The strength of the US Dollar Index could keep bitcoin and certain altcoins under pressure in the near term.

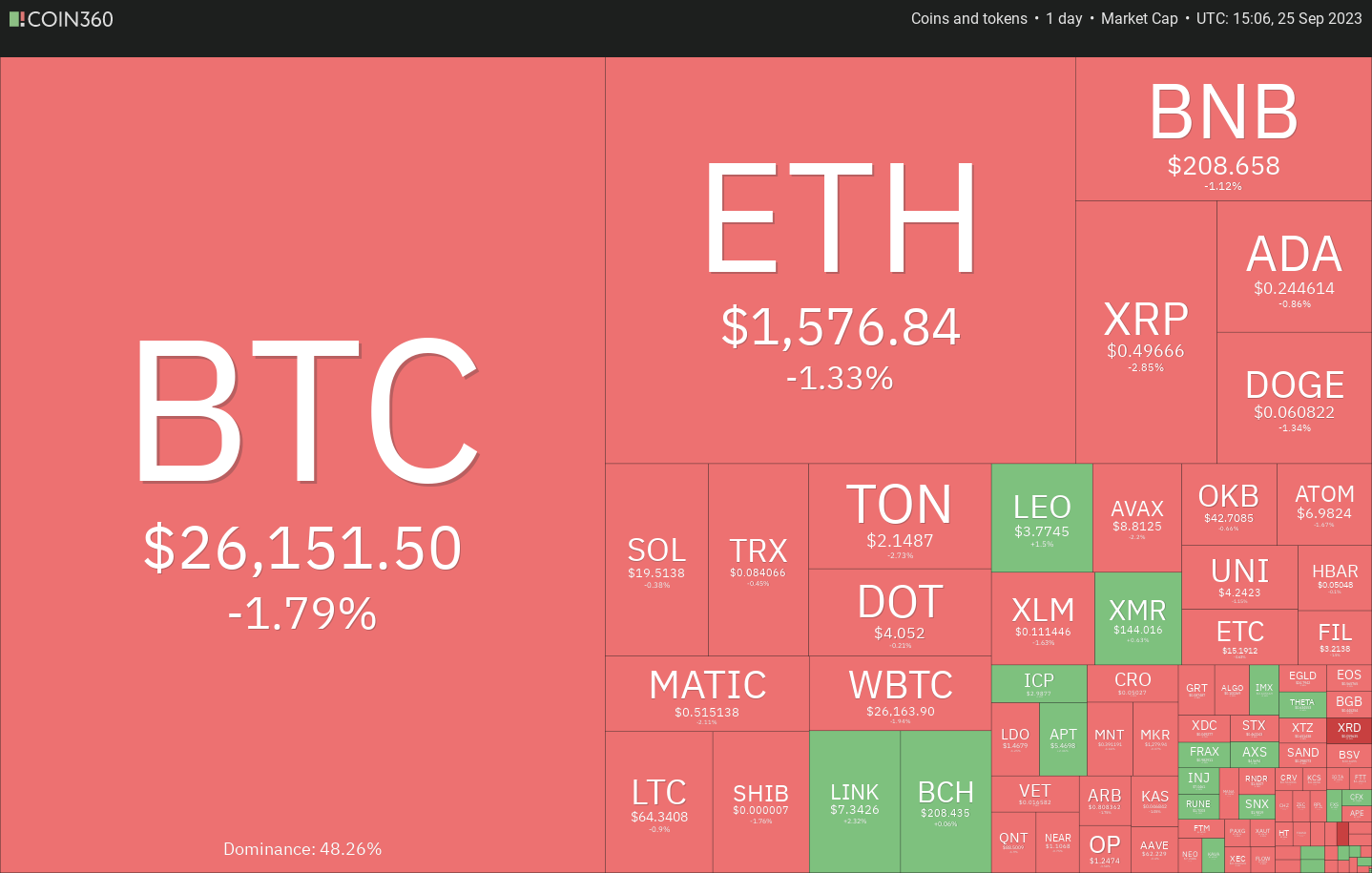

bitcoin (btc) weakness on September 24 shows that the bears remain in control. Sellers are trying to push the price below $26,000, but the bulls are likely to defend the level vigorously. Buyers are trying to achieve a positive monthly close for bitcoin in September for the first time since 2016.

If they can pull this off, it will be a big confidence boost as October generally favors buyers. According to data from CoinGlass, bitcoin has had a negative monthly close in October only twice, in 2014 and 2018. However, bitcoin bulls will find it difficult to maintain momentum if macroeconomic headwinds persist.

Another risk to the cryptocurrency recovery may come from the strength of the dollar, which has risen for 10 consecutive weeks, its longest winning streak since 2014. The US dollar index (DXY) has also formed a golden cross, indicating greater upside potential in the near term.

Will the US Dollar extend its gains or witness a short-term correction? Will bitcoin bulls be able to contain the bearish pressure in the last week of September? Let’s analyze the graphs to find out.

S&P 500 Index Price Analysis

The S&P 500 index fell sharply from the downtrend line and broke below the moving averages on September 15. This started a move lower, which reached the crucial support at 4,325.

The 20-day exponential moving average (EMA) (4.422) has started to turn lower and the relative strength index (RSI) is close to the oversold territory, indicating that the bears have the upper hand. If the price stays below 4.325, the index will complete a bearish head and shoulders (H&S) pattern. This negative setup has a target target of 4,043.

If the bulls want to avoid the decline, they will have to quickly push the price above the 20-day EMA. That could attract more buying, and the bulls will then try to lift the price above the downtrend line. If they manage to do so, the index has a good chance of retesting the local high at 4,607.

US Dollar Index Price Analysis

The US Dollar Index bounced off the 20-day EMA (104.85) on September 20, indicating that sentiment remains positive and traders are buying on dips.

The bullish movement is likely to hit a wall at 106. This is the key level to pay attention to in the short term. If the price turns down from this resistance but bounces off the 20-day EMA, it will improve prospects for a rally above 106. The next upside resistance is at 108.

Sellers will have to push the price below the 20-day EMA if they want to weaken the bullish momentum. The index could then fall to 104.40 and later to the 50-day SMA (103.35).

bitcoin price analysis

The uncertainty of the intraday candlestick pattern on September 22 and 23 resolved to the downside on September 24. This suggests that the bears have asserted their supremacy.

Sellers will try to further strengthen their position by driving the price to the solid support of $24,800. This remains the key level to watch in the near term as the bulls are expected to defend it with all their might. If the support at $24,800 gives way, the btc/USDT pair could start a downward move towards $20,000.

Time is running out for the bulls. If they want to start a significant recovery, they will have to push and maintain the price above the moving averages. That will open the door for a retest of the overhead resistance at $28,143.

Ether Price Analysis

Ether (eth) has been gradually falling towards the fundamental level of $1,531, suggesting a lack of buying support from the bulls.

Although the descending moving averages indicate an advantage for sellers, the RSI shows signs of forming a bullish divergence. This suggests that selling pressure could be reducing. This increases the probability of a bounce at $1,531.

If the bulls push the price above the 20-day EMA ($1,616), it will indicate range-bound action between $1,531 and $1,746 for a few days. This view will be invalidated if the bears sink and hold the eth/USDT pair below $1,531. The pair could then fall to $1,368.

BNB Price Analysis

BNB (BNB) has been fluctuating between $220 and $203 for the past few days. In a range, traders typically buy near support and sell near resistance.

Both moving averages are falling, indicating an advantage for the bears, but the RSI is trying to form a bullish divergence. This suggests that bearish momentum may be weakening. Buyers are likely to vigorously defend the $203 level.

If the price rises from the current level or bounces off $203, it will suggest that the range-bound action may continue for some time to come. Sellers will have to push the price below the critical support at $203 to take over. The BNB/USDT pair could fall to $183.

XRP Price Analysis

After staying above the 20-day EMA ($0.50) for a few days, XRP (XRP) fell below the level on September 24. This suggests that the bears have gained the upper hand.

XRP price could fall to the uptrend line, which is expected to act as strong support. If the price bounces off the uptrend line, the bulls will again try to push the price above the 20-day EMA. If they do, it will indicate aggressive buying at lower levels. Then, the pair may rise to the 50-day SMA ($0.53).

On the contrary, if the uptrend line does not hold, XRP price could fall first to $0.46 and then to the formidable support of $0.41. This level is likely to attract heavy buying by the bulls.

Cardano Price Analysis

Cardano ADA (ADA) fell to the critical support of $0.24 on September 25, indicating that the bears have maintained their pressure.

A small advantage in favor of the bulls is that the RSI is forming a bullish divergence. The bulls will have to quickly push the ADA/USDT pair above the downtrend line to reduce the risk of a break below $0.24. If they can achieve this, the bearish descending triangle will become invalid, which could push the price to $0.29.

Instead, if the bears drag the ADA price below $0.24, the bearish setup will be completed. That could start a move lower towards $0.22 and subsequently towards the pattern target of $0.19.

Related: How much is bitcoin worth today?

Dogecoin Price Analysis

Dogecoin (DOGE) is stuck within a tight range between $0.06 and the 20-day EMA ($0.06). Typically, a reduction in volatility is followed by an expansion in volatility, but it is difficult to predict the direction of the breakout.

If the price rises from the current level, the bulls will again try to overcome the upper hurdle at the 20-day EMA. If they succeed, the DOGE/USDT pair could rise to $0.07 and then accelerate to $0.08. The bears are expected to sell near this level.

Alternatively, if the range resolves to the downside with a break below $0.06, it will indicate that the bears have taken control. DOGE price may plummet to the next major support at $0.055.

Toncoin Price Analysis

Toncoin (TON) turned down sharply from the overhead resistance of $2.59 on September 20 and continued lower, indicating that the bulls are taking profits.

The first support on the downside is at the 20-day EMA ($2.11). If the price bounces strongly off this level, it will suggest that sentiment remains positive and traders are buying the dips. The bulls will again try to push the price to $2.59.

Contrary to this assumption, if the price falls below the 20-day EMA, it will indicate that the bulls are losing control. The TON/USDT pair could first fall to the psychological level of $2 and then to the 50-day SMA ($1.72). A deeper correction is likely to delay the next leg of the bullish move.

Solana Price Analysis

Solana’s SOL (SOL) has been holding on to the 20-day EMA ($19.53) for the past few days, indicating a tough battle between the bulls and the bears.

The flat 20-day EMA and the RSI just below the midpoint indicate a balance between supply and demand. On the upside, the bulls will have to push the price above the 50-day SMA ($20.80) to signal the start of a recovery to $22.30.

On the contrary, if the price turns down from the current level, it will suggest that the bears have taken control again. The SOL/USDT pair could retest the important support at $17.33. If this level is broken, the pair may collapse to $14.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.