Even with the recent rise in the price of bitcoin, public bitcoin mining stocks start the year with more impressive gains than the asset itself.

The following is an excerpt from a recent issue of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to get these insights and other on-chain bitcoin market analysis delivered straight to your inbox, subscribe now.

Public Mining Update

Looking at the high-level view of bitcoin holdings, we’ve seen a downward trend in public miner holdings throughout 2022, from 46,930 BTC at its peak in April 2022 to 31,892 in January 2023, a 32% decrease in 10 months. With Bitfarms, Core Scientific, and Northern Data divesting of their bitcoin, public miner holdings are now heavily concentrated in Marathon Digital, Hut 8, and Riot Platforms.

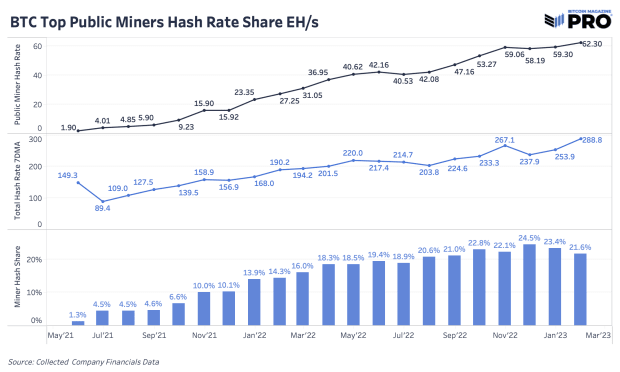

The hash rate expansion trend is “up only” with public miners increasing their hash rate by 129% over the last year. This growth has been a significant driver of the overall hash rate expansion, as the network hash rate recently reached 300 EH/s and public miners account for nearly 25% of all hash rate in one day. certain. That percentage is an underestimate as we don’t include all public miners, such as Cipher and Terawulf.

Mine Production Update Notes

Marathon made a statement about his choice to sell some bitcoins that the company mined, “With bitcoin production increasing and its consistency, we made the strategic decision to sell some of our bitcoins, as previously planned, to cover some of our operating expenses and to general corporate purposes. . We intend to continue selling a portion of our bitcoin holdings in 2023 to fund monthly operating costs.”

In their announcement, they shared places for further hash rate expansion. “The company still expects to have approximately 23 EH/s of installed capacity around mid-2023.”

Similarly, HIVE production update reported to shareholders on bitcoin sales, “HIVE sells all Bitcoin earned from our GPU mining hashrate, with a focus on HODL, ASIC mined green Bitcoin.”

riot platforms announced a delayed timeline for increasing its hash rate, “Unfortunately, as a result of this damage, our previously announced goal of reaching 12.5 EH/s in total hash rate capacity in Q1 2023 is expected to be delayed. We will provide additional updates as we gain more clarity on the impact on our planned implementation timeline. Meanwhile, construction of the remaining infrastructure at our Rockdale facility continues to progress, with Building E now 50% complete and on track for full completion this quarter, and we continue to execute the expansion at our Corsicana facility. ”

iris energy increased its mining capacity from 2.0 to 5.5 EH/s using prepayments to acquire new miners.

In other public mining news, Hut 8 shared about a recent merger and your HODL strategy:

“On February 7, 2023, Hut 8 announced a merger of equals with US Data Mining Group, Inc. dba US Bitcoin Corp (‘USBTC’), which is expected to establish the combined company as a publicly traded large-scale Bitcoin miner. focused on economic mining, highly diversified income streams, and industry-leading best practices in ESG.

“We have been intentional and strategic in pursuing our HODL strategy – by building a large, unencumbered stack, we have given ourselves the option of strategically using a portion to cover operating expenses rather than having to seek other financing options with longer terms. less attractive. said Jaime Leverton, CEO. “I am confident that selling production while we focus on closing the merger with USBTC is the right approach as we look forward to building a strong self-mining, hosting, HPC and managed infrastructure operations organization for the long term.”

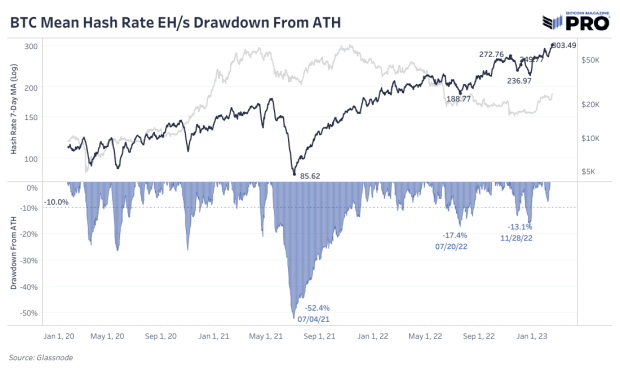

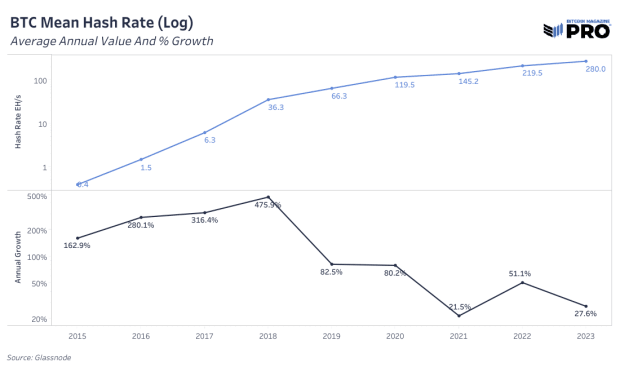

Hash rate all-time highs

With the help of cost-sensitive miners turning the rigs back on, Bitcoin’s 7-day average hash rate once again reached new all-time highs, averaging 303 EH/s weekly.

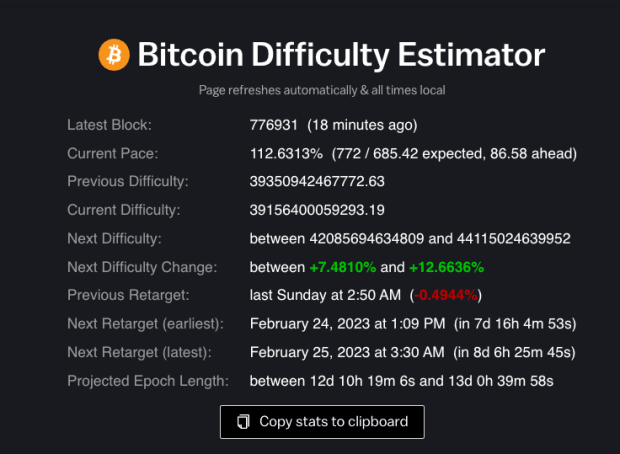

With the network hash rate hitting new highs, the next difficulty adjustment is expected to be +12.0%, likely on February 25.

The expected increase in mining difficulty will take away some of the relief that operations have felt in recent weeks, due to the increase in dollar-denominated revenue. Revenue from miners denominated in bitcoin terms will once again hit new lows.

As hash rate, and subsequently mining difficulty, continue to stretch towards highs, older generation machines and inefficient operations will continue to be squeezed at the expense of more efficient business with newer generation mining machines.

public mining performance

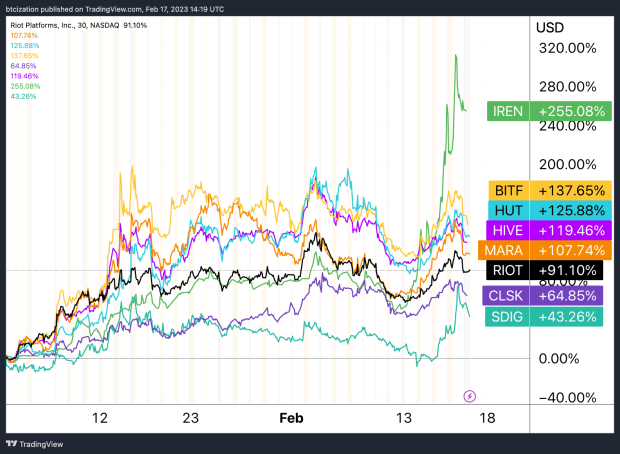

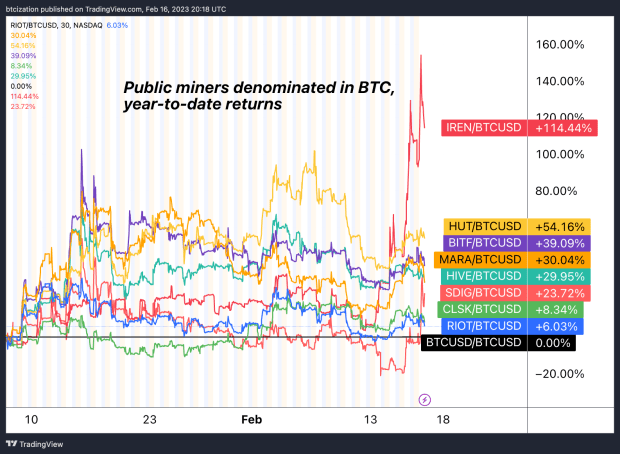

Public miners have been among the best in the stock markets so far this year, with Iris Energy shares leading the way with an impressive 255% gain, followed by shares of Bitfarms, Hut 8 and HIVE Blockchain.

The performance of these companies against bitcoin is equally impressive because all of the top public miners in our closely watched basket have outperformed their baseline (BTC) as of 2023.

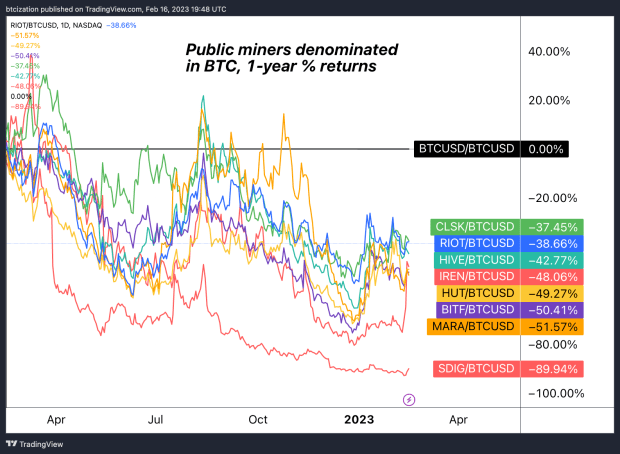

Over longer time horizons, we find bitcoin outperformance a very difficult task, given the cutthroat competitiveness of the global mining industry, coupled with a programmatically decreasing block subsidy that continues to occur every 210,000 bitcoin blocks, roughly once every four years.

Regardless of the next direction bitcoin or stock markets in general take, mining stocks will continue to offer investors a great deal of volatility, and the right market conditions will present much of that volatility in the form of upward appreciation.

Final note

Global investors will be hard-pressed to find anything on the planet that continues to flourish and grow at a rate comparable to bitcoin’s hash rate. The story here that has been unfolding for over a decade is the evolution of the strongest decentralized computing force the world has ever seen, but most miss the forest for the trees.

Short-term market correlations and exchange rate performance aside, bitcoin remains the world’s best singular opportunity to achieve a globally neutral monetary protocol for final settlement.

Relevant Articles:

- State of the mining industry: survival of the fittest

- Time-Based Capitulation: Bitcoin Volatility Hits Record Lows Amid Market Apathy

- This time is no different: miners are the biggest risk facing the Bitcoin market in the repeat of the 2018 cycle

- Hash Rate Hits New All-Time High: Implications For Mining Stocks

- Bitcoin hash rate falls 17% from all-time high