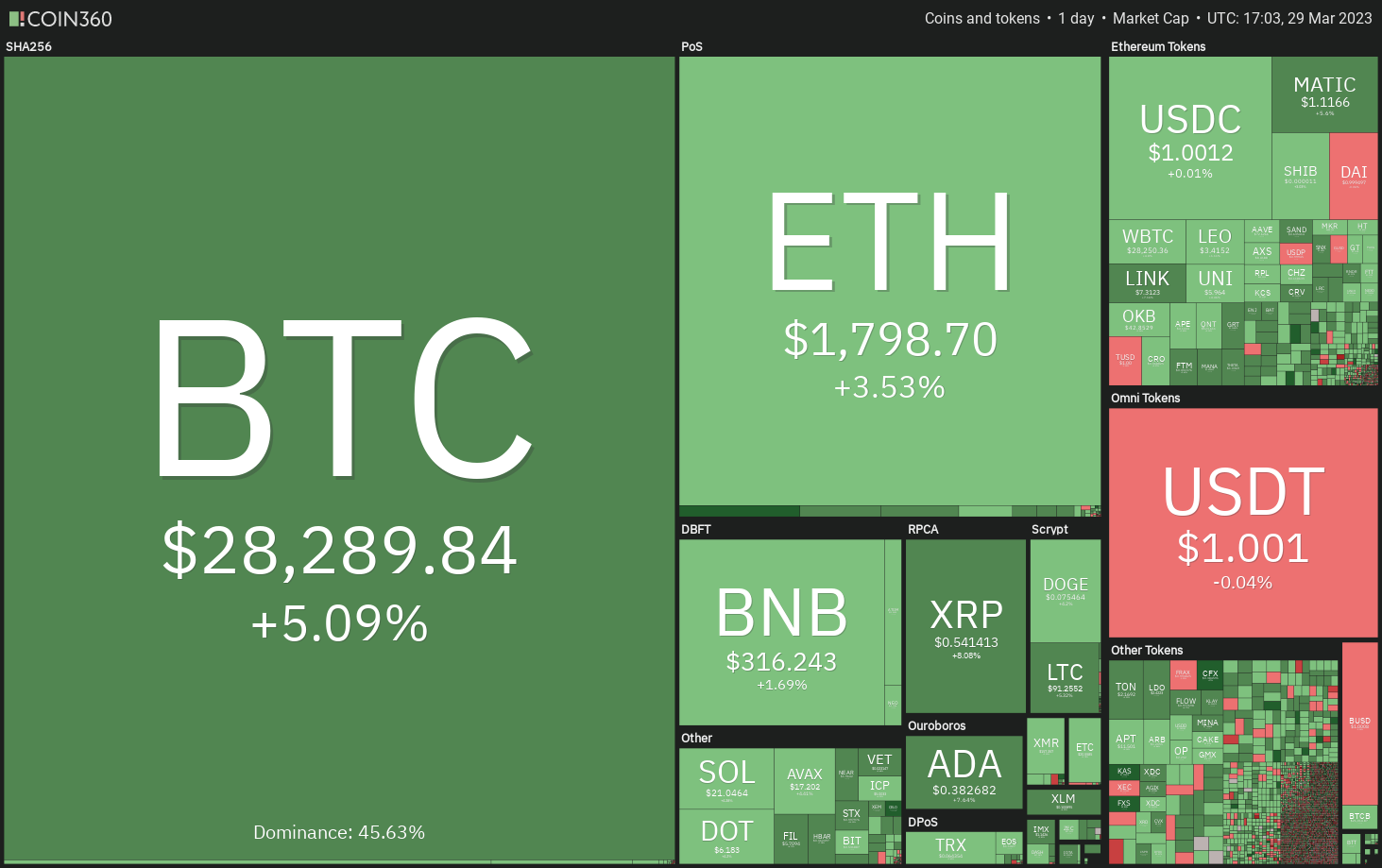

Bitcoin and select altcoins are close to breaking out of their general resistance levels, indicating that the bulls remain in control of the crypto market.

Bitcoin (BTC) is up about 71% in the first quarter of 2023, which is the first positive quarter after four consecutive quarters of negative returns in 2023, according to data from Coinglass. This shows that sentiment has turned positive and the bulls are trying to bottom out on Bitcoin.

When the background is bullish, negative news results in shallow corrections. That’s what happened after the United States Commodity Futures Trading Commission filed a lawsuit against Binance and its CEO, Changpeng Zhao, for trading violations. This news pushed the markets slightly lower, but did not start a strong move lower.

Another thing that happens in a bullish environment is that cryptocurrencies go up without any specific catalyst. That happened on March 29 when Bitcoin and several major altcoins came out in force.

Could Bitcoin and select altcoins start the next leg of the uptrend? And where is the rally likely to meet resistance? Let’s study the charts of the top 10 cryptocurrencies to find out.

Bitcoin Price Analysis

In an uptrend, traders typically buy pullbacks to the 20-day exponential moving average ($26,371). The long tails on the March 27 and 28 candles show just that.

The rising 20 day EMA and the RSI above 63 indicate that the bulls are in control. Buyers will try to further cement their dominance by pushing the price above $28,868.

If successful, the BTC/USDT pair is likely to spike to $30,000 and then continue the rally to the critical resistance of $32,500. The bears will try to stop the bullish move in this zone because a rally above $32,500 could clear the way for a strong rally to $40,000.

Time is running out for bears. They will have to drop the price below the 20 day EMA first, and then retest the breakout level of $25,250. If this level doesn’t hold either, the pair can plummet to the 200-day simple moving average ($20,281).

Ether Price Analysis

Ether (ETH) bounced off the $1680 support on March 28, indicating that lower levels are attracting buyers. This keeps the price stuck between $1,680 and $1,857.

The rising 20-day EMA ($1720) and the RSI near 58 suggest that the bulls have the upper hand. If the buyers push the price above $1,857, the ETH/USDT pair could rally to $2,000 and then rally to $2,200.

Conversely, if the sellers want to avoid this bullish move, they will have to quickly push the price below the $1680 support. If that happens, the pair could slide to $1,600 and then plummet to $1,461.

BNB Price Analysis

BNB (BNB) plunged below the 20-day EMA ($316) on March 26, but the bears were unable to keep up the selling pressure. The bulls bought the dip and pushed the price above the 20-day EMA on March 29.

Next, the buyers will try to overcome the hurdle at the downtrend line. If they can pull it off, the BNB/USDT pair can rally to the upper resistance zone between $338 and $346. The bears are expected to defend this zone with all their might because if it gives way, the pair could skyrocket towards $400.

Conversely, if the price changes direction from the current level or the downtrend line, it will suggest that sentiment remains negative and that the bears are selling rallies. The pair can then collapse to the 200-day SMA ($290).

XRP Price Analysis

XRP (XRP) gained momentum on March 27 and broke above the immediate resistance zone of $0.49 to $0.51 on March 28.

The bulls continued their buying spree on March 29 and sent the XRP/USDT pair soaring above the crucial resistance at $0.56. If the bulls hold the price above $0.56, it will signal the start of a new uptrend. The pair can go up to $0.65 and then to $0.80.

The long wick of the March 29 candle shows that the bears are selling the rally above $0.56. If the price turns down and falls below $0.49, it will indicate that the current breakout may have been a bull trap. The pair could then drop to $0.43.

Cardano Price Analysis

Cardano (ADA) broke below the 20-day EMA ($0.35) on March 27, but it turned out to be a bear trap. The price appeared and spiked above the moving averages on March 28.

The bulls have breached the immediate resistance at $0.39, clearing the way for a possible rally towards the neckline of the inverse head and shoulders (H&S) pattern. If the bulls maintain momentum and push the price above the neckline, the bullish setup will be completed. That can start a new up move that has a pattern target of $0.60.

On the downside, a breakout and close below $0.33 will be a warning sign that the bears are back in the game. That may sink the ADA/USDT pair to life support at $0.30.

Dogecoin Price Analysis

Dogecoin (DOGE) remains stuck between the 200-day SMA ($0.08) and $0.07. This consolidation could act as a launch pad for the next directional move.

A break and close above the 200-day SMA will be the first sign that the bulls have absorbed the selling. That could attract more buying and catapult the price into the upper resistance zone between $0.10 and $0.11.

Another possibility is that the price turns down from the 200-day SMA and falls below the support at $0.07. If that happens, it will suggest that the bears have beaten the bulls. The DOGE/USDT pair could fall to $0.06.

Polygon Price Analysis

Polygon (MATIC) rallied from the strong support at $1.05 on March 28, indicating that the bulls are fiercely protecting this level.

The bulls extended the rally on March 29 by pushing the price above the 20-day EMA ($1.12). If the buyers hold the breakout, it will clear the way for a possible rally to the overhead resistance zone between $1.25 and $1.30.

Conversely, if the price turns down and breaks below the $1.05 support, it will suggest that the bears are selling on relief rallies. The MATIC/USDT pair can then slide to the 200-day SMA ($0.97). This is important support to watch out for because if it is broken, the next stop could be $0.69.

Related: ‘Definitely Not Bullish’: Bitcoin Price Gains of 7% Fail to Convince Traders

Solana Price Analysis

Solana (SOL) has been trading between the downtrend line and the horizontal support of $18.70 for the past few days.

The bulls have been buying the dips at $18.70 but have failed to push the price above the downtrend line. This indicates that the bears are active at higher levels. This state of uncertainty is unlikely to last for long.

If the buyers force the price above the downtrend line, it will suggest a possible trend reversal. The SOL/USDT pair could first rally to $27.12 and then attempt a rally to $39. Conversely, a break below $18.70 could extend the decline to $15.28.

Moles Price Analysis

Polkadot (DOT) closed below the 200-day SMA ($5.95) on March 27, but the bears were unable to take advantage and sink the price below $5.70.

The bulls bought at lower levels and pushed the price back above the 200-day SMA on March 28. The buyers further added to their strength by pushing the price above the 20-day EMA ($6.11). The DOT/USDT pair could rally to $6.70. This is major short-term resistance for the bulls to break above.

If they succeed in doing that, the pair may attempt a rally to the neckline of the inverse H&S pattern. This positive view will be reversed if the price breaks below the $5.70 to $5.15 support zone.

Litecoin Price Analysis

Litecoin (LTC) fell below the 20-day EMA ($87) on March 28, but the long tail of the candle shows solid buying at the lower levels.

The bulls continued their buying on March 29 and are trying to push the price above the immediate resistance at $96. If they manage to do that, the LTC/USDT pair could rally to the strong overhead resistance of $106. The rising 20-day EMA and the RSI near 55 indicate a bit of an advantage for the buyers.

If the bears want to gain an advantage, they will have to pull the price below the uptrend line. If that happens, the pair could drop to the strong support at $75.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER