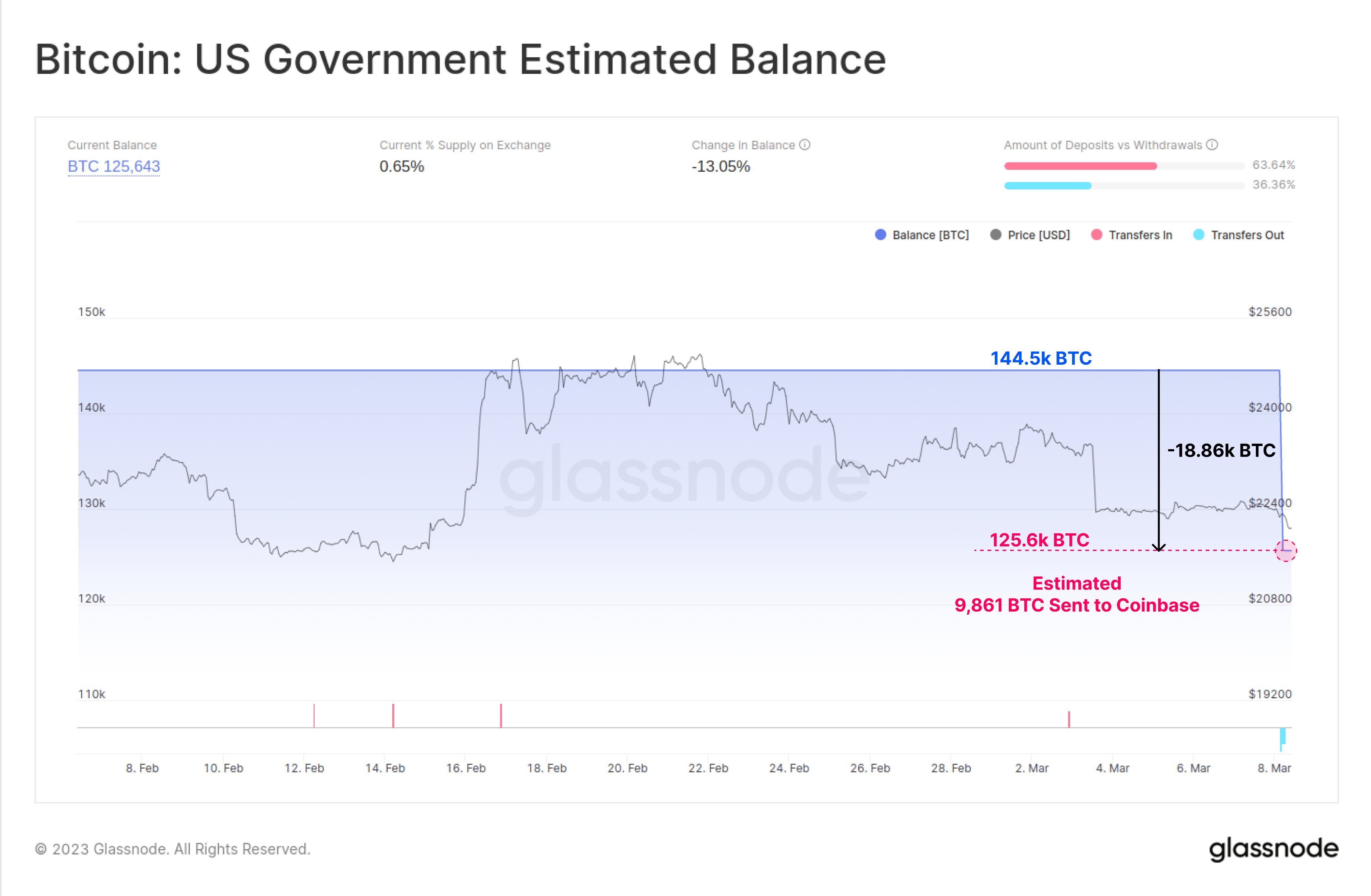

Of these three transfers, the majority appear to be internal transfers. However, approximately 9,861 BTC was sent to Coinbase. The other two transfers include a 30,000 BTC transfer to an address beginning with bc1q… and a 9,000 BTC transfer to an address beginning with bc1qe7…

Silk Road was an online black market and the first modern darknet marketplace. It was launched in 2011 by its American founder Ross Ulbricht under the pseudonym “Dread Pirate Roberts”. The exchange was one of the first to accept Bitcoin payments and even popularized the use of cryptocurrencies at the time. US law enforcement agencies seized several items from its founder, including BTC treasures that have been up for auction from time to time and since 2014.

Related: Key Bitcoin Price Metrics Point To BTC Downside Below $22.5K

Popular Bitcoin proponent Tim Draper bought nearly 30,000 BTC in 2014 at one of these auctions. Another auction for 50,000 BTC was held in October 2015, where the US Marshall Services auctioned 21 blocks of 2,000 BTC and one block of 2,341 in an online auction.

While only a small part of the 50,000 BTC was sent to Coinbase, the movement of billions of BTC from wallets linked to the US enforcement agency sparked wild reactions and even wilder theories. An user pointed He noted that if US agencies were to decide to sell his Silk Road Bitcoin, it would put significant selling pressure on the market. At the same time, some others questioned the timing of the sale.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER