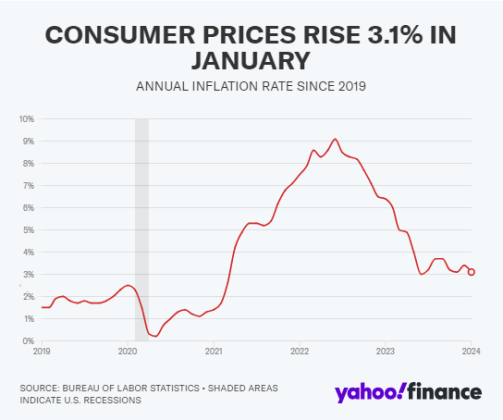

Inflationary pressures in the United States are Prepared to Attack crypto-Friendly Fast Food Chains, which could lead to a decline in their fortunes. Recent data from the Bureau of Labor Statistics indicates rising inflation, creating challenges related to raw materials and the labor market. As the cost of essential ingredients increases, fast food establishments may experience lower profits, decreased customer footfall, and increased labor costs.

Gastronomic dilemma: the cost of eating out skyrockets

According to a Yahoo Finance report, Americans are increasingly reluctant to accept invitations to fancy dinners outside their homes. In January alone, the cost of eating out increased 5.1% compared to the same month last year and 0.5% compared to the previous month. In contrast, food prices saw a more modest increase of 1.2% over the previous year and 0.4% over December, before stabilizing thereafter.

In the past, according to Citi analyst Jon Tower, a pattern has emerged where, if commodity inflation exceeds labor inflation, grocery prices tend to rise faster than restaurant prices. Conversely, when labor inflation exceeds commodity inflation, restaurant prices tend to exceed grocery prices.

This trend suggests that consumers may choose to cook at home more frequently as the cost of dining out continues to rise. Additionally, the higher cost of living translates into higher raw material prices, posing profitability challenges for fast food chains.

Several cryptocurrency-friendly fast food chains are already facing the impact of skyrocketing inflation. KFC, known for selling the “bitcoin Bucket,” faced difficulties when poultry prices hit an all-time high last year.

Total crypto market cap at $1.859 trillion on the daily chart: TradingView.com

Similarly, Starbucks, which allows customers to pay with bitcoin, faced a more than 40% increase in Arabica coffee raw material prices since the start of the pandemic. Subway, one of the pioneers in accepting bitcoin as payment, has grappled with the rising costs of vegetables, bread and other essential raw materials.

In addition to rising raw material costs, fast-food chains that operate at least 60 locations across the United States will soon face the need to raise the minimum wage for their restaurant employees to $20 an hour. This impending change, which will take effect in April, is likely to exacerbate challenges related to profitability and cash flow.

crypto Payments Decline Amid Inflation Concerns

The impact of rising inflation extends beyond the fast food industry to the realm of crypto transactions. As restaurants struggle to maintain their presence in the market, many customers may choose to avoid using cryptocurrencies as payment.

Performing crypto transactions on various platforms incurs fees and with purchasing power already under pressure, customers may try to minimize additional expenses and prefer cash or card payments.

Featured image from, TradingView chart

NEWSLETTER

NEWSLETTER