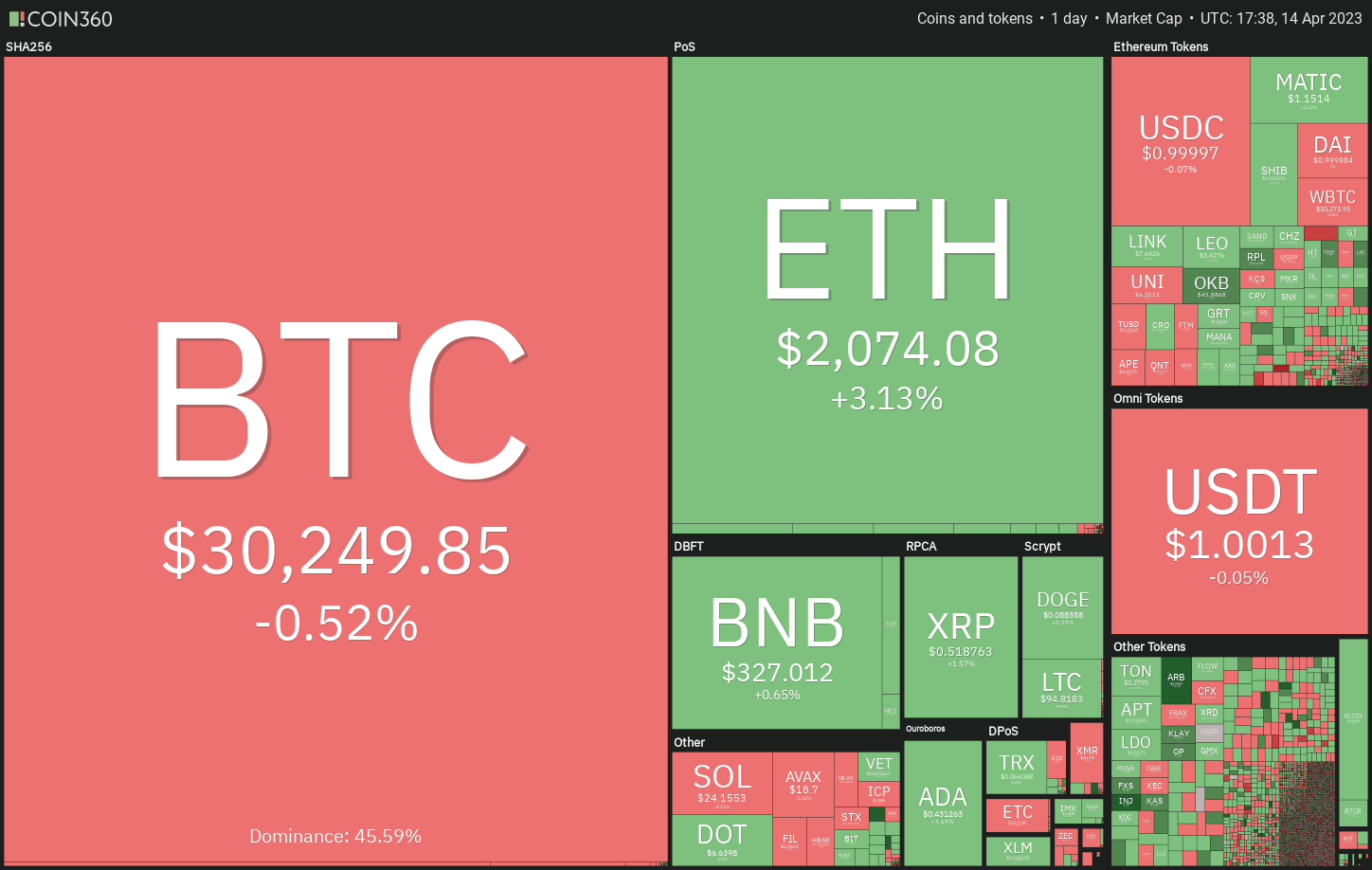

Bitcoin reached a year-to-date high of $31,000 and was followed by the price of ETH. What altcoins will be next?

Bitcoin (BTC) and Ether (ETH) are trading above the psychologically important levels of $30,000 and $2,000 respectively. This suggests that the crypto winter may be on its last legs.

Some analysts are calling for an alternate season to begin, but it may be too early for that. When most crypto bears turn bullish, Bitcoin is likely to drop sharply and catch late entrants off guard. That could hurt sentiment in the short term and lead to an altcoin sell-off. After the weak hands are shaken off, the crypto markets may stabilize and start a sustained uptrend.

Data from the on-chain intelligence platform Glassnode suggests that there are significant similarities between the current cycle and previous ones. However, Ecoinometrics warned that an economic downturn could upset things.

Let’s look at the charts of the top 10 cryptocurrencies to spot important resistance levels that can initiate a retracement.

Bitcoin Price Analysis

The bears tried to stop the upward movement on April 12, but the bulls did not give up. They resumed their buying on April 13 and cleared the $30,550 hurdle on April 14.

If the buyers hold the price above $30,550, the BTC/USDT pair can rally to $32,400. Bears are expected to protect this level with all their might.

If the price turns down from this level but does not break below the 20-day EMA ($28,542), it will improve the prospects for a rally above $32,400. If this level is scaled, the pair can go closer to $40,000.

On the other hand, if the 20 day EMA breaks down, it will suggest that the bears are trying to come back. That could clear the way for a potential drop to $25,250.

Ether Price Analysis

Ether (ETH) bounced off the 20-day EMA ($1870) on April 12, indicating that the bulls are protecting the level vigorously.

The buying continued on April 13, with the bulls pushing the price above the psychologically important $2,000 level. That attracted more buying and the ETH/USDT pair began its climb towards $2,200. This is a crucial level for the bears to defend because if they don’t, the pair may witness a buying spree. The pair could then skyrocket to $3,000.

Conversely, if the price turns below $2,200 and falls below $2,000, the pair can drop to the 20-day EMA. This is an important level to watch because a break below it can take the pair to $1,680.

BNB Price Analysis

The bulls did not allow BNB (BNB) to dip below the 20-day EMA ($317) on April 12-13. This indicates that the sentiment is turning positive and traders are buying the dips.

The 20 day EMA started to turn higher and the RSI jumped above 60, which suggests that the tide is turning in favor of the bulls.

The buyers will try to solidify their position by catapulting the price above the upper zone of $338 to $346. If they can do that, the BNB/USDT pair can pick up momentum and rally to $360 and then $400.

Conversely, if the price turns down from the upper zone, it will suggest that the bears are active at higher levels. That may keep the pair trapped between the 20-day EMA and $346 for some time.

XRP Price Analysis

Buyers successfully protected the 38.2% Fibonacci retracement level of $0.49. That attracted more buying in XRP (XRP), which pushed the price towards the overhead resistance zone of $0.56 to $0.58.

The rising 20-day EMA ($0.49) and the RSI in the positive zone indicate that the bulls have a slight advantage. If the buyers push the price above $0.58, the XRP/USDT pair can start an up move that could go as high as $0.65 and then $0.80.

Conversely, if the price turns down from the upper zone, it will suggest that the pair may consolidate between $0.49 and $0.58 for a few days. The trend will favor the bears if they push the price below $0.49.

Cardano Price Analysis

Cardano (ADA) rose above the neckline of the inverse H&S pattern on April 13, completing the reversal setup.

Usually, after the breakout of a pattern, the price goes down and retests the breakout level. In this case, the ADA/USDT pair can fall to the neckline. If the price bounces off this level, it will suggest that the bulls have changed the level to support. That can initiate an upward move towards the pattern target of $0.60.

Contrary to this assumption, if the price turns sharply and falls below $0.37, it will suggest that the break above the neckline was a false exit. Then the pair can fall to $0.30.

Dogecoin Price Analysis

Dogecoin (DOGE) bounced off the moving averages on April 12, as seen by the long tail of the day’s candle.

The bulls tried to push the DOGE/USDT pair above the 38.2% Fibonacci retracement level of $0.09, but the bears did not budge. This suggests that sentiment remains negative and traders are selling rallies.

Buyers will have to push and hold the price above $0.09 to indicate that selling pressure may be easing. The pair can then rally to the 61.8% retracement level of $0.10. Typically, a breakout and close above this level results in a 100% retracement. If that happens, the pair can skyrocket to $0.11.

Polygon Price Analysis

The Polygon (MATIC) slid below the support line of the Symmetrical Triangle pattern on April 12, but the long tail of the candlestick shows that the bulls bought aggressively at the lower levels.

The MATIC/USDT pair turned up and broke above the 20-day EMA ($1.11) on April 13. That may have trapped the aggressive bears, resulting in a short twitch. The pair reached the triangle resistance line on April 14, where the bears pose a strong challenge.

If the bulls push the price above the triangle, the rally can reach the resistance at $1.30. This level can be a huge hurdle again, but if it is crossed then the move to $1.60 could go as high. This positive view will be invalidated in the short term if the price turns down and falls below $1.08.

Related: BTC Price Targets See $33K Next as Bitcoin Eyes Key Resistance Flip

Solana Price Analysis

The bulls have relied on the break of the downtrend line in Solana (SOL). This shows demand at higher levels.

The rise of the 20-day EMA ($21.74) and the RSI close to the overbought zone indicate an advantage for the buyers. The SOL/USDT pair could rally to $27.12 where the bears can mount a strong defense. If the bulls break out of this barrier, the pair can resume its rally towards $39.

On the downside, the downtrend line is the key level to watch. The bears will have to dig in and hold the price below the downtrend line to catch the aggressive bulls. The pair can then collapse to $15.28.

Moles Price Analysis

The long tail of the April 12 candle shows that the bulls have bought the dip of the 20-day EMA ($6.32). Polkadot (DOT) continued its northerly march and broke above the downtrend line on April 13, but bulls face selling at higher levels.

The DOT/USDT pair turned down from the 61.8% Fibonacci retracement level of $6.85 and the bears are trying to push the price back below the downtrend line. If they manage to do that, the pair can drop to the 20 day EMA. A break below this level can sink the pair to the crucial support at $5.70.

Conversely, if the price rises and closes above $6.85, it can drive the price to the neckline of the inverse H&S pattern. If the bulls break through this overhead resistance, the pair may start a new uptrend.

Litecoin Price Analysis

Litecoin (LTC) broke above the 20-day EMA ($91) on April 13, indicating that bulls continue to view dips as a buying opportunity.

The bulls tried to further strengthen their position by pushing the price above immediate resistance at $96 on April 14, but the long wick on the day’s candlestick shows that the bears are selling rallies aggressively.

If the bears pull the price below the 20 day EMA, it could trap several aggressive bulls. The LTC/USDT pair can drop to $85. On the other hand, if the price rises and sustains above $96, it will open the doors for a potential rally to $106.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.