This article appears in bitcoin Magazine. “The question of registration.” Click here to get your annual subscription to bitcoin Magazine.

bitcoin, not blockchain

bitcoin, not blockchain. This has been a prominent meme over the past two eras, guiding newbies towards a bitcoin-only way of life, away from fraudulent “crypto”s that promise greater “blockchain technology.” Yet here we are, more focused than ever on blockchain. But this time it's different: the entire world has its eyes set on the bitcoin blockchain. The driving force behind this attention is a new metaprotocol, a protocol that is based on the bitcoin protocol, called Ordinals. Ordinals is a novel approach to “naming” individual satoshis from the bitcoin UTXO set, but perhaps most interestingly, it includes a way to “enroll” data files into the bitcoin blockchain. This article provides an analysis of how Ordinals have influenced the demand for block space on the bitcoin blockchain in 2023 and explores the challenges and opportunities this development presents.

Technical description of ordinals

Ordinals is a protocol built on top of the bitcoin protocol. It consists of two different parts: Ordinal Theory and inscriptions. Ordinal theory is a protocol for assigning serial numbers to satoshis, the smallest subdivision of a bitcoin, and tracking those satoshis as they are spent in transactions. This has led to some controversial conversations around fungibility, as the market might assign higher value to one satoshi than another, but the market is gaining interest in this part of the Ordinals protocol. The second and main objective of this article is registrations. Inscriptions allow arbitrary content to be attached to individual satoshis, turning them into native bitcoin digital artifacts. Perhaps the simplest example to explain inscriptions would be to inscribe (save) a photo on the bitcoin blockchain (a large storage hard drive or database) and assign that photo to a single bitcoin satoshi. That unique satoshi shows when the inscription was inscribed on the blockchain, and that inscription, or that unique satoshi representing the photo, can then be transferred from one person to another. Many people see no value in collecting or trading these inscriptions and some go so far as to call them “spam” or a “denial of service attack” on bitcoin, but a new market has emerged from the Ordinals protocol and this year has demonstrated a significant influence on the shape, demand and cost of block space. What's more interesting are the possibilities that signups bring to bitcoin, some of which we will discuss further, while many have yet to be imagined.

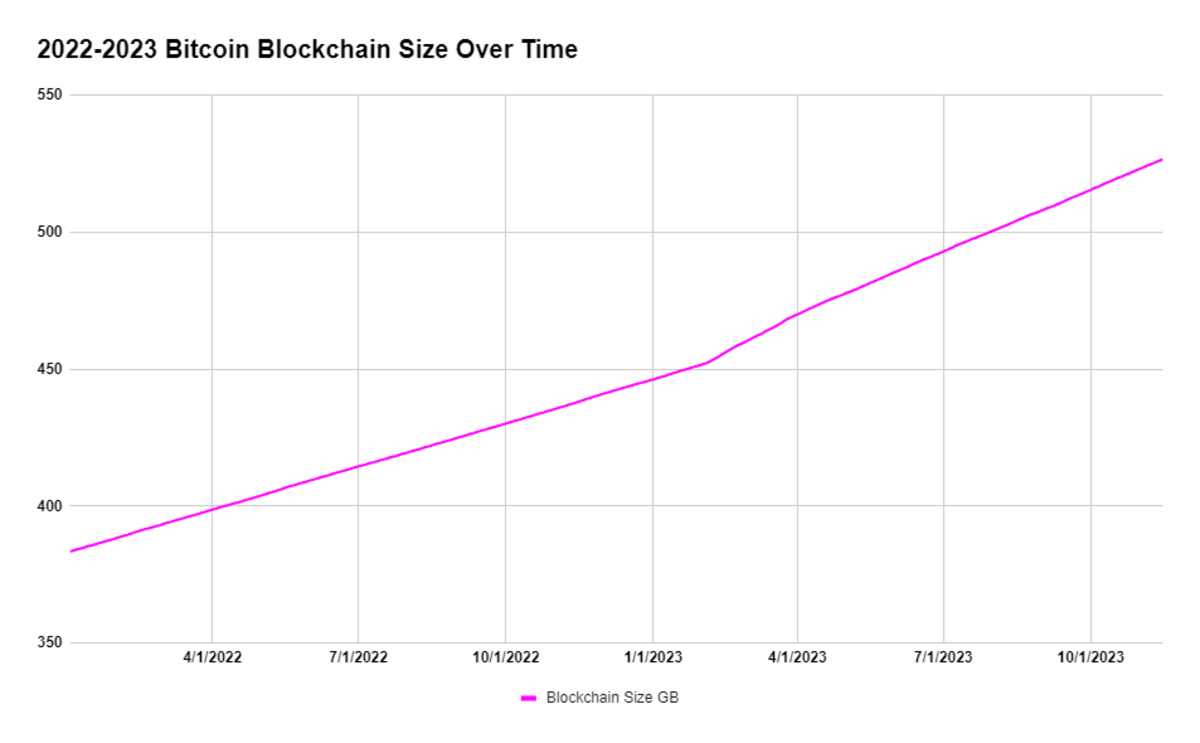

As Ordinals moved from a whitepaper in late 2022 to production in 2023, we have seen a measurable increase in the growth rate of the bitcoin blockchain. In February of this year, the daily growth trajectory of blockchain will be seen to change noticeably. It is important to note that the block size has not increased, but rather more block space is being used every day. Block space is limited by the bitcoin protocol code to around ~4MB per block. This graph shows us that in February 2023, there was a huge increase in block space usage.

Zooming in on the graph, it can be seen in February 2023 that the average block size increases significantly, which is attributed to the widespread use of the Ordinal protocol. We'll delve a little deeper into the blockchain space in the next section, but the key takeaway is that the growth trajectory of the blockchain space has increased and this new demand doesn't look like it's going away anytime soon.

Blockspace Demand Analysis

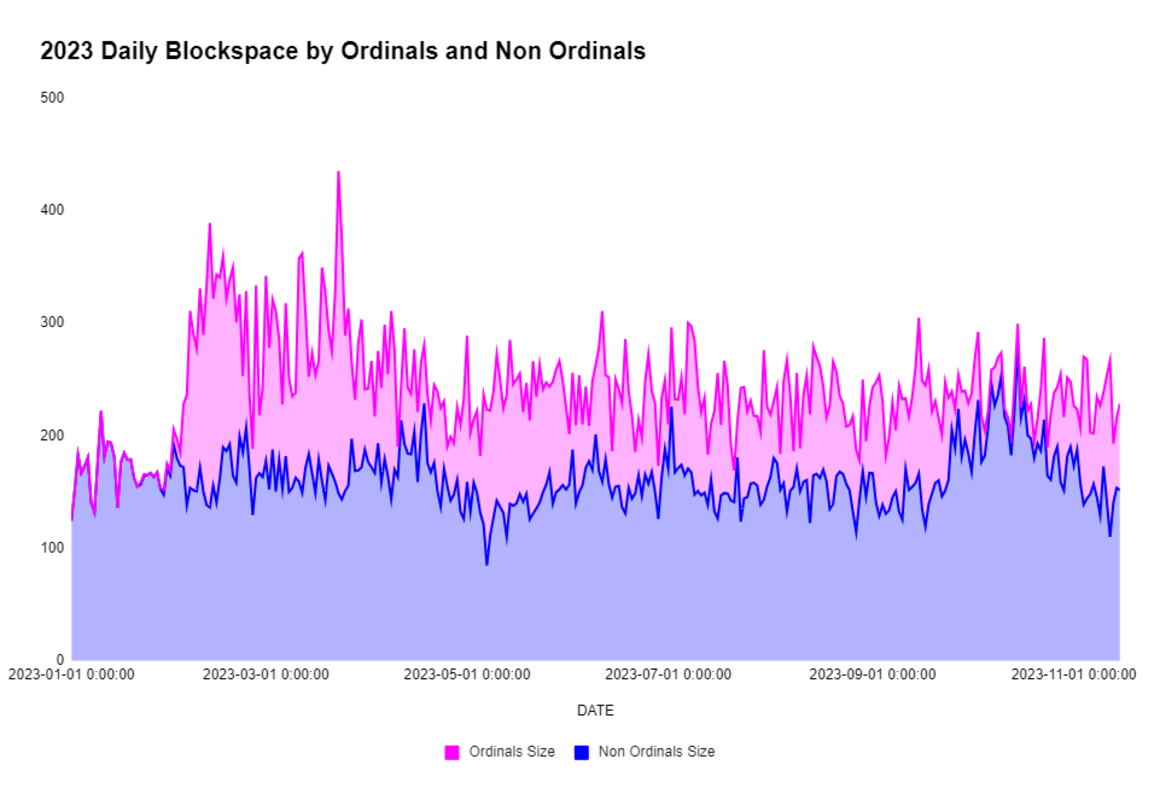

The arrival of ordinals has impacted market demand for a limited supply of block space through signups. These inscriptions take up bytes in each block, and people writing inscriptions pay the dynamic market rate for that space. Since Ordinals did not yet exist in 2022, we only saw demand for block space coming from “economic” transactions. Now, with Ordinals live, we see “economic” transactions competing with registrations for block space. Since block space is scarce, only a limited number of bytes (and therefore transactions) can be included in each block. Now that signups demand more of that space, the free block space market is doing its thing, with markets emptying out roughly every 10 minutes.

As we delve into the impact of enrollments on the economics of the bitcoin blockspace, we will first delve into the demand for the blockspace in 2023. As mentioned above, ordinals only started in 2023, so it is easy to see how these transactions have begun to gain strength. block space.

In February, you'll be able to see where ordinals are starting to make a significant footprint in the block space. In the month of January, we saw an average of 0.5MB of daily signups added to the blockchain, but from February through the rest of the year an average of 85MB of signups were added per day.

Economic impact

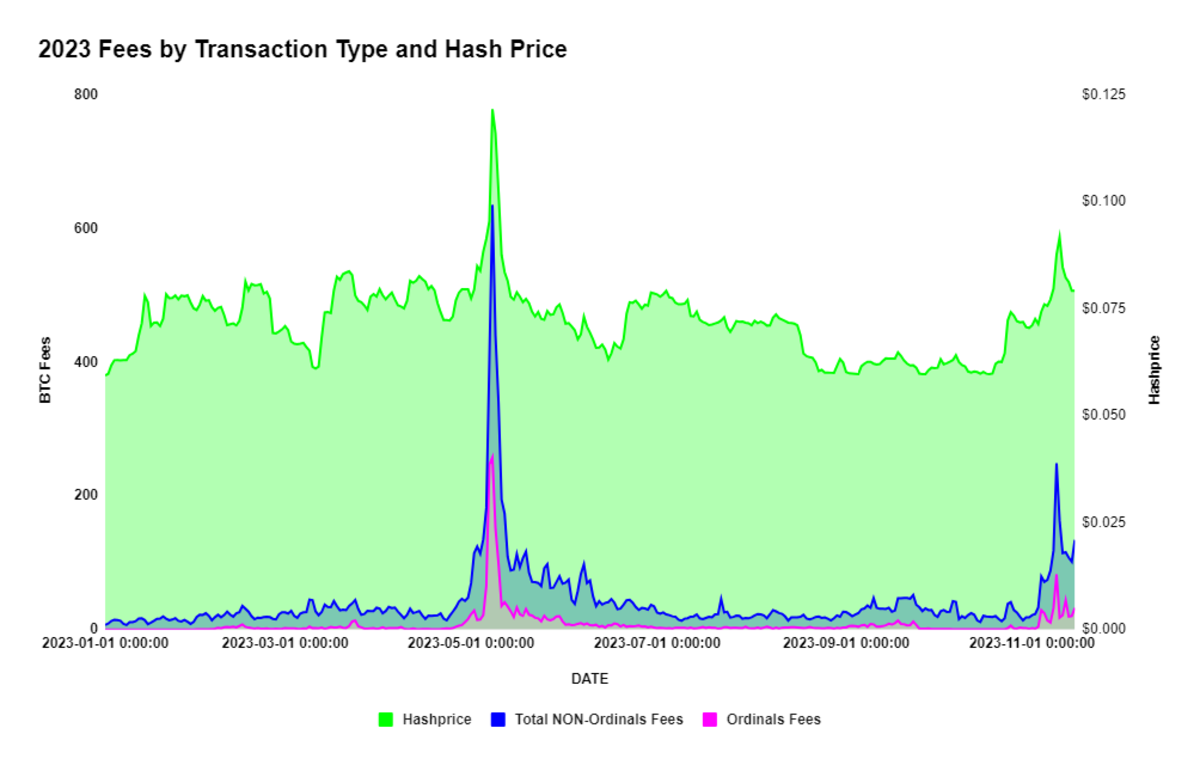

The economic implications of Ordinals are significant, particularly in the context of transaction fees and miners' income. An analysis of transaction fees in 2023 illustrates a growing trend that affects both users and miners. Miners, in particular, have seen notable benefit from this increase, as higher fees translate into higher revenues. In fact, in recent years we have heard calls about the imminent failure of bitcoin if fees do not increase significantly, and with the innovation of Ordinals we have seen fees increase substantially. During January 2023, we saw an average of 12.97 btc paid in fees per day and 0.005 btc generated from signups. But from February to November 15, we saw an average of 44.22 btc in fees per day, a 240% increase, of which 8.67 btc came from signups.

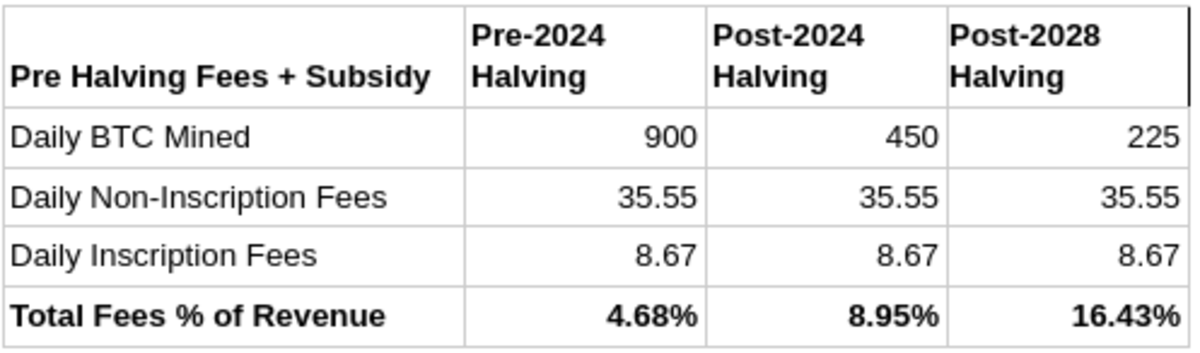

Considering that the total new bitcoins mined each day is currently around 900 btc, the total transaction fees represent only 4.5% of miners' income. While this is not enough revenue to move the needle for small and medium-sized miners, it is important for industrial-scale miners who have the added advantage of lower energy costs due to purchasing at scale. You can see a direct correlation with the hash price and transaction fees, specifically in May 2023. The rest of the chart does not show an exact correlation, mainly because the hash price is a function of the btc price in USD and the difficulty total of the network. We know that as mining becomes more profitable, additional miners are activated to take advantage of the increased revenue, and this year has seen explosive growth in mining difficulty, rising from 252 EH/s in January 2023 to 457 EH/s in November 2023. an increase of 81% in just under a year.

Future prospects and implications of the halving

As we approach the halving in April 2024, it will be interesting to see what happens to the dynamics of the block space as the daily mining supply is halved. How will a hypothetical increase in the price of btc make sats that much more valuable? Will we see continued demand for enrollment or will it become too expensive in US dollar terms? Other things to consider are the emergence of new data markets within the bitcoin ecosystem that have the potential to bring new applications and future uses of the bitcoin blockspace, going beyond traditional transactions and registrations. Ordinals' potential to store various types of data and the development of markets for this data opens up exciting possibilities for the future, ranging from digital art storage to complex data applications, signaling a new era in the utility of space of bitcoin blocks.

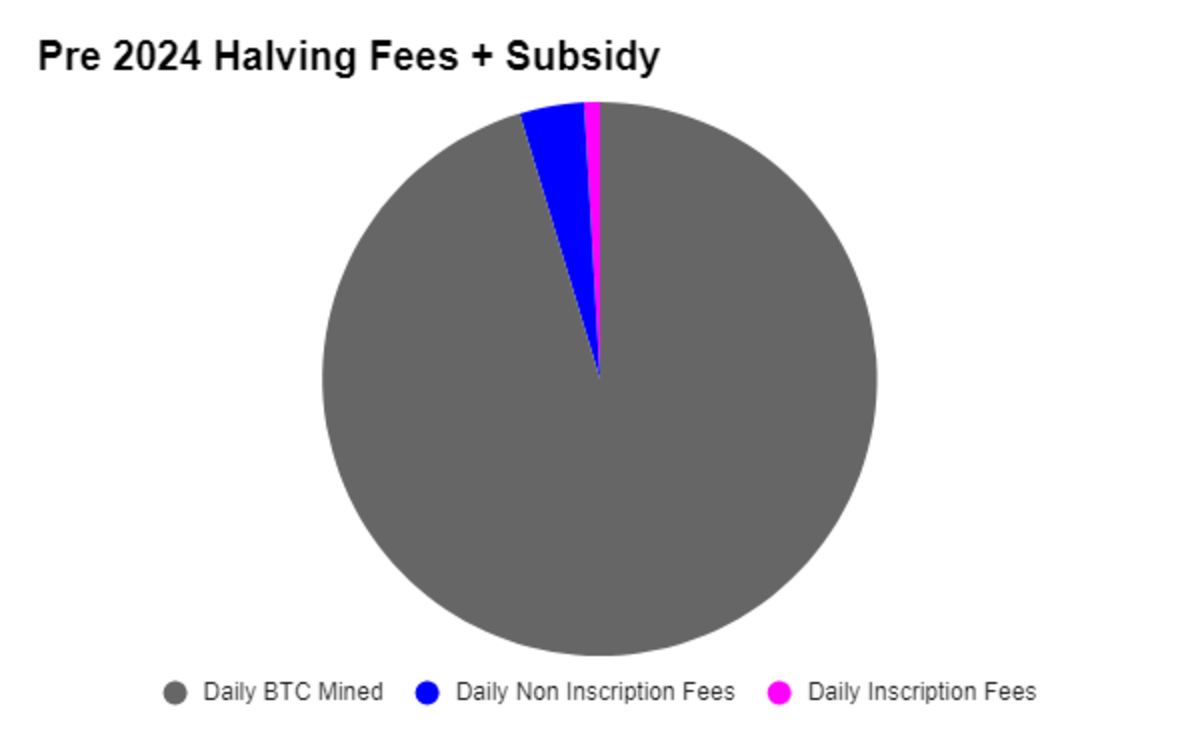

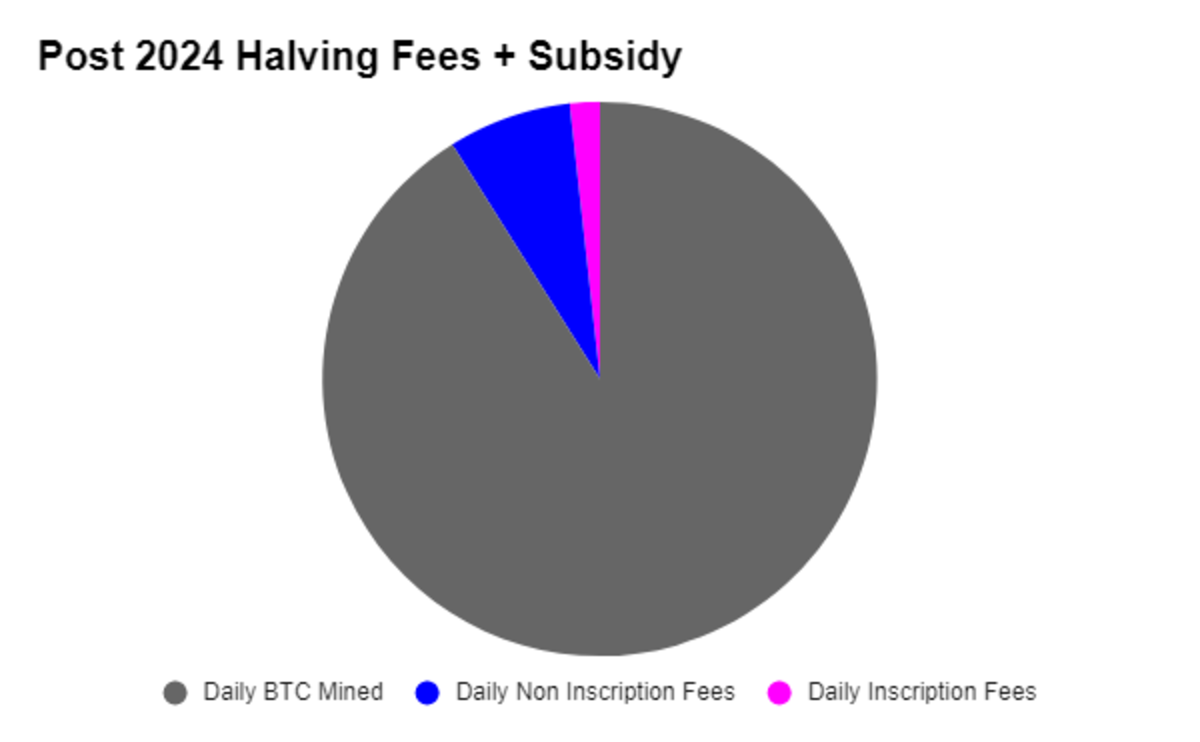

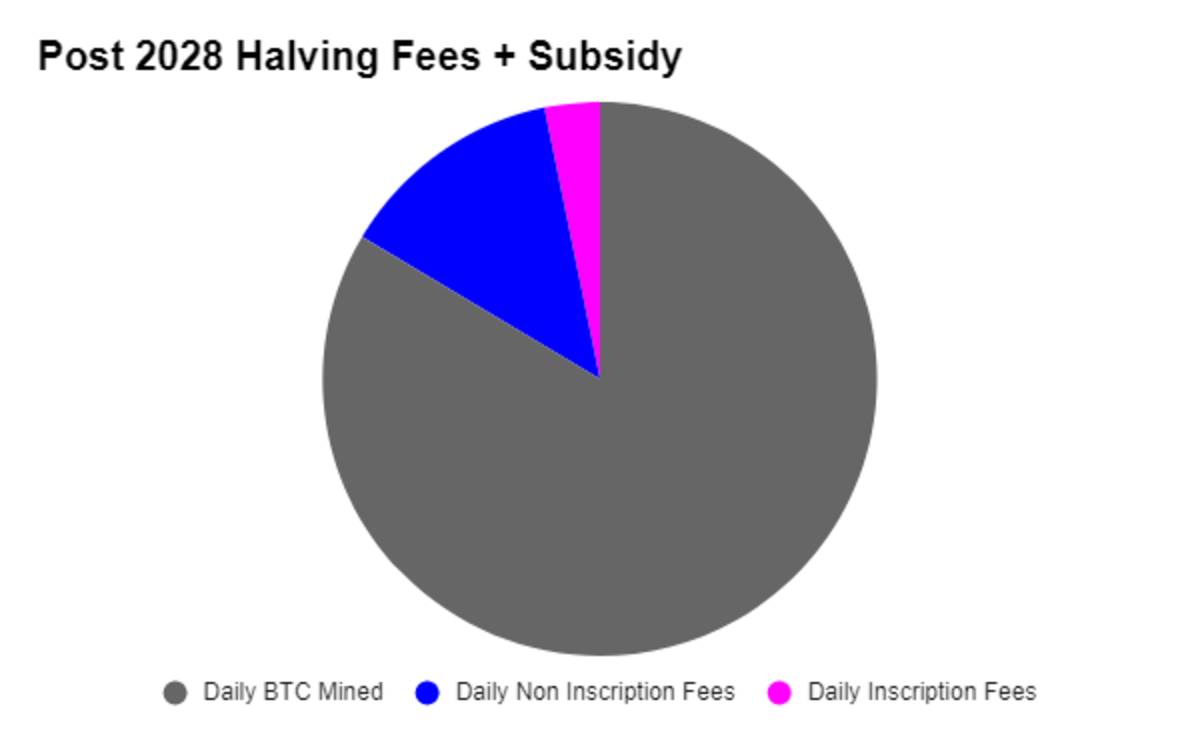

What's exciting to think about is what will happen to fees and subsidies before and after the 2024 halving. We saw earlier that if you average daily revenue from transaction fees plus registration fees, it equals around 4.5% of the miners' daily income. But what about that halving? And what if we lived in a vacuum and kept rates stable until the 2028 halving?

If we continue at the current pace, we will see transaction fees become much more important to mining revenue after the fourth halving and have significant value in the post-halving environment of 2028. It is difficult to imagine the demand for block space hold stable for two halves, and using current demand is quite conservative. This also rules out the invention of new ways to use block space that we haven't even imagined yet.

Clear markets

In closing, the emergence of Ordinals inscriptions has fundamentally reshaped the bitcoin blockchain, marking a significant change in both its technical landscape and economic dynamics. As we delve deeper into this new world of bitcoin evolution, we must consider the broader implications of ordinals and new uses of block space and their potential impacts. With the upcoming halving poised to introduce new supply complexities, the role of Ordinals in shaping bitcoin's future becomes even more interesting. From my perspective, this is an exciting chapter in the blockchain saga, full of uncharted territories and immense possibilities. These are not JPEG files; It is a free market resistant to censorship. As the bitcoin protocol continues its evolution, it remains to be seen how the market will adapt to these changes and what other novel uses of the blockchain space will emerge. One thing is clear: the journey ahead will be unpredictable and strange. But at the end of the day, the markets clear up.

This article appears in bitcoin Magazine. “The question of registration.” Click here to get your annual subscription to bitcoin Magazine.

NEWSLETTER

NEWSLETTER