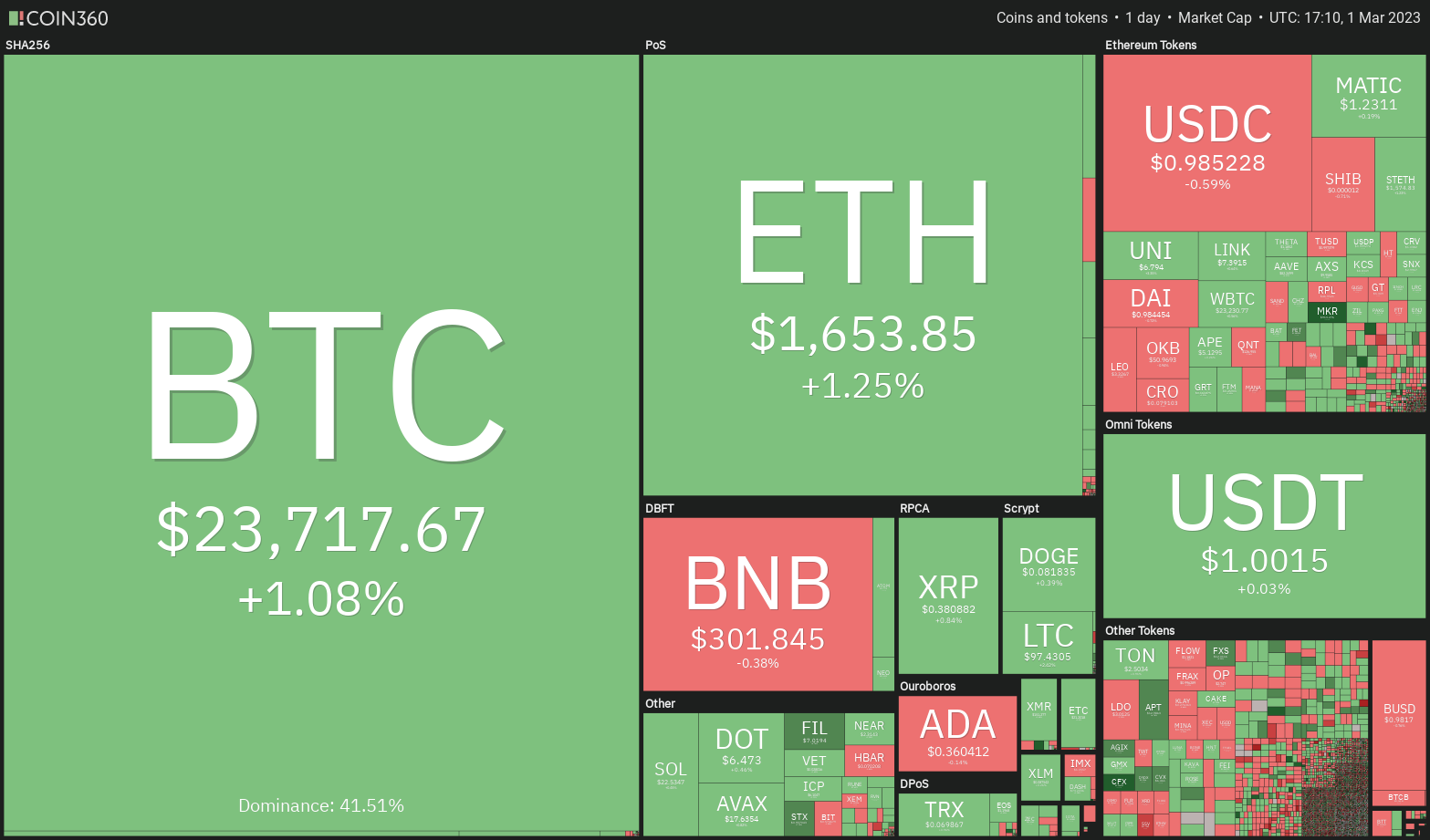

Bitcoin started March on a positive note, but the month has historically posted lackluster gains, which could be an early warning sign for crypto investors.

Bitcoin (BTC) was marginally positive in February despite the S&P 500 Index (SPX) falling 2.61%. On the first day of March, Bitcoin started on a positive note as the US stock markets are struggling. This shows that Bitcoin is trying to disassociate itself from the US stock markets.

One positive sign is that retail traders appear to have taken full advantage of the cryptocurrency bear market. Instead of panicking and selling their assets, traders bought at lower levels. Glassnode data shows that wallets containing at least one Bitcoin have been steadily increasing and are approaching the 1 million mark for the first time.

Historically, March has been a mediocre month for Bitcoin. Data from Coinglass shows that Bitcoin closed the month of March with double-digit gains only twice in the last ten years, in 2013 and in 2021. Therefore, the possibility of continued consolidation in March remains high.

What are the critical levels that can act as major obstacles to the recovery of Bitcoin and altcoins? Let’s study the charts of the top 10 cryptocurrencies to find out.

USDT/BTC

Bitcoin’s $22,800 level has been acting as solid support over the past few days, which is a positive sign. This indicates that sentiment remains bullish and traders view dips as a buying opportunity.

The bulls have cleared the first hurdle at the 20-day exponential moving average ($23,435) and will then try to push the price towards the crucial resistance at $25,250. This is an important level for bears to defend because a breakout and close above it can attract big buying. Next, the pair could skyrocket to $31,000 as there are no major resistances in between.

Conversely, if the price turns below $25,250, it will suggest that the pair may remain range bound for a few days. A consolidation near the local highs is a bullish sign, as it shows that buyers are not rushing out. The bears will have to sink in and hold the price below $22,800 to make a dent in the bullish sentiment. That may start a correction towards $20,000.

EUR/USDT

Even after repeated attempts, the bears failed to sink Ether (ETH) below the 50-day SMA ($1600). This indicates that the bulls are buying the dips of the 50-day SMA.

The buyers will try to strengthen their position by catapulting the price above the upper resistance zone between $1680 and $1743. If they did, the ETH/USDT pair could start a rally to $2,000. The bears may present a strong challenge at $1,800, but a crossing of this level is likely.

The first sign of weakness will be a break and close below the 50-day SMA. If that happens, short-term bulls may be tempted to book profits. Next, the pair could fall to the support near $1,500.

USD/USDT

The price action of the last few days has formed a symmetrical triangle pattern in BNB (BNB). This indicates indecision between buyers and sellers.

The bulls bought the dip to the support line on March 1, but the long wick on the day’s candle shows that the bears are fiercely protecting the moving averages. If the price falls below the triangle, the BNB/USDT pair can fall to $280.

Conversely, if the buyers push the price above the moving averages, the pair can reach the resistance line of the triangle. This remains the key level to watch in the short term because a break above it can start a move higher to $340 and then to the pattern target of $371.

USD/XRP

Even after repeated attempts, the bears were unable to push XRP (XRP) to the strong support at $0.36. This suggests that the selling pressure is easing.

The bulls will now try to push the price above the resistance line of the descending channel. If successful, the XRP/USDT pair can rally to the above resistance at $0.43. Buyers will have to break through this resistance to clear the way for a possible rally to $0.52.

The bears probably have other plans. They will try again to stop the rally at the resistance line of the channel. If the price turns down, the possibility of a break below $0.36 increases. The pair can then slide to $0.33.

ADA/USDT

Cardano (ADA) is trying to bounce off the strong support near $0.34. The rally could face resistance at the 20-day EMA ($0.37), as the bears will try to turn this level into resistance.

If the price turns down from the 20-day EMA, the bears will try to pull the ADA/USDT pair below the $0.34 support. If they do, the pair may start a deeper correction to $0.32 and then $0.30.

Instead, if the bulls push the price above the moving averages, it will suggest aggressive buying at lower levels. The pair can then attempt a rally towards the neckline of the developing inverse head and shoulders (H&S) pattern.

DOGO/USDT

The bulls successfully defended the support near $0.08 over the past few days, but failed to make a strong bounce in Dogecoin (DOGE). This suggests that demand is drying up at higher levels.

The price action of the last few days has formed a bearish descending triangle pattern, which will complete on a breakout and close below support near $0.08. This negative setup has a target of $0.06.

Conversely, if the buyers push the price above the moving averages, it will invalidate the bearish setup. That can result in short covering by aggressive bears. The DOGE/USDT pair may then attempt a rally to $0.10.

MATIC/USDT

The sharp correction in Polygon (MATIC) is finding support at the 50-day SMA ($1.17). The bulls are trying to start a rally, but the long wick on the day’s candlestick shows that the bears are selling the rallies to the 20-day EMA ($1.28).

If the price continues lower, the bears will make one more attempt to pull the MATIC/USDT pair below the 50-day SMA. If they manage to do that, the pair could fall to the vital support at $1.05. This level is likely to attract solid buying by the bulls.

Conversely, a break above $1.30 could encourage the bulls. They will then try to push the price towards the upper resistance at $1.57. The rally could also face hurdles at $1.42 and again at $1.50.

Related: Ethereum price resistance at $1,750 could reflect trader anxiety over the Shanghai update

SOL/USDT

Solana (SOL) turned down from the 20-day EMA ($23.02) on the 27th of February, indicating that the bears are trying to turn this level into resistance.

However, the bulls have not given up and are once again trying to push the price above the 20 day EMA. Retesting a resistance within a short period tends to weaken it. If the buyers push the price above the 20-day EMA, the SOL/USDT pair could reach the resistance line.

This remains the key level to watch in the short term because a breakout and close above it will signal a potential trend change. If the bears want to gain an advantage, they will have to sink the pair below the support at $19.68.

POINT/USDT

Polkadot (DOT) broke below the 50-day SMA ($6.43) on Feb. 28, but the bears failed to take advantage of this advantage. This suggests that the buyers are trying to catch the aggressive bears.

The 20-day EMA ($6.68) is the important level to watch in the short term. If the buyers push the price above this level, it will suggest that the short-term corrective phase may be over. The bulls will then try to push the price towards the neckline of the developing Inverse H&S pattern.

Alternatively, if the DOT/USDT pair turns back down from the 20 day EMA, it will suggest that the bears have turned the level into resistance. That will increase the probability of a drop to $5.50.

USDT/USDT

The Litecoin (LTC) retracement found strong support at the 50-day SMA ($92). This suggests that the lower levels continue to attract buyers.

The bulls pushed the price back above the 20-day EMA ($95) on March 1, opening the doors for a possible rally to the overhead resistance at $106. This level can act as a solid barrier, but if the bulls break above it, the LTC/USDT pair can rally to $115 and then $130.

The important support to watch on the downside is the area between the 50-day SMA and $88. If this zone is broken, the selling could build momentum and the pair could slide to $81 and then $75.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.