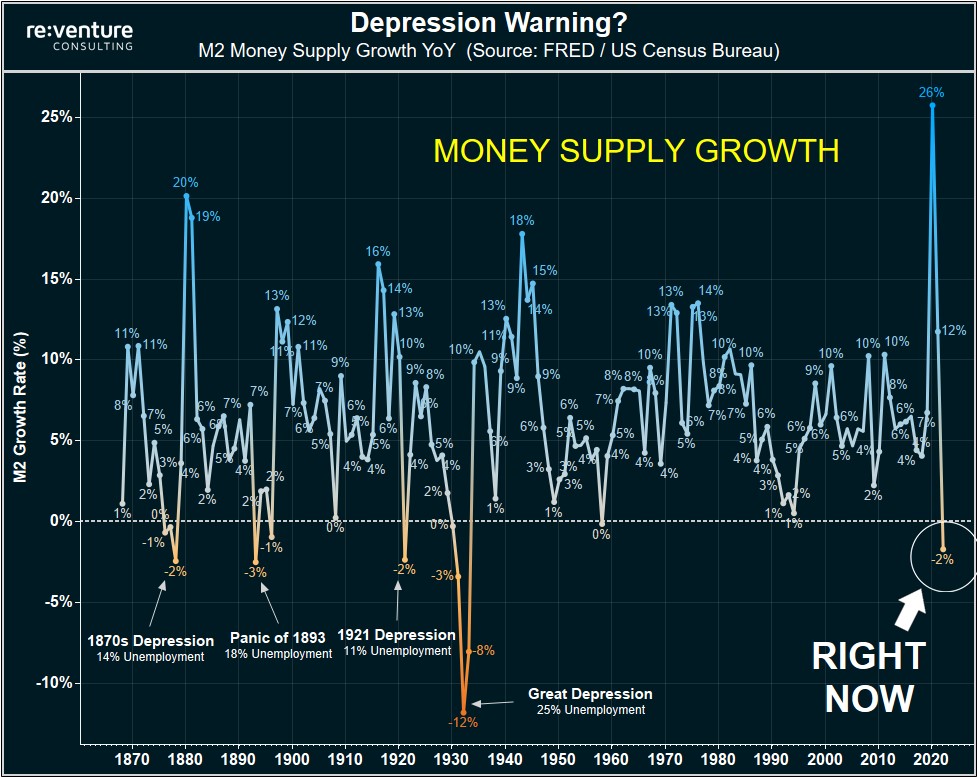

During the Covid-19 pandemic, central banks like the US Federal Reserve eased fiscal and monetary policy. Now these same financial institutions are apparently engaged in quantitative tightening (QT) practices. According to Nick Gerli, CEO and founder of Reventure Consulting, “the money supply is officially contracting.” This has only happened four times in the last 150 years. Gerli warns that every time it happens, you get a depression with double-digit unemployment rates.

The contraction of the money supply and its impact on the economy

Many market analysts and economists are uncertain about the future of the economy, while many believe that things will soon get worse due to significant inflation and failures in central planning. When the Covid-19 pandemic hit, the US government and many other nation-states around the world trillions of dollars funded borrowed to sustain the economy. The debt has grown to colossal levels and many believe it could sink several Western economies. Speculators insist that this will hurt the dollar and that only tangible assets will survive the fallout.

In a recent interview at the 2023 BMO Critical Metals, Mining & Minerals Conference, Rob McEwen, chief executive of McEwen Mining, said: “Hard assets will increase in value as the dollar loses value relative to other currencies because governments are irresponsible. They steal from their citizens by excessively printing money and borrowing in ways they shouldn’t… Look at the amount of debt most of the Western world is carrying right now; it’s huge.

On March 8, 2023, nick gerliCEO and founder of Reventure Consulting, warned that the money supply is contracting. “The money supply is officially contracting,” Gerli said on Wednesday. This has only happened four times in the last 150 years, and each time, a depression followed with double-digit unemployment rates.

The Reventure executive insists that when the money supply contracts while inflation rises, it creates a “nasty mix” because fewer dollars are available to pay higher prices, ultimately leading to a deflationary collapse.

Girl aggregate:

This is exactly what happened in the depression of 1921. (NOT the Great Depression). This occurred after World War I and the Spanish flu. Where there were years of high inflation/money supply growth. And then… BAM! Deflation of 11% and the unemployment rate skyrocketed. All it took was a -2% contraction in the money supply in 1921 to cause that deflationary depression.

The Reventure executive noted that there has already been a 2% contraction in 2023. Gerli says this suggests that “the resilience of our economy and current inflation might not be as strong as people think.” Gerly however admits that there is still a significant amount of money circulating in the financial system in 2023, with a money supply roughly 35% higher than before the pandemic, at $21 trillion. Despite this, history shows that just a little push and depression and deflation could build up.

“(The) historical record is clear: slumps/deflations don’t need a ‘linear’ decline in the money supply to occur, it just needs to be a little. 2-4% contraction yoy, and then the problems arise”, Gerli aggregate.

Girl think that people are too focused on rate hikes and don’t pay attention to quantitative tightening (QT) practices and the money supply. He thinks that at the current rate, the money supply will shrink further as recession fears mount and inflation continues. “This is how a system collapse and a deflationary depression happen”, Gerli stressed. The Reventure executive added that a deflationary trough in 2023-24 “is not a guarantee.” Because governments are diligently watching, there is a chance that they could “try to print money again, send stimulus checks and jump-start inflation/economy.” according to Gerli.

What do you think the government should do to address the possible contraction in the money supply and the threat of deflationary depression? Share your thoughts in the comments below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.