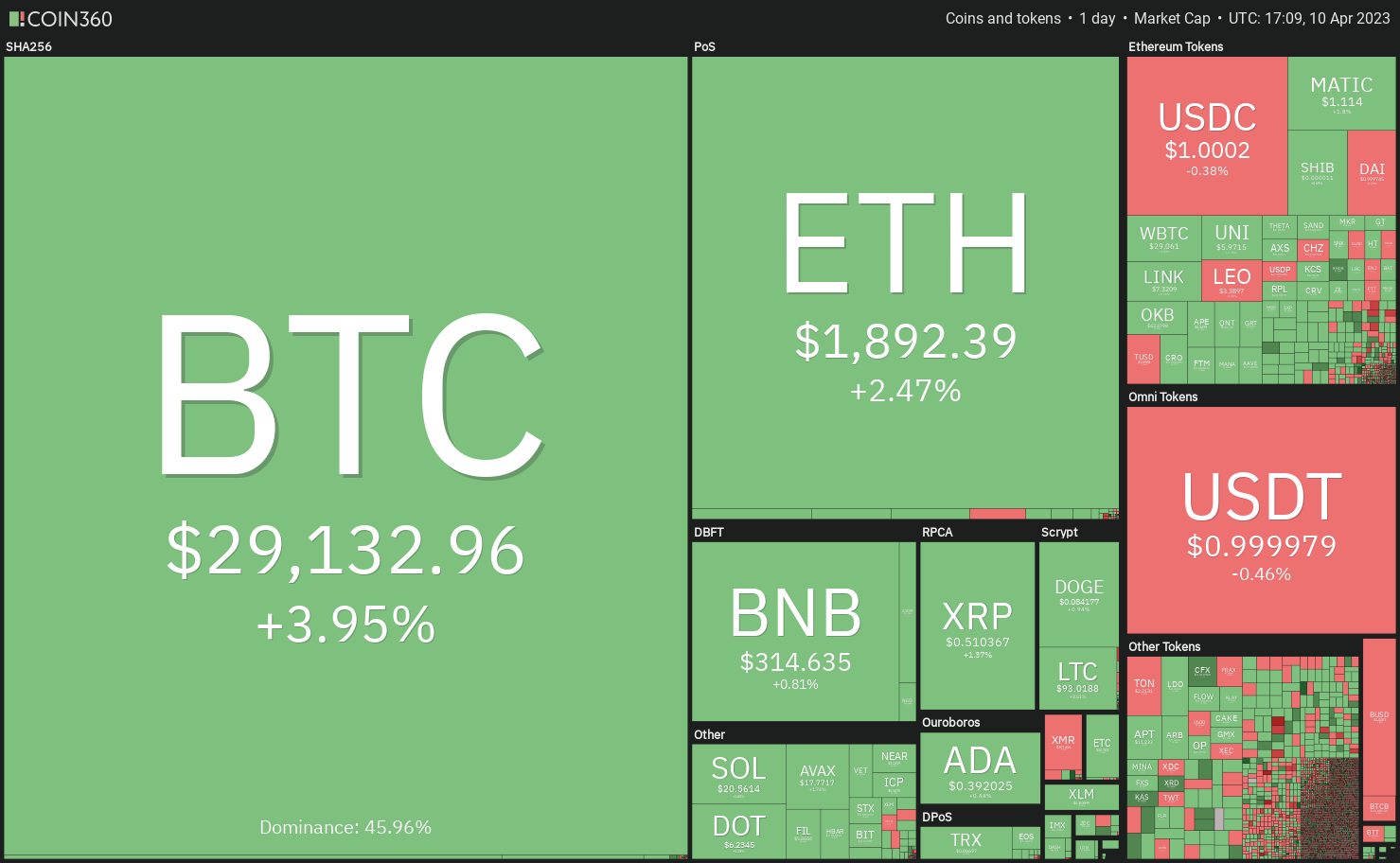

After days of consolidation near the local high, Bitcoin is trying to break out and challenge the $30,000 level.

Bitcoin (BTC)’s tight consolidation near its local top suggests that traders are waiting for a catalyst to initiate the next trending move. Consumer price data for April 12 and Producer Price Index data for April 13 could give insight into future Federal Reserve rate hikes and bring traders out of their sleep.

The boring price action in Bitcoin has not dampened interest in it. According to Ahrefs search volume data, Bitcoin remains the most searched term on Google in the United States, followed by the keywords Donald Trump and Breaking news.

Another point worth noting is that the circulating supply of Bitcoin continues to decline. Citing data from Glassnode, investor Anthony Pompliano noted that 53% of Bitcoin’s circulating supply has not moved in the past two years.

If demand increases, there could be a shortage of supply, which could push prices up. What are the critical resistance levels to watch for in Bitcoin and altcoins in the short term?

Let’s study the graphs to find out.

S&P 500 Index Price Analysis

The S&P 500 Index (SPX) rose after a two-day correction on April 6, indicating that sentiment remains positive and traders are buying minor dips.

The up-sloping 20-day exponential moving average (4035) and the RSI in positive territory increase the probability of a rally to 4200. Although this level has acted as a formidable barrier in the past, it is likely to be scaled on the third try. If that happens, the index can challenge the resistance at 4,300. This level may witness aggressive selling by the bears.

The first major support to watch on the downside is the 20 day EMA. If this support breaks, the index could retest vital support at the 200-day simple moving average ($3,944).

US Dollar Index Price Analysis

The US Dollar Index continues to trade below the 20-day EMA (102.73), which indicates that the short-term trend remains down. The sellers are likely to defend the 20 day EMA during the current relief rally.

If the price turns down from the 20-day EMA, the index can drop to the vital support of 100.82. The bulls are expected to protect this level with all their might because a break below it will complete a head and shoulders (H&S) pattern. The index can then start the next leg of the downtrend.

Another possibility is that the price bounces off the 100.82 support and goes above the 20-day EMA. If that happens, it will suggest that the index can range between 100.82 and the 200-day SMA (106.47) for some more time.

Bitcoin Price Analysis

Bitcoin bounced off the 20-day EMA ($27,692) on April 9, indicating that it is being bought at lower levels. The gradually turning up 20 day EMA and the RSI in the positive territory indicate an advantage for buyers.

$29,200 is the key level to watch on the upside. If the bulls break through this resistance, the BTC/USDT pair can rally to $30,000. The bears will try to stop the rally at this level, but the probability of a break above it is high. The pair can then skyrocket to $32,200.

Conversely, if the price turns back below $29,200, it will suggest that the bears are active at higher levels. Then the sellers will make one more attempt to sink the price below the 20 day EMA. If they succeed, the pair can drop to $25,250.

Ether Price Analysis

Buyers successfully defended the 20-day EMA ($1,813) on April 9, indicating that the trend remains positive in Ether (ETH).

The bulls will try to break through the $1,943 barrier and catapult the price to $2,200. Sellers are likely to fiercely defend the $2,000-$2,200 zone. If the price turns down from this area but does not break below the 20 day EMA, it indicates that the rally may extend further.

This positive view will be invalidated in the short term if the price turns down and breaks below the 20 day EMA. The ETH/USDT pair could turn down to the strong support zone of $1,743 to $1,680.

BNB Price Analysis

BNB (BNB) has been trading below the 20-day EMA ($313) for the past few days, but the bulls have not allowed the price to dip below the immediate support of $306. This suggests that selling pressure is drying up at the lower levels.

The bulls will take advantage of the situation and try to push the price above the overhead resistance of $318. If they do that, the BNB/USDT pair could pick up momentum and shoot up to $338 and then $346.

Conversely, if the price turns down from the current level, it will suggest that the bears are selling on every minor relief rally. If the $306 level gives way, the pair can drop to the 200-day SMA ($292).

XRP Price Analysis

XRP (XRP) has been trading above the 38.2% Fibonacci retracement level of $0.49 for the past few days, indicating that buyers are not waiting for a deeper correction to buy.

The bulls will try to strengthen their position by pushing the price to the upper zone between $0.56 and $0.58. This remains the key area to watch because a break above could open the doors for a possible rally to $0.65 and then $0.80.

Instead, if the price turns down and falls below the 20-day EMA ($0.48), it will suggest that short-term traders may be booking profits. That could take the XRP/USDT pair to the important support at $0.43.

Cardano Price Analysis

Cardano (ADA) has been trading above the 20-day EMA ($0.37) for the past few days, but the bulls are struggling to clear the neckline of the inverse H&S pattern. This suggests that the bears are defending the level vigorously.

Usually, a tight consolidation is followed by a sharp breakout. The rising 20 day EMA and the RSI in the positive area suggest that a breakout may occur to the upside. A close above the neckline will complete the reversal setup and signal the start of a new uptrend towards the $0.60 target.

This bullish view will be reversed if the price turns down and breaks below the 20 day EMA. The ADA/USDT pair can then drop to the 200-day SMA ($0.35). This level is likely to attract heavy buying by the bulls.

Related: ‘Pop or drop?’ Bitcoin Analysts Decide If BTC Price Will Break Above $30K

Polygon Price Analysis

The sellers tried to plunge Polygon (MATIC) below the support line on April 9-10, but the bulls held their ground. This suggests buying at lower levels.

The bulls will try to push the price above the 20-day EMA ($1.11). If successful, the MATIC/USDT pair could rally to the resistance line of the symmetrical triangle. A breakout and close above the triangle will suggest that the bulls have beaten the bears. That will clear the way for a potential rally to $1.30.

Instead, if the price turns down from the 20-day EMA and falls below the support line, it will indicate that the bears are in control. The pair may then retest vital support at the 200-day SMA ($0.99).

Dogecoin Price Analysis

Dogecoin (DOGE) successfully held the moving averages on April 8, but the shallow bounce on April 9 suggests demand is drying up at higher levels.

Both moving averages have flattened out and the RSI is just above the midpoint, indicating a balance between supply and demand. The bounce from the current level could be faced with selling at the 38.2% Fibonacci retracement level of $0.09. If the price turns down from this level, the DOGE/USDT pair can range between $0.09 and the moving averages for some time.

A break below the moving averages could sink the pair to the strong support of $0.07, while a rise above $0.09 will increase the probability of a rally to $0.11.

Solana Price Analysis

The trading range in Solana (SOL) has narrowed further, indicating uncertainty between the bulls and the bears.

The flat 20-day EMA ($20.64) and the RSI just below the midpoint do not give a clear advantage to either the bulls or the bears. Therefore, it is better to wait for a breakout to occur before placing large bets.

If the price rises and breaks through the downtrend line, it may attract strong buying by the bulls. The SOL/USDT pair could start a rally to $27 and later to $39. On the other hand, the selling could intensify if the price falls below $18.70. The pair can then plummet to $15.28.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.