Stock markets continue to trend higher as crypto investors await statements from the Federal Reserve this week before choosing which direction BTC and altcoin prices will take.

US equity markets are trying to extend their rally into the start of the new week. One of the reasons that could be boosting investor confidence is that the benchmark 10-year note yield has fallen further to 3.924%.

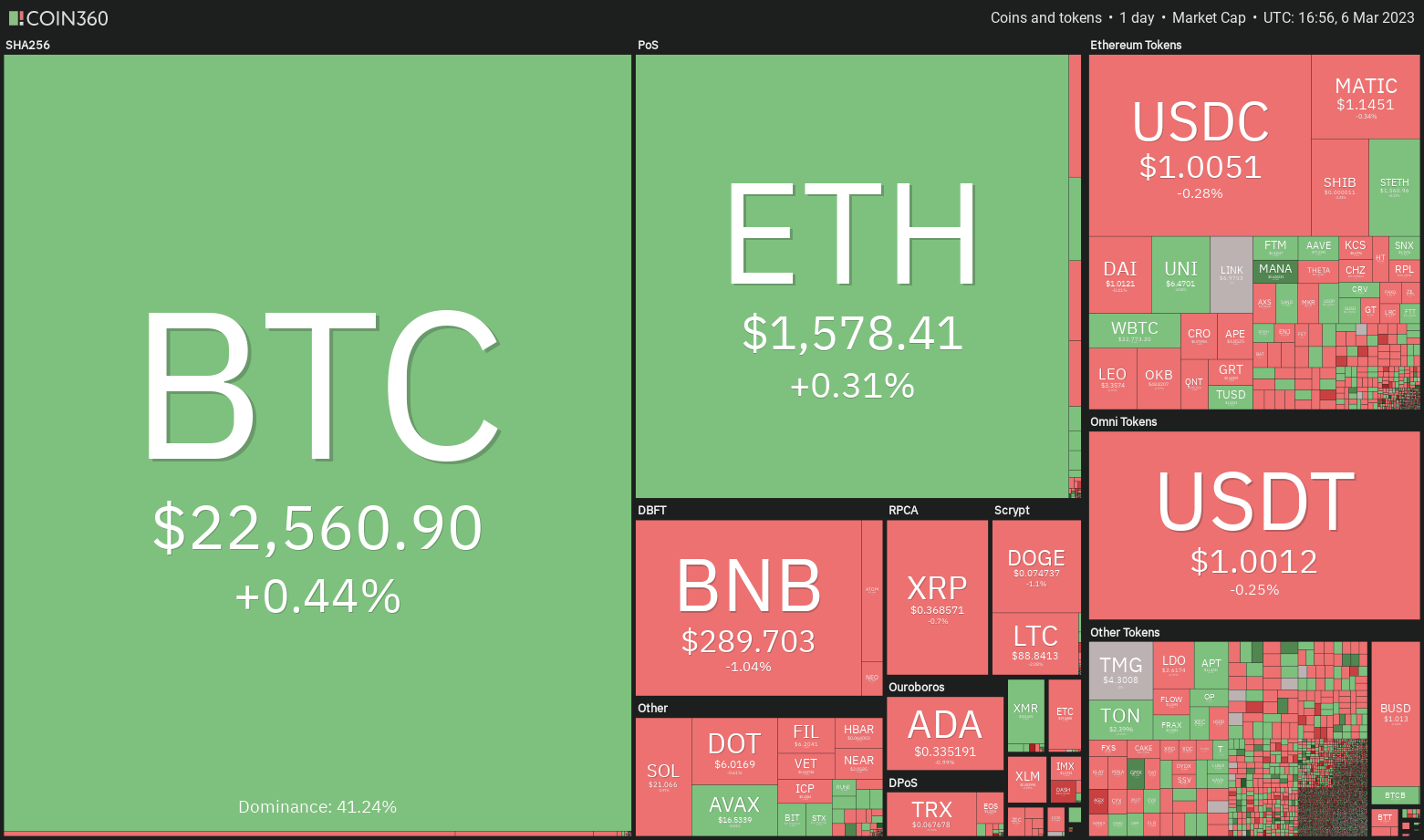

However, the bullish sentiment in the stock markets has not rubbed off on the cryptocurrency markets, which continue to underperform. Bitcoin (BTC) narrow range trading since March 4 suggests that there is uncertainty about the next directional move.

In general, periods of low volatility are followed by a spike in volatility. Federal Reserve Chairman Jerome Powell’s testimony to Congress will be watched on March 7 and 8 for the outlook on inflation and rate hikes. Later, on March 10, the publication of the employment report for February could increase volatility.

Could the strength of the US equity markets and the weakness of the US dollar index (DXY) attract buying in the battered cryptocurrency sector? Let’s study the graphs to find out.

SPX

The S&P 500 Index (SPX) rose sharply from 3,928 on March 2, indicating that buyers have not given up and are accumulating at lower levels.

Buyers pushed the price above the 20-day exponential moving average (4030) on March 3 and followed it up with another move higher on March 6. The rise above the uptrend line could have caught the aggressive bears who might be racing to the exit. . The index will try to rise to 4,200 and then 4,300.

Conversely, if the price turns down from the current level or the overhead resistance and breaks below the moving averages, it will suggest that the bears are back in the game. A break and close below 3,928 could open the doors for a possible drop to 3,764.

DXY

The rally in the US Dollar Index (DXY) is facing selling near the 38.2% Fibonacci retracement level of 105.52, but a minor positive in buyers’ favor is that they have not allowed the price falls below the 20-day EMA (104.10).

If the price bounces off the 20-day EMA, the bulls will try again to push the index above the overhead resistance. If successful, the index could rally to the 50% retracement level of 106.98 and then to the 61.8% retracement level of 108.43.

Instead, if the price turns down and falls below the 20-day EMA, the next stop may be the 50-day SMA (103.36). Such a move will suggest that the index may consolidate between 101.29 and 105.52 for some time.

USDT/BTC

Bitcoin is struggling to rally back above $22,800, indicating that the bears are trying to turn the level into resistance. The moving averages are about to complete a bearish crossover and the RSI is in the negative zone, indicating an advantage for the bears.

If the price turns down from the current level, the BTC/USDT pair can fall to the critical support at $21,480. This level can witness a tough battle between the bulls and the bears. If the bears win, the pair can extend its decline to the psychologically important $20,000 level.

On the other hand, if the price bounces off $21,480, the bulls will make one more attempt to clear the general hurdle at $22,800. If they manage to do that, the pair can start its upward move towards $25,250.

EUR/USDT

Ether (ETH) has been trading in a tight range after the sharp drop on March 3. This indicates indecision between buyers and sellers.

If the bears push the price below $1,544, the advantage could tilt in their favor and the ETH/USDT pair could fall towards the strong support at $1,461. This level is likely to act as strong support again. If the price rises from this level again, the pair may remain stuck between $1,461 and $1,743 for a while longer.

On the upside, the bulls will have to push and hold the price above the moving averages to signal a comeback. The pair can then try to rally above the $1,680 resistance zone at $1,743. If that happens, the pair can start its journey towards $2,000.

USD/USDT

The shallow retracement of BNB (BNB) from the current level shows a lack of aggressive buying by the bulls. The downsloping 20-day EMA ($301) and the RSI in the negative territory indicate that the path of least resistance is to the downside.

If the bears push the price below $280, the BNB/USDT pair will complete a bearish head and shoulders (H&S) pattern. That could start a move lower towards the first target at $245 and then $222.

If the bulls want to avoid the downturn, they will have to fiercely defend the $280 support and quickly push the price above the 20-day EMA. That could raise the possibility of a push to the resistance above $318.

USD/XRP

XRP (XRP)’s rebound from the $0.36 support on March 3 was met with sharp selling near the 20-day EMA ($0.38). This suggests that sentiment is negative and that traders are selling rallies.

If the price falls below $0.36, the XRP/USDT pair could reach the support line of the descending channel pattern. Buyers can buy this dip to keep the pair within the channel, but could struggle to clear the $0.36 hurdle.

The first sign of strength will be a breakout and close above the resistance line of the channel. That could attract more buying and the pair may attempt a rally to $0.43, where it is likely to meet stiff resistance from the bears.

ADA/USDT

Cardano (ADA) bounced off the support at $0.32 on March 3, but the bulls were unable to push the price above the overhead resistance at $0.34. This shows that rallies are being sold.

The bears will again try to sink the price below the support at $0.32. If they can pull it off, the ADA/USDT pair could see some aggressive selling. There is no major support until the pair reaches $0.26.

This negative view could be invalidated in the short term if the price bounces off $0.32 and breaks above the moving averages. That could increase the possibility of the formation of the right shoulder of the reverse H&S pattern.

Related: Bitcoin Traders Eye $19K BTC Price Bottom, Warn of ‘Hot’ February CPI

MATIC/USDT

Polygon (MATIC) formed an inside candlestick pattern on March 5, indicating indecision between the bulls and the bears.

The downside 20-day EMA ($1.23) and the RSI below 41 suggest an advantage for the bears. The MATIC/USDT pair could fall to the solid support of $1.05. Buyers are expected to defend this level aggressively because a breakout and close below it can sink the pair to $0.90 and then $0.69.

Alternatively, if the price rises from the current level or bounces strongly from $1.05, it will indicate that demand is at lower levels. That can start a relief rally to the 20 day EMA, where the bears can mount a strong defense again.

DOGO/USDT

Dogecoin (DOGE) attempted a rally on March 5, but the long wick on the day’s candle indicates that it is selling on rallies.

The downside 20 day EMA ($0.08) and the RSI near the oversold zone show that the bears are in control. The sellers will try to further strengthen their position by pulling the price below the crucial support near $0.07. If this level is broken, the pair could reach the pattern target of $0.06.

On the way up, the first resistance to watch out for is $0.08. If this level is scaled, the DOGE/USDT pair can start a rally towards $0.10.

SOL/USDT

The bulls tried to initiate a rally in Solana (SOL) on March 5, but the long wick on the day’s candle shows selling near the 20-day EMA ($22.32).

The bears will try to push the price below the strong support near $19.68. If they succeed, the selling may intensify and the SOL/USDT pair could plummet towards the strong support near $15.

Conversely, if the price bounces off $19.68, it will suggest accumulation on the dips. The bulls will again try to push the price above the moving averages. If that happens, the pair could rally to the resistance line.

The area between the resistance line and $27.12 remains the key area to watch as a break above could catapult the pair towards $39.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER